Strategic overview

Resilience: let’s start again from where we never stopped

SUMMARY & BUSINESS UPDATE

Executive summary

Ensuring employee health and safety and preserving backlog are our top priorities. Solid FY results despite COVID-19 related shortfall in revenue of ~€1 bn and ~3.2 mln production hours

Ready to get back on our growth path

Ready to get back on our growth path

• Succesfully managed to keep our people safe, with ~4% tested positive and 91% satisfaction expressed by our employees over the COVID-19 spread prevention measures

• Changing tack towards sustained growth in second half with our operational best practices and engineering capabilities fully preserved from the crisis

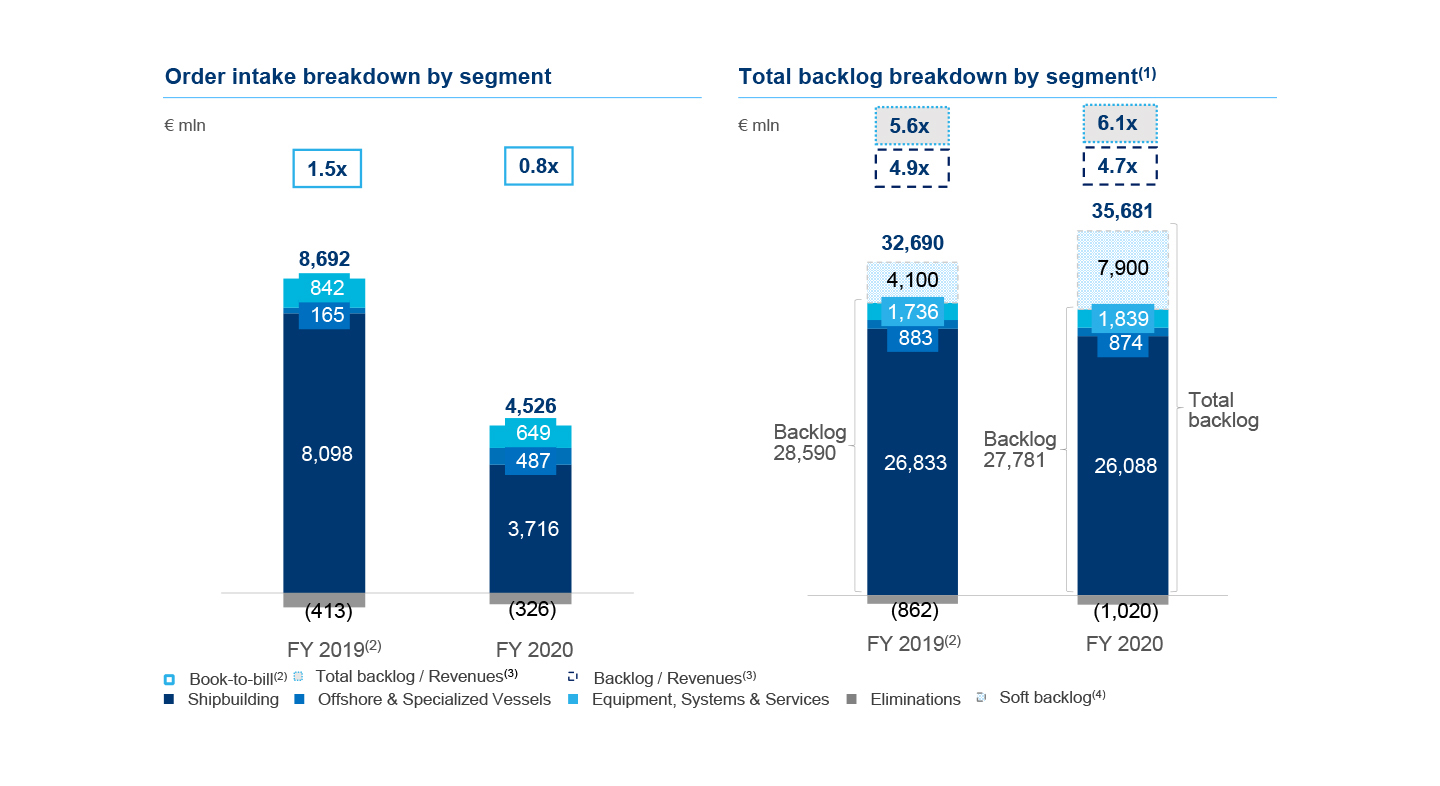

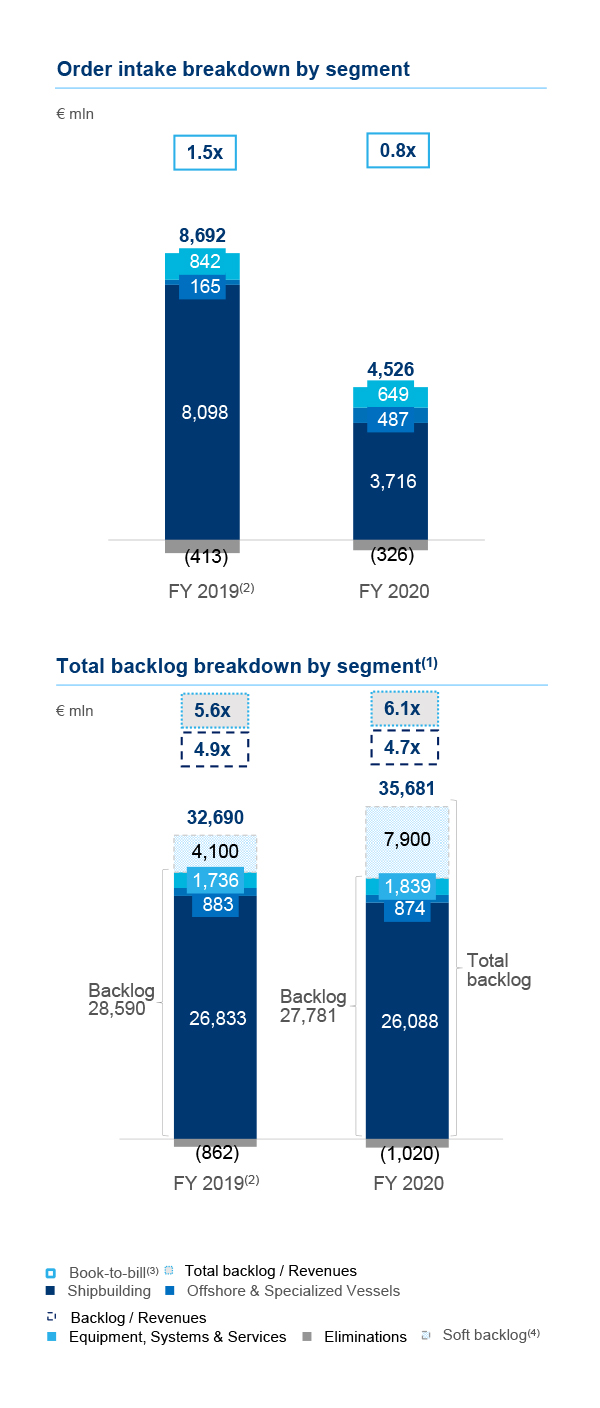

• No orders cancelled (total backlog at €35.7 bn at end FY2020), and production programmes successfully rescheduled

• 7 cruise ships successfully delivered as per the pre-pandemic schedule, 4 of which in the second half, 12 more ships in Naval and Offshore and Specialized Vessels

Strategic development

• New orders for €4.5 bn (18 new units), thanks to the excellent performance of the Naval and to the positive momentum of Wind Offshore

• Consolidation in the global defence industry, with significant national (frigates and submarines to the Italian Navy) and international orders (frigates for the US Navy, European Patrol Corvette project to Naviris)

• Expanding our strategic positioning in the infrastructure sector, through both organic and inorganic growth

• Fincantieri NextTech, Autostrade Tech, and IBM to deploy a new system for monitoring the Italian highway network

Business update

Continuous focus on strategic development

|

CRUISE |

• 7 cruise ships successfully delivered, 5 from the Italian shipyards and 2 from the Norwegian shipyards, testify the resilience of the cruise industry, that is firmly committed to a new restart |

|

DEFENCE |

• Outstanding commercial achievements in the Naval, both domestically and internationally, including 2 frigates and 2 submarines for the Italian Navy, the frigates for the US Navy, Naviris fully operating with 2 contracts signed with OCCAR in 2020 and an MoU with Navantia for the European Patrol Corvette (“EPC”) project |

|

OFFSHORE & SPECIALIZED VESSELS |

• 6 new important orders for the offshore wind and fishing industry, proving the effectiveness of the turnaround strategy aimed at driving VARD into a new path towards structural growth in sustainable businesses |

|

EQUIPMENT, SYSTEMS, AND SERVICES |

• Enhancing our expertise into high value-added and promising sectors, from infrastructures to complete accommodation: Fincantieri NexTech monitoring system for the highway network, acquisition of INSO and SOF, Marine Interiors to supply ≃2,800 cabins to the JV CSSC1 |

|

SUSTAINABILITY |

• Fincantieri among the companies leading the fight against climate change: A- rating up from B in 2019 by Carbon Disclosure Project (CDP), and confirmed in the “Advanced” range by Vigeo Eiris and 1/53 among its peers in the Mechanical Components and Equipment |

(1) JV CSSC is the joint venture between Fincantieri China and CSSC Cruise Technology Development Co. Ltd (CCTD). The cruise ship will be built by SWS, a CSSC subsidiary

New orders

Leveraging our solid track-record in the Naval, while expanding our presence in Wind Offshore

|

Segment |

Vessel |

Client |

Expected Delivery |

|

|

FFG(X) first-in-class frigate |

US Navy |

2026 |

|

2 FREMM frigates(1) |

Italian Navy |

2025 |

|

|

2 U212 NFS submarines(1) |

Italian Navy |

2027-2029 |

|

|

|

|||

|

|

Fishing vessel |

Framherij |

2022 |

|

Fishing vessel |

Nergard Havfiske |

2022 |

|

|

SOV for wind offshore |

Ta San Shang Marine |

2022 |

|

|

Fishing vessel(1) |

Luntos |

2022 |

|

|

8 Marine robotic vessels(1) |

Ocean Infinity |

2022-2023 |

|

|

Cable-laying vessel for wind offshore(1) |

Van Oord |

2023 |

|

Our strong leadership position and solid track-record have enabled us to acquire as many as 18 new units throughout such a challenging year

(1) Ordered in Q4

Main deliveries

7 cruise ships successfully delivered as per pre-pandemic schedule

The delivery of Enchanted Princess, our 100th cruise ship, amid the pandemic, is an historic achievement

|

Segment |

Vessel |

Client |

Shipyard |

|

|

Cruise ship “Seven Seas Splendor” |

Regent Seven Seas Cruises |

Ancona |

|

Cruise ship “Scarlet Lady” |

Virgin Voyages |

Genova |

|

|

Littoral Combat Ship “St. Louis” (LCS 19) |

US Navy |

Wisconsin |

|

|

Fishing vessel |

Finnmark Havfiske |

VARD Søviknes |

|

|

Expedition cruise vessel “Le Bellot” |

Ponant |

VARD Søviknes |

|

|

Cruise ship “Enchanted Princess” |

Princess Cruises |

Monfalcone |

|

|

Ferry “Madonna” |

Washington Island |

Wisconsin |

|

|

Expedition cruise vessel “Le J. Cartier” |

Ponant |

VARD Søviknes |

|

|

Cruise ship “Silver Moon”(1) |

Silversea Cruises |

Ancona |

|

|

Cruise ship “Costa Firenze” (1) |

Costa Crociere |

Marghera |

|

|

FREMM frigate(1) |

Egyptian Navy |

La Spezia |

|

|

Barge(1) |

Van Enkevort |

Wisconsin |

|

|

|

|||

|

|

Fishing vessel |

Nergard Havfiske |

VARD Brattvåg |

|

Offshore Subsea Construction Vessel (OSCV) |

Island Offshore |

VARD Brevik |

|

|

2 Ferries |

Boreal Sjø |

VARD Langsten |

|

|

Aqua |

Remøybuen |

VARD Langsten |

|

|

Fishing vessel |

Australian Longline Vessel |

VARD Vung Tau |

|

|

Open hatch container feeder(1) |

Yara Norge |

VARD Brattvåg |

|

(1) Delivered in Q4

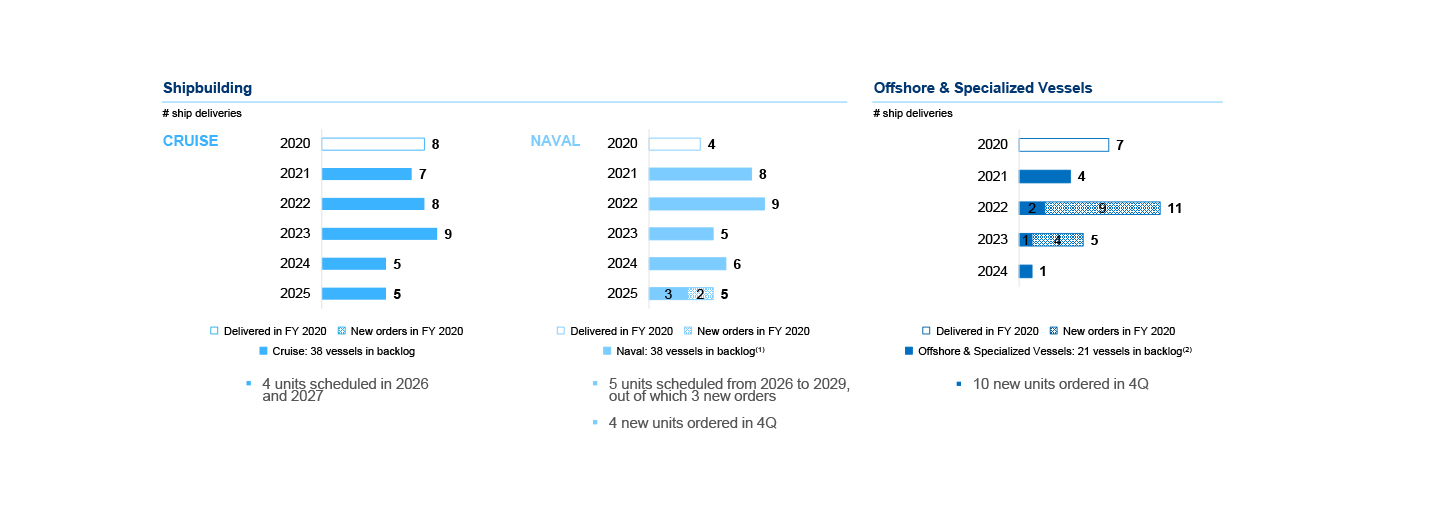

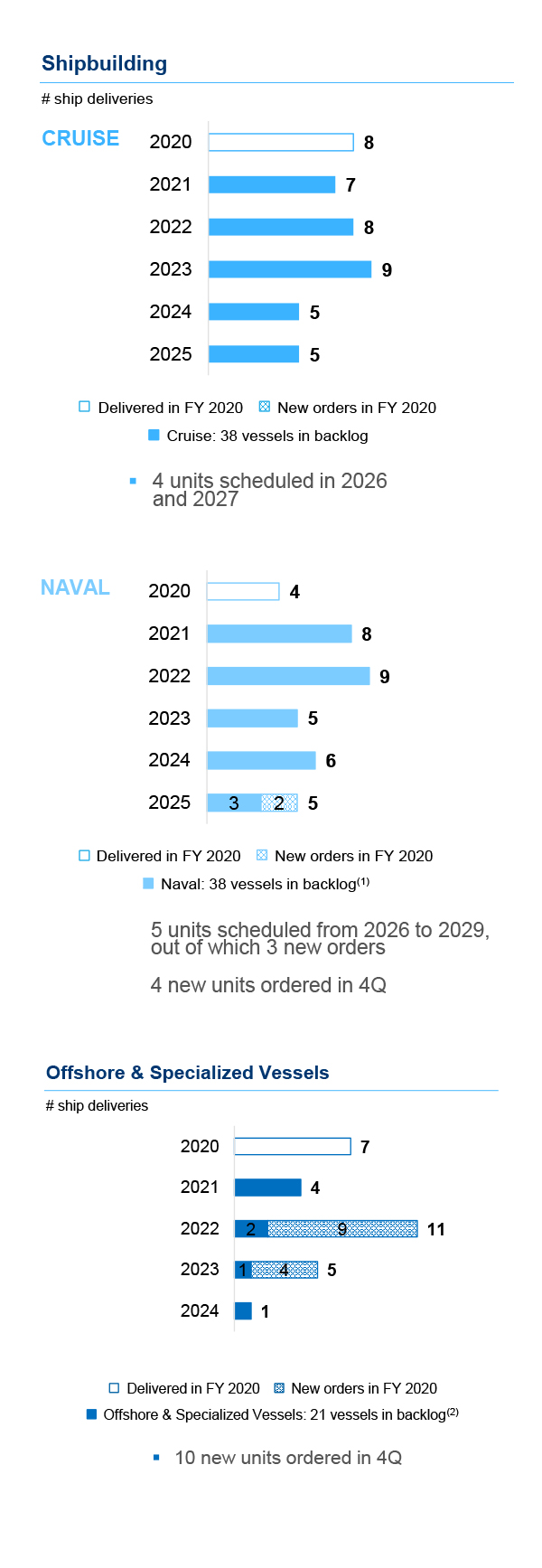

Backlog deployment

Improved visibility up to 2029 in the Naval and 13 new units acquired in the Offshore & Specialized Vessels

FY 2020

FINANCIAL RESULTS

Order intake and backlog

Strong contribution from the Naval and significant recovery of the Offshore on Y/Y comparison

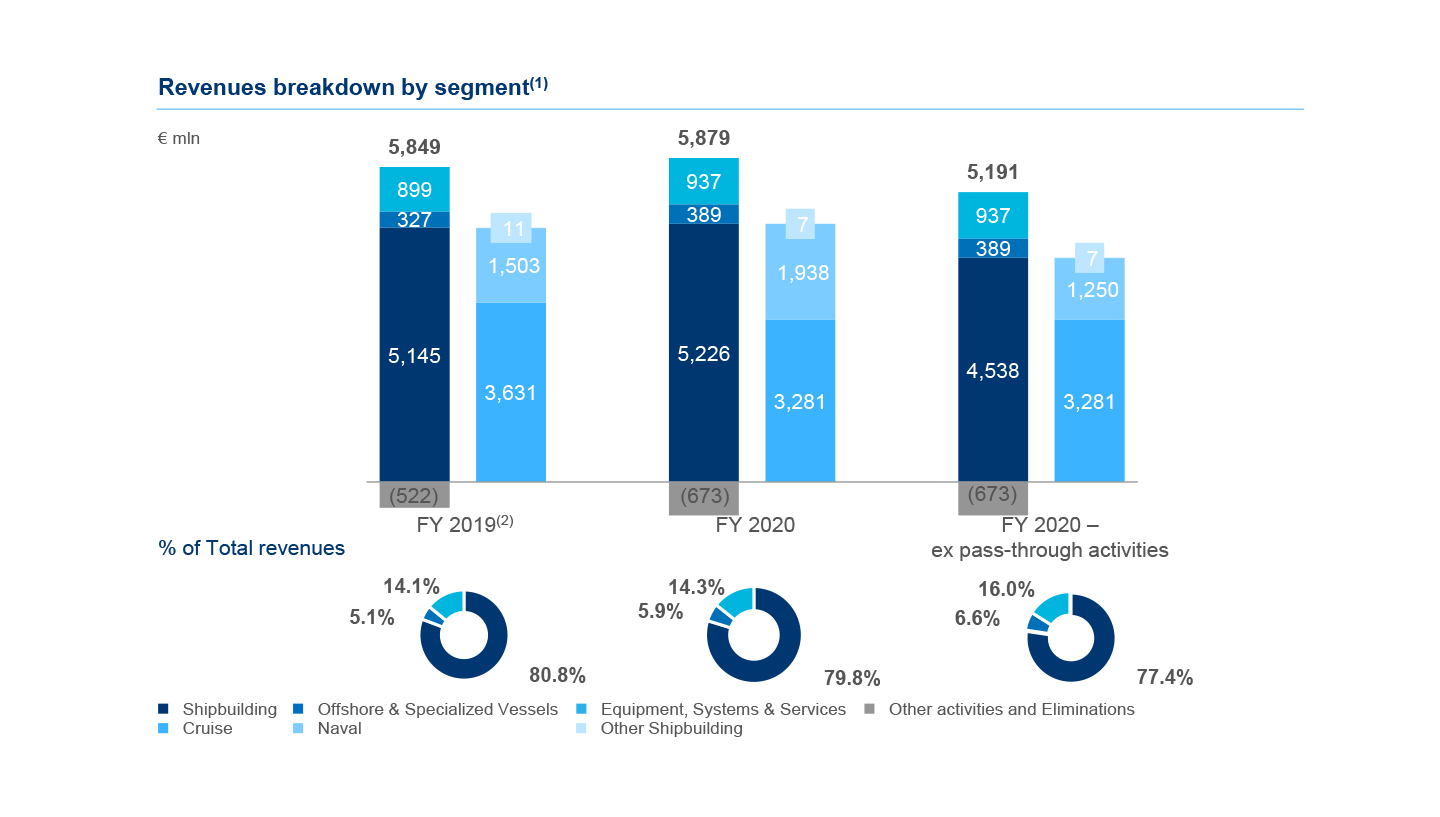

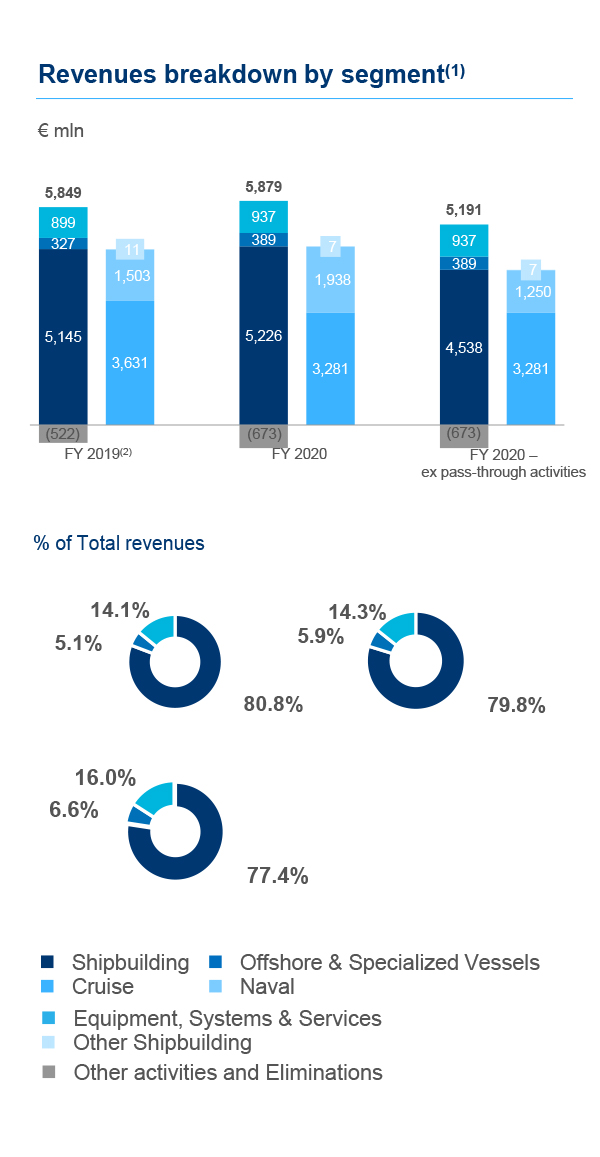

Revenues

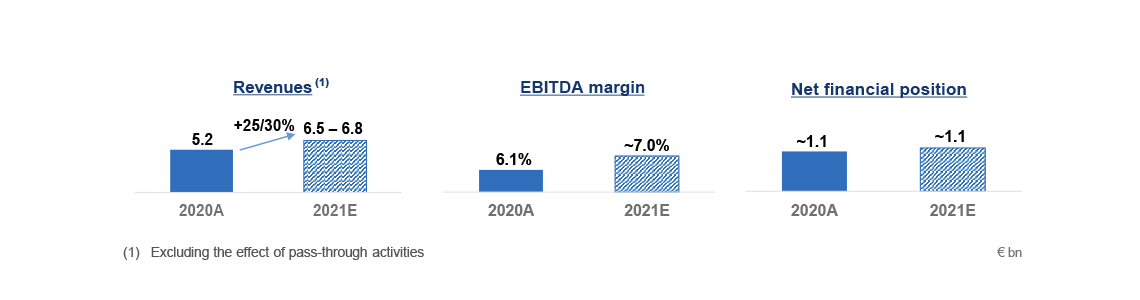

Steady top line YoY despite the effect of €1,055 mln Covid-19 related shortfall in revenue

Steady top line YoY (+0.5%) including the effect of €690 mln pass-through activities (Naval), despite Covid-19 related revenue shortfall of €1,055 mln (~3.2 mln shortfall in production hours)

Revenue shortfall to be recovered in 2021-2022

![]() Shipbuilding: €909 mln COVID-19 related revenue shortfall and €41 mln negative EUR/NOK conversion

Shipbuilding: €909 mln COVID-19 related revenue shortfall and €41 mln negative EUR/NOK conversion

![]() Offshore & Specialized Vessels revenues up 19.0% YoY despite €26 mln negative effect from EUR/NOK conversion

Offshore & Specialized Vessels revenues up 19.0% YoY despite €26 mln negative effect from EUR/NOK conversion

![]() Equipment, Systems & Services: €222 mln COVID-19 related revenue shortfall

Equipment, Systems & Services: €222 mln COVID-19 related revenue shortfall

(1) Breakdown calculated before eliminations

(2) Restated following the reallocation of VARD Electro from the Offshore to the Shipbuilding segment

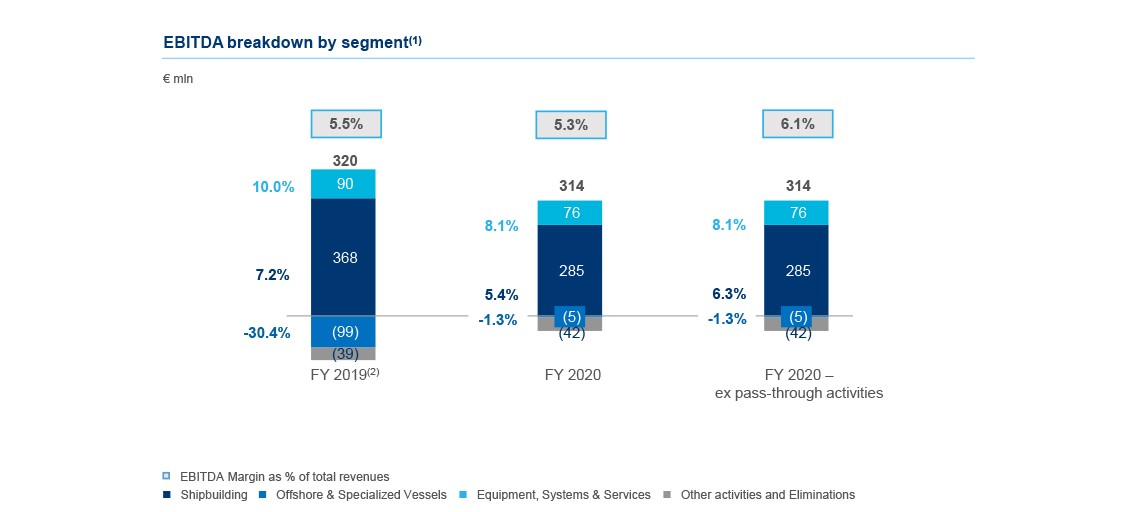

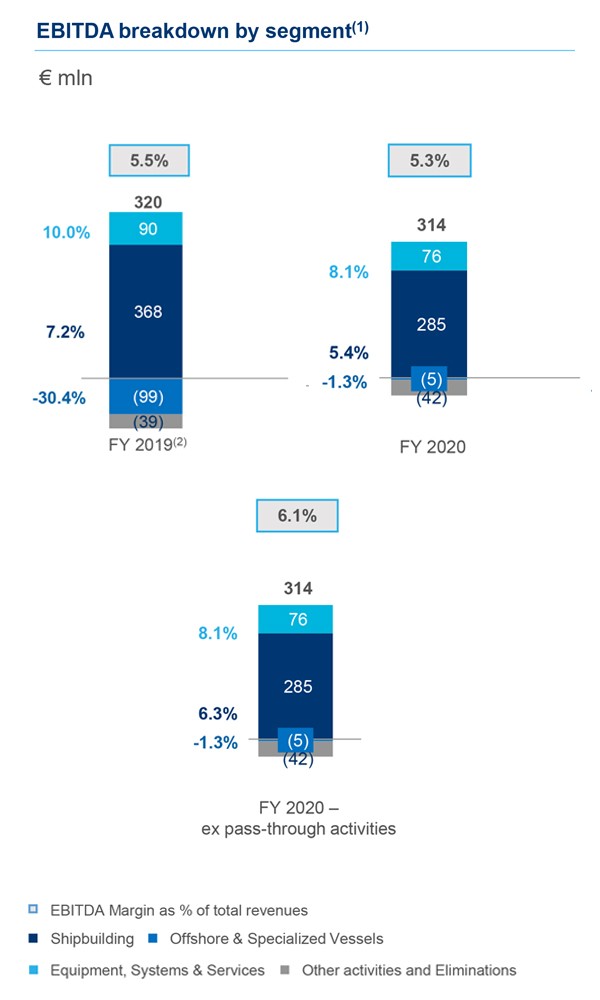

EBITDA

Robust EBITDA despite €80 mln COVID-19 related EBITDA shortfall

EBITDA margin at 6.1% excluding pass-through activities

![]() €58 mln lost EBITDA contribution from Shipbuilding due to Covid-19

€58 mln lost EBITDA contribution from Shipbuilding due to Covid-19

![]() Offshore & Specialized Vessels nearly at breakeven

Offshore & Specialized Vessels nearly at breakeven

![]() €22 mln lost EBITDA contribution from Equipment, Systems & Services due to Covid-19

€22 mln lost EBITDA contribution from Equipment, Systems & Services due to Covid-19

(1) EBITDA is a Non-GAAP Financial Measure. The Company defines EBITDA as profit/(loss) for the period before (i) income taxes, (ii) share of profit/(loss) from equity investments, (iii) income/expense from investments, (iv) finance costs, (v) finance income, (vi) depreciation and amortization (vii) expenses for corporate restructuring, (viii) accruals to provision and cost of legal services for asbestos claims, (ix) other non recurring items

(2) Restated following the reallocation of VARD Electro from Offshore to Shipbuilding

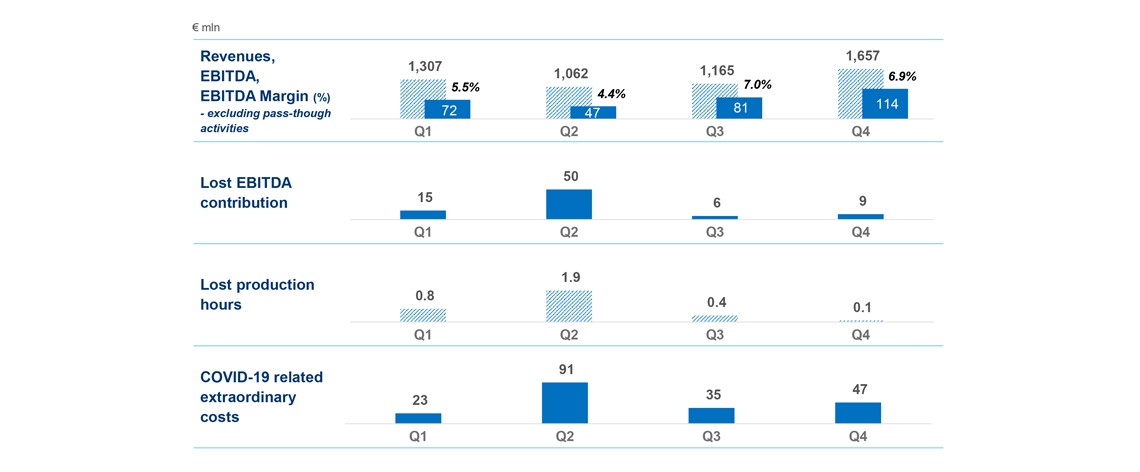

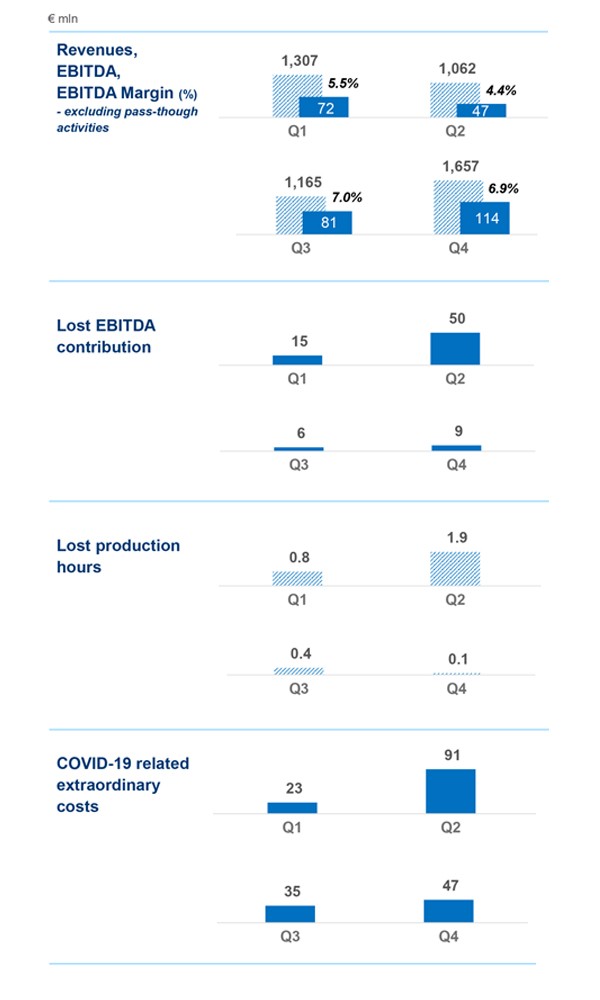

2020 performance by quarter

Beyond COVID-19: our route towards recovery

• First half was heavily impacted by COVID-19

• COVID-19 related extraordinary costs have reduced throughout the year, with a clear path towards operational normalization

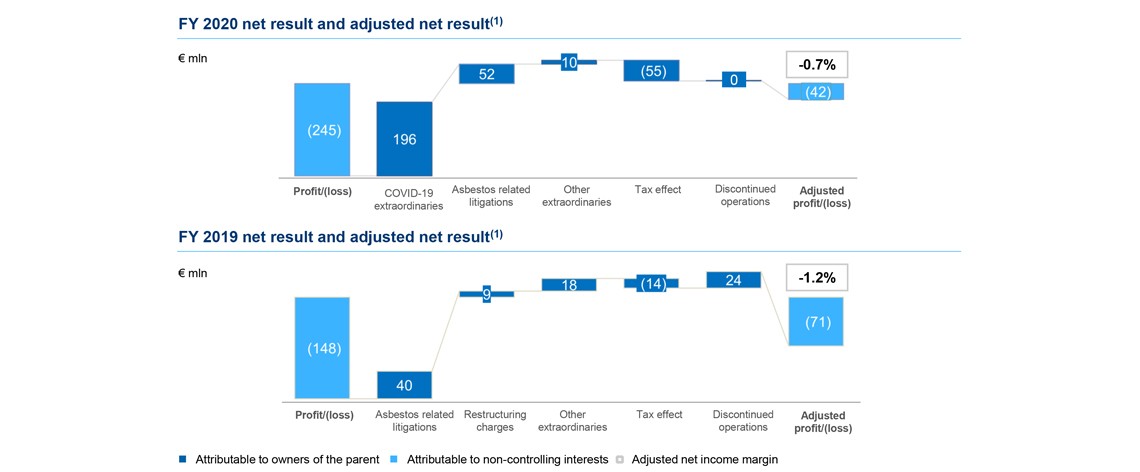

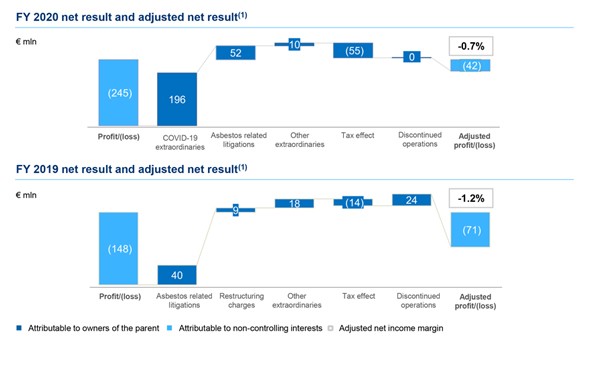

Net result

Impact from COVID-19 extraordinary costs, including reduced operating leverage after production halt

Extraordinary and non-recurring items include:

• €196 mln COVID-19 related costs

• €52 mln asbestos-related litigations

Negative minorities at €(5) mln in FY 2020 versus negative minorities at €(7) mln in FY 2019

(1) Net result before extraordinary and non-recurring items

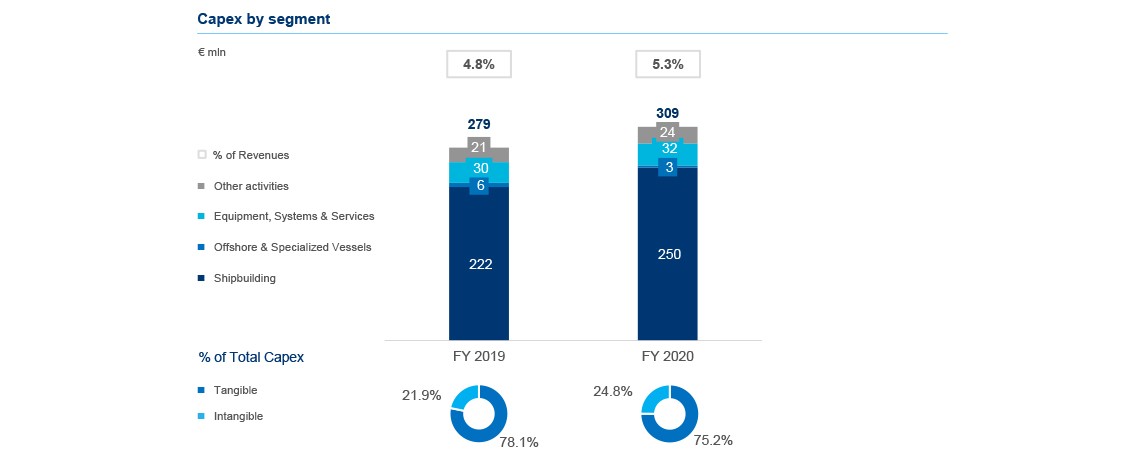

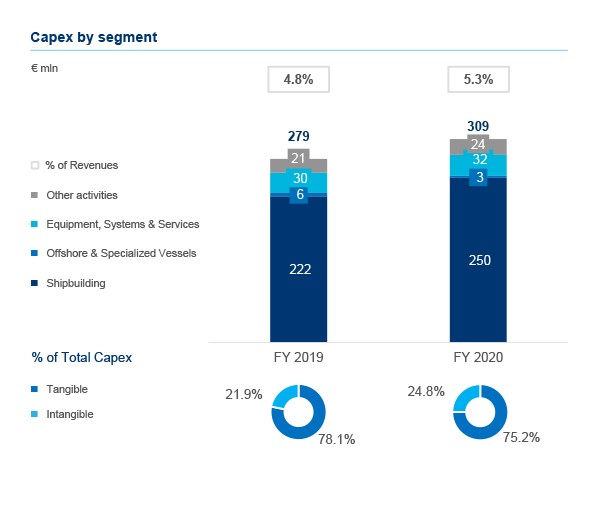

Capex

Preserving our long-term capex program for enhancing technological innovation and scale up of US operations

• Adjusting production capacity at Italian yards

• Improving general safety and environmental conditions

• Improving efficiency at Romanian shipyards

• Scale up of US operations for the FFG(X) program

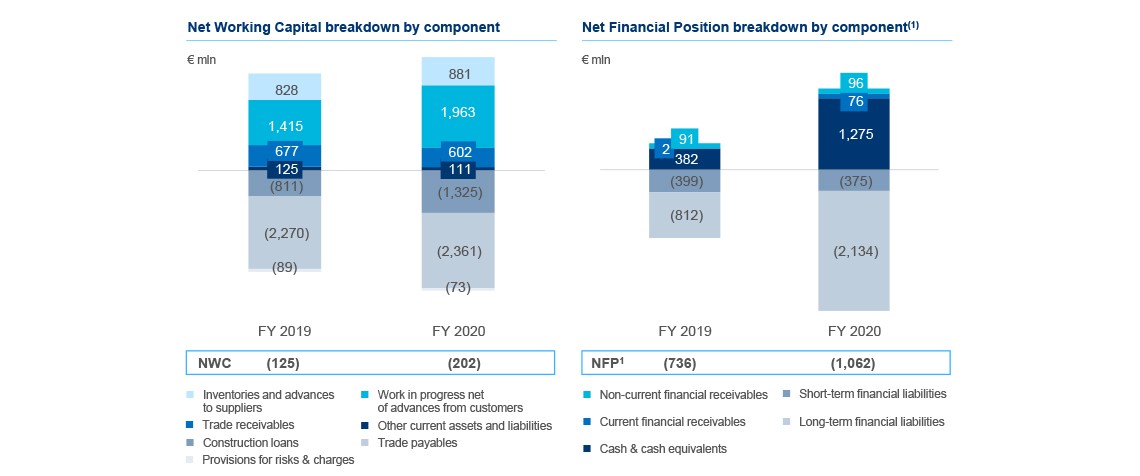

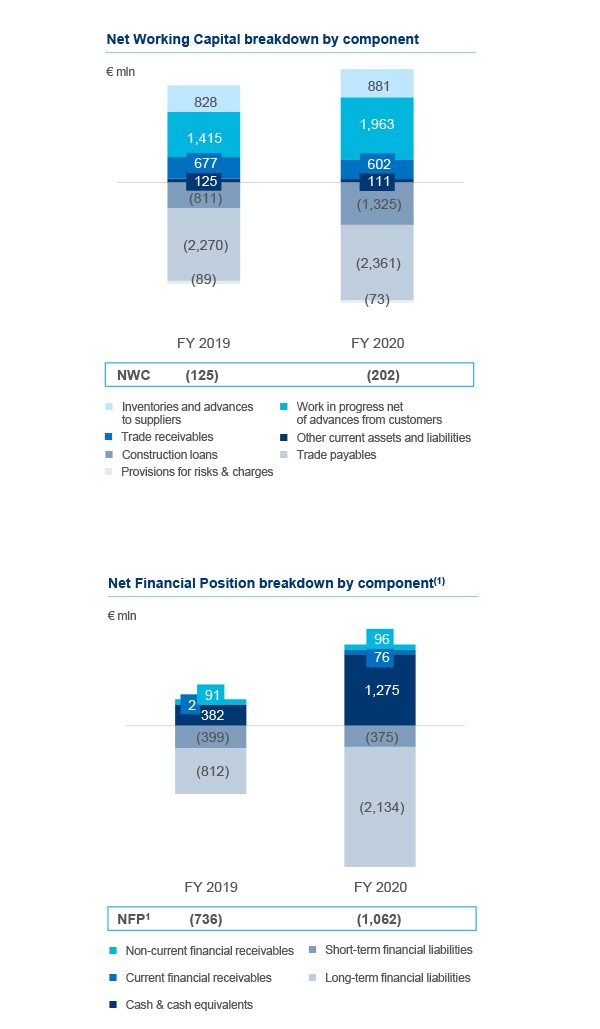

Net working capital and net financial position

Improved quality of total debt q/q with greater reliance on construction loans

• Net financial position impacted by the postponed cash-in of cruise ship installments agreed with the shipowners (~ €450 mln)

• ~ €360 mln q/q improvement of net financial position with greater reliance on construction loans

• Adequate liquidy position thanks to 2 cruise ships delivered in 4Q and €1.15 bn loan guaranteed by SACE

• No financial covenants

(1) Construction loans are committed working capital financing facilities, treated as part of Net working capital, not in Net debt, as they are not general purpose loans and can be a source of financing only in connection with ship contracts

Outlook

Focus on cruise

More efficient and eco-friendly fleets will make shipbuilding demand thrive

• EU operations partially resumed, while US operations still voluntarily suspended

• The success of vaccination programs is key to industry recovery, with a phased-in return expected from 2H 2021

• All the major shipowners have confirmed that 2021 bookings remain within the historical range despite minimal advertising campaigns

• 74% of cruisers are likely to cruise in the next few years

• 2 out of 3 cruisers are willing to cruise within a year

• 58% of international vacationers who have never cruised are likely to cruise in the next few years

• ~40-45%(2) of customers have opted for future cruise credits as opposed to cash refunds

• Secular growth trend is still intact with expected strong pent-up demand in the aftermath of the pandemic

(1) CLIA-Qualtrics Survey December 2020-4,000 International vacationers each, eight countries, U.S, Canada, Australia, UK, Germany, France, Italy and Spain

(2) Public sources from major shipowners

• Disposal of older and less efficient vessels to capitalize on pent-up demand and compliance with stricter environmental regulations will drive demand for new orders in the medium-term

• Technological innovation may thrive in response to enhanced health and safety protocols and medical facilities required onboard

2021 Company outlook

• Programmed production ramp-up in order to catch-up with the revenue shortfall in 2020

• Cruise: 5 ships to be delivered from Italy and 2 from Norway

• Naval: 5 vessels to be delivered from Italy and 3 from the US. Kick-off of the preliminary operations for the FFG(X) program

• Orders in line with 2020, with significant intake expected from wind offshore and fishery

• 4 vessels to be delivered in 2021, while pursuing margin recovery also through the diversification strategy

• Execution of the backlog, with strong focus on after-sale services (contracts for the Italian and the Qatari Navy); complete accommodation (cabins, bathrooms, and public halls); electronics, systems, and software (naval defence systems; monitoring and safety of critical infrastructures); and infrastructures (steel infrastructures, ports, and healthcare facilities)

• Significant ramp-up expected with acceleration in production programmes and strong focus on the execution of the backlog, in view of the substantial program of deliveries

• Return to profitability and margins embedded in the current backlog, thanks to fully preserved order portfolio and strong focus on execution

• NFP was impacted by the rescheduling of installments of cruise clients

• The gap is expected to close starting from the end of 2021/beginning of 2022

• Return to profit may lead to a resumption of a sustainable dividend distribution starting from 2022