Observations and early strategic priorities

• Strategic review of infrastructure projects and other non core businesses

• Enhanced collaboration with Leonardo on defence business, envisioning a fully fledged prime contractorship model and key international alliances

• Continuous engagement on modernization and digitalization of shipyards operations up to excellence

• Firm focus on the core business of cruise and defence shipbuilding and increased entrepreneurial approach on green propulsion systems (e.g. LNG, methanol, ammonia, hydrogen) and on digital solutions (e.g. digital twins, simulators, energy management, predictive maintenance) leveraging Fincantieri global and undisputed leadership

• Maximum attention to financial discipline and deleveraging

• Utmost focus on Fincantieri human capital at any organizational level

Opening remarks

• Positive operating performance affected by:

- the results of a strategic review in Infrastructure

- raw materials prices impact on shipbuilding projects’ whole life costs

- write-off of some financial assets

- goodwill impairment related to the Norwegian subsidiary Vard and US subsidiary Fincantieri Marine Group

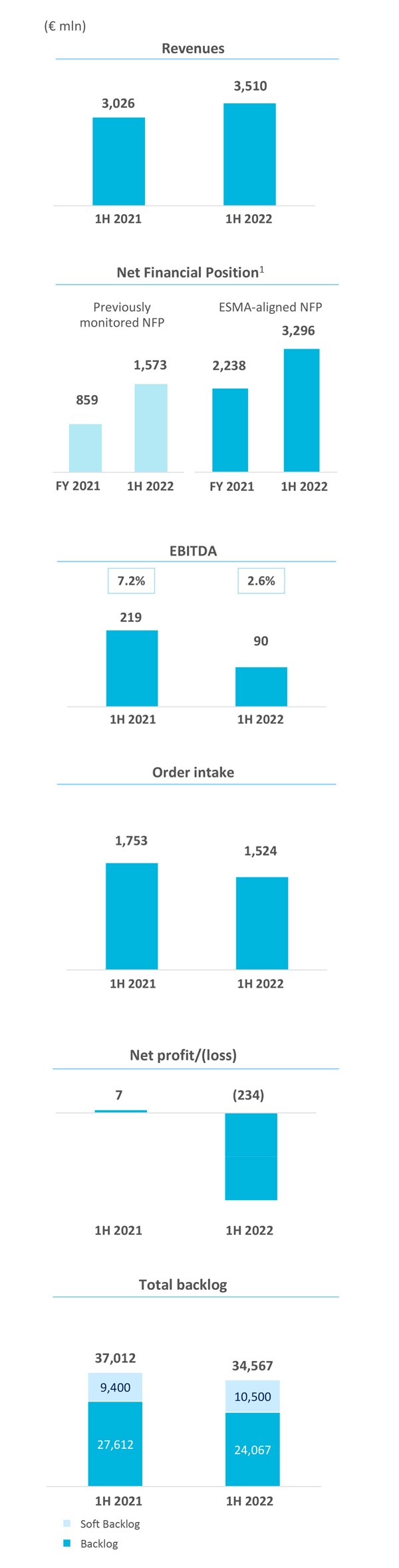

• Revenues at € 3,510 mln, up 16% YoY, in line with expectations

• Net loss at € 234 mln due to 1H 2022 extraordinary items (€ 156 mln)

• First signs of resumption in cruise orders

Financial and operating highlights

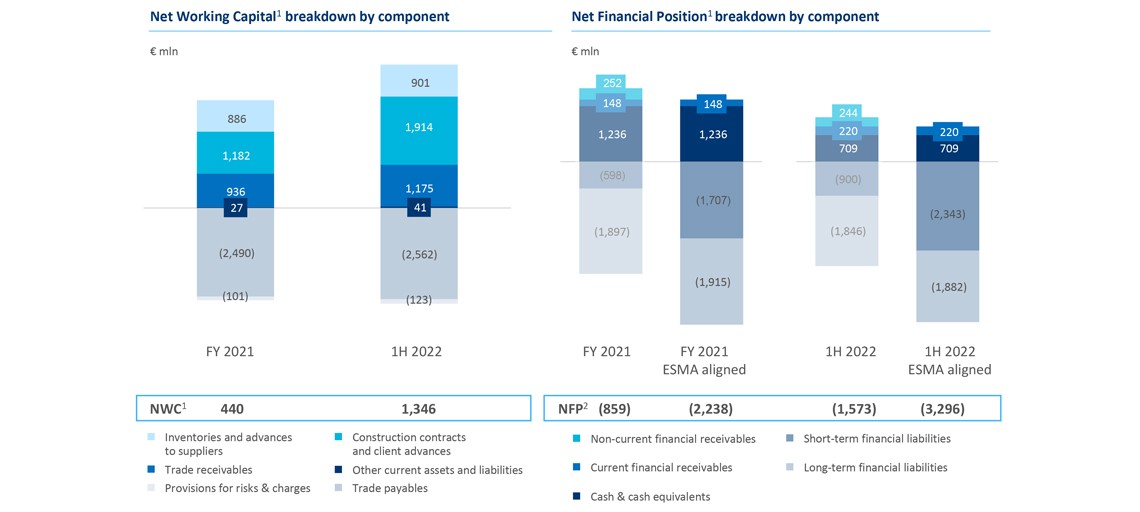

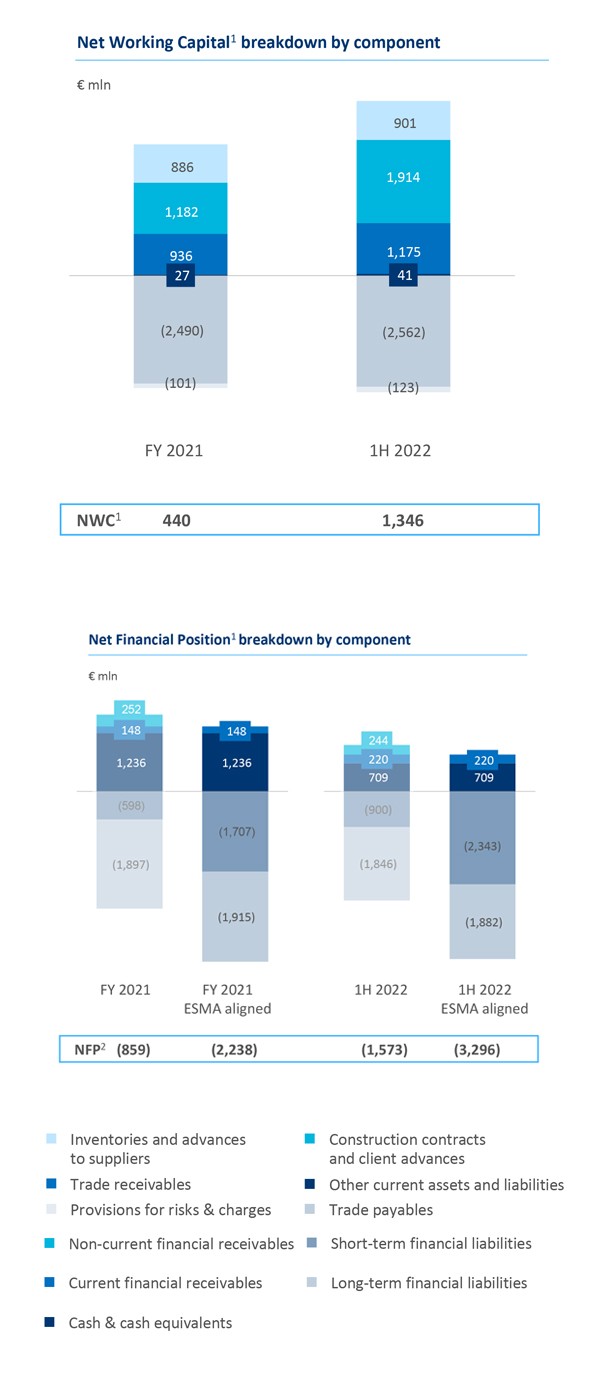

Please note that throughout the entire presentation:

- 1H 2021 and 1H 2022 data are reported excluding the effect of pass-through activities

- 1H 2021 data have been restated following the reallocation of VARD Electro and Seonics respectively from the Shipbuilding and the Offshore & Specialized Vessels segment to the Equipment, Systems & Services segment

1. Group Net financial position has been aligned with ESMA guidelines and it includes (i) construction loans, (ii) non-current financial liabilities on hedging instruments and (iii) liabilities for fair-value options investments that were previously excluded, furthermore it excludes non-current financial receivables

BUSINESS UPDATE

Positive business operating performance across all segments

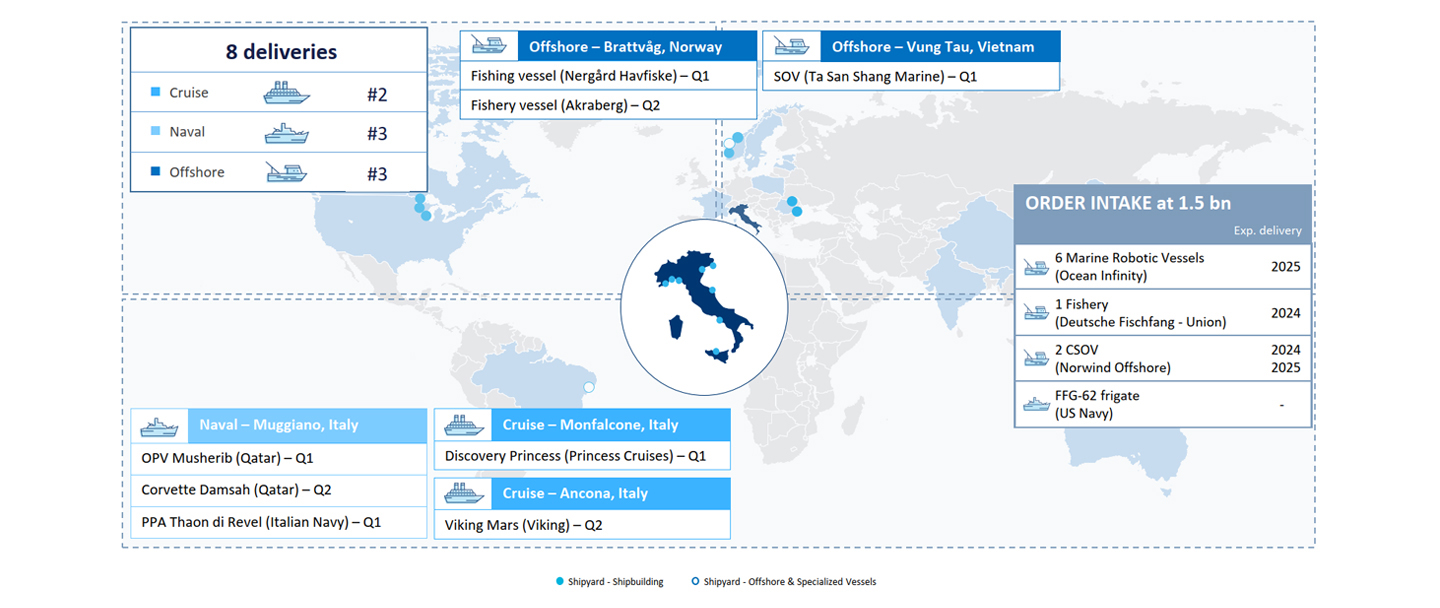

| 1H | July | ||

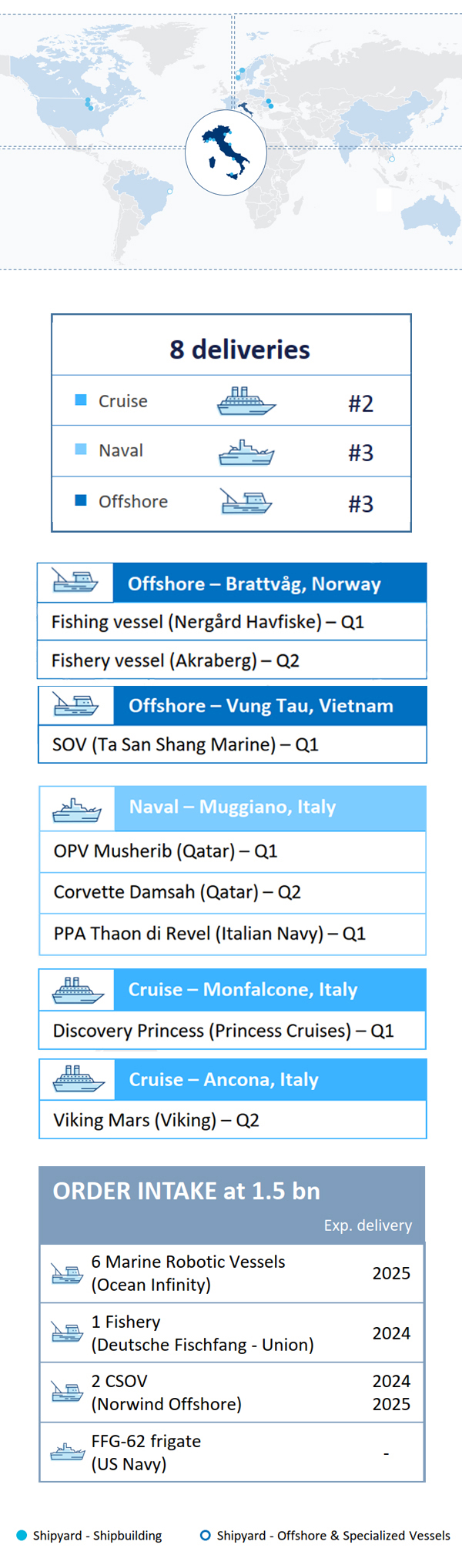

| Cruise | ▪ Delivered Discovery Princess, the sixth unit of the Royal class, for Princess Cruises, a Carnival Group brand | ▪ Delivered Viking Mars, eighth unit of the fleet for shipowner Viking ▪ Steel cutting of the first two new concept LNG cruise ships for Tui Cruises |

▪ MoA with MSC for the construction of two next generation hydrogen-powered cruise ships to be delivered by 2028 ▪ New order for an ultra luxury cruise ship to be delivered by 2025 |

| Naval | ▪ Qatari Ministry of Defence: delivery of the first Offshore Patrol Vessel (OPV) «Musherib» ▪ Italian Navy: delivery of the first PPA «Thaon di Revel» and production kick off for the first new generation submarine |

▪ US Navy: award for the construction of the third frigate of the Constellation program ▪ Qatari Ministry of Defence: delivery of the second Corvette «Damsah» |

▪ Qatari Ministry of Defence: delivery of the second Offshore Patrol Vessel (OPV) «Sheraouh» |

| Offshore | ▪ Delivered the first Service Operation Vessel (SOV) for Ta San Shang Marine ▪ Contract for the design and construction of 6 marine robotic vessels for Ocean Infinity |

▪ Order for additional two Commissioning Service Operation Vessels (CSOV) for Norwind Offshore | |

Implementing cutting-edge technologies to improve environmental performance

FIRST MAJOR AGREEMENT FOR NEW CONSTRUCTION AFTER THE PANDEMIC

▪ Long term partnership with MSC Cruises strengthened with a total of six Explora Journeys luxury cruise ships equipped with industry top-notch features

▪ Four cruise ships powered by liquefied natural gas (LNG), the cleanest marine fuel currently available, reducing CO2 emissions by up to 25% vs standard marine fuels

▪ MoA signed in July 2022 for two additional cruise ships featuring new generation hydrogen powered engines, that will tackle the issue of methane slip

▪ Hydrogen to power a 6 MW fuel cell allowing emissions-free hotel operations and zero emissions in ports, with engines turned off

Key ESG initiatives signed in 2022

GREEN

ENEA

R&I program on energy efficiency, renewable energy generation systems for the production and distribution of hydrogen, fuel cells and circular economy

RINA

Developing synergies for decarbonization, with a focus on alternative fuels, carbon capture and renewable energies in the shipping sector

RENOVIT

Construction of 10 MW of solar farms at 5 Italian production sites, contributing to reducing GHG emissions, with Snam subsidiary

EU

Part of IPCEI1 hydrogen project, seeking to identify alternative energy sources, with € 5.4 bn granted by the EU (€ 1 bn to Italy)

DIGITAL INNOVATION

ALMAVIVA

Integrated digital solutions, applied to static and dynamic monitoring, and to the security of Italy’s critical infrastructure

PEOPLE

FINCANTESIMO

Inauguration of the first corporate nursery in Trieste, to be followed by Monfalcone shipyard

SUSTAINABLE FINANCE

BNP PARIBAS

Sustainability-linked guarantees facility for up to €700 mln connected to efficient energy consumption management and a sustainable supply chain

INTESA SAN PAOLO

Sustainability-linked revolving credit facility for an amount of €500 mln connected with ESG rating and cruise ship energy efficiency

1. Initiative launched by IPCEI (Important Projects of Common European Interest) that brings together companies and research centers from different EU Member States providing significant benefits to strategic EU goals

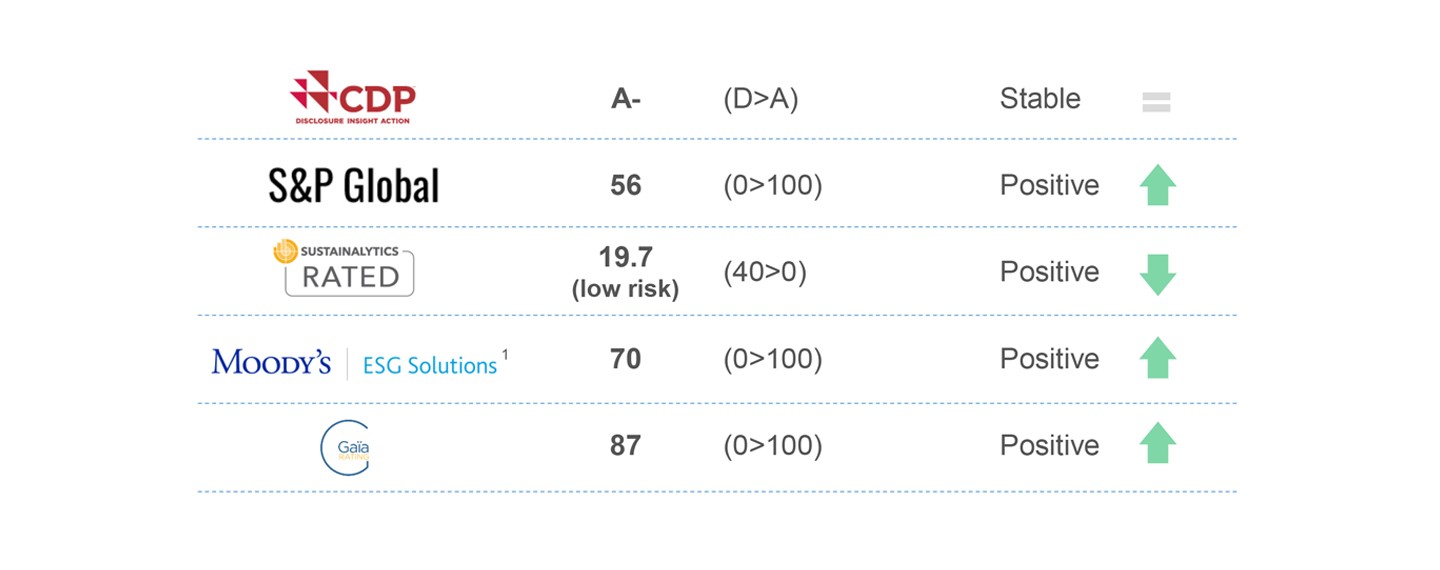

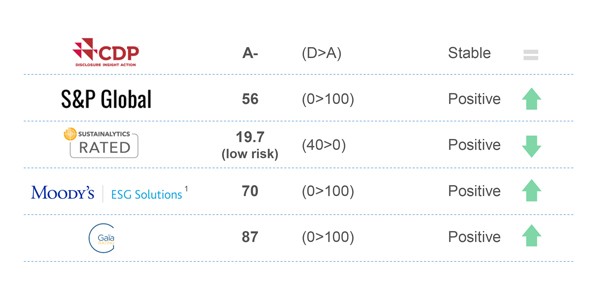

Tireless effort to become a model of excellence acknowledged at the international level

1. Formerly known as V.E

2. Ranked fourth for sustainability communication

Innovation as key for future growth

HYDROGEN AND ALTERNATIVE FUELS

• ZEUS, Zero Emissions Ultimate Ship, the first experimental fuel cell-powered marine vessel equipped with a lithium-ion battery

• LNG-powered cruise ships for a more sustainable and energy efficient cruise industry, in line with IMO regulations

• Next generation hydrogen-powered cruise ships to be developed for MSC Cruises

COLD IRONING AND GREEN PORTS

• Target of zero emissions in ports by 2030

• Development of next generation port infrastructure with a low environmental impact

DIGITAL INNOVATION

• Marine robotic vessels featuring next generation technologies such as fuel cells and green ammonia fuel systems, onshore remote control and unmanned operations

• Infrastructure monitoring solutions such as digital twins, to reproduce a structure’s features using drones and AI to detect structural imperfections

8 vessels delivered and 10 ships ordered in 1H 2022

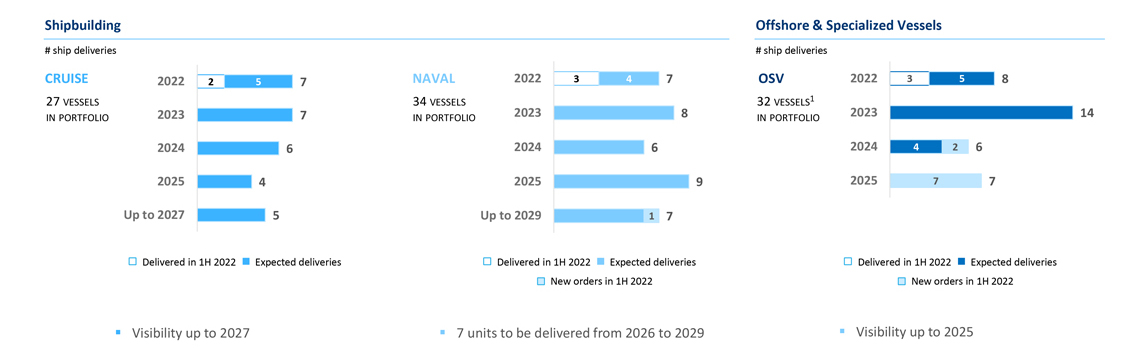

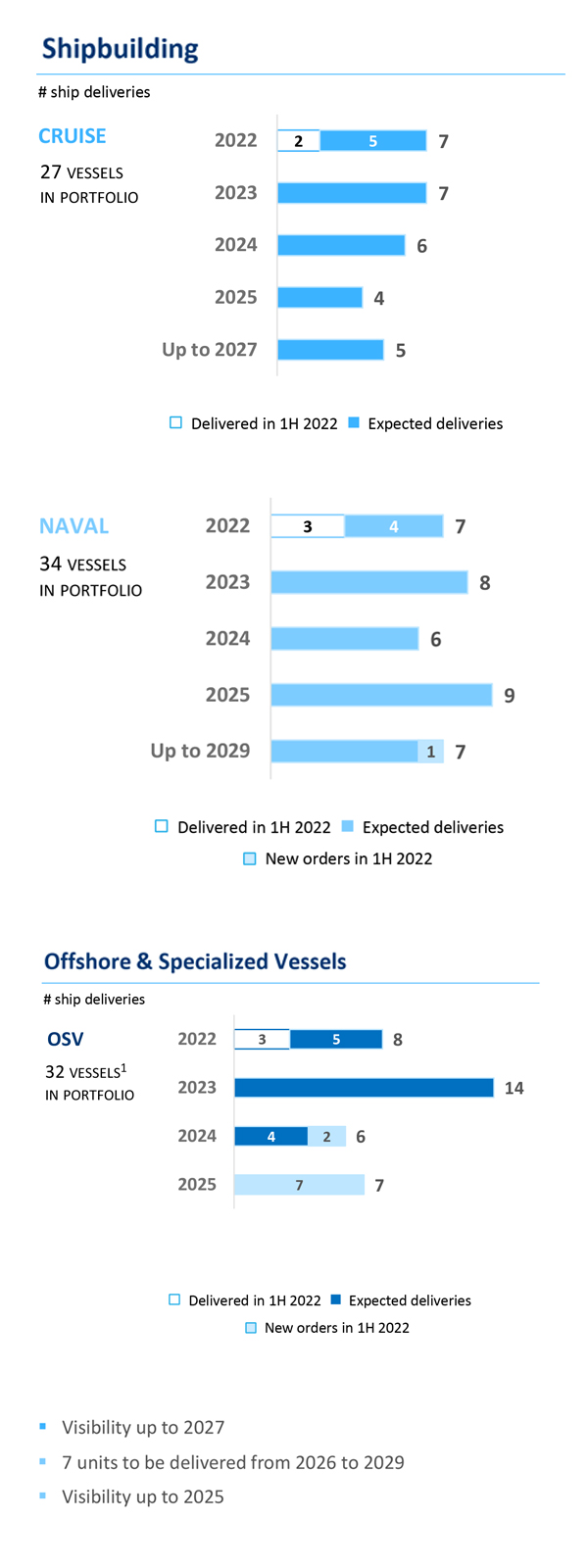

Well-balanced visibility and deliveries up to 2029

1. The Offshore & Specialized Vessels business generally has shorter production times and, as a consequence, shorter backlog and quicker order turnaround than Cruise and Naval

FINANCIAL RESULTS

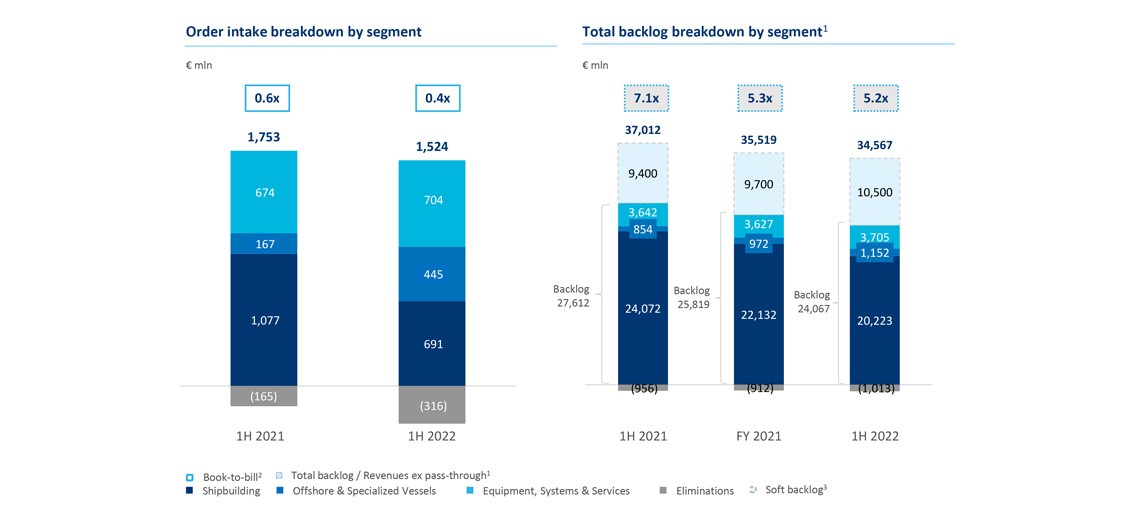

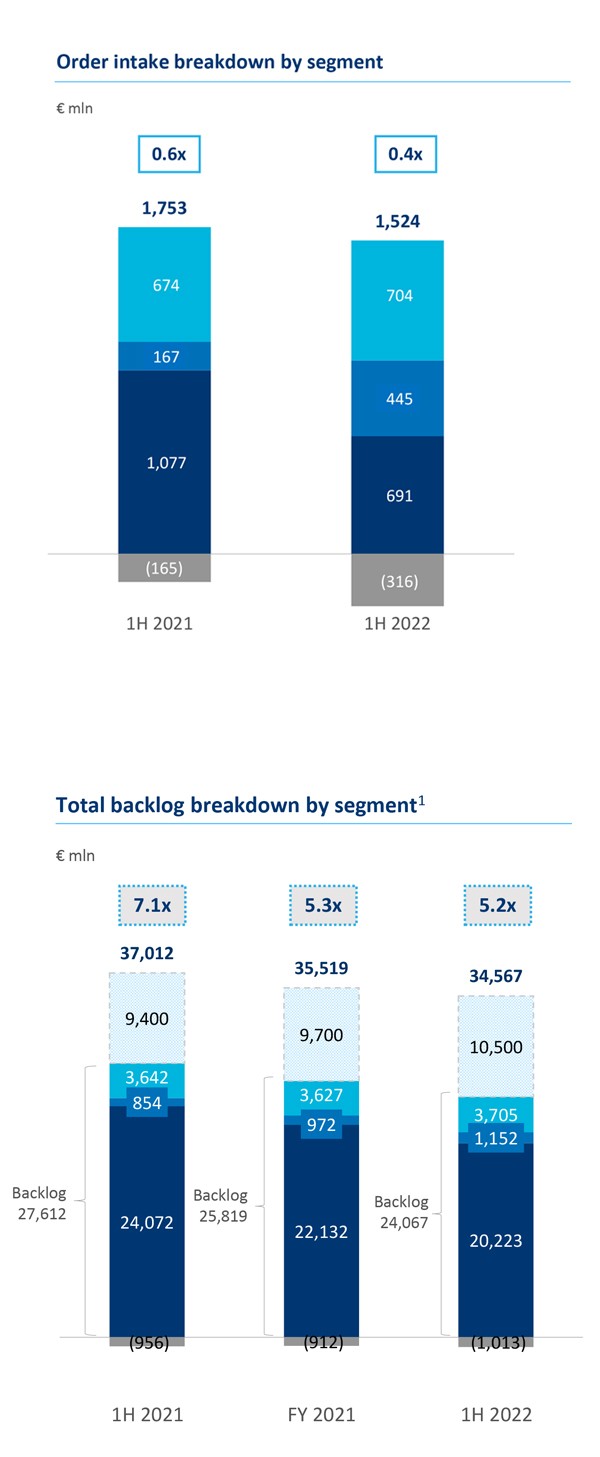

Solid backlog despite lower order intake impacted by COVID-related sector slowdown

▪ Order intake at €1.5 bn, impacted by shipbuilding slowdown, partially offset by offshore positive momentum

▪ First signs of resumption in cruise orders registered already in July 2022

▪ Total backlog representing 5.2x 2021 revenues

1. Total backlog is the sum of backlog and soft backlog. Backlog coverage calculated as Total Backlog/ previous year revenues ex pass through activities

2. Order intake/revenues ex pass-through

3. Soft backlog represents the value of existing contract options and letters of intent as well as contracts in advanced negotiation, none of which yet reflected in the order backlog

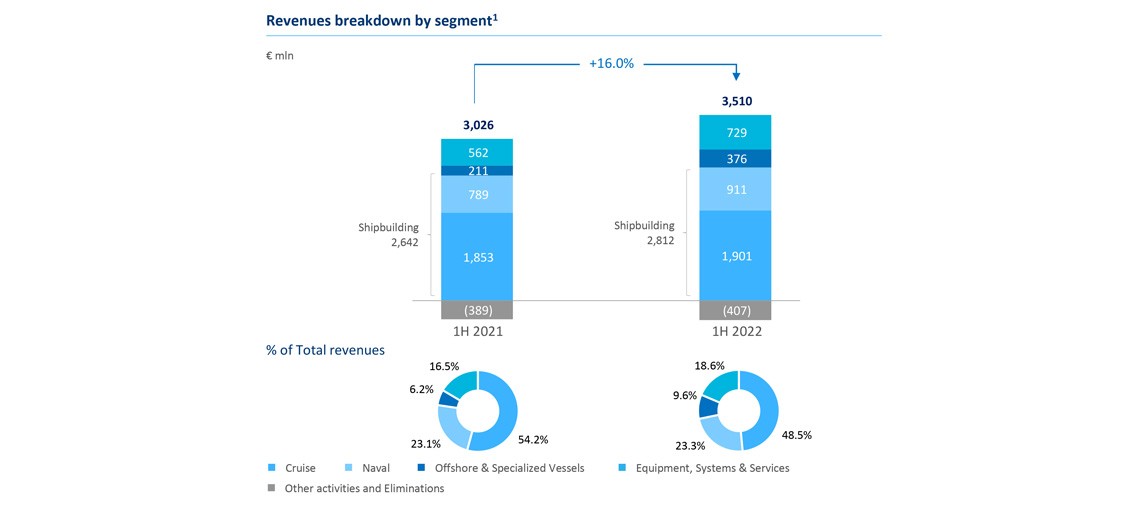

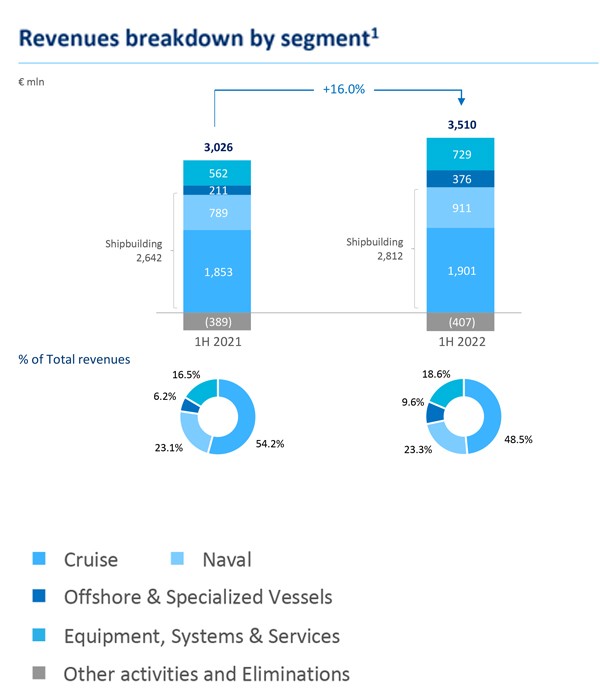

Revenues up 16.0% with positive contribution across all segments

Revenues up 16.0% YoY at €3,510 mln

▪ Shipbuilding up 6.5% YoY, with record production volumes at the Group’s Italian shipyards. Cruise accounts for 48.5% of total revenues and Naval for 23.3%

▪ Offshore & Specialized Vessels up 78.8% YoY, thanks to the effective repositioning strategy

▪ Equipment, Systems & Services up 29.6% YoY mainly related to the Mechatronics, Complete Accommodation and Infrastructure business areas

88% of revenues from international clients

1. Breakdown calculated before eliminations

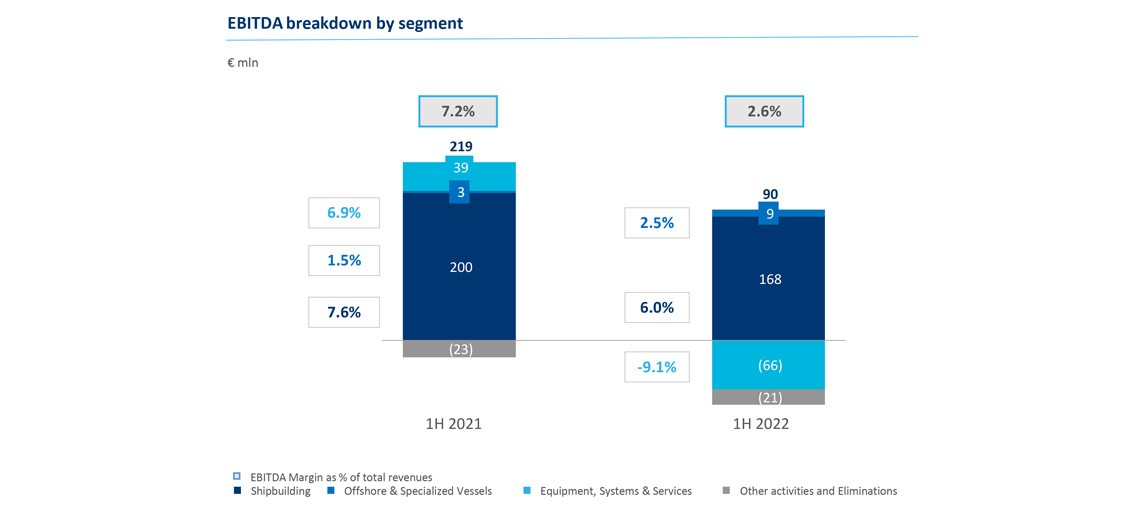

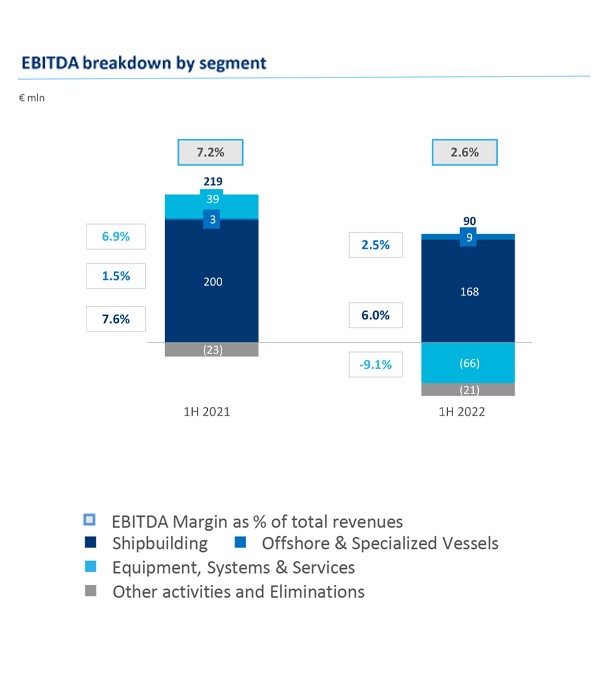

Positive operating performance over 7% margin, net of 1H 2022 one offs

EBITDA margin at 2.6% impacted by lower marginality in Infrastructure, increased raw materials’ prices and 1H 2022 non-recurring items in Shipbuilding

▪ Shipbuilding: EBITDA mainly affected by a write-down (according to IFRS9) of work in progress due reassessment of a client credit rating for a ship to be initially delivered in July 2022, now delayed in 2H 2022. Net of this one off, EBITDA margin at over 8%

▪ Offshore: increased EBITDA thanks to the repositioning strategy towards more promising sectors

▪ ESS: EBITDA impacted by the reduction in marginality of the Infrastructure business area, raw materials inflation and FX rates effects

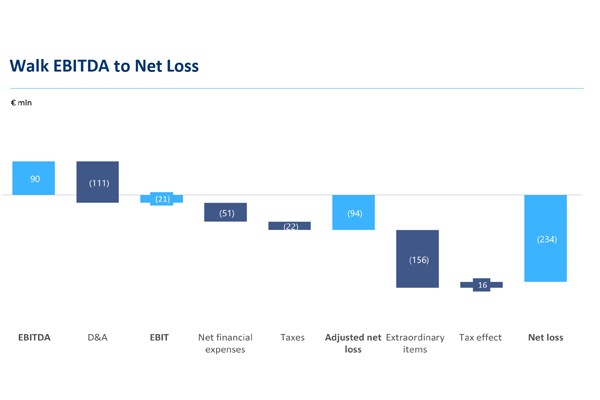

Net loss at €234 mln, due to 1H 2022 extraordinary items

▪ Net result for 1H 2022 negative at €234 mln, despite positive business operating performance

▪ Extraordinary items include:

- €107 mln for goodwill impairments and other intangible assets

- €29 mln for asbestos related litigations

- €20 mln due to provisions for risks of probable non-fulfillment of obligations related to offset agreements

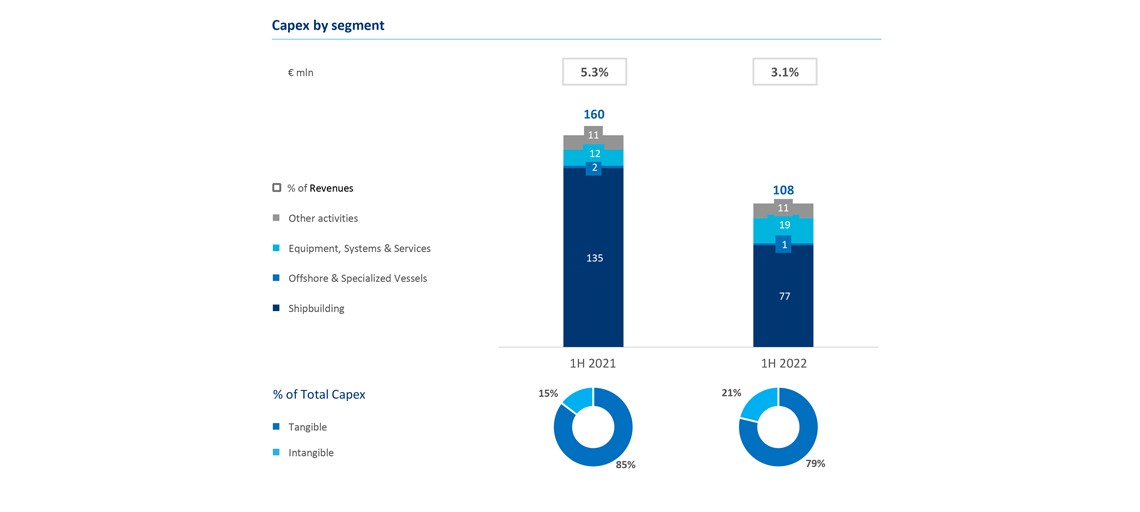

Capex underpinning further efficiencies in engineering and production processes

▪ Capex at €108 mln to support further efficiencies to address new production scenarios

▪ Strategic investments in Monfalcone and Marghera shipyards expected to be completed by year end

▪ Investments breakdown per category:

- Capacity increase for €39 mln

- Safety and maintenance for €34 mln

- Efficiency improvements for €19 mln

- IT, digitalization and advanced robotics for €16 mln

▪ Investments breakdown as follows:

- Intangible activities for €23 mln

- Tangible activities for €85 mln

NFP aligned to ESMA recommendations still affected by COVID-19 measures

▪ Net financial position at €3,296 mln, consistent with 2022 deliver schedule, to be aligned to the ESMA recommendations from now onwards

▪ NFP consistent with production volumes and reflecting net working capital dynamics

▪ Net financial position still impacted by the strategy of deferrals granted to clients (€317 mln) during COVID-19 pandemic, of which €251 mln already repaid as of July 1, 2022

1. Group Net Working Capital aligned with ESMA guidelines excludes (i) construction loans, (ii) current portion of derivative liabilities for non-financial items, and (iii) the current portion of the fair value of option on equity investment

2. Group Net financial position has been aligned with ESMA guidelines and it includes (i) construction loans, (ii) non-current financial liabilities on hedging instruments and (iii) liabilities for fair-value options investments that were previously excluded, furthermore it excludes non-current financial receivables

MARKET OUTLOOK

Cruise full recovery expected in 2023. Naval likely to benefit from higher defence budget

| CRUISE | ▪ The US Centers for Disease Control and Prevention (CDC) has ended its COVID-19 program for cruise ships while still recommending cautiousness ▪ 90% of the global fleet back in operation in July 20221, with load factors approaching historical levels ▪ Booking trends for 2022 and 2023 in line with 2019 levels, for some companies at higher net yields ▪ Passenger volumes expected to recover and surpass 2019 levels by the end of 20232 with a target of 30 mln pax, pre-Covid volumes ▪ Net carbon neutrality for cruise industry by 20503 and 40% reduction of average CO2 intensity per tonne/mile required by International Maritime Organization (IMO) regulations by 2030 vs 2008; by 2027 26 LNG-powered cruise ships and 174 cruise ships with shoreside power connectivity expected in operation3. By 2035, all cruise ships will be equipped to use shore power |

| NAVAL | ▪ Total global defence spending reached USD 2.09 trillion in 2021, showing a compound annual growth rate of 2.0% (CAGR 2013-2021), with defence budgets expected to accelerate in the upcoming years4, achieving + 1.3% in 2022, +2.7% in 2023 and +2.4% in 2024 ▪ In 2021, the defence budget allocated to navy procurement estimated at 6.3% of global budget4 ▪ Increased interest from member states in the creation of a common EU Defence framework ▪ EU major defence programs include the Permanent Structured Cooperation (PESCO) for a new class of modular military ships, the European Patrol Corvette |

| OFFSHORE | ▪ World wind farms operating today delivering nominal power of ca. 53 GW ▪ Total installed capacity of ca. 258 GW expected by 2030 (CAGR 14.6%)5 ▪ Rapidly growing demand for SOVs: 29 vessels ordered since January 2020, compared with total fleet of 29 vessels6 |

1. Cruise industry news – Ships in Service, July 2022

2. CLIA – State of the Cruise Industry 2022 report

3. CLIA - Cruise Industry is Sailing Back Toward a Better Future, April 2022

4. Jane’s – Global Defence Budget, June 2022

5. 4C Offshore – Global Market Overview Q2 2022 Slide Deck, June, 24, 2022

6. 4C Offshore – orderbook as of June 2022, Fincantieri analysis as of July 2022; excluding Chinese shipowners