EXECUTIVE SUMMARY

Financial and operating highlights

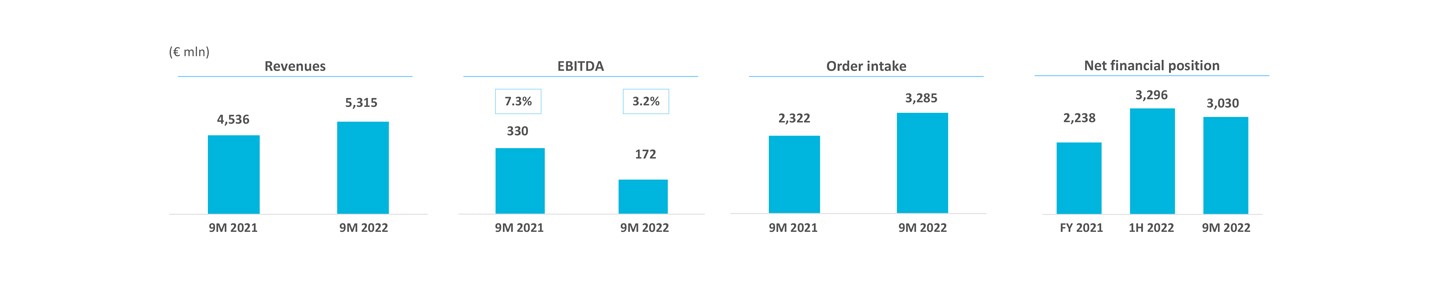

• Revenues at € 5,315 mln, up by 17% YoY, in line with expectations and with the development of backlog

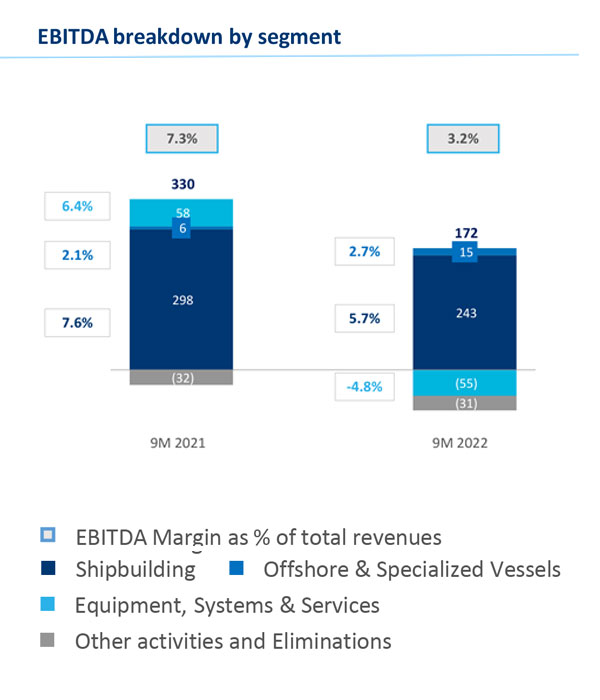

• EBITDA at € 172 mln and EBITDA margin at 3.2%, impacted by 1H 2022 one-offs

• Order intake at € 3.3 bn, new agreements for cruise ships signed with three different shipowners in 3Q 2022

• Net financial position at € 3.0 bn, improving compared to 1H 2022

Please note that throughout the entire presentation:

- 9M 2021 and 9M 2022 data are reported excluding the effect of pass-through activities

- 9M 2021 data have been restated following the reallocation of VARD Electro and Seonics respectively from the Shipbuilding and the Offshore & Specialized Vessels segment to the Equipment, Systems & Services segment

BUSINESS UPDATE

Positive business operating performance both in Cruise and Naval

| CRUISE | ▪ MoA with MSC for the construction of two next generation hydrogen-powered luxury cruise ships to be delivered by 2028 ▪ Ultra-luxury cruise ship to be delivered to Four Seasons by 2025 ▪ Agreement for four new cruise ships to be delivered to Viking, reaching a total of 18 vessels for the shipowner ▪ Four cruise ships delivered, among which: - Discovery Princess, the sixth unit of the Royal class, for Princess Cruises, a Carnival Group brand - Norwegian Prima to Norwegian Cruise Line, first of six vessels of the Prima Class |

| NAVAL | ▪ Delivery of the first PPA «Thaon di Revel» and second PPA «Morosini» in October to the Italian Navy ▪ Successfully delivered three vessels to the Qatari Ministry of Defence: - First Offshore Patrol Vessel (OPV) «Musherib» in Q1 - Second Corvette «Damsah» in Q2 - Second Offshore Patrol Vessel (OPV) «Sheraouh» in Q3 ▪ US Navy: award for the construction of the third frigate of the Constellation program ▪ Preliminary consortium agreement with Naviris, Naval group and Navantia for the Modular and Multirole Patrol Corvette (MMPC) |

Major agreements for green and next generation cruise ships in 3Q 2022, strengthening the partnership with consolidated clients and welcoming newcomer luxury brands

Viking

▪ The collaboration with shipowner Viking reaches a total of 18 vessels: 4 new cruise ships to be delivered by 2028

▪ The vessels will be built according to the latest navigation regulations, equipped with the most modern safety systems and will be designed for hydrogen fuel cells, setting new industry standards

MSC Cruises

▪ Long term partnership with MSC Cruises strengthened with a total of six Explora Journeys luxury cruise ships equipped with industry notch features

▪ Four cruise ships powered by liquefied natural gas (LNG), the cleanest marine fuel currently available, reducing CO2 emissions by up vs standard marine fuels and two additional cruise ships featuring new generation hydrogen powered engines

▪ Hydrogen to power a 6 MW fuel cell allowing emissions-free hotel operations and zero emissions in ports, with engines turned off

Four Seasons

▪ First ultra-luxury cruise ship for Four Seasons to be delivered by 2025

▪ The vessel, which is currently being designed, will be 207 meters long and 27 meters wide, with 14 decks. It will offer ultimate privacy, flexibility and spaciousness in an all-suite nautical residential setting

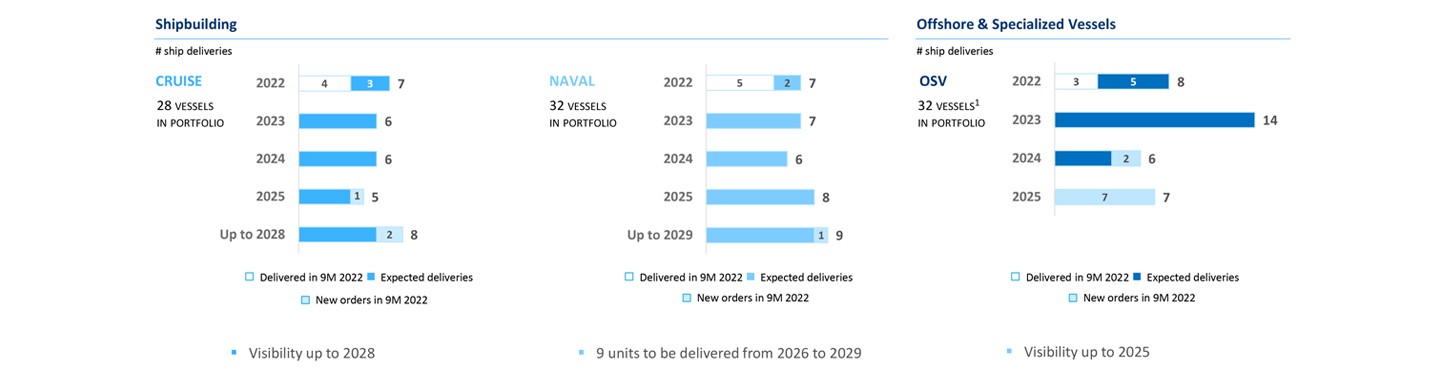

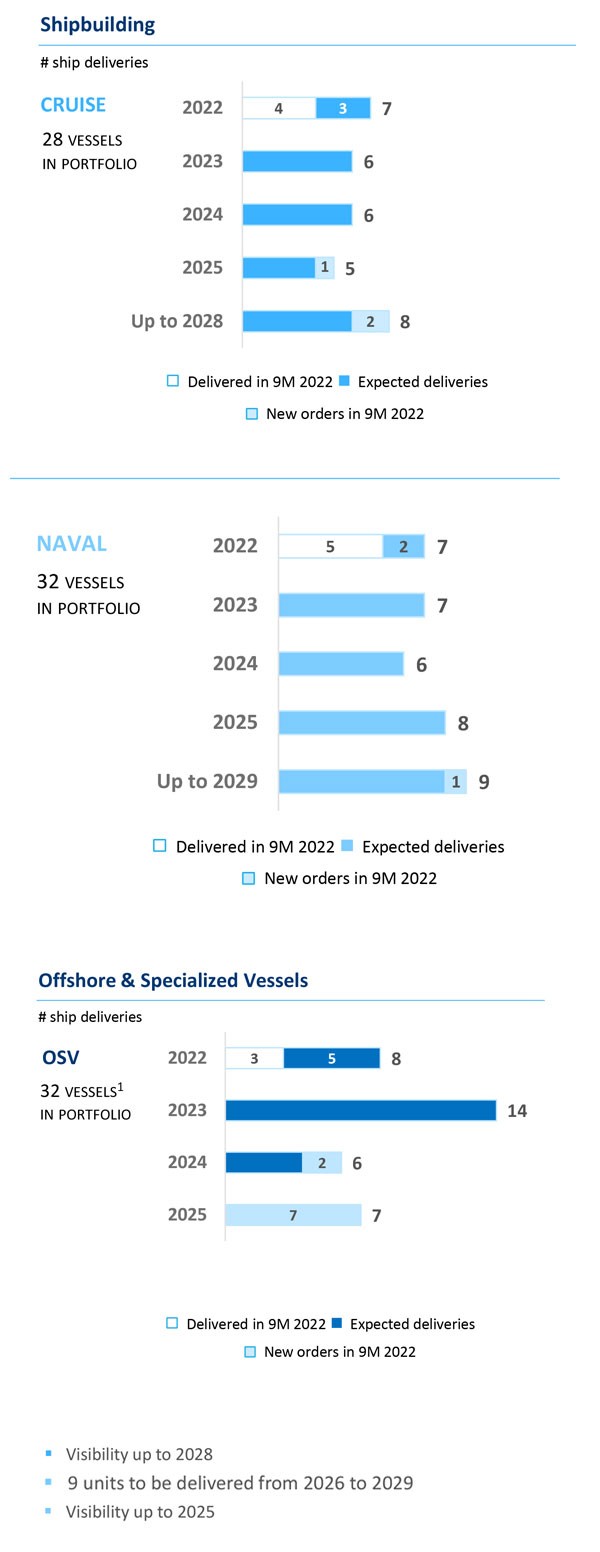

Well-balanced visibility and deliveries up to 2029

1. The Offshore & Specialized Vessels business generally has shorter production times and, as a consequence, shorter backlog and quicker order turnaround than Cruise and Naval

FINANCIAL RESULTS

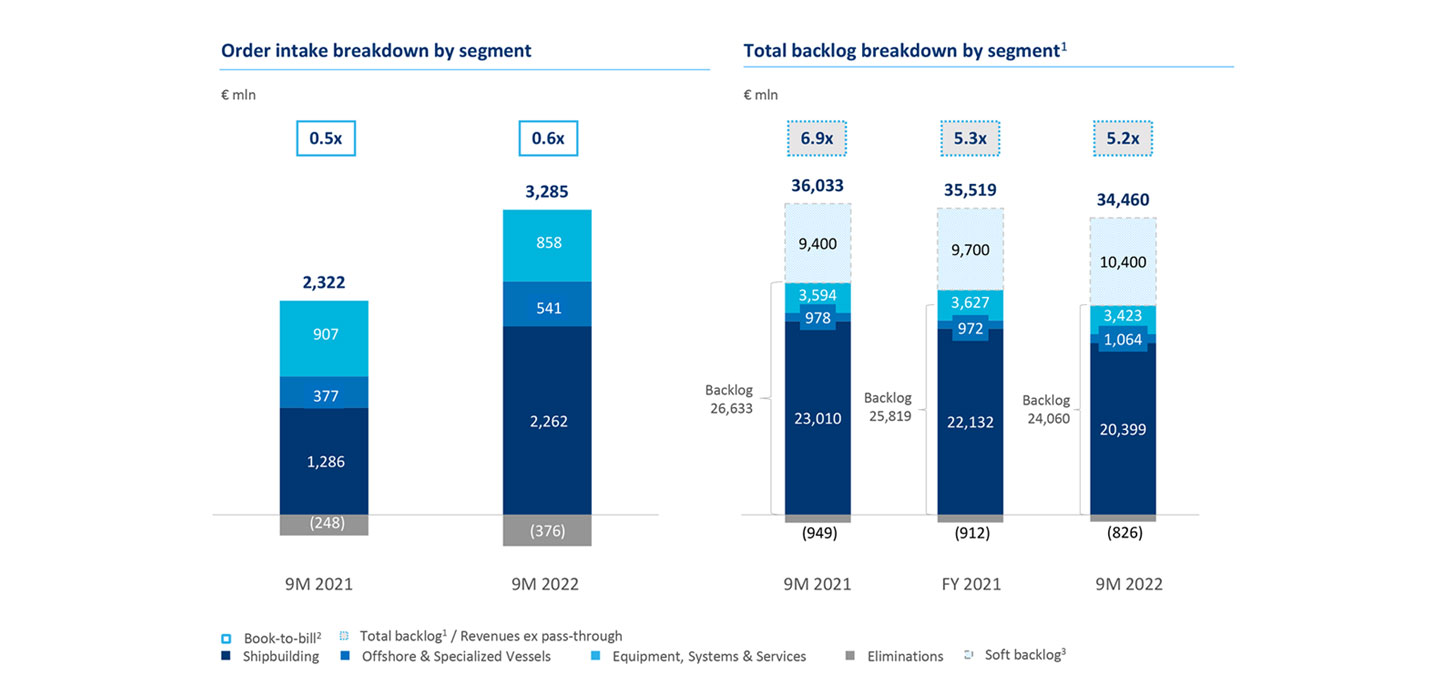

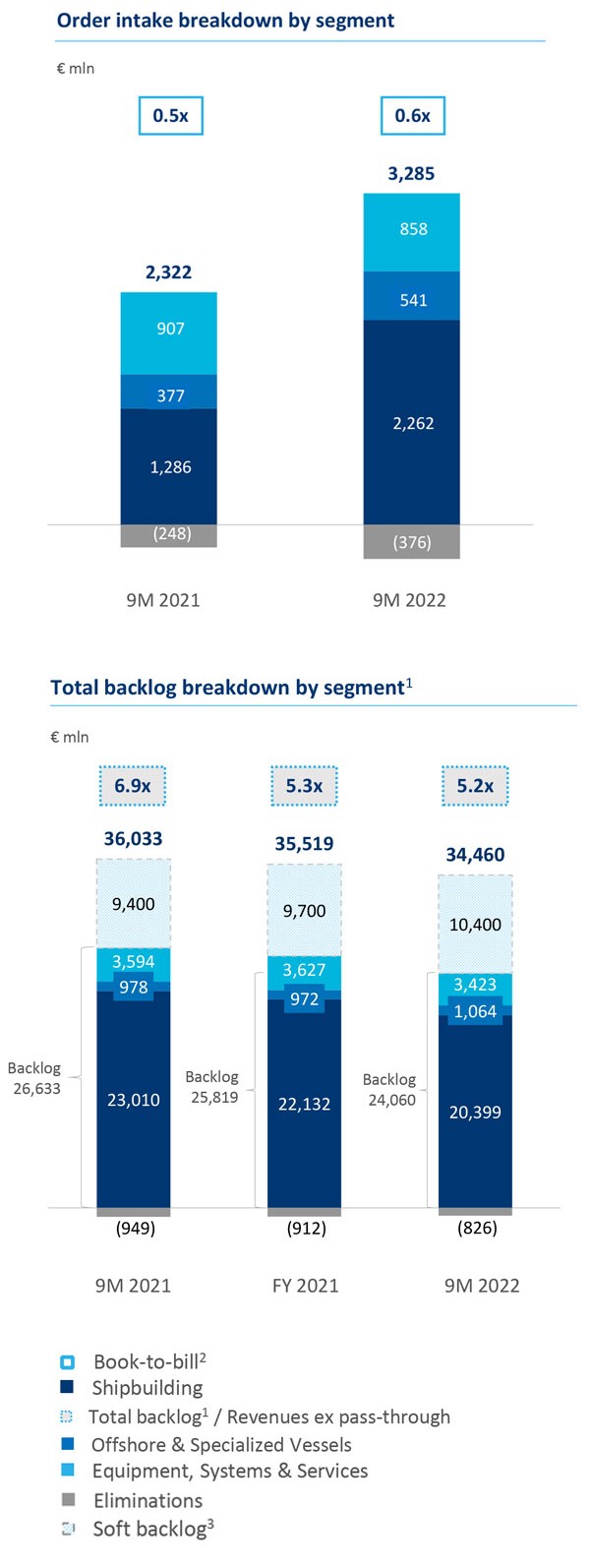

Stable backlog with first signs of order resumption in Cruise and Offshore

▪ Order intake at €3.3 bn, with major contribution from Shipbuilding

▪ New agreements signed in 3Q 2022 for next generation, green, technological, and innovative cruise ships, strengthening the collaboration with consolidated clients and welcoming newcomer luxury brands

▪ Total backlog representing 5.2x 2021 revenues

1. Total backlog is the sum of backlog and soft backlog. Backlog coverage calculated as Total Backlog/ previous year revenues ex pass through activities

2. Order intake/revenues ex pass-through

3. Soft backlog represents the value of existing contract options and letters of intent as well as contracts in advanced negotiation, none of which yet reflected in the order backlog

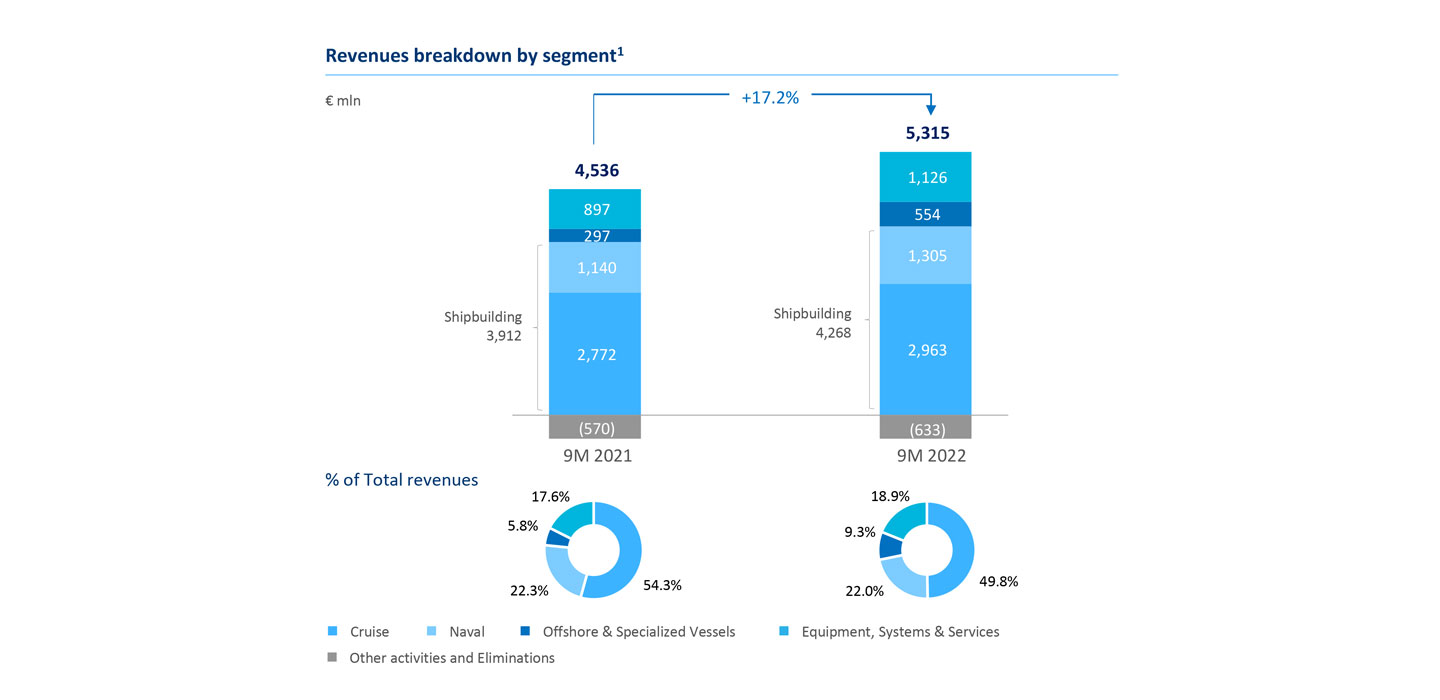

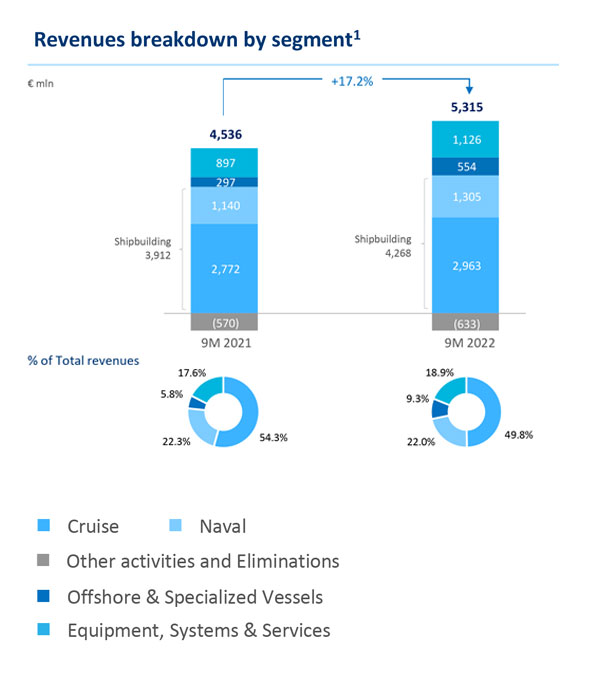

Revenues up 17% with a positive contribution from Offshore & Specialized Vessels

Revenues up 17% YoY at €5,315 mln

▪ Shipbuilding up 9.1% YoY, with Cruise accounting for 50% and Naval for 22% of total revenues

▪ Offshore & Specialized Vessels up 86.4% YoY, thanks to the effective repositioning strategy, confirming the positive trend since 2021

▪ Equipment, Systems & Services up 25.5% YoY mainly related to the Mechatronics and Complete Accommodation businesses

87% of revenues from international clients

1. Breakdown calculated before eliminations

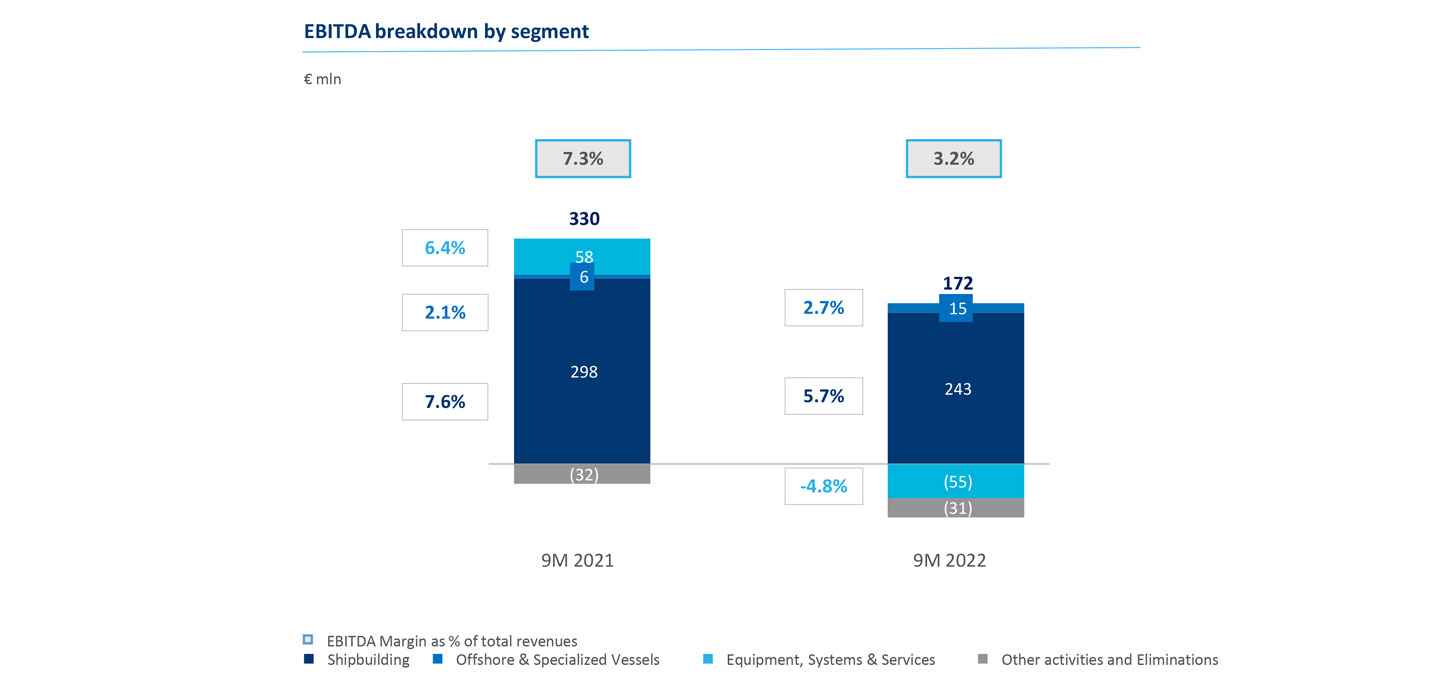

Operating performance at 3.2% margin, impacted by 1H 2022 one offs

EBITDA margin at 3.2% impacted by lower marginality in Infrastructure, raw materials inflation, 1H 2022 non-recurring items in Shipbuilding and US market headwinds

▪ Shipbuilding: EBITDA mainly affected by a 1H 2022 write-down (according to IFRS9) of work in progress due reassessment of a client credit rating

▪ Offshore: increased EBITDA thanks to the repositioning strategy towards offshore wind sectors

▪ ESS: EBITDA impacted by the reduction in Infrastructure business margins, raw materials inflation, as already recorded in 1H 2022

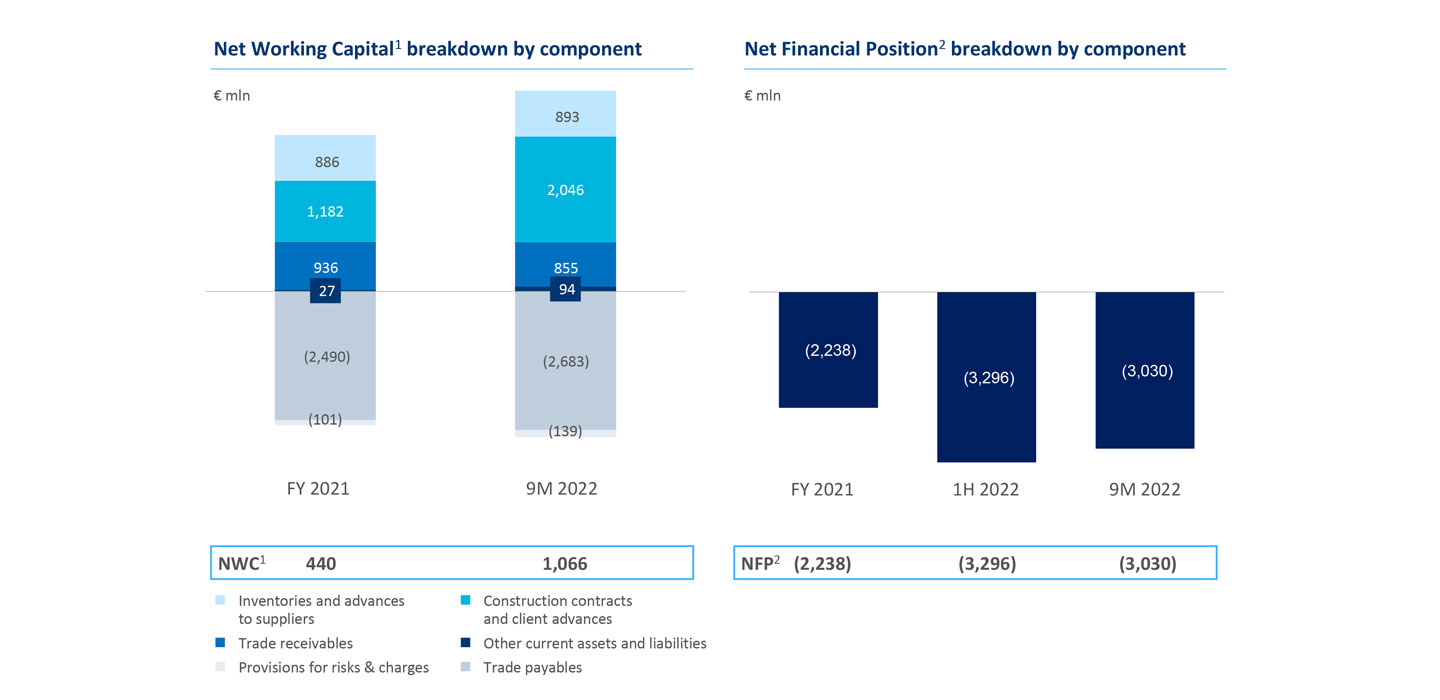

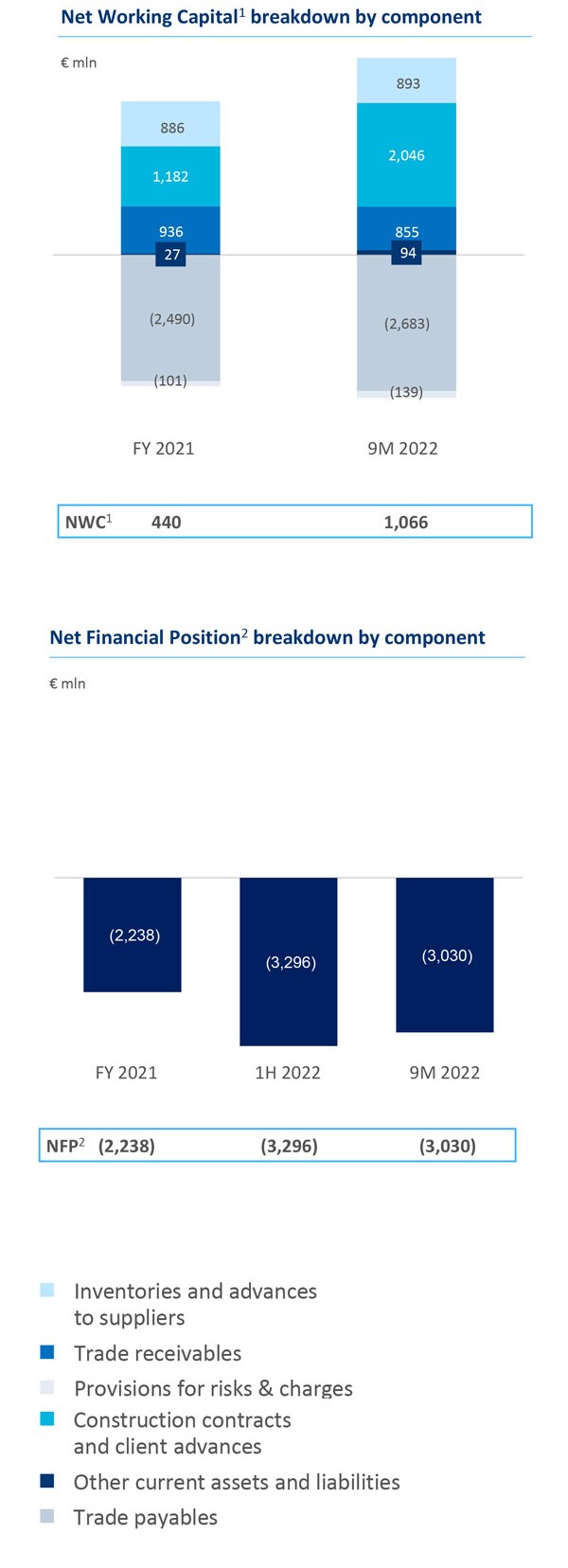

Improved NFP when compared to 1H 2022, consistent with delivery schedule

▪ Net financial position at €3,030 mln, improved by €266 mln when compared to 1H 2022

▪ Net financial position still impacted by €132 mln deferrals granted to clients during COVID-19 pandemic

▪ No financial covenants

▪ Net working capital positive at €1,066 mln (€1,346 mln in 1H 2022)

▪ Capex at €183 mln to support further efficiencies to address new production scenarios (€108 mln in 1H 2022), to scale up US and European shipyards

1. Group Net Working Capital aligned with ESMA guidelines excludes (i) construction loans, (ii) current portion of derivative liabilities for non-financial items, and (iii) the current portion of the fair value of option on equity investment

2. Group Net financial position has been aligned with ESMA guidelines and it includes (i) construction loans, (ii) non-current financial liabilities on hedging instruments and (iii) liabilities for fair-value options investments that were previously excluded, furthermore it excludes non-current financial receivables

MARKET OUTLOOK

Cruise full recovery expected in 2023

Operations and market outlook

▪ 94% of the global fleet back in operation at the end of September 20221, with load factors approaching pre-pandemic levels

▪ Major cruise lines dropped vaccine requirements and eased pre-boarding Covid rules

▪ Value proposition gap between cruises and land-based holidays further shifting towards cruising during the pandemic. As a result, lately, few hotel brands expanded their business in the cruise sector

▪ Booking trends for 2023 in line with 2019 levels, for some companies at higher net yields

▪ Passenger volumes expected to recover and surpass 2019 levels by the end of 20232 with a target of 30 mln pax, pre-Covid volumes

Sustainability

▪ Net carbon neutrality for cruise industry by 20503 and 40% reduction of average CO2 intensity per tonne/mile required by International Maritime Organization (IMO) regulations by 2030 vs 2008

▪ Alternative fuels: shipowners increasingly interested in green propulsion systems, in particular hydrogen-powered zero-emission solutions, for a fully decarbonized cruise industry

▪ Shore-side power connectivity: 209 ships expected in operation by 20283, including ships already fitted, ships planned to be retrofitted and 98% of ships on order book through 2028

1. Cruise industry news – Ships in Service, October 2022

2. CLIA – State of the Cruise Industry 2022 report

3. CLIA - Cruise Industry August 2022, Environmental Technologies and Practices

Naval likely to benefit from higher defence budgets and new opportunities in Offshore

▪ Global defence spending reached USD 2.09 trillion in 2021, with a compound annual growth rate of ca. 2.0% (CAGR 2013-2021)

▪ Defence budgets expected to accelerate in the upcoming years, especially in the Western European Countries (+2% in 2022 and +5.5% in 2023)1

▪ In 2021-2022, the defence budget allocated to navy procurement estimated at 6.3% of global budget1

▪ Increased interest from EU member states in the creation of a common EU Defence framework

▪ EU major defence programs include the Permanent Structured Cooperation (PESCO) for a new class of modular military ships, the European Patrol Corvette

▪ Worldwide wind farms operating today delivering nominal power of ca. 55 GW2

▪ Favorable growth scenario, with 271 GW of total offshore wind capacity to be installed by 2030 (CAGR 15.7%)2

▪ Floating offshore wind expected to rapidly grow: 18 GW of floating offshore wind capacity to be installed or underway globally by 2030 and 63 GW by 20352

▪ Growing demand for Service Operation Vessels (SOVs): 30 units ordered since January 2020, compared with current fleet of 29 vessels3

1. Jane’s – Global Defence Budget, October 2022

2. 4C Offshore – Global Market Overview Q3 2022 Slide Deck, September 14, 2022

3. 4C Offshore – orderbook as of September 2022, Fincantieri analysis as of October 2022; excluding Chinese shipowners