Electronic Invoicing

Dear supplier,

The 2018 Budget Law (Law no. 205 of December 27, 2017) introduced the obligation to issue electronic invoices between private entities starting from January 1, 2019 (since 2015, a corresponding obligation has already existed for invoices issued to Public Administrations).

This obligation is brought forward to July 1, 2018 in the following two cases:

- Transfers of petrol or diesel intended to be used as motor fuel. Decree Law no. 79 of June 28, 2018 postponed, from July 1, 2018 to January 1, 2019, the effective date of the electronic invoicing obligations for the supply of fuel for vehicles carried out at roadside distribution facilities. The remaining transfers of petrol or diesel intended to be used as motor fuel remain subject to electronic invoicing from July 1, 2018;

- Services provided by subcontractors and sub-suppliers within the supply chain, under a contract for works, services, or supplies entered into with a public administration.

To avoid the impossibility for us to process invoices sent through channels not provided for by the new regulations, all suppliers are invited to verify, before issuing the invoice, whether the transaction carried out falls within the cases where the electronic invoicing obligation is anticipated to July 1, 2018.

If the invoiced transactions fall under points 1 and 2 above, the invoice must be issued according to the technical specifications approved by the Revenue Agency’s director in the provision of last April 30 and must be transmitted via the SdI (Sistema di Interscambio).

In particular, considering our activities, the case relating to public administration subcontracts may apply. The presence of CIG/CUP codes relating to the traceability of financial flows in the orders we issue may assist you in this assessment.

If the invoice is issued in ways other than those provided (e.g., paper format), the invoice – by express legal provision – will be considered as not issued.

As of January 1, 2019, invoices must be issued in the electronic invoice format (XML) and transmitted through the Sistema di Interscambio (SdI).

Based on the experience gained in these first months, some issues have emerged in the compilation of electronic invoices in XML format. These issues can create difficulties in receiving documents and errors in identifying key fields that allow Fincantieri’s systems to process invoices quickly.

In order to reduce the possibility of errors in the compilation of electronic invoices, we have prepared this support document, which covers the following main aspects:

- Transmission data

- Non-Delivery Notification

- Purchase order

- Order lines and Description

- Stamp duty

- Tax regime and declaration of intent

- VAT liability

- Tax documents issued in currencies other than euro

- CIG/CUP

- Document total/Payment amount

- Attachments

- Contacts

- Supplier code

- Rejection, Refusal, and Credit/Debit Notes

- DDT

- Work progress certificates (SAL)

The guidelines provided are based on the information available to date and may be modified following updates from the Revenue Agency or to integrate information or data that may become necessary for Fincantieri in the invoice registration process.

The numbers shown in square brackets are the references for the positions as provided in the tabular representation of the XML layout.

The submission of invoices or credit/debit notes to Fincantieri must be carried out using the Formato di Trasmissione [1.1.3] provided for invoicing between private parties or B2B (FPR12), which requires a Codice Destinatario [1.1.4] of 7 characters: "0000000".

| Description | XML Example |

|---|---|

CORRECT EXAMPLE

| <DatiTrasmissione> <IdTrasmittente> <IdPaese>IT</IdPaese> <IdCodice>01889670996</IdCodice> </IdTrasmittente> <ProgressivoInvio>15370</ProgressivoInvio> <FormatoTrasmissione>FPR12</FormatoTrasmissione> <CodiceDestinatario>0000000</CodiceDestinatario> </DatiTrasmissione> |

INCORRECT EXAMPLE The transmission format is NOT the one required for sending B2B electronic invoices. The recipient code is incorrect.

| <DatiTrasmissione> <IdTrasmittente> <IdPaese>IT</IdPaese> <IdCodice>01889670996</IdCodice> </IdTrasmittente> <ProgressivoInvio>1</ProgressivoInvio> <FormatoTrasmissione>FPA12</FormatoTrasmissione> <CodiceDestinatario>9999999</CodiceDestinatario> </DatiTrasmissione> |

Fincantieri has chosen NOT to provide suppliers with the certified email (PEC) address for receiving electronic invoices in order to avoid receiving communications or emails unrelated to the purpose of the latter.

For the delivery of electronic invoices, it is sufficient to correctly indicate the Codice Destinatario 0000000 and the Partita IVA 00629440322. The SdI (Sistema di Interscambio) will forward the document to the electronic address provided through the "registration service," regardless of whether a different address is indicated or not in the electronic invoice.

However, it may happen that, due to technical reasons such as a full or inactive PEC mailbox, the SdI (Sistema di Interscambio) is unable to forward the document to the electronic address and instead sends a non-delivery notification to the issuer/provider. For more details, please refer to the chapter on Non-Delivery Notification.

Therefore, for the correct delivery of the electronic invoice, it is necessary to provide the following information:

Recipient Code: 0000000 (Mandatory)

VAT Number: IT00629440322 (Mandatory)

Tax Code: 00397130584 (Recommended)

Examples of detected errors:

| Description | XML Example |

|---|---|

CORRECT EXAMPLE Cessionario Committente [1.4] | <CessionarioCommittente> <DatiAnagrafici> <IdFiscaleIVA> <IdPaese>IT</IdPaese> <IdCodice>00629440322</IdCodice> </IdFiscaleIVA> <CodiceFiscale>00397130584</CodiceFiscale> <Anagrafica> <Denominazione>FINCANTIERI S.P.A.</Denominazione> </Anagrafica> </DatiAnagrafici> |

INCORRECT EXAMPLE The VAT number of Fincantieri has not been provided. | <CessionarioCommittente> <DatiAnagrafici> <CodiceFiscale>00397130584</CodiceFiscale> <Anagrafica> <Denominazione>FINCANTIERI S.P.A.</Denominazione> </Anagrafica> </DatiAnagrafici> |

INCORRECT EXAMPLE The VAT number and the Tax Code have been reversed. | <CessionarioCommittente> <DatiAnagrafici> <IdFiscaleIVA> <IdPaese>IT</IdPaese> <IdCodice>00397130584</IdCodice> </IdFiscaleIVA> <CodiceFiscale>00629440322</CodiceFiscale> <Anagrafica> <Denominazione>FINCANTIERI S.P.A.</Denominazione> </Anagrafica> </DatiAnagrafici> |

In the event that, due to technical reasons not attributable to the SdI (such as a full or inactive PEC mailbox or an inactive electronic channel), delivery is not possible, the SdI makes the electronic invoice available to the customer in their reserved area on the Italian Revenue Agency’s website, notifying the transmitting party of this information. The issuer/provider is required to promptly inform Fincantieri, via email at CO-CSA@fincantieri.it, that the original electronic invoice is available in the reserved area of the Revenue Agency’s website. This communication must include a copy of the notification and a digital or paper copy of the electronic invoice.

Below are some examples of communications that the customer/provider might receive from the SdI

| Description | Notification Type |

|---|---|

CORRECT EXAMPLE The document was found to meet the requirements set by the Sistema di Interscambio, which accepted the document and successfully forwarded it to the recipient designated by the customer. | Delivery Receipt SDI Identifier: 111 |

INCORRECT EXAMPLE The document was found to meet the requirements set by the Sistema di Interscambio, which accepted the document but failed to forward it to the designated recipient. In the case of Fincantieri, the provider is required to send a communication to the email address CO-CSA@fincantieri.it including a PDF copy of the document and the non-delivery notification.

| Failed Delivery Notification SDI Identifier: 111 |

INCORRECT EXAMPLE The invoice did not pass the SdI’s validation and was rejected. The provider can either cancel the document through an internal accounting adjustment and issue a new document with a new number to be sent to the SdI (the new document must include a reference to the rejected invoice by filling in the “DatiFattureCollegate” field), or make the necessary corrections to the original XML file and resubmit it. The new submission must be made within 5 days of the rejection notification. These actions do not need to be reported to Fincantieri. | Rejection Notification SDI Identifier: 111 Riferimento Archivio Message Id:123456 Note: Note |

If provided by Fincantieri, as contractually agreed, the order identifier must be included in the document and placed within the DatiOrdineAcquisto [2.1.2] under the IdDocumento [2.1.2.2].

If entered in other fields, such as "DatiContratto" the element will not be recognized by our systems.

The Fincantieri order identifier can contain a maximum of 10 alphanumeric characters: exceeding this limit causes processing issues and blocks the document flow.

Therefore, please pay attention to:

The length of the string, avoiding the inclusion of unnecessary data such as revision indexes, positions, or similar information.

The use of the characters "O" (letter O) and "0" (zero).

Examples of detected errors:

| Description | XML Example |

|---|---|

CORRECT EXAMPLE

|

</DatiGeneraliDocumento>

<DatiOrdineAcquisto>

<IdDocumento>DC060R031</IdDocumento>

<Data>2018-04-21</Data>

<CodiceCommessaConvenzione>36260</CodiceCommessaConvenzione>

<CodiceCIG>Z4A10167AE</CodiceCIG>

</DatiOrdineAcquisto>

|

CORRECT EXAMPLE

|

</DatiGeneraliDocumento>

<DatiOrdineAcquisto>

<RiferimentoNumeroLinea>1</RiferimentoNumeroLinea>

<RiferimentoNumeroLinea>2</RiferimentoNumeroLinea>

<IdDocumento>X06259675S</IdDocumento>

<Data>2017-12-06</Data>

<CodiceCIG>ZB61333017</CodiceCIG>

</DatiOrdineAcquisto>

|

INCORRECT EXAMPLE The purchase order was entered in the data block referring to Dati Contratto. |

<DatiContratto>

<RiferimentoNumeroLinea>1</RiferimentoNumeroLinea>

<RiferimentoNumeroLinea>2</RiferimentoNumeroLinea>

<IdDocumento>R06248ABY1</IdDocumento>

<Data>2018-07-31</Data>

</DatiContratto>

|

INCORRECT EXAMPLE The identifier field exceeds 10 characters due to the inclusion of the word "Ordine", making automatic recognition of the data impossible. |

</DatiGeneraliDocumento>

<DatiOrdineAcquisto>

<IdDocumento>Ordine DC060R031 MOD 1</IdDocumento>

<Data>2018-04-21</Data>

<CodiceCommessaConvenzione>36260</CodiceCommessaConvenzione>

<CodiceCIG>Z4A10167AE</CodiceCIG>

</DatiOrdineAcquisto>

|

INCORRECT EXAMPLE The identifier field exceeds 10 characters due to the inclusion of the text "MOD 1," making automatic recognition of the data impossible. |

</DatiGeneraliDocumento>

<DatiOrdineAcquisto>

<IdDocumento>DC060R031 MOD 1</IdDocumento>

<Data>2018-04-21</Data>

<CodiceCommessaConvenzione>36260</CodiceCommessaConvenzione>

<CodiceCIG>Z4A10167AE</CodiceCIG>

</DatiOrdineAcquisto>

|

INCORRECT EXAMPLE Ordine, CIG, and Declaration of Intent are all data elements that were not entered in their respective fields. |

<Causale>CIG: ZB10090992</Causale>

<Causale>Dichiar. Num. 342 del: 1/12/17</Causale>

<Causale>Nr.Regist.Num. 1 del: 15/12/17</Causale>

<Causale>ORDINE N.X062770941 DEL 31/03/2016</Causale>

|

Although not required by the data format, indicating the order item is important for registration purposes and must be included in the descriptive field of the line, corresponding to GOODS / SERVICES DATA in the section Descrizione [2.2.1].

Generic descriptions of the goods supplied and services rendered are not allowed; a detailed description is necessary to clearly identify the operations carried out in case of an audit.

| Description | XML Example |

|---|---|

CORRECT EXAMPLE

|

<DettaglioLinee>

<NumeroLinea>1</NumeroLinea>

<Descrizione>Pos.0001 - Composiz.Piani di Manovra di PRF -

S.A.L. 25% dell'importo complessivo</Descrizione>

<Quantita>1.00</Quantita>

<PrezzoUnitario>3737.50</PrezzoUnitario>

<PrezzoTotale>3737.50</PrezzoTotale>

<AliquotaIVA>0.00</AliquotaIVA>

<Natura>N3</Natura>

</DettaglioLinee>

|

INCORRECT EXAMPLE The order item is not specified in the line details. |

<DettaglioLinee>

<NumeroLinea>1</NumeroLinea>

<Descrizione>Isolazioni termiche, acustiche e tagliafuoco"chiavi

in mano" - S.A.L. al 30/05/18</Descrizione>

<Quantita>0.00600000</Quantita>

<UnitaMisura>N</UnitaMisura>

<PrezzoUnitario>1040000.00000</PrezzoUnitario>

<PrezzoTotale>6240.00</PrezzoTotale>

<AliquotaIVA>0.00</AliquotaIVA>

<Natura>N3</Natura>

</DettaglioLinee>

|

INCORRECT EXAMPLE No description of the invoiced good or service is provided. |

<DettaglioLinee>

<NumeroLinea>1</NumeroLinea>

<Descrizione>ADDE POS. 12 E POS.14 </Descrizione>

<Quantita>1.00000000</Quantita>

<UnitaMisura>PZ</UnitaMisura>

<PrezzoUnitario>2849.00000</PrezzoUnitario>

<PrezzoTotale>2849.00000</PrezzoTotale>

<AliquotaIVA>0.00</AliquotaIVA>

<Natura>N3</Natura>

</DettaglioLinee>

|

In cases where stamp duty is applicable, the data in the dedicated block DatiBollo [2.1.1.6] must be populated:

[2.1.1.6.1] BolloVirtuale SI

[2.1.1.6.2] ImportoBollo 2.00

Please note that for invoices below €77.47, the stamp duty is not applicable.

<DatiBollo>

<BolloVirtuale>SI</BolloVirtuale>

<ImportoBollo>2.00</ImportoBollo>

</DatiBollo>

If the supplier fills in the aforementioned field without simultaneously including a line item for the €2 stamp duty amount, the stamp duty will be considered at the supplier's expense. If the supplier includes the corresponding detail line, the stamp duty will be included in the invoice total and must be paid. Below is an example.

| Description | XML Example |

|---|---|

CORRECT EXAMPLE

| <DettaglioLinee> <NumeroLinea>2</NumeroLinea> <Descrizione>Bollo</Descrizione> <Quantita>1.00</Quantita> <PrezzoUnitario>2.00</PrezzoUnitario> <PrezzoTotale>2.00</PrezzoTotale> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N1</Natura> </DettaglioLinee>

<DatiRiepilogo>

<AliquotaIVA>0.00</AliquotaIVA>

<Natura>N1</Natura> <ImponibileImporto>2.00</ImponibileImporto>

<Imposta>0.00</Imposta>

<RiferimentoNormativo>Escluso Art. 15 DPR 633/72 - Bollo assolto ai sensi dell'art. 6 del DM del 17.6.2014</RiferimentoNormativo>

|

The declaration of intent allows habitual exporters to purchase or import goods and services without the application of tax. Therefore, it is mandatory to include the details of the declaration within a fiscal document to justify the VAT exemption regime.

In the XML structure of an electronic invoice, the tax regime and the details of the declaration of intent must be placed within the field "RiferimentoNormativo" [2.2.2.8] and expressed clearly and unequivocally.

However, the Italian Revenue Agency, in a provided clarification, specified that references to the declaration of intent can be indicated in the field Causale [2.1.1.11], within DatiGeneraliDocumento.

Completion of this field is mandatory only if the field Natura [2.2.2.2] is populated, i.e., in cases of transactions that are not taxable or in cases of reverse charge.

| INDICATIVE TABLE OF THE MOST COMMON VAT REGIMES | ||

|---|---|---|

| NATURE | Tax Regime | Description for <RiferimentoNormativo> (max 100 characters) |

| N1 Excluded pursuant to Article 15 | Article 15 | Article 15 |

| N2 Not subject to VAT | Article 1 | Article 1 |

| Article 2 | Article 2 | |

| Article 3 | Article 3 | |

| Article 4 | Article 4 | |

| Article 5 | Article 5 | |

| Article 7 | Article 7 | |

| Article 26, third paragraph | Article 26, third paragraph | |

| Article 74, first paragraph – Regime for minimum and flat-rate taxpayers | Article 74, first paragraph | |

| N3 Non-taxable | Transactions objectively exempt from VAT | Transactions objectively exempt from VAT |

| Article 8, first paragraph, letters a) and b) – export | Article 8, first paragraph, letter a) of Presidential Decree 633/1972 | |

| Article 8, first paragraph, letter b) of Presidential Decree 633/1972 | ||

| Article 8-bis, first paragraph, letters a), a-bis), b), c), d), e), and e-bis) – high seas commercial ships and warships | Article 8-bis, first paragraph of Presidential Decree 633/1972 | |

| Article 9, first paragraph – international services | Article 9, first paragraph of Presidential Decree 633/1972 | |

| Article 58 of Legislative Decree 331/1993 – national intra-community triangulations | Article 58 of Legislative Decree 331/1993 | |

| VAT non-taxable transactions based on the declaration of intent, where issued, and within the limits of the plafond allocated for the period | VAT non-taxable transactions based on the declaration of intent, if issued, and within the limits of the plafond assigned for the period | |

| Article 8, first paragraph, letter c) | Article 8, first paragraph, letter C - Presidential Decree 633/1972 – Declaration of Intent No. XXXXX/18 dated 01.12.2017 | |

| Article 8-bis, second paragraph | Article 8-bis, second paragraph - Presidential Decree 633/1972 – Declaration of Intent No. XXXXX/18 dated 01.12.2017 | |

| Article 9, second paragraph | Article 9, second paragraph - Presidential Decree 633/1972 – Declaration of Intent No. XXXXX/18 dated 01.12.2017 | |

| N4 Exempt | Article 10 | Article 10 |

| N5 Margin scheme | ||

| N6 Reverse charge | Article 17, sixth paragraph – cleaning services on buildings | Article 17, sixth paragraph, point 6 |

| N7 VAT paid in another EU Member State | Article 74, seventh and eighth paragraphs – scrap materials | Article 74, seventh and eighth paragraphs |

| Description | XML Example |

|---|---|

| CORRECT EXAMPLE | <DatiRiepilogo> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> <ImponibileImporto>5200.00</ImponibileImporto> <Imposta>0.00</Imposta> <RiferimentoNormativo>Art. 8, 1°C., lett. C - DPR 633/1972 – dichiarazione d'intento N. 12345/18 del 01.12.2017</RiferimentoNormativo> </DatiRiepilogo> |

| CORRECT EXAMPLE | <DatiRiepilogo> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> <ImponibileImporto>1200.00</ImponibileImporto> <Imposta>0.00</Imposta> <RiferimentoNormativo>Art. 8-bis, secondo comma - DPR 633/1972 – dichiarazione d'intento N. 111111/18 del 01.12.2017</RiferimentoNormativo> </DatiRiepilogo> |

| CORRECT EXAMPLE | <DatiRiepilogo> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> <ImponibileImporto>3737.50</ImponibileImporto> <Imposta>0.00</Imposta> <RiferimentoNormativo>NON IMP.IVA ART.8-BIS 1°C.-DPR 633/1972</RiferimentoNormativo> </DatiRiepilogo> |

| CORRECT EXAMPLE The indicated tax regime is not detailed; however, the cause field clearly and unequivocally reports the regime and the details of the declaration of intent. | <DatiGenerali> <DatiGeneraliDocumento> <TipoDocumento>TD01</TipoDocumento> <Divisa>EUR</Divisa> <Data>2018-08-31</Data> <Numero>1111</Numero> <ImportoTotaleDocumento>1000.00</ImportoTotaleDocumento> <Causale>Art. 8, 1°C., lett. C - DPR 633/1972 – dichiarazione d'intento N. 12345/18 del 01.12.2017</Causale> </DatiGeneraliDocumento> <DatiRiepilogo> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> <ImponibileImporto>650.00</ImponibileImporto> <Imposta>0.00</Imposta> <RiferimentoNormativo>Non Imponibile Art. 8 DPR 633/72</RiferimentoNormativo> </DatiRiepilogo> |

| CORRECT EXAMPLE The tax data, which appear incomplete in the RiferimentoNormativo field, have been supplemented in the field Causale . | <DatiGenerali> <DatiGeneraliDocumento> <TipoDocumento>TD01</TipoDocumento> <Divisa>EUR</Divisa> <Data>2018-08-31</Data> <Numero>1111</Numero> <ImportoTotaleDocumento>1000.00</ImportoTotaleDocumento> <Causale>dichiarazione d'intento N. 111111/18 del 01.12.2017</Causale> </DatiGeneraliDocumento> <DatiRiepilogo> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> <ImponibileImporto>129.00</ImponibileImporto> <Imposta>0.00</Imposta> <RiferimentoNormativo>N.I. 8/bis II c.</RiferimentoNormativo> </DatiRiepilogo> |

| INCORRECT EXAMPLE The indicated tax regime is not detailed either in the RiferimentoNormativo field or in the field Causale. | <DatiGenerali> <DatiGeneraliDocumento> <TipoDocumento>TD01</TipoDocumento> <Divisa>EUR</Divisa> <Data>2018-08-31</Data> <Numero>1111</Numero> <ImportoTotaleDocumento>1000.00</ImportoTotaleDocumento> <Causale>dichiarazione d'intento N. 12345/18 del 01.12.2017</Causale> </DatiGeneraliDocumento> <DatiRiepilogo> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> <ImponibileImporto>650.00</ImponibileImporto> <Imposta>0.00</Imposta> <RiferimentoNormativo>Art. 8, 8-bis, 9 DPR 633/1972</RiferimentoNormativo> </DatiRiepilogo> |

| INCORRECT EXAMPLE No details of the tax regime are provided. | <DatiGenerali> <DatiGeneraliDocumento> <TipoDocumento>TD01</TipoDocumento> <Divisa>EUR</Divisa> <Data>2018-08-31</Data> <Numero>1111</Numero> <ImportoTotaleDocumento>1000.00</ImportoTotaleDocumento> <Causale>Fattura elettronica</Causale> </DatiGeneraliDocumento> <DatiRiepilogo> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> <ImponibileImporto>1200.00</ImponibileImporto> <Imposta>0.00</Imposta> </DatiRiepilogo> |

| INCORRECT EXAMPLE There are two types of VAT non-taxability present: Article 8 and 8-bis. The applied tax regime must be clearly and unequivocally indicated. | <DatiGenerali> <DatiGeneraliDocumento> <TipoDocumento>TD01</TipoDocumento> <Divisa>EUR</Divisa> <Data>2018-08-31</Data> <Numero>1111</Numero> <ImportoTotaleDocumento>1000.00</ImportoTotaleDocumento> <Causale>Fattura elettronica</Causale> </DatiGeneraliDocumento> <DatiRiepilogo> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> <ImponibileImporto>1200.00</ImponibileImporto> <Imposta>0.00</Imposta> <RiferimentoNormativo>Art. 8, 8-bis, 9 DPR 633/1972 – dichiarazione d'intento N. 111111/18 del 01.12.2017</RiferimentoNormativo> </DatiRiepilogo> |

| INCORRECT EXAMPLE The applied tax regime requires the details of our declaration of intent to be indicated. | <DatiGenerali> <DatiGeneraliDocumento> <TipoDocumento>TD01</TipoDocumento> <Divisa>EUR</Divisa> <Data>2018-08-31</Data> <Numero>1111</Numero> <ImportoTotaleDocumento>1000.00</ImportoTotaleDocumento> <Causale>Fattura elettronica</Causale> </DatiGeneraliDocumento> <DatiRiepilogo> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> <ImponibileImporto>129.00</ImponibileImporto> <Imposta>0.00</Imposta> <RiferimentoNormativo>N.I. 8/bis II c.</RiferimentoNormativo> </DatiRiepilogo> |

| INCORRECT EXAMPLE The tax regime is not clearly detailed; the possible declaration of intent is missing. | <DatiGenerali> <DatiGeneraliDocumento> <TipoDocumento>TD01</TipoDocumento> <Divisa>EUR</Divisa> <Data>2018-08-31</Data> <Numero>1111</Numero> <ImportoTotaleDocumento>1000.00</ImportoTotaleDocumento> <Causale>Fattura elettronica</Causale> </DatiGeneraliDocumento> <DatiRiepilogo> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> <ImponibileImporto>650.00</ImponibileImporto> <Imposta>0.00</Imposta> <RiferimentoNormativo>Non Imponibile Art. 8 DPR 633/72</RiferimentoNormativo> </DatiRiepilogo> |

Fincantieri falls under the split payment mechanism. For this reason, only electronic invoices issued under the split payment regime will be accepted, and any other VAT liability regime will not be accepted.

| Criteria for valuing VAT liability [2.2.2.7] | ||

|---|---|---|

| Code | Description | Regulation/Reference |

| D | Deferred VAT liability | |

| I | Immediate VAT liability | |

| S | Split payment mechanism | Article 17-ter of Presidential Decree 633/1972 |

| Descriprion | XML Example |

|---|---|

| CORRECT EXAMPLE | <DatiBeniServizi> <DettaglioLinee> <NumeroLinea>1</NumeroLinea> <Descrizione>FORNITURA RICAMBI EDIFICIO 42</Descrizione> <Quantita>1.00</Quantita> <UnitaMisura>PZ</UnitaMisura> <PrezzoUnitario>230000.00</PrezzoUnitario> <PrezzoTotale>230000.00</PrezzoTotale> <AliquotaIVA>22.00</AliquotaIVA> </DettaglioLinee> <DatiRiepilogo> <AliquotaIVA>22.00</AliquotaIVA> <ImponibileImporto>230000.00</ImponibileImporto> <Imposta>50600.00</Imposta> <EsigibilitaIVA>S</EsigibilitaIVA> <RiferimentoNormativo>IVA 22% split payment art. 17-ter DPR 633/72</RiferimentoNormativo> </DatiRiepilogo> </DatiBeniServizi> |

| INCORRECT EXAMPLE Fincantieri and its subsidiaries fall under the SPLIT PAYMENT mechanism; any other VAT liability regime is incorrect. | <DatiBeniServizi> <DettaglioLinee> <NumeroLinea>1</NumeroLinea> <Descrizione>FORNITURA RICAMBI EDIFICIO 42</Descrizione> <Quantita>1.00</Quantita> <UnitaMisura>PZ</UnitaMisura> <PrezzoUnitario>230000.00</PrezzoUnitario> <PrezzoTotale>230000.00</PrezzoTotale> <AliquotaIVA>22.00</AliquotaIVA> </DettaglioLinee> <DatiRiepilogo> <AliquotaIVA>22.00</AliquotaIVA> <ImponibileImporto>230000.00</ImponibileImporto> <Imposta>50600.00</Imposta> <EsigibilitaIVA>I</EsigibilitaIVA> <RiferimentoNormativo>IVA 22%</RiferimentoNormativo> </DatiRiepilogo> </DatiBeniServizi> |

Issuing an invoice in a foreign currency is possible; however, as required by Article 21 of Presidential Decree 633/72, the amounts of the summaries, taxable amounts, and taxes must be indicated in the national currency (euro).

The Revenue Agency has proposed three solutions for documents issued for transactions in currencies other than the euro, as follows:

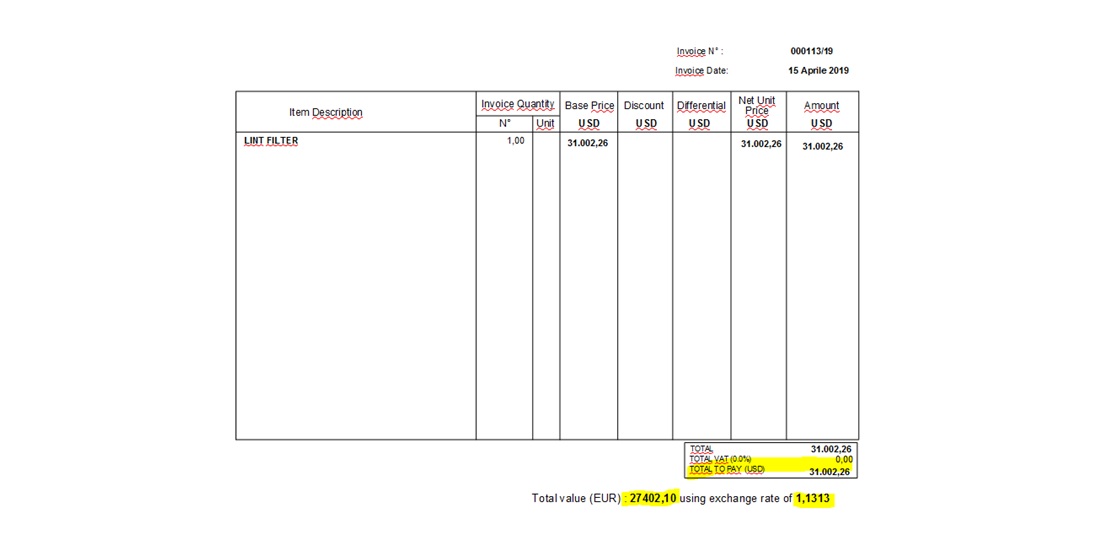

- It is possible to issue an invoice in EUR, always indicating the values in euros in the electronic invoice layout. However, a courtesy copy in PDF format (a document not relevant for tax purposes) must also be attached to the electronic invoice layout. This document shows the values (taxable amount, tax, total) in the original currency of the transaction (e.g., USD, GBP, etc.), with the corresponding conversion into euros and the exchange rate on the day the VAT became due.

| Document type: | TD01 (invoice) |

| Currency amounts: | EUR |

| Document date: | 2019-04-15 (15 April 2019) |

| Name document: | 000113/19 |

| Total document amount | 27404.10 |

| Data relating to the supply detail lines | |

| Line number: 1 | |

| Description of good/service: | LINT FILTER |

| Amount: | 1.00000000 |

| Unit value: | 27402.10000000 |

| Total value: | 27402.10000000 |

| VAT (%): | 0.00 |

| Nature of operation: | N3 (not taxable) |

| Line number: 2 | |

| Description of good/service: | amount to be paid in USD 31,002.26 at the EUR/USD exchange rate on 04/15/2019 1.1313 |

| Unit value: | 0.00000000 |

| Total value: | 0.00000000 |

| VAT (%): | 0.00 |

| Nature of operation: | N3 (not taxable) |

| Summary data by VAT rate and nature | |

| VAT rate (%): | 0.00 |

| Nature of operations: | N3 (not taxable) |

| Total taxable amount/amount: | 27402.10 |

| Total tax: | 0.00 |

| Regulatory reference: | Not subject to art. 7-bis co. 1 DPR 633/72 Reverse charge |

- It is possible to issue the invoice in EUR currency, always indicating all values in Euro in the electronic invoice layout but detailing the exchange rate and the conversion of the amounts in the currency other than the Euro in field 2.2.1.4 <Description>.

| Document type: | TD01 (invoice) |

| Currency amounts: | EUR |

| Document date: | 2019-04-15 (15 April 2019) |

| Document number: | 000113/19 |

| Total document amount: | 27404.10 |

| Data relating to the supply detail lines | |

| Line number: 1 | |

| Description of good/service: | LINT FILTER |

| Quantity: | 1.00000000 |

| Unit value: | 27402.10000000 |

| Total value: | 27402.10000000 |

| VAT (%): | 0.00 |

| Nature of operation: | N3 (not taxable) |

| Line number: 2 | |

| Description of good/service: | amount to be paid in USD 31,002.26 at the EUR/USD exchange rate on 04/15/2019 1.1313 |

| Unit value: | 0.00000000 |

| Total value: | 0.00000000 |

| VAT (%): | 0.00 |

| Nature of operation: | N3 (not taxable) |

| Summary data by VAT rate and nature | |

| VAT rate (%): | 0.00 |

| Nature of operations: | N3 (not taxable) |

| Total taxable amount/amount: | 27402.10 |

| Total tax: | 0.00 |

| Regulatory reference: | Not subject to art. 7-bis co. 1 DPR 633/72 Reverse charge |

- If field 2.1.1.2 <Currency> is filled with an element other than EUR, e.g. USD, GBP, etc., the XML file must be filled in as follows:

- field 2.1.1.9 <ImportoTotaleDocumento> must be filled in the same currency shown in the currency field

- The fields, present in the detail lines, 2.2.1.9 <PrezzoUnitario> and 2.2.1.11 <PrezzoTotale> must always be expressed in EUR. It is also important to detail the exchange rate and the conversion of the amounts in the currency other than the euro in field 2.2.1.4 <Description>.

- also in the "Summary data" section, fields 2.2.2.5 <ImponibileImporto> and 2.2.2.6 <Imposta> must always be indicated in EUR as established by art. 21 DPR 633/1972

| Document type: | TD01 (envoice) |

| Currency amounts: | USD |

| Document date: | 2019-04-15 (15 April 2019) |

| Document number: | 000113/19 |

| Total document amount: | 31.002.26 |

| Data relating to the supply detail lines | |

| Line number: 1 | |

| Description of good/service: | LINT FILTER |

| Quantity: | 1.00000000 |

| Unit value: | 27402.10000000 |

| Total value: | 27402.10000000 |

| VAT (%): | 0.00 |

| Nature of operation: | N3 (not taxable) |

| Line number: 2 | |

| Description of good/service: | value expressed in euros at the EUR/USD exchange rate on 04/15/2019 1.1313 |

| Unit value: | 0.00000000 |

| Total value: | 0.00000000 |

| VAT (%): | 0.00 |

| Nature of operation: | N3 (not taxable) |

| Summary data by VAT rate and nature | |

| VAT rate (%): | 0.00 |

| Nature of operations: | N3 (not taxable) |

| Total taxable amount/amount: | 27402.10 |

| Total tax: | 0.00 |

| Regulatory reference: | Not subject to art. 7-bis co. 1 DPR 633/72 Reverse charge Currency amounts: |

The CIG/CUP codes, if present, can be viewed on the first page of the order, next to the header and within the order text after the payment terms. CUP and CIG must be reported in DatiOrdineAcquisto [2.1.2] in the CodiceCUP [2.1.2.6] and/or CodiceCIG [2.1.2.7] sections respectively.

| Description | XML Example |

|---|---|

| CORRECT EXAMPLE | </DatiGeneraliDocumento> <DatiOrdineAcquisto> <IdDocumento>DC060R031</IdDocumento> <Data>2018-04-21</Data> <CodiceCommessaConvenzione>36260</CodiceCommessaConvenzione> <CodiceCIG>Z4A10167AE</CodiceCIG> </DatiOrdineAcquisto> |

| INCORRECT EXAMLPE The CIG code was not entered in the appropriate field of the track | <DettaglioLinee> <NumeroLinea>2</NumeroLinea> <Descrizione>CIG: ZB10090992</Descrizione> <Quantita>1.00000000</Quantita> <UnitaMisura>n</UnitaMisura> <PrezzoUnitario>0.00000000</PrezzoUnitario> <PrezzoTotale>0.00000000</PrezzoTotale> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> |

[2.1.1.9] ImportoTotaleDocumento

Although this is not a mandatory field, we recommend completing it as it highlights the total amount of the document.

Both the [2.1.1.9] ImportoTotaleDocumento and [2.4.2.6] ImportoPagamento fields must be the sum of the values in the PrezzoTotale field for each detail line.

If there is a difference between the amount indicated as the document total or amount to be paid and the sum of the line totals, the invoice will be recorded and paid at the latter value.

| Description | XML Example |

|---|---|

| INCORRECT EXAMPLE There is a difference of €2.00 between the amount indicated as the document total/Payment amount and the sum of the line totals. The stamp duty was incorrectly added without being documented with a detail line (see the stamp duty section). The amount for which the invoice will be paid will be €3,737.50. | <DatiGenerali> <DatiGeneraliDocumento> <TipoDocumento>TD01</TipoDocumento> <Divisa>EUR</Divisa> <Data>2018-07-19</Data> <Numero>XYS 01/18</Numero> <DatiBollo> <BolloVirtuale>SI</BolloVirtuale> <ImportoBollo>2.00</ImportoBollo> </DatiBollo> <ImportoTotaleDocumento>3741.50</ImportoTotaleDocumento> </DatiGenerali> <DatiBeniServizi> <DettaglioLinee> <NumeroLinea>1</NumeroLinea> <Descrizione>Pos.0001 - Composiz.Piani di Manovra di PRF - S.A.L. 25% dell'importo complessivo</Descrizione> <Quantita>1.00</Quantita> <PrezzoUnitario>3737.50</PrezzoUnitario> <PrezzoTotale>3737.50</PrezzoTotale> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> </DettaglioLinee> <DatiRiepilogo> <AliquotaIVA>0.00</AliquotaIVA> <Natura>N3</Natura> <ImponibileImporto>3737.50</ImponibileImporto> <Imposta>0.00</Imposta> <RiferimentoNormativo>NON IMP.IVA ART.8-BIS 1°C.-DPR 633/1972</RiferimentoNormativo> </DatiRiepilogo> </DatiBeniServizi> <DatiPagamento> <CondizioniPagamento>TP02</CondizioniPagamento> <DettaglioPagamento> <ModalitaPagamento>MP05</ModalitaPagamento> <DataScadenzaPagamento>2018-09-17</DataScadenzaPagamento> <ImportoPagamento>3741.50</ImportoPagamento> |

Please note: if the attachment contains one or more data already present in the XML template, the former cannot in any way replace the latter, if different. The latter remains the officially valid data.

<Allegati>

<NomeAttachment>FINCANTIERI.pdf</NomeAttachment>

<DescrizioneAttachment>Comprovante Fincantieri</DescrizioneAttachment>

</Allegati>

[1.2.5.1] Telefono (required)

[1.2.5.2] Fax

[1.2.5.3] Email (required)

<Contatti>

<Telefono>555-5784</Telefono>

<Fax>555-5784</Fax>

<Email>emaildiprova@gmail.it</Email>

</Contatti>

This is the field in which the seller/provider must enter the Supplier Code used in the Fincantieri database.

</Contatti>

<RiferimentoAmministrazione>78901</RiferimentoAmministrazione>

</CedentePrestatore>

Currently, there is no option to reject or discard electronic invoices from the Exchange System. Suppliers will be notified of any errors found via traditional communication systems (fax and email). Corrections must be made by issuing and sending electronic variation notes to the SDI.

The variation notes must have the DatiFattureCollegate [2.1.6] field filled in to demonstrate that the tax document is linked to a previously issued document.

<DatiFattureCollegate>

<IdDocumento>239/1</IdDocumento>

<Date>2016-04-29</Date>

</DatiFattureCollegate>

NumeroDDT [2.1.8] is mandatory to identify the sequential number of the transport document assigned by the transferor when it was issued (Article 21, paragraph 4, Presidential Decree 633/1972).

This information may be reported more than once to allow the invoice to be linked to multiple transport documents.

Examples

| Description | XML Example |

|---|---|

| CORRET EXAMPLE |

</DatiDDT>

<DatiDDT>

<NumeroDDT>310</NumeroDDT>

<DataDDT>2018-07-09</DataDDT>

<RiferimentoNumeroLinea>2</RiferimentoNumeroLinea>

</DatiDDT>

|

| INCORRECT EXAMPLE In the field referring to the DDT identifier, only the number must be reported without adding any other data. |

</DatiDDT>

<DatiDDT>

<NumeroDDT>ddt 310</NumeroDDT>

<DataDDT>2018-07-09</DataDDT>

<RiferimentoNumeroLinea>2</RiferimentoNumeroLinea>

</DatiDDT>

|

Since this is data that does not fit into the XML file, we request that it be inserted into the NumeroDDT block [2.1.8]. It is important that the proof code, which can have a maximum length of 10 characters, be reported in full without adding any other data/characters.

| Description | XML Example | Proof of Works |

|---|---|---|

| CORRECT EXAMPLE |

</</DatiDDT>

<DatiDDT>

<NumeroDDT>1001249766</NumeroDDT>

<DataDDT>2018-10-04</DataDDT>

<RiferimentoNumeroLinea>2</RiferimentoNumeroLinea>

</DatiDDT>

| COMPROVANTE LAVORI Ente Em. : PA-COP Rif. : 1001249766 Data: 04/10/18 Fornitore: - |

| INCORRECT EXAMPLE The SAL ID field must contain only the code without any other information. The proof code can be numeric or alphanumeric, with a maximum length of 10 characters. |

</</DatiDDT>

<DatiDDT>

<NumeroDDT>RIF 1001249766</NumeroDDT>

<DataDDT>2018-10-04</DataDDT>

<RiferimentoNumeroLinea>2</RiferimentoNumeroLinea>

</DatiDDT>

|