EXECUTIVE SUMMARY

FY 2022 financial and operating highlights

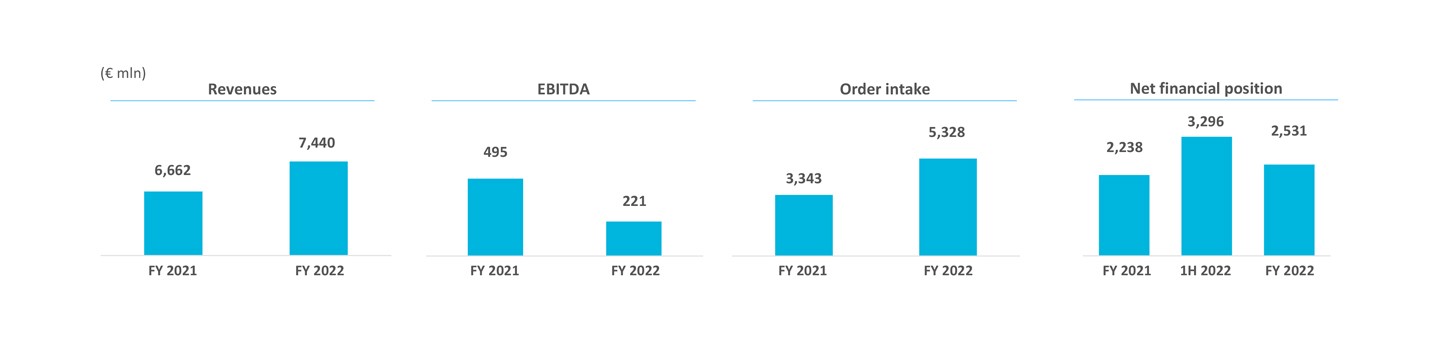

• Revenues at € 7,440 mln, up by 11.7% YoY, in line with expectations and with the development of backlog

• EBITDA at € 221 mln and EBITDA margin at 3.0%, mainly impacted by inflationary pressures and 1H 2022 one-offs

• Order intake at € 5.3 bn, with new contracts for cruise ships signed with two consolidated clients and a sector newcomer

• Net financial position at € 2,531 mln, following € 765 mln net cash generation in 2H 2022

• Net loss at € 324 mln, due to extraordinary or non-recurring items, of which € 164 mln non-cash impairment items

Please note that throughout the entire presentation:

- FY 2021 and FY 2022 data are reported excluding the effect of pass-through activities

BUSINESS UPDATE

Consistent business operating performance throughout the year

| Q1 | Q2 | Q3 | Q4 | |

|

▪ Delivered Discovery Princess, the sixth unit of the Royal class, for Princess Cruises, a Carnival Group brand | ▪ Delivered Viking Mars, eighth unit of the fleet for Viking Cruises ▪ Steel cutting of the first two new concept LNG cruise ships for Tui Cruises |

▪ MoA with MSC for two hydrogen-powered cruise ships ▪ Luxury cruise ship for Four Seasons ▪ Four new cruise ships for Viking ▪ Delivered Norwegian Prima and Viking Polaris |

▪ Delivered MSC Seascape, the largest and most technologically advanced cruise ship ever built in Italy |

|

▪ Italian Navy: delivery of first PPA «Thaon di Revel» and production kick off for the first new generation submarine ▪ Qatari Ministry of Defence: delivery of first OPV «Musherib» |

▪ US Navy: award for the construction of the third frigate of the Constellation program ▪ Qatari Ministry of Defence: delivery of the second Corvette «Damsah» |

▪ Qatari Ministry of Defence: delivery of the second OPV «Sheraouh» | ▪ Italian Navy: delivery of second PPA «Morosini» and launch of fifth PPA ▪ Preliminary consortium agreement for European Modular and Multirole Patrol Corvette led by Naviris ▪ New order for a hydro-oceanographic ship |

|

▪ Delivered the first Service Operation Vessel (SOV) for Ta San Shang Marine ▪ Ordered for 6 Marine RoboticVessels for Ocean Infinity |

▪ Order for 2 additional Commissioning Service Operation Vessels for Norwind Offshore ▪ Order for Stern trawler for Deutsche Fischfang Union |

▪ 1 additional cutting-edge Cable Laying Vessel for Prysmian Group |

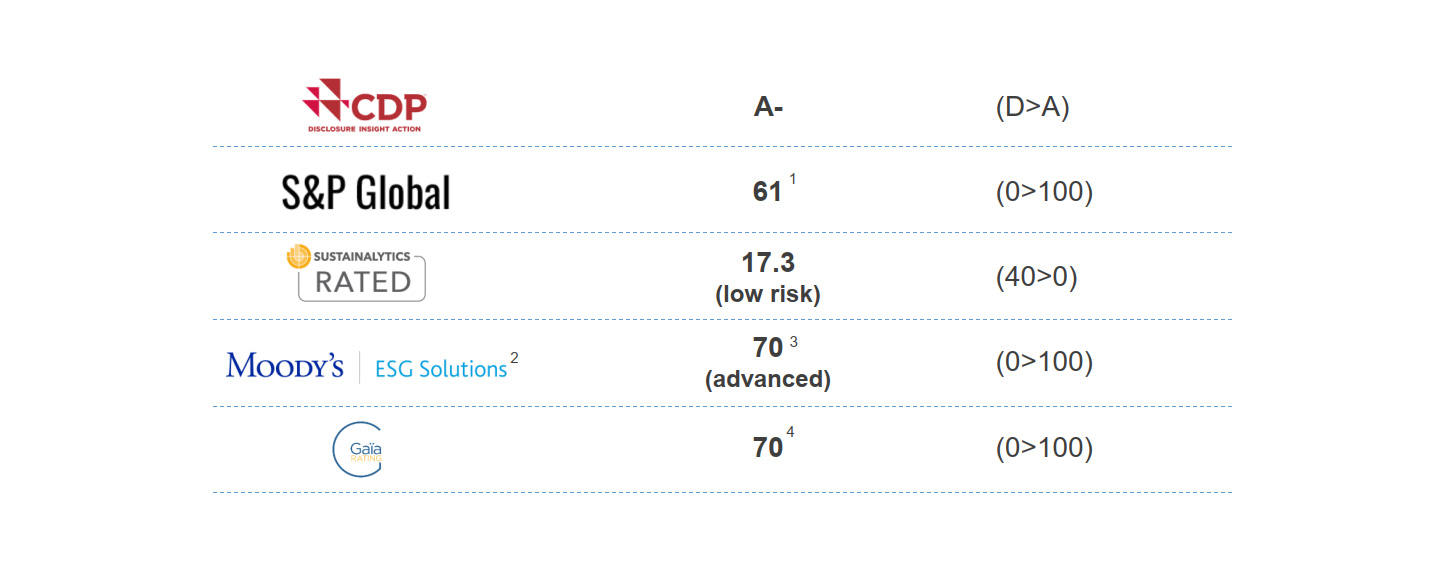

Tireless effort to become a model of excellence acknowledged at the international level

1. As of December 16, 2022

2. Formerly known as V.E

3. The last evaluation was held in 2021, placing Fincantieri in the “Advanced” range; the next evaluation will take place in 2023

4. In 2022, the score attribution criteria and methodology was revised

5. Ranked fourth for sustainability communication

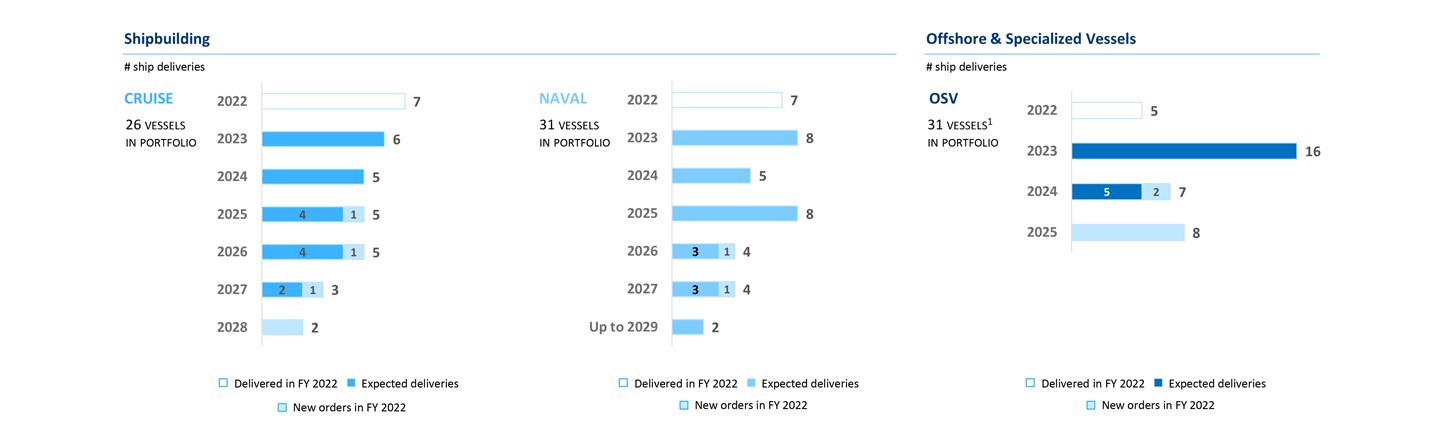

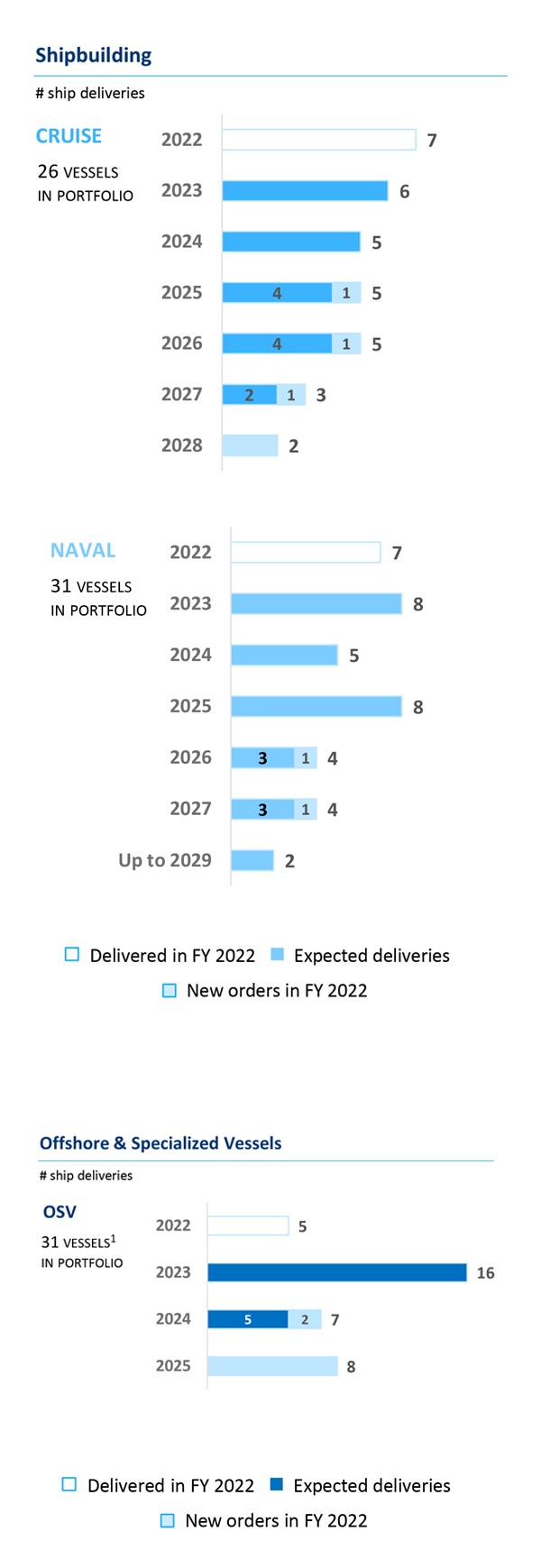

Strong visibility up to 2029 with 84 ships scheduled to be delivered by 2027

1. The Offshore & Specialized Vessels business generally has shorter production times and, as a consequence, shorter backlog and quicker order turnaround than Cruise and Naval

FINANCIAL RESULTS

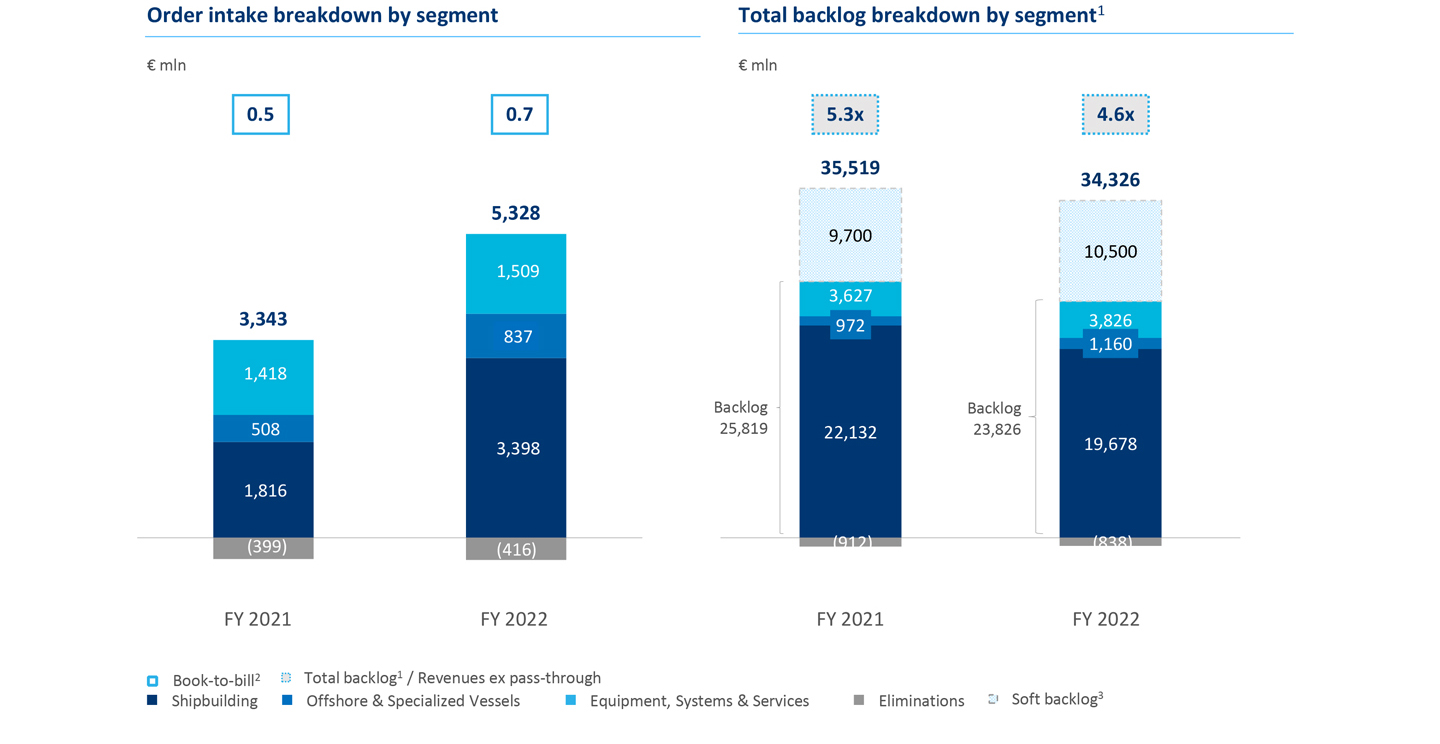

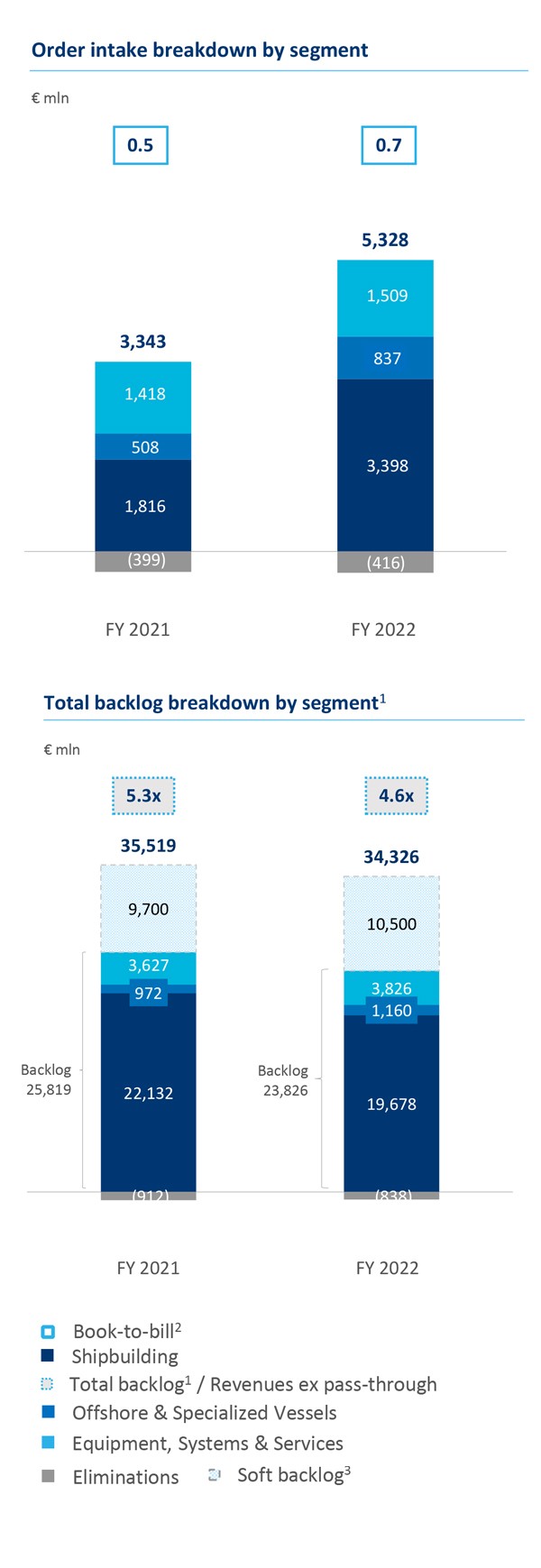

Positive signals in order resumption upholding a stable backlog

▪ Order intake at €5.3 bn, with major contribution from Shipbuilding (+87% YoY). Offshore increased by 65% YoY, with 10 vessels ordered

▪ New agreements signed for nextgeneration, highly technological and innovative cruise ships, strengthening collaborations with consolidated clients and welcoming newcomer luxury brands

▪ Total backlog representing 4.6x 2022 revenues

1. Total backlog is the sum of backlog and soft backlog. Backlog coverage calculated as Total Backlog/ previous year revenues ex pass through activities

2. Order intake/revenues ex pass-through

3. Soft backlog represents the value of existing contract options and letters of intent as well as contracts in advanced negotiation, none of which yet reflected in the order backlog

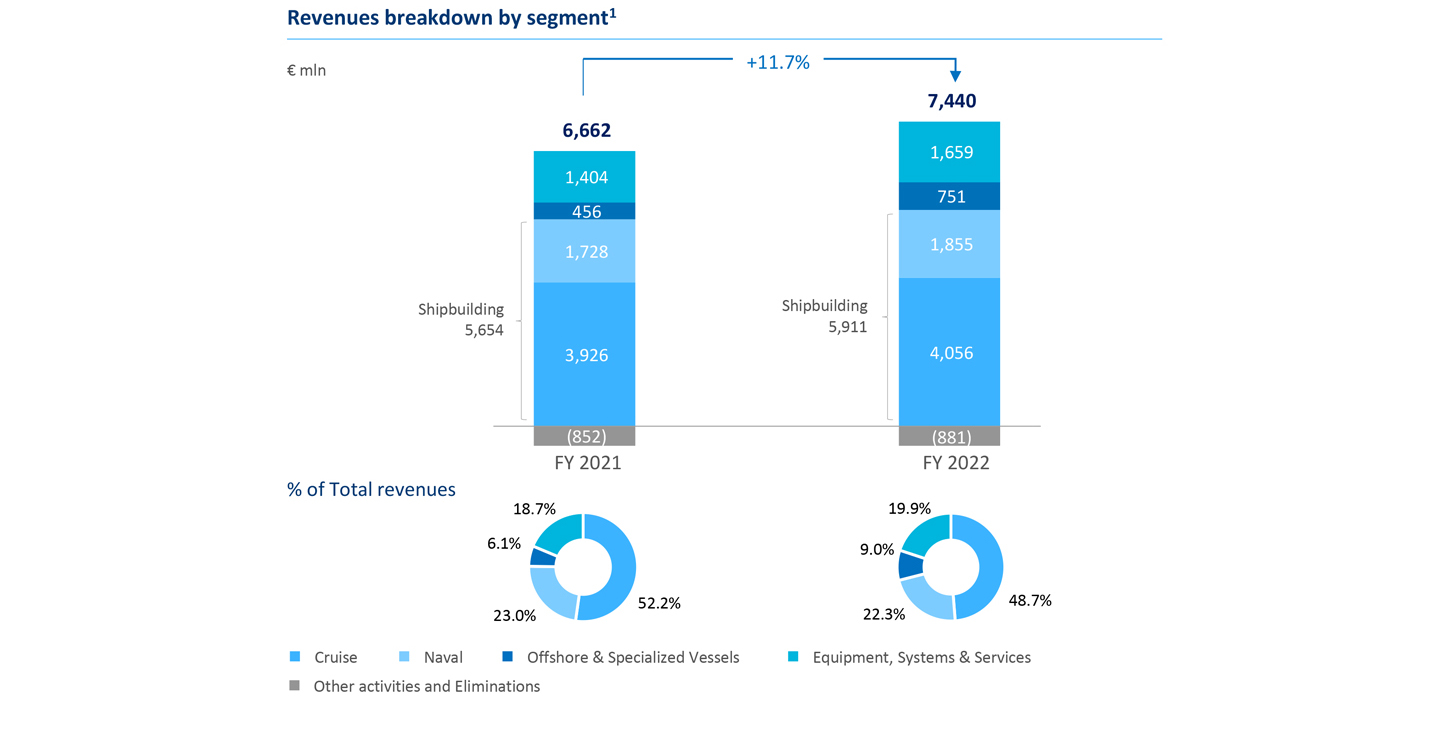

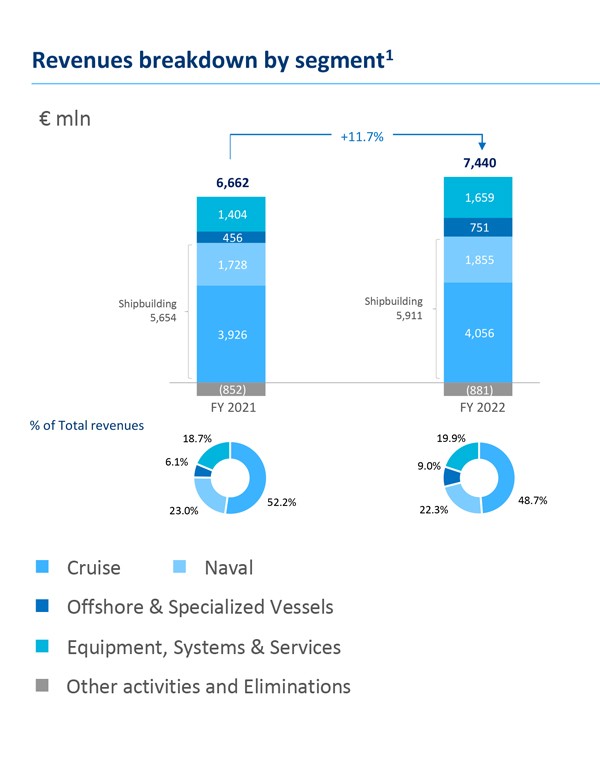

Revenues up 11.7% with a positive contribution from Offshore & Specialized Vessels

Revenues up 11.7% YoY at €7,440 mln

▪ Shipbuilding up 4.5% YoY, with Cruise accounting for 48.7% and Naval for 22.3% of total revenues

▪ Offshore & Specialized Vessels up 64.7% YoY, confirming the positive trend recorded since 2021, also thanks to positive FX rates effects

▪ Equipment, Systems & Services up 18.1% YoY mainly related to the Mechatronics and Complete Accommodation businesses

87% of revenues from international clients

1. Breakdown calculated before eliminations

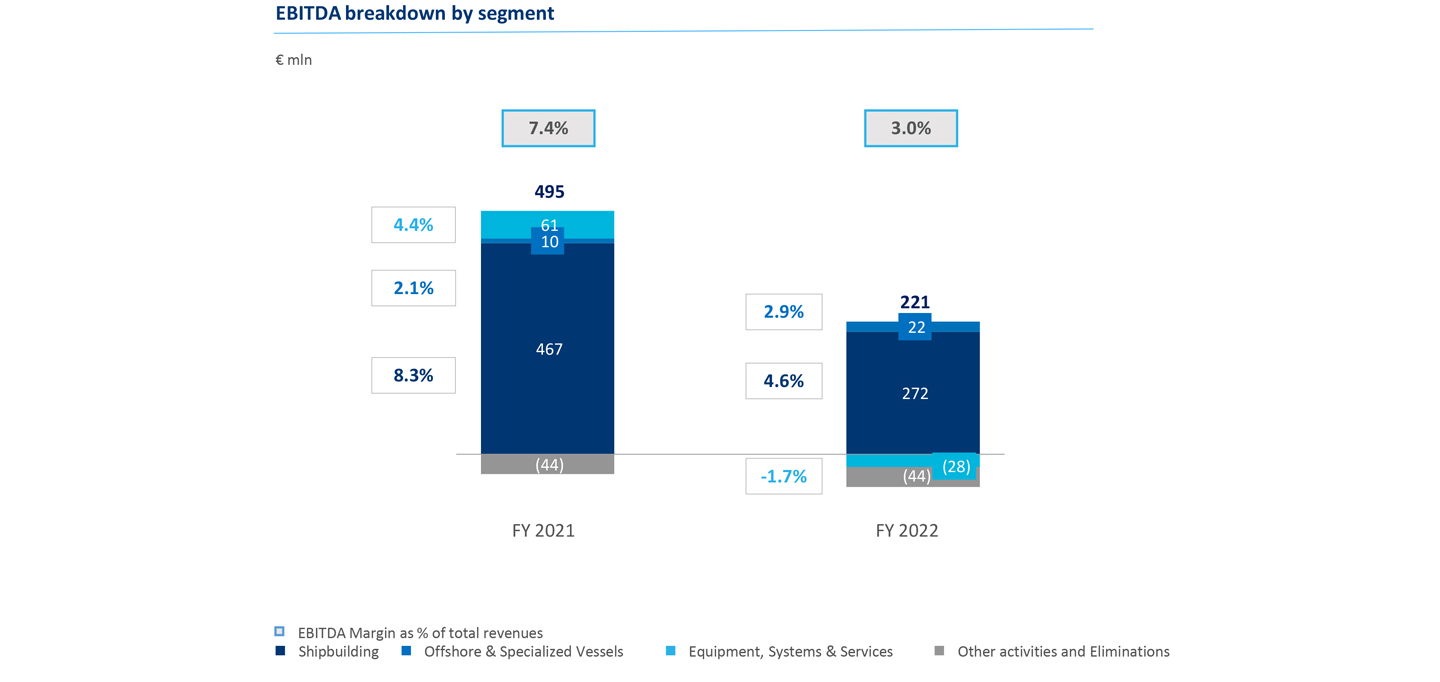

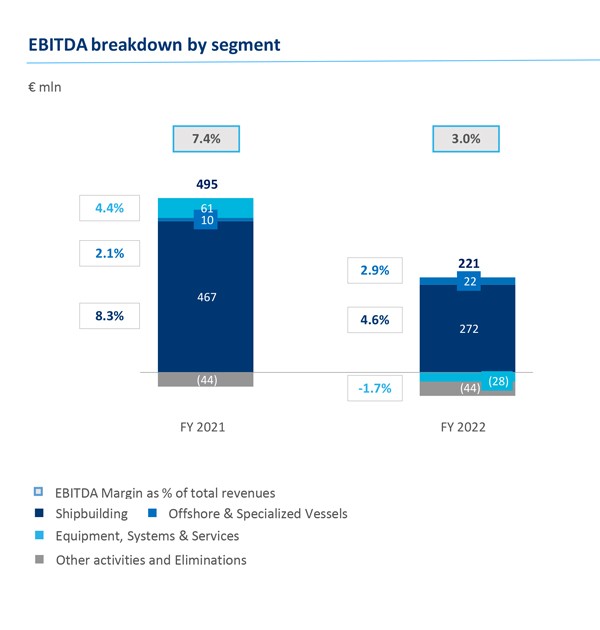

Operating performance at 3.0% margin, affected by inflationary pressures

EBITDA margin at 3.0% impacted by raw material and energy inflation, in particular in 4Q 2022, as well as low marginality in the Infrastructure business and non-recurring items in Shipbuilding

▪ Shipbuilding: EBITDA impacted by inflationary pressures, mainly affecting raw materials and energy, along with the US labour market and supply chain. Marginality still carries the negative impact of 1H2022 write-down (according to IFRS 9) of work in progress due to the reassessment of a client credit rating

▪ Offshore: improved EBITDA confirming the successful repositioning strategy towards the wind offshore sector

▪ ESS: negative EBITDA due to lower margins in Infrastructure business, together with raw materials inflation, already recorded in previous quarters

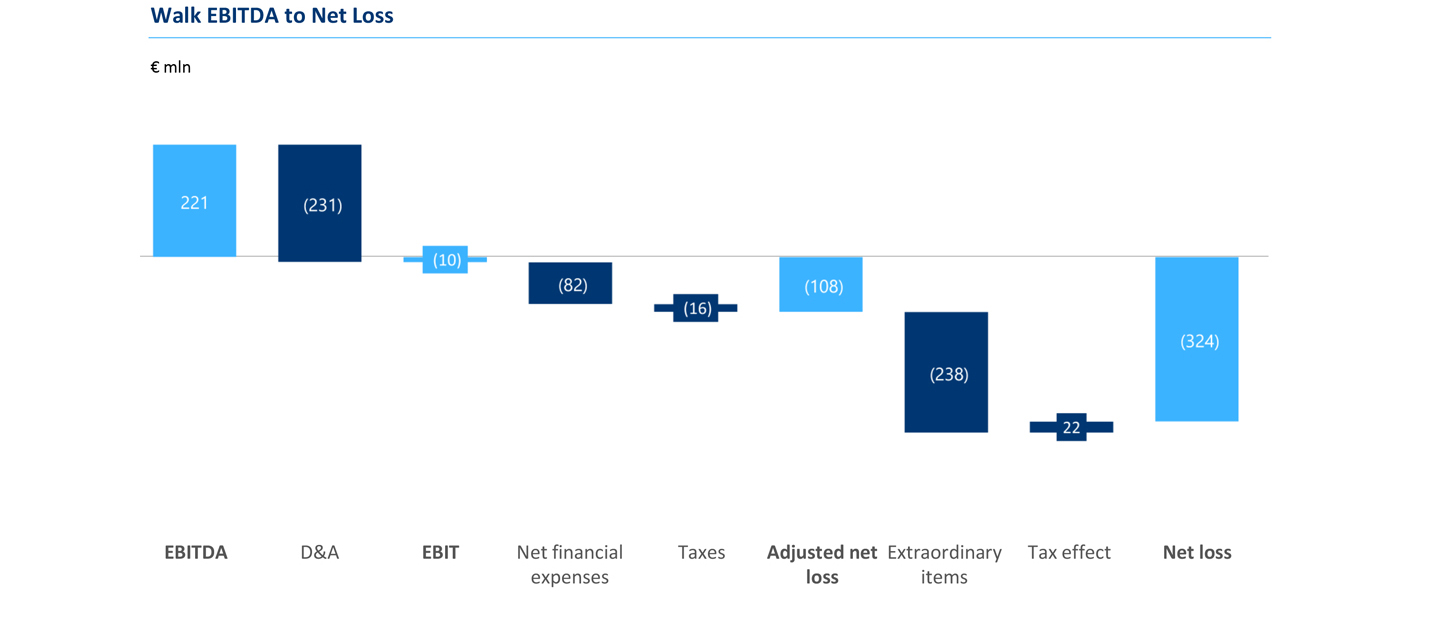

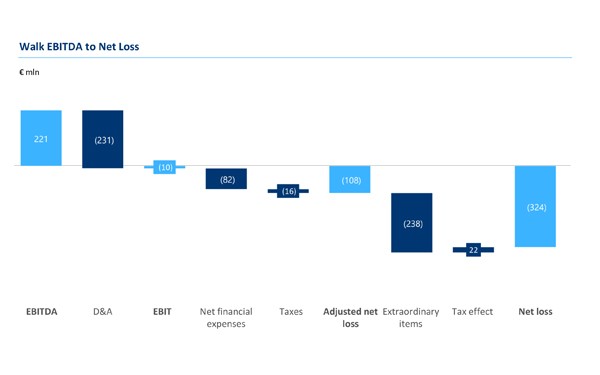

Net loss at €324 mln, mainly due to one off items of the period

▪ Net result for FY 2022 negative at €324 mln, despite positive business operating performance

▪ Extraordinary items include:

- €164 mln for goodwill impairments and other intangible assets

- €52 mln for asbestos related litigations

- €22 mln due to provisions for risks of probable non-fulfillment of obligations related to offset agreements and other extraordinary expenses

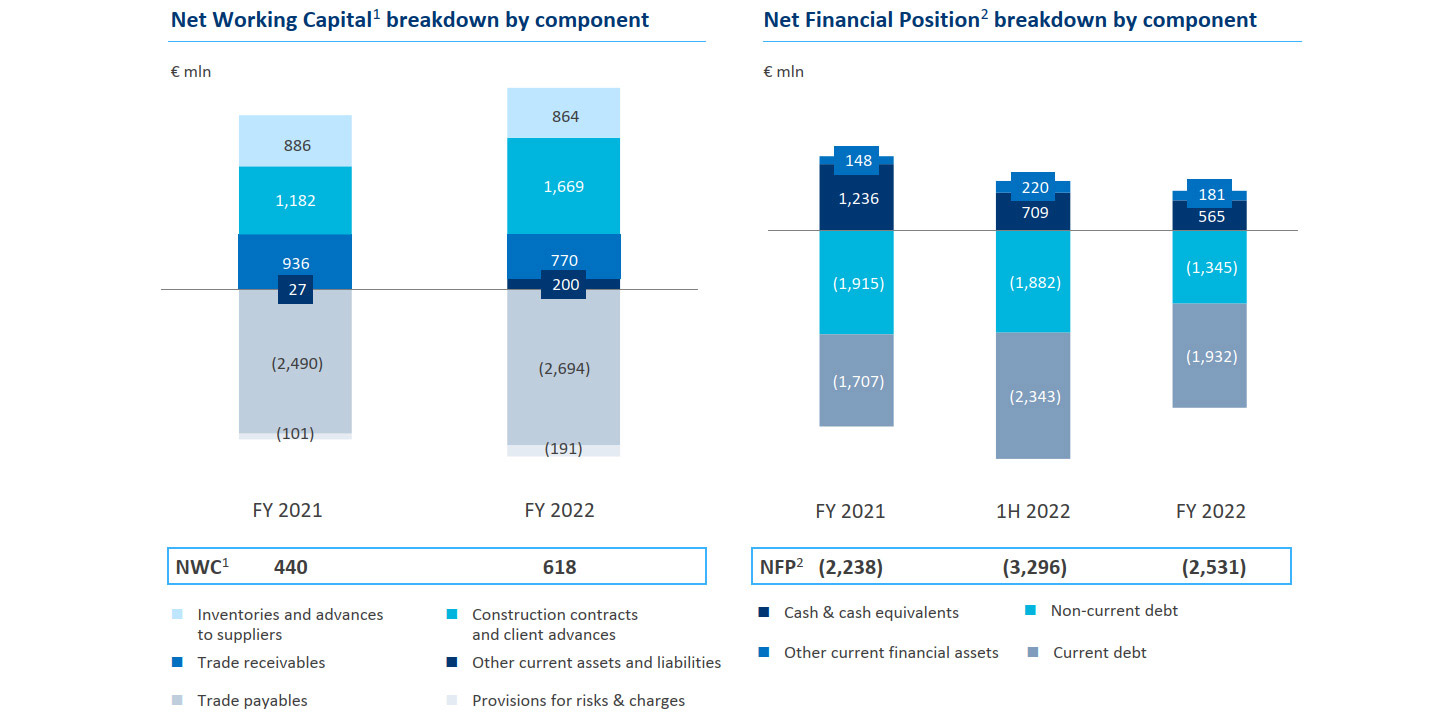

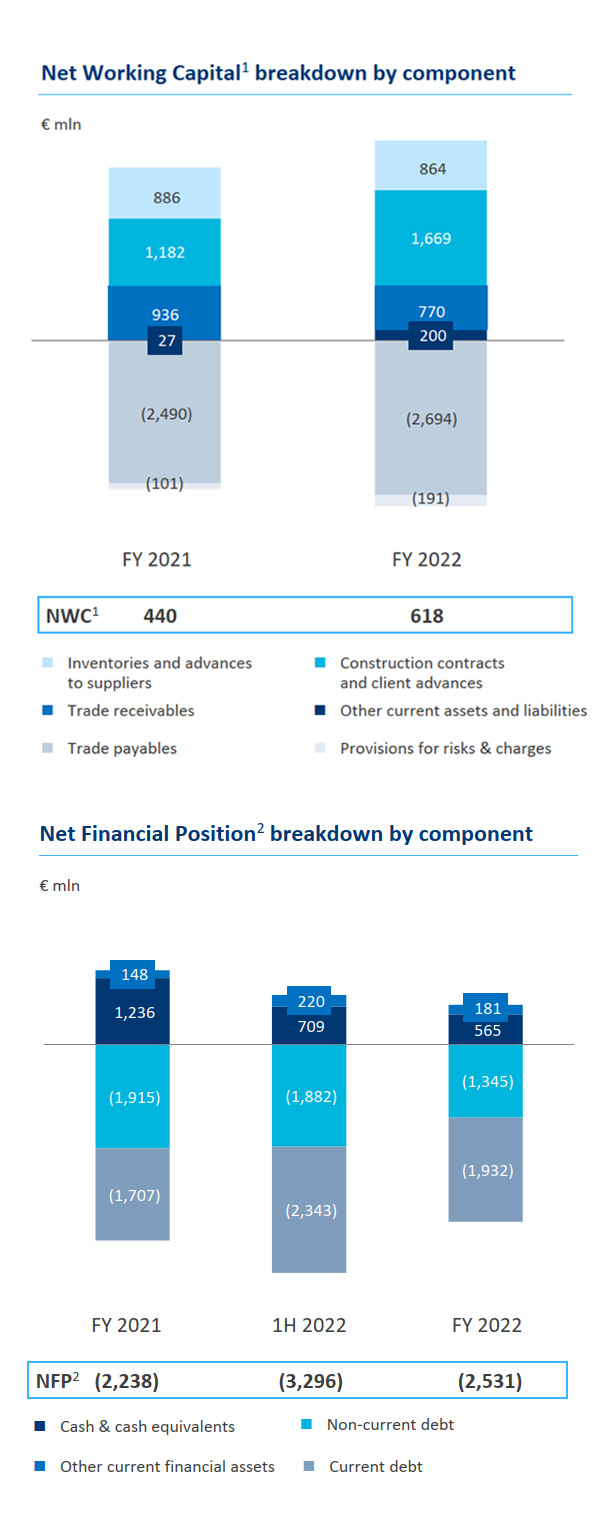

Improved NFP when compared to 1H 2022, consistent with production schedule

▪ Net financial position at €2,531 mln, improved when compared to 1H 2022 with an implied net cash generation of €765 mln in 2H 2022

▪ Net financial position still impacted by €94 mln deferrals granted to clients during COVID-19 pandemic

▪ No financial covenants

▪ Net working capital increased to €618 mln from €440 mln in FY 2021

1. Group Net Working Capital aligned with ESMA guidelines excludes (i) construction loans, (ii) current portion of derivative liabilities for non-financial items, and (iii) the current portion of the fair value of option on equity investment

2. Group Net financial position has been aligned with ESMA guidelines and it includes (i) construction loans, (ii) non-current financial liabilities on hedging instruments and (iii) liabilities for fair-value options investments that were previously excluded, furthermore it excludes non-current financial receivables

MARKET OUTLOOK

Cruise full recovery expected in 2023

Operations and market outlook

▪ 93% of the global fleet back in operation at the end of December 20221, with load factors approaching pre-pandemic levels

▪ Major cruise lines dropped vaccine requirements and eased pre-boarding Covid rules

▪ Value proposition gap between cruises and land-based holidays further shifting towards cruising during the pandemic. Resumption of orders already recorded for the luxury niche segment, with new operators (i.e. brands established by hotel groups), for medium to small vessels

▪ Booking trends for 2023 in line with 2019 levels

▪ Passenger volumes expected to have reached 28 million in 2022 and to surpass 2019 levels by the end of 20232 with a target of 32 million passengers, pre-Covid volumes

Sustainability

▪ Net carbon neutrality for cruise industry by 20503 and 40% reduction of average CO2 intensity per tonne/mile required by International Maritime Organization (IMO) regulations by 2030 vs 2008

▪ Alternative fuels: shipowners increasingly interested in green propulsion systems and new fuels (LNG, methanol, ammonia and hydrogen) for a fully decarbonized cruise industry

▪ Shore-side power connectivity: 209 ships expected in operation by 20283, including ships already fitted, ships planned to be retrofitted and 98% of ships on order book through 2028

1. Cruise Industry News – Ships in Service, 1st December 2022

2. CLIA – State of the Cruise Industry 2022 Report

3. CLIA - Cruise Industry August 2022, Environmental Technologies and Practices

Best positioned thanks to higher defence budgets and new opportunities in wind offshore

▪ Global defence spending reached USD 2.08 trillion in 2022 confirming value of 2020-2021, with a compound annual growth rate of ca. 1.6% (CAGR 2014-2022)

▪ Fostered by the Ukraine crisis, Defence budgets have been revised upwards, above all in Western European Countries and according to NATO guidelines.

Global spending is expected to further increase by 4.4% in 20231

▪ Defence budget allocated to navy procurement estimated at 6.6% of global budget1

▪ Increased interest from EU member states in the creation of a common EU Defence framework

▪ EU major defence programs include the Permanent Structured Cooperation (PESCO) for a new class of modular military ships, the European Patrol Corvette

1. Jane’s – Global Defence Budget, October 2022

Best positioned thanks to higher defence budgets and new opportunities in wind offshore

▪ Worldwide wind farms operating today delivering nominal power of ca. 55 GW2

▪ Favorable growth scenario, with almost 270 GW of total offshore wind capacity to be installed by 2030 (CAGR 15.7%)2

▪ Floating offshore wind expected to rapidly grow: 14 GW of floating offshore wind capacity to be installed or underway globally by 20302

▪ Growing demand for SOV - Service Operation Vessels and CSOV - Construction Service Operations Vessels: 41 units ordered since January 2020, compared with current fleet of 33 vessels3

2. 4C Offshore – Global Market Overview Q4 2022 Slide Deck, 14 December 2022

3. 4C Offshore – Orderbook and fleet as of end December 2022, excluding Chinese shipowners; Fincantieri analysis

NEXT STEPS & CONCLUDING REMARKS

2023-2027 Business Plan – The Strategic Pillars & Actions

FOCUS ON CORE BUSINESS

• Review and digitalization of the Group yards

• Higher competitiveness in specialized vessels segment seizing opportunities in the fast-moving wind offshore industry

• De-risking and partnering of the infrastructure business

• Accommodation upswing supporting captive market and expansion in the non-captive one

• Underpinning suppliers’network

LIFE-CYCLE MANAGEMENT

• Strengthening the role as digital design authority and complex system integrator, including automation, data management and Artificial Intelligence

SYSTEM INTEGRATION

• Reinforcing Orizzonte Sistemi Navali know-how to enhance combat systems integration

FINANCIAL DISCIPLINE

• Interfunctional and interdivisional approach, spreading procurement best practices

• Financial discipline, assigning specific and cross functional responsibilities to monitor cost and standardize processes

INDUSTRIAL SUSTAINABILITY

• Enabling new alternative fuels and propulsion technologies

• A clear sustainability strategy aimed at

- fostering the Human Capital within an inclusive and international environment

- offering innovative solutions to clients to reach their Net-Zero targets

- enhancing top-notch standards throughout the supply chain

2023-2027 Business Plan – Main Targets

| 2025 | 2027 | |

| REVENUES | €8.8bn | €9.8bn |

| EBITDA | ~7% | ~8% |

| NFP/EBITDA | 4.5-5.5x | 2.5-3.5x |

Investor Day at 1Q23 results

Concluding remarks

• Entrepreneurial approach to further strengthen the competitive positioning and business distinctiveness in the international shipbuilding industry, optimizing performance and anticipating clients’ future needs

• Focus on high added value shipbuilding business triggered by continuous innovation, digital solutions and energy transition, seizing market opportunities through cross-fertilization of competences across the core business

• Increased productivity and efficiency thanks to a thorough review and sharpen-up of the production processes together with a relentless attention to cost governance and financial discipline

• 2023-2027 Business and Sustainability Strategy as building blocks of the sustainable growth of the business and the creation of value to all the stakeholders to be presented during our Investor Day at 1Q23 results

• 2023 Guidance: Revenues in line with 2022, EBITDA margin at around 5%, NFP broadly in line with 2022