Executive summary

Revenues up by 17.8% and EBITDA +17.2%. Backlog at €34.4 bn

▪ Total backlog with 111 units at €34.4 bn, 5.2x 2021 revenues: backlog with 93 units at €24.8 bn and soft backlog at €9.6 bn

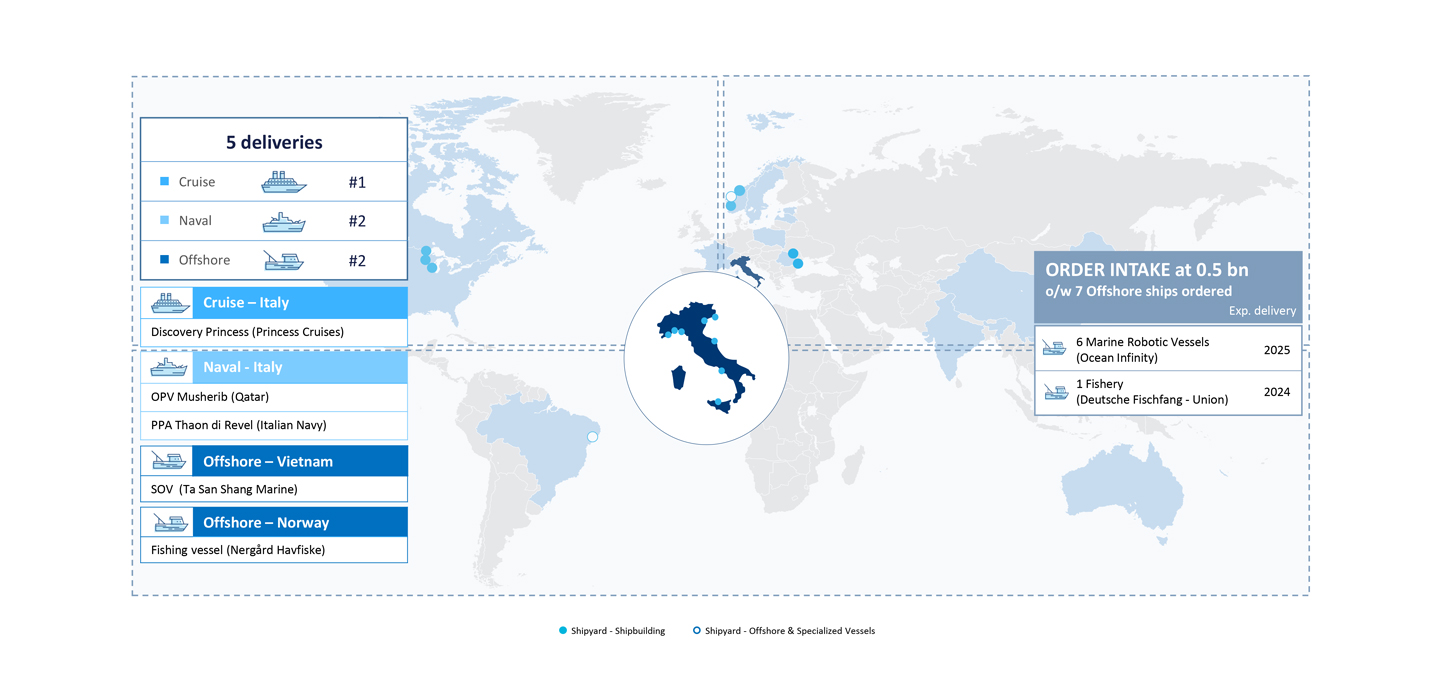

▪ Order intake at €0.5 bn

▪ 5 ships, one cruise and two naval vessels, one SOV and one fishery successfully delivered

▪ Capex at € 53 mln to support the upgrade of Italian and US shipyards, creating further efficiencies and improving technological standards

▪ Production volumes in line with 1Q 2021 levels generated higher Shipbuilding revenues and therefore higher margins

▪ 86% of revenues from international clients

Please note that throughout the entire presentation:

1. 1Q 2021 and 1Q 2022 data are reported excluding the effect of pass-through activities

2. 1Q 2021 data have been restated following the reallocation of VARD Electro and Seonics respectively from the Shipbuilding and the Offshore & Specialized Vessels segment to the Equipment, Systems & Services segment

Business update

Positive business operating performance across all segments

| ▪ Successfully delivered Discovery Princess, the sixth unit of the Royal class, for Princess Cruises, a Carnival Group brand ▪ Program for the Qatari Ministry of Defence: - delivery of the first Offshore Patrol Vessel (OPV) «Musherib» - launch of the fourth corvette «Semaisma» and delivery of the second corvette «Damsah» in April ▪ Program for the Italian Navy - delivery of the PPA «Thaon di Revel», first of seven units - launch of the fourth PPA - production activities kick off for the first of two new generation submarines |

|

| ▪ Delivery of the first Service Operation Vessel (SOV) for Ta San Shang Marine ▪ Contract for the design and construction of 6 marine robotic vessels for Ocean Infinity |

|

| ▪ Construction kick off for the new MSC Cruise Terminal in PortMiami ▪ Fincantieri Infrastructure to work with Società Italiana Dragaggi, Sales and Fincosit on the construction of sea defence works and dredging at the port of Livorno |

Strategic ESG initiatives

Fully committed to guarantee the highest environmental, social and governance standards

DECARBONIZATION & INNOVATION

▪ ENEA: MoU to develop R&I program regarding energy efficiency, renewable energy generation systems for the production, transportation and distribution of hydrogen, fuel cells, and circular economy

▪ RINA: MoU to develop synergies in the field of decarbonization, with a focus on alternative fuels, carbon capture and renewable energies in the shipping sector

OUR PEOPLE & OUR COMMUNITIES

▪ Fincantieri’s subsidiary VARD offered the use of its facilities at the Tulcea shipyard in Romania to accommodate up to 250 Ukrainian refugees, providing them with food and medical assistance

▪ Fincantieri takes part to School4Life, a program developed by companies and institutions against school dropout

▪ Signed the corporate nursery program, to be inaugurated in Trieste and to be followed by Monfalcone shipyard

STRUCTURAL HEALTH MONITORING & SMART ROADS

▪ Fincantieri NexTech: agreement with Almaviva and Leonardo to offer integrated and innovative digital solutions, applied to static and dynamic monitoring, and to the security of Italy’s critical infrastructure

SUSTAINABLE FINANCE

▪ Agreement with BNP Paribas for a sustainability-linked guarantees facility related to the achievement of two KPIs included in the Group’s Sustainability Plan, efficient energy consumption management and a sustainable supply chain

ESG ratings and awards

Tireless effort to become a model of excellence acknowledged at the international level

CDP

In 2021 Fincantieri was awarded with the A- score (scale from A to D) for its commitment and transparency in fighting climate change

V.E1

In 2021 Fincantieri achieved a score of 70/100, holding its position in the «Advanced» range and ranked first among its peers belonging to the Mechanical Components & Equipment sector

GAïA

Gaïa Rating improved the overall score of Fincantieri to 87 points out of 100 from 85 points in 2020

S&P GLOBAL

On December 20, 2021 S&P Global ranked Fincantieri 24th out of 186 “IEQ Machinery and Electrical Equipment” companies with a score of 58/100 in the Corporate Sustainability Assessment (CSA)

SUSTAINALYTICS

Sustainalytics positioned Fincantieri in the «Low Risk» range, and 6th out of 121 companies in the «Heavy Machinery and Trucks» category

1. V.E is part of Moody’s ESG Solutions

UNIVERSUM

Fincantieri ranked as Italy’s Most Attractive Employer in the Manufacturing, Mechanical and Industrial Engineering sector according to Universum

HEALTH AND SAFETY

The Shipbuilder Council of America (SCA) awarded Fincantieri Marinette Marine with the “Excellence in Safety Award” and Fincantieri Bay Shipbuilding (Sturgeon Bay) with the “Improvement in Safety Award”

GREEN STAR 2021

Fincantieri was identified among the most sustainable Italian companies, receiving the "Green Star 2021" Seal by the German Institute of Quality (ITQF). Fincantieri won the first prize in the “Engineering, constructions and infrastructure” sector

Main deliveries & New orders

5 vessels delivered and 7 ships ordered in 1Q 2022

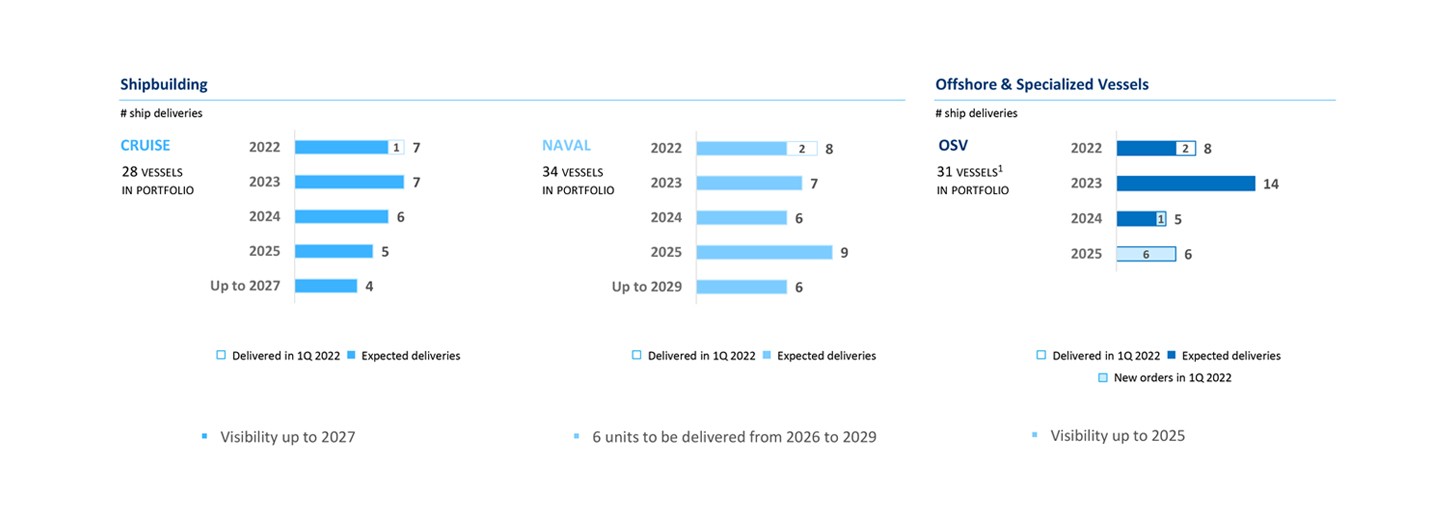

Backlog deployment

Well-balanced visibility both in Cruise and Naval, 7 new orders in Offshore and Specialized Vessels

1. The Offshore & Specialized Vessels business generally has shorter production times and, as a consequence, shorter backlog and quicker order turnaround than Cruise and Naval

FINANCIAL RESULTS

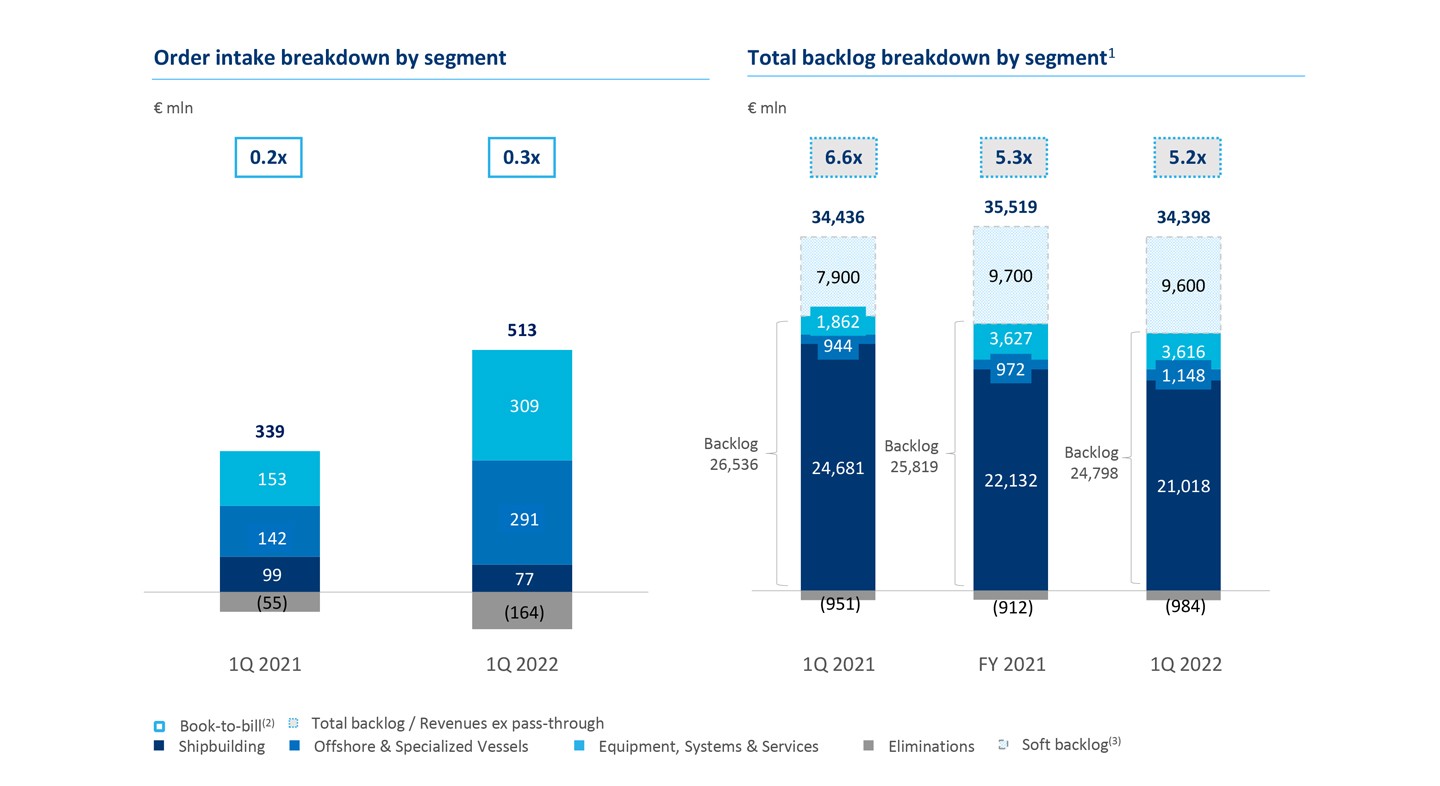

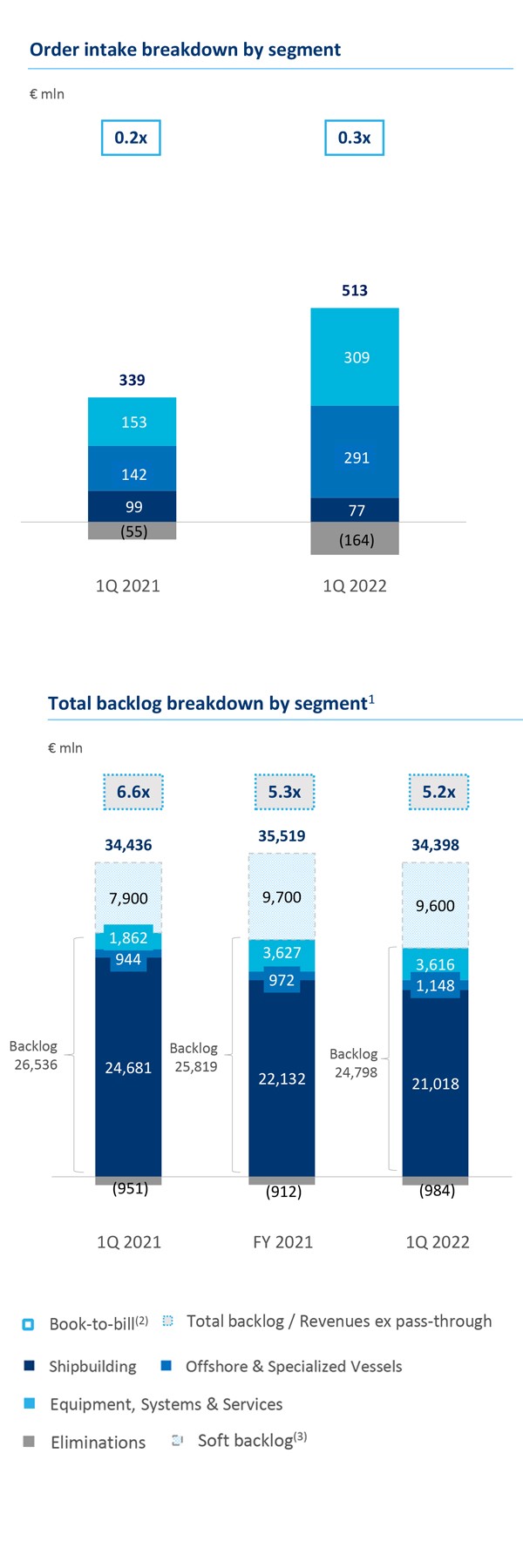

Order intake and backlog

Positive order intake with a solid contribution of ESS and Offshore. Sustained backlog and a robust soft backlog in line with 1Q 2021

▪ Order intake at €0.5 bn, driven mainly by the expansion of ESS and Offshore

▪ Total backlog representing 5.2x 2021 revenues

1. Total backlog is the sum of backlog and soft backlog

2. Order intake/revenues ex pass-through

3. Soft backlog represents the value of existing contract options and letters of intent as well as contracts in advanced negotiation, none of which yet reflected in the order backlog

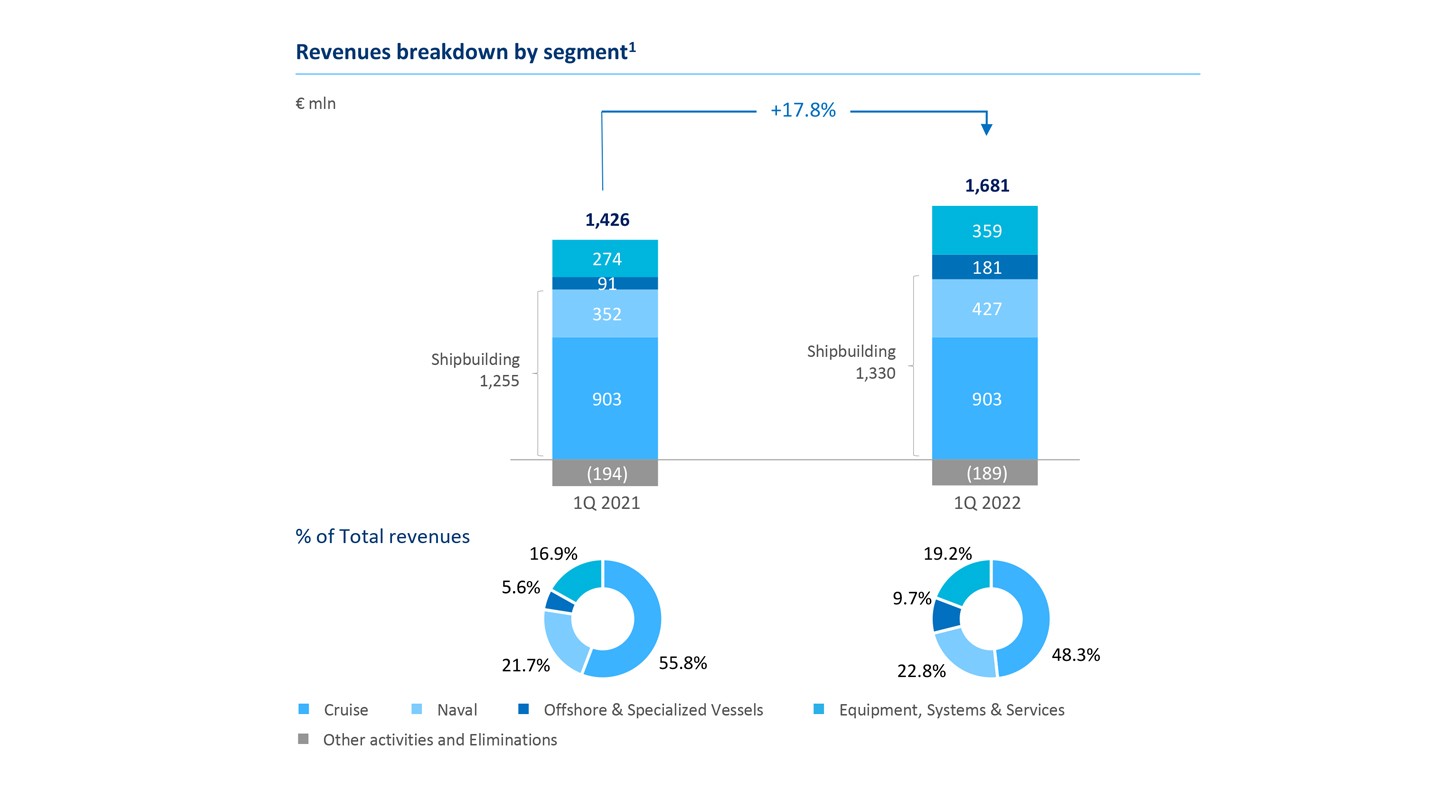

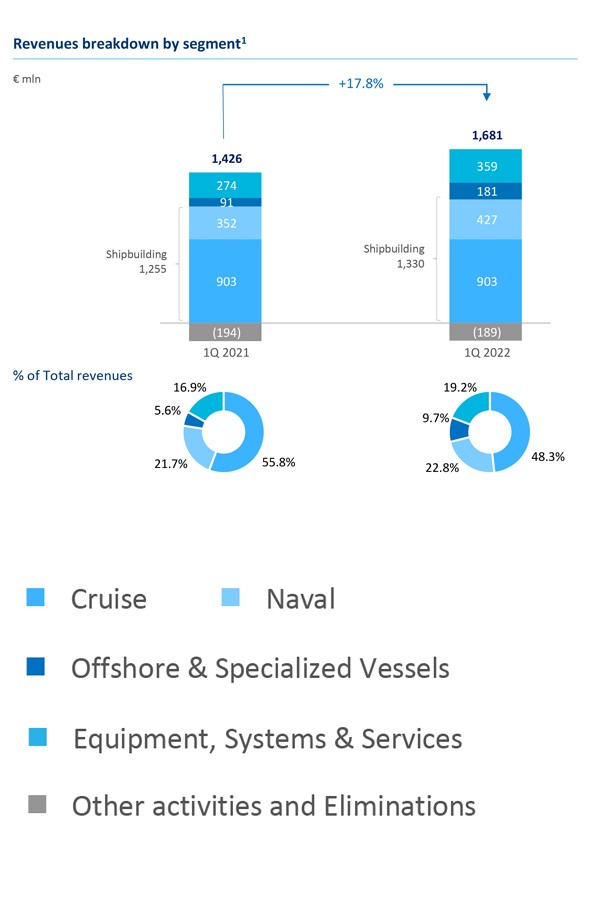

Revenues

Revenues up 17.8%, with positive contribution across all segments

Revenues up 17.8% YoY with positive contribution across all segments ![]() Shipbuilding up 6.0% YoY, mainly thanks to Naval, accounting for 22.8% of total revenues

Shipbuilding up 6.0% YoY, mainly thanks to Naval, accounting for 22.8% of total revenues

![]() Offshore & Specialized Vessels doubled, up 90 mln YoY

Offshore & Specialized Vessels doubled, up 90 mln YoY ![]() Equipment, Systems & Services up 31.4% YoY mainly related to infrastructure and mechatronics business areas

Equipment, Systems & Services up 31.4% YoY mainly related to infrastructure and mechatronics business areas

86% of revenues from international clients

1. Breakdown calculated before eliminations

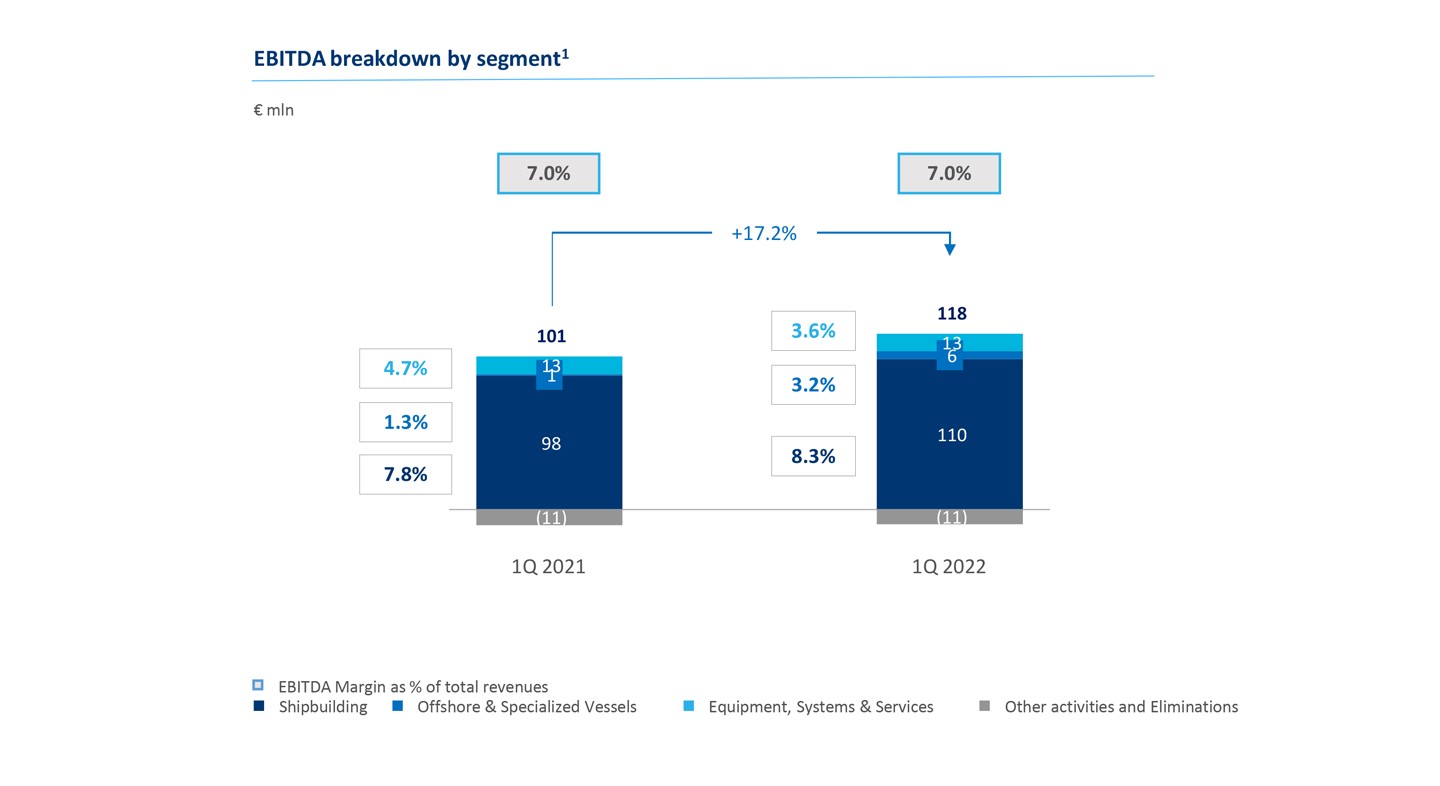

EBITDA

EBITDA at €118 mln (+17.2%) with an EBITDA margin at 7.0%

EBITDA margin at 7.0% mainly thanks to the positive contribution from Shipbuilding, despite the impact from increased commodities’ prices![]() Shipbuilding EBITDA is up €12 mln YoY with margin at 8.3%

Shipbuilding EBITDA is up €12 mln YoY with margin at 8.3% ![]() Offshore EBITDA is up €5 mln YoY thanks to the effective repositioning strategy in more promising sectors

Offshore EBITDA is up €5 mln YoY thanks to the effective repositioning strategy in more promising sectors![]() ESS EBITDA stable despite raw materials inflation

ESS EBITDA stable despite raw materials inflation

1. EBITDA is a Non-GAAP Financial Measure. The Company defines EBITDA as profit/(loss) for the period before (i) income taxes, (ii) share of profit/(loss) from equity investments, (iii) income/expense from investments, (iv) finance costs, (v) finance income, (vi) depreciation and amortization (vii) expenses for corporate restructuring, (viii) accruals to provision and cost of legal services for asbestos claims, (ix) other non recurring items

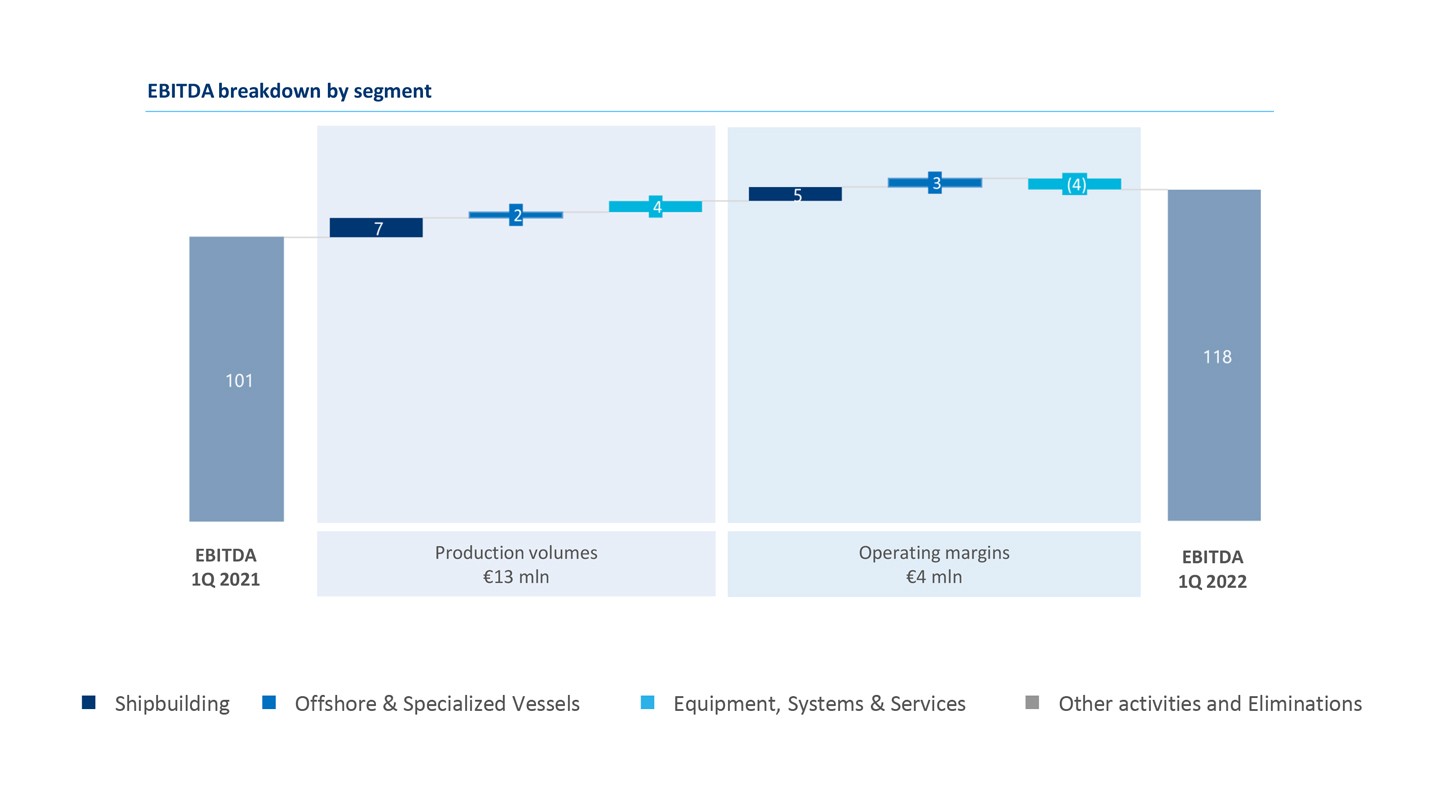

EBITDA growth

Better operating margin thanks to higher production volumes and improved margins

![]() Shipbuilding: EBITDA improvement driven by higher production volumes and operating margins

Shipbuilding: EBITDA improvement driven by higher production volumes and operating margins![]() Offshore and Specialized Vessels: increased EBITDA thanks to positive production volumes and operating margins

Offshore and Specialized Vessels: increased EBITDA thanks to positive production volumes and operating margins![]() ESS: production volumes fully offsetting lower margins

ESS: production volumes fully offsetting lower margins

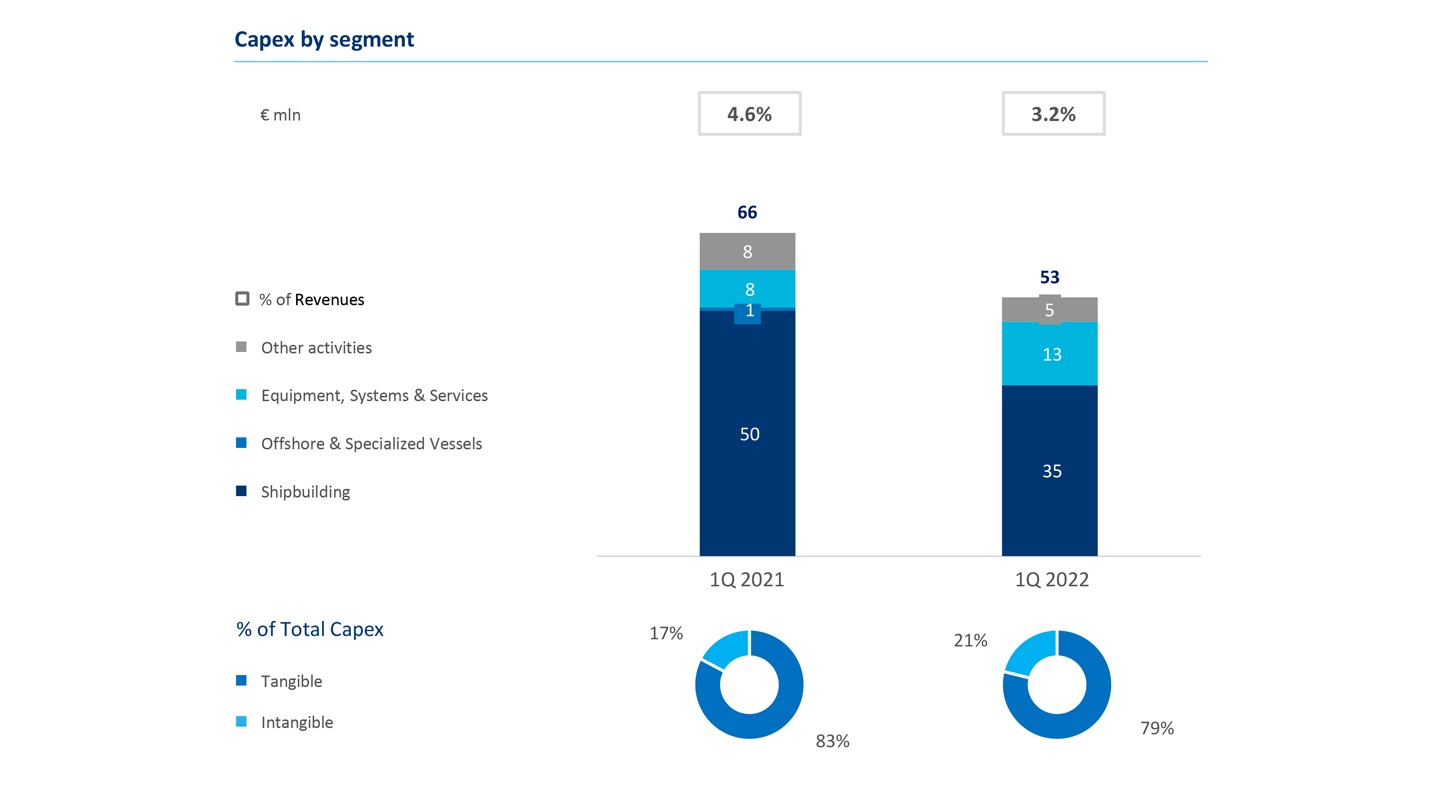

Capex

Investments underpinning further efficiencies in engineering and production processes

▪ Capex at €53 mln to support further efficiencies to address new production scenarios

▪ Upgrade of Marghera and Monfalcone shipyards along with US and Italian naval sites and further investments to improve the Group’s technological solutions

▪ Investments breakdown:

- Intangible activities for €11 mln

- Tangible activities for €42 mln

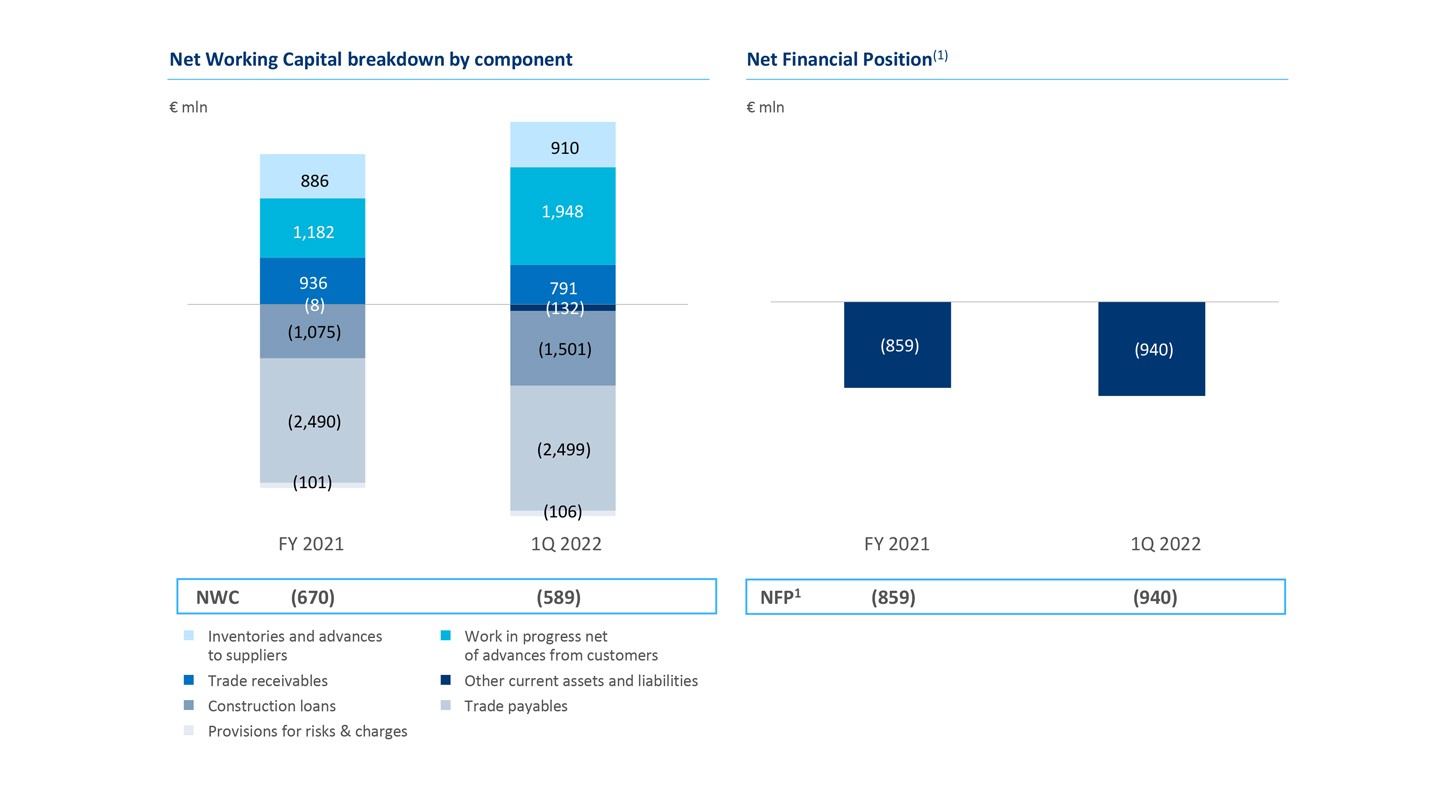

Net working capital and net financial position

NFP broadly in line with FY 2021. Construction loans consistent with 2022 delivery schedule

▪ Net financial position at €940 mln consistent with production volumes and reflecting net working capital dynamics

▪ Net financial position still impacted by the strategy of deferrals granted to clients (ca. €292 mln)

▪ Construction loans increased to €1,501 mln (vs €1,075 mln in FY 2021) due to production dynamics, with six cruise vessels expected to be delivered in the rest of the year

▪ No financial covenants

1. Construction loans are committed working capital financing facilities, treated as part of Net working capital, not in Net debt, as they are not general purpose loans and can be a source of financing only in connection with ship contracts

OUTLOOK

Focus on core business

Competitive positioning confirmed. Cruise full recovery expected in 2023. Naval likely to benefit from higher defence budget.

| CRUISE | ▪ The U.S. Centers for Disease Control and Prevention (CDC) has dropped cruise travel warning after two years and Australia lifted cruise ban too from mid April 2022 ▪ Nearly 100% of CLIA oceangoing member lines are projected to be in operation by summer season 2022, with load factors approaching historical levels1 ▪ Booking trends for 2022 and 2023 are in line with 2019 levels, but at higher prices ▪ Passenger volumes are expected to recover and surpass 2019 levels by the end of 20231 with a target of 30 million pax, pre-Covid volumes ▪ Recovery of cruise demand with a growth rate of +5% per year (CAGR 2009-2019 in terms of cruise pax) foresees a target of almost 34 million pax in 2026 and 42 million in 2030. A resumption in orders would be possible from 2023-2024, taking into account construction lead-times and the availability of slots by shipyards1 ▪ The cruise industry aims to reach net carbon neutrality by 2050; by 2027 CLIA member fleet will include 26 LNG-powered cruise ships and 174 cruise ships with shoreside power connectivity1. By 2035, all cruise ships will be equipped to use shore power in order to pursue net-zero carbon cruising by 20502 |

| NAVAL | ▪ Total global defence spending reached USD 2.06 trillion in 2021, showing a compound annual growth rate of 1.8% (CAGR 2013-2021), with defence budgets expected to accelerate in the upcoming years3 ▪ In 2021, the defence budget allocated to navy procurement estimated at 6.4% of global budget3 ▪ While the upward effects of the war in Ukraine on defence budget are yet to be determined, the conflict may accelerate the creation of a common EU Defence ▪ On 21 March 2022, the European Council has adopted the Strategic Compass, with the target to strengthen EU security and defence policy by 2030 ▪ EU major defence programs include the Permanent Structured Cooperation (PESCO) for a new class of modular and flexible military ships, the European Patrol Corvette (EPC) |

1. CLIA - State of the Cruise Industry 2022 report

2. CLIA - Cruise Industry is Sailing Back Toward a Better Future, April 2022

3. Jane’s - Global Defence Budget, March 2022