SUMMARY & BUSINESS UPDATE

Executive summary

Year-end guidance confirmed, increased revenues and profitability in 1Q 2021

Business update

Leveraging our core competencies, while expanding our strategic capabilities and gearing up to become a key player within the missions set by the Recovery Plan

|

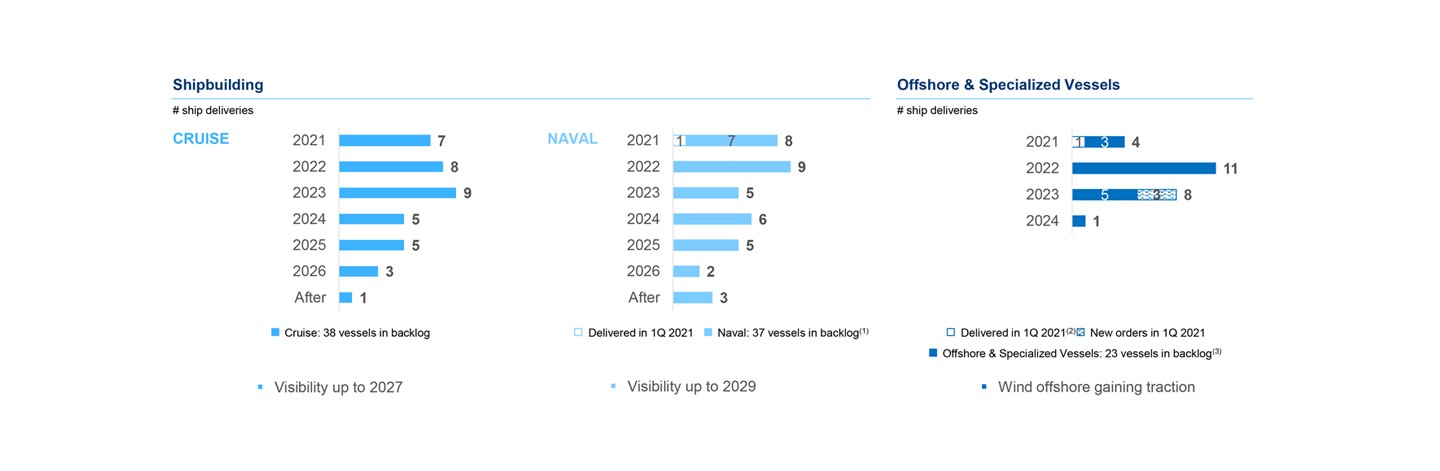

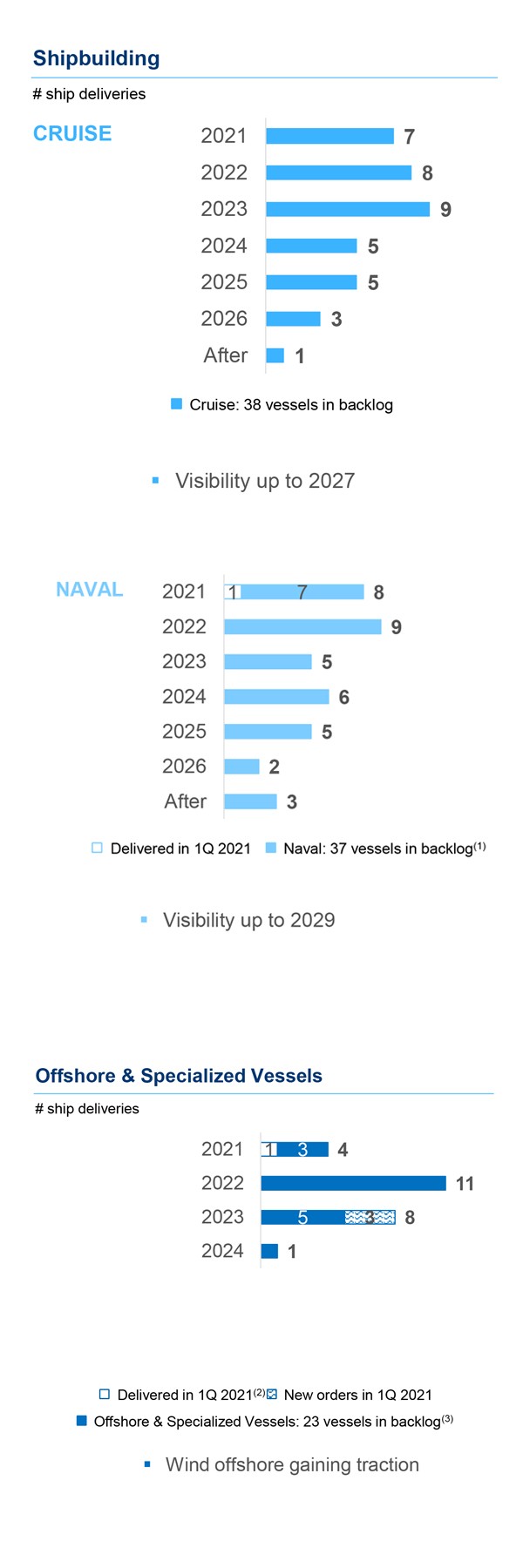

CRUISE |

• Delivery schedule carried on as expected |

|

DEFENCE |

• Fincantieri to officially partake in the Sea Defence Project, aimed at providing technologies generation of naval platforms and pursued in further European development programmes |

|

OFFSHORE & SPECIALIZED VESSELS |

• VARD to design a cable repair vessel for Orange Marine, specifically developed for the maintenance of submarine cables with special attention to sea-keeping capabilities, maneuverability and low fuel consumption |

(1) Permanent Structured Cooperation

|

DIGITAL TRANSFORMATION AND INNOVATION |

• Cloud computing: A cooperation agreement was signed with Amazon Web Services to accelerate digital innovation and technological development at national level, with special focus on cloud computing to provide technological and infrastructural solutions to institutions, large companies, SMEs, and startups |

|

GREEN REVOLUTION AND ECOLOGICAL TRANSITION |

• Connected vehicles and smart roads: an agreement was signed with Almaviva to support and enhance the digitalisation process in the transportation and logistics sector |

|

INFRASTRUCTURES FOR A SUSTAINABLE MOBILITY |

• Cold ironing: a letter of intent was signed with Enel X to collaborate on building and running next-generation port infrastructure with a low environmental impact and developing electricity-powered solutions for ground logistics services |

Events

3 new orders in wind offshore and 2 deliveries in the quarter

New orders

|

Segment |

Vessel |

Client |

Expected Delivery |

|

|

3 Service Operation Vessels |

North Star Renewables |

2023 |

Deliveries

|

Segment |

Vessel |

Client |

Shipyard |

|

|

LSS “Vulcano” |

Italian Navy |

Muggiano |

|

|

Cruise “Coral Geographer” (1) |

Coral Expeditions |

Vung Tau |

(1) For reasons connected to the organizational responsibility of VARD yards split between Cruise and Offshore, “Coral Geographer” for Coral Expeditions delivered in Q1 2021 is included in the Offshore & Specialized Vessels deliveries

Backlog deployment

Fully preserved order backlog with visibility stretching up to 2029 in Naval

1Q 2021

ECONOMIC AND FINANCIAL RESULTS

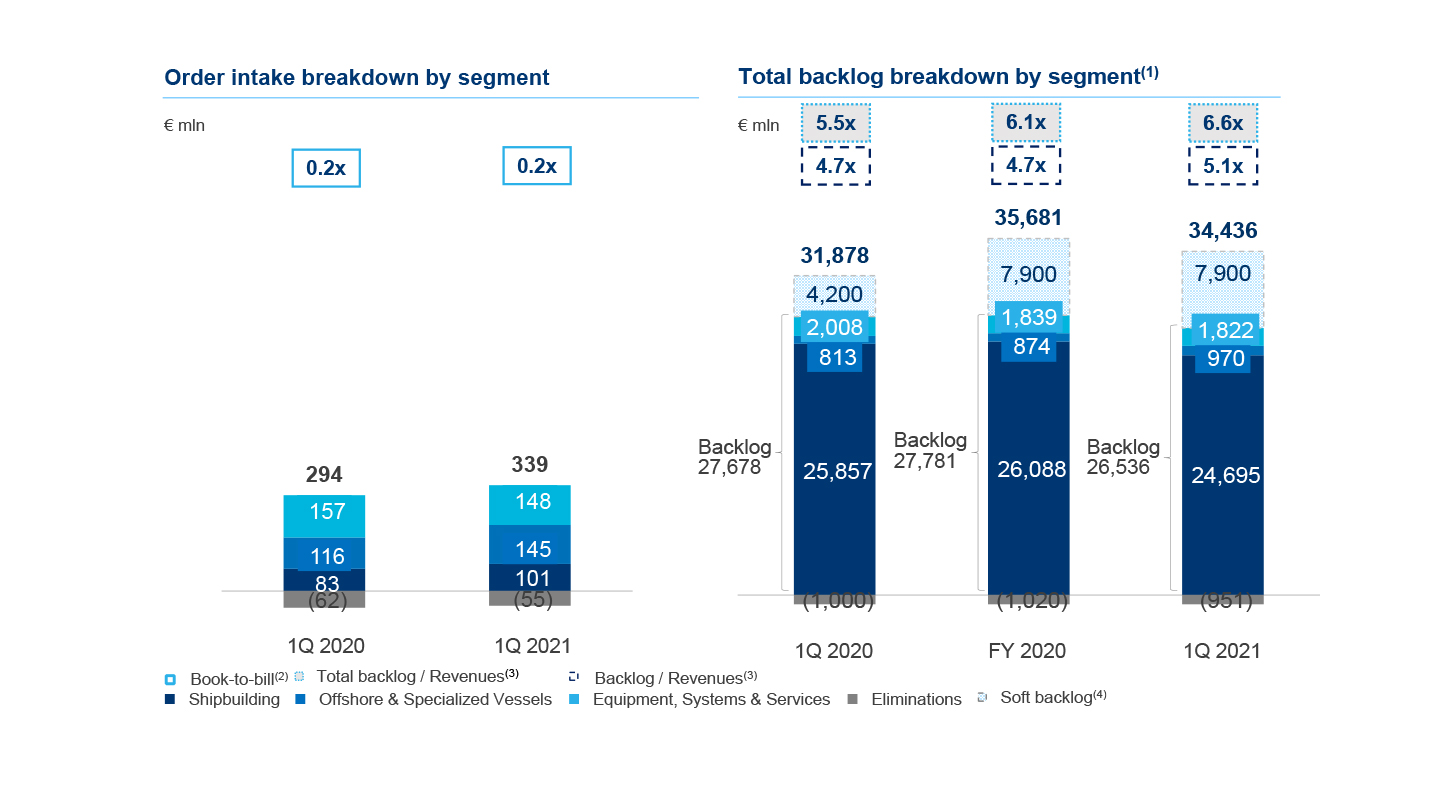

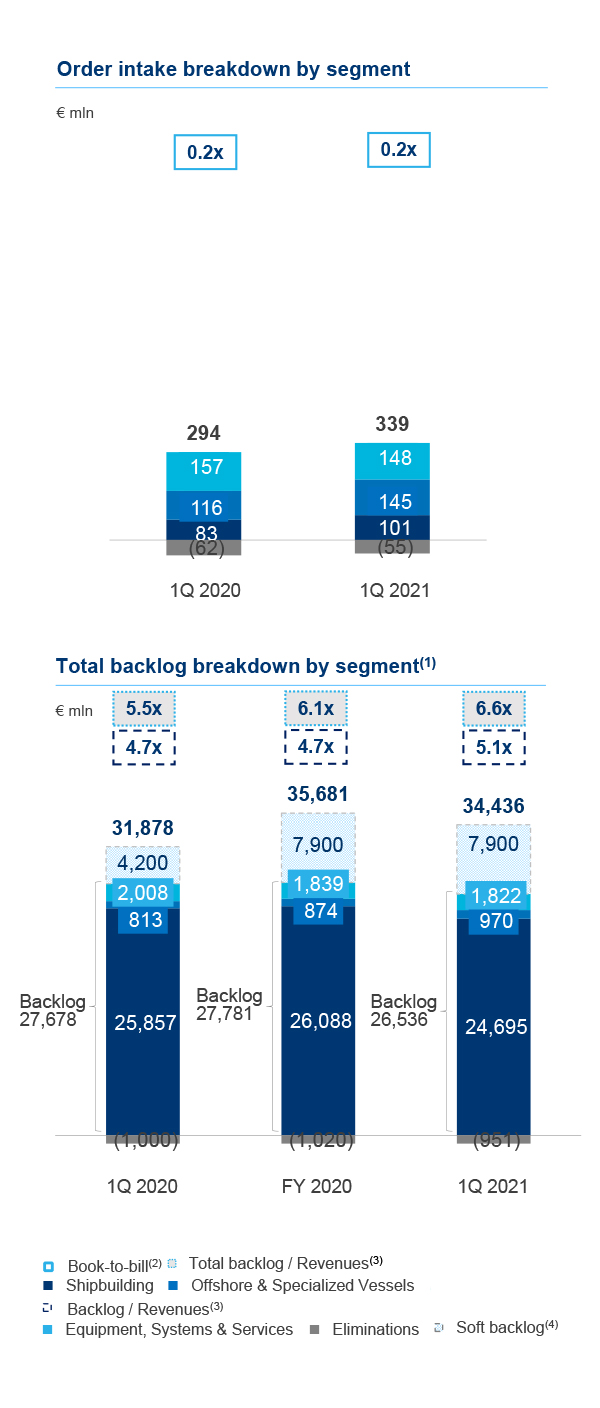

Order intake and backlog

Order intake is still limited but long-term visibility is confirmed

• Limited order intake in Shipbuilding with a wait-and-see attitude on the restart of cruise operations

• 3 Service Operation Vessels acquired in the Wind Offshore segment

• Total backlog at €34.4, approximately 6.6x 2020 revenues

(1) Total backlog is the sum of backlog and soft backlog

(2) Order intake/revenues excluding pass-through activities

(3) Excluding pass-through activities

(4) Soft backlog represents the value of existing contract options and letters of intent as well as contracts in advanced negotiation, none of which yet reflected in the order backlog

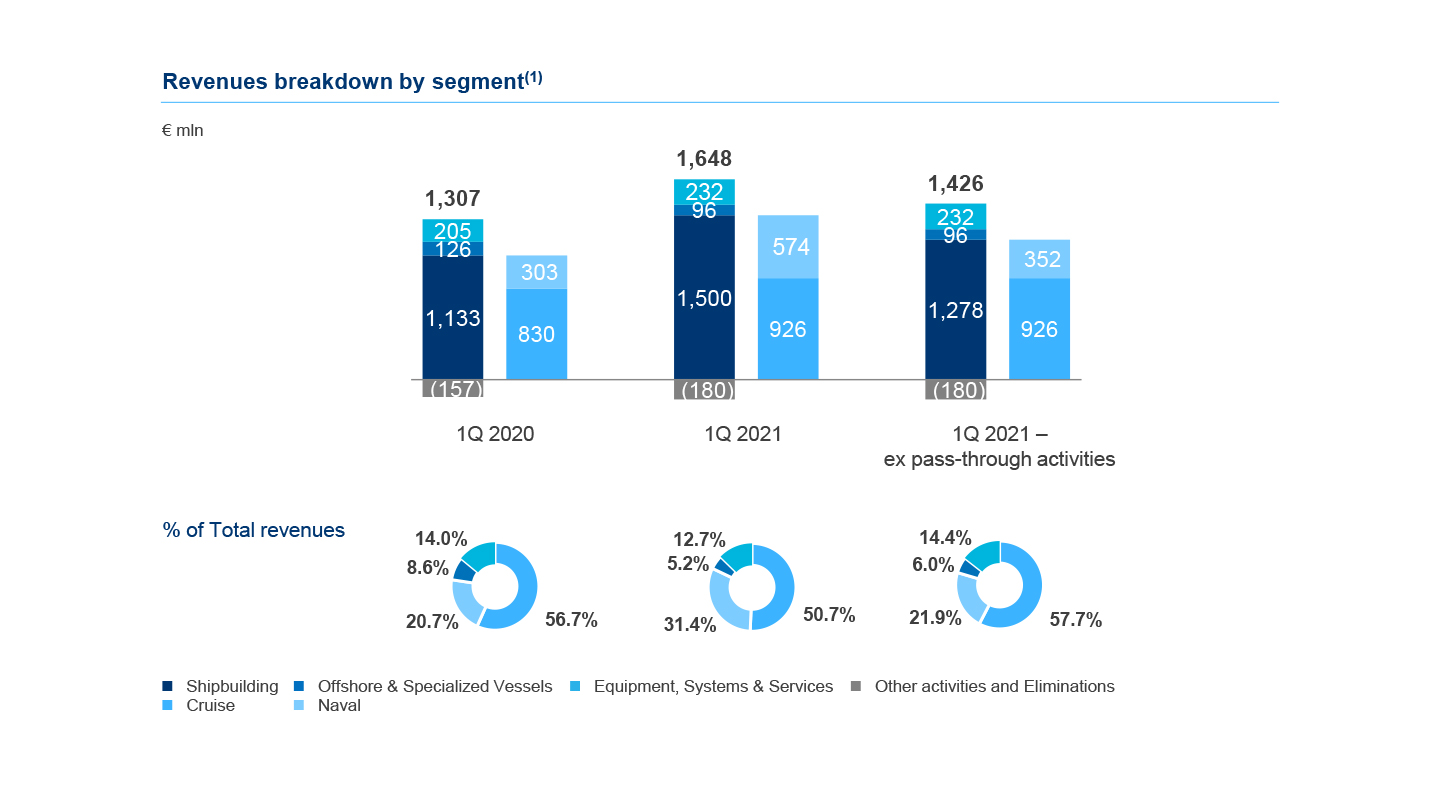

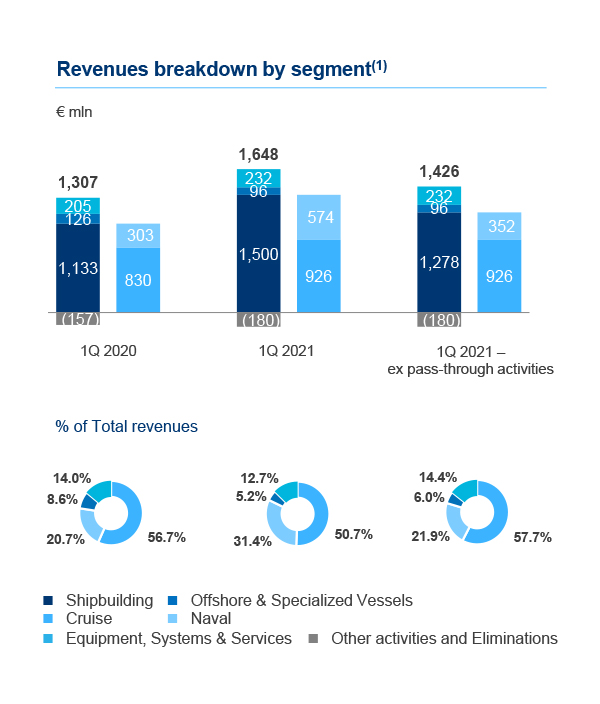

Revenues

Top-line growth on the right track: full swing of production programmes driving revenues up 9.1% YoY

Revenues excluding pass-through activities up 9.1% YoY thanks to resumption of operations and full swing of production programmes

![]() Shipbuilding up 12.8% YoY excluding pass-through activities

Shipbuilding up 12.8% YoY excluding pass-through activities

![]() Offshore & Specialized Vessels down 23.5% due to (i) disposal of Brevik shipyard (ii) effects of market repositioning on higher-value added segments still to unwind

Offshore & Specialized Vessels down 23.5% due to (i) disposal of Brevik shipyard (ii) effects of market repositioning on higher-value added segments still to unwind

![]() Equipment, Systems & Services: up 13.4%

Equipment, Systems & Services: up 13.4%

(1) Breakdown calculated before eliminations

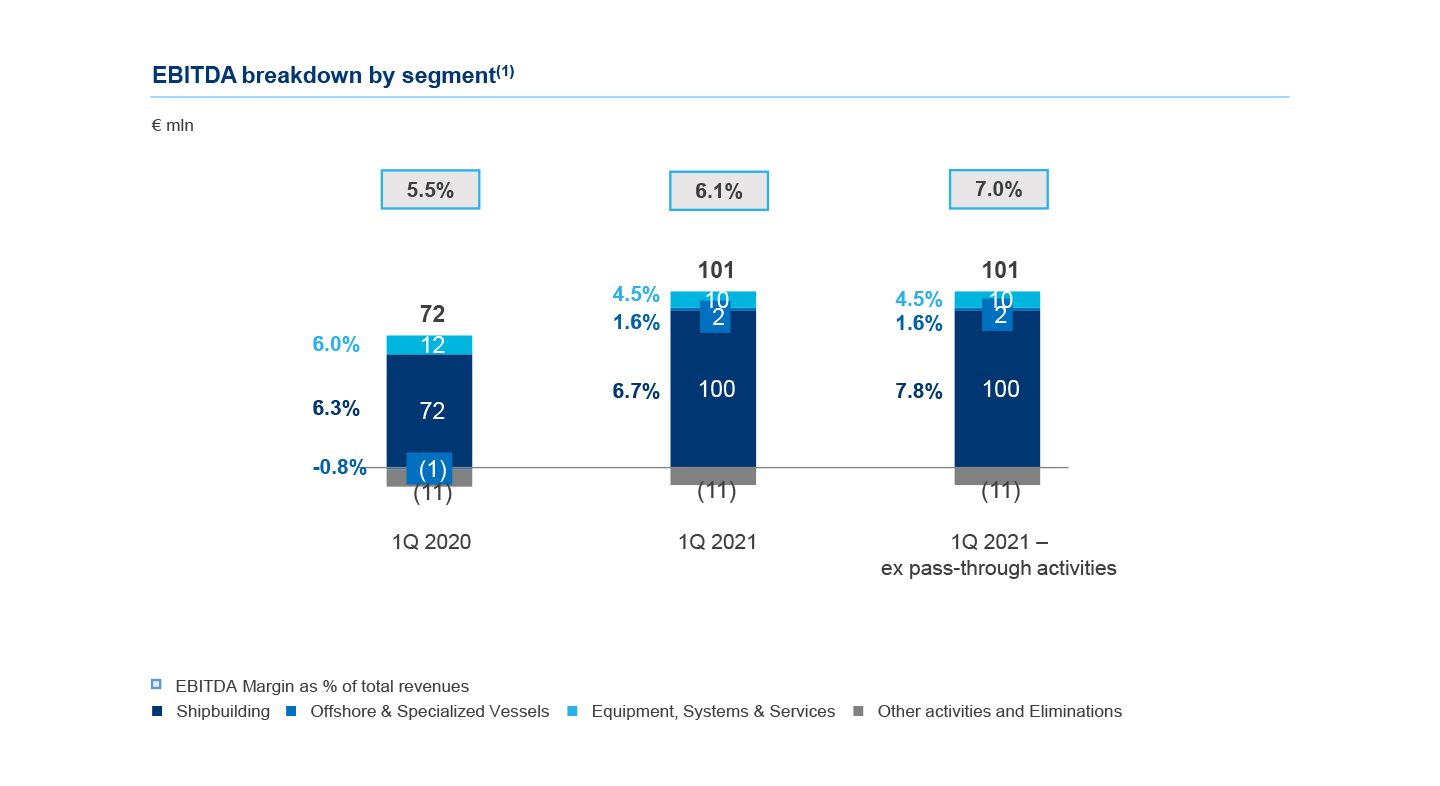

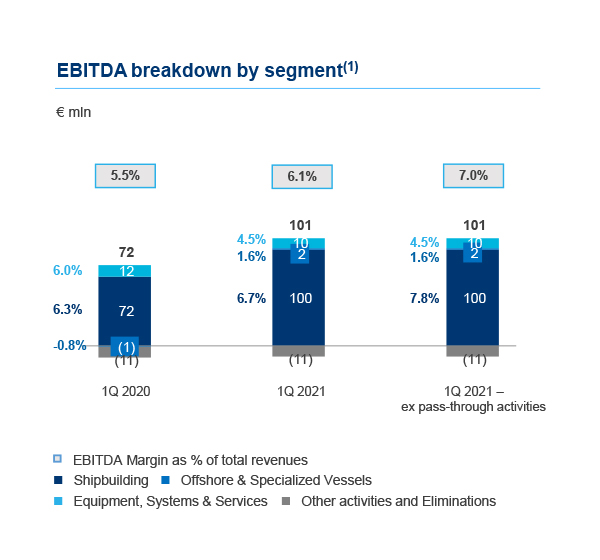

EBITDA

Operating profitability at 7.0% is in line with 4Q 2020 performance and 2021 guidance

Significantly improved profitability on track with previous quarter positive performance and guidance for 2021

![]() Shipbuilding up 39% margin at 7.8% confirming backlog profitability

Shipbuilding up 39% margin at 7.8% confirming backlog profitability

![]() Offshore & Specialized Vessels up to € 2 mln from negative €1 mln as a result of the successful turnaround strategy implemented in 2019 and market repositioning

Offshore & Specialized Vessels up to € 2 mln from negative €1 mln as a result of the successful turnaround strategy implemented in 2019 and market repositioning

![]() Equipment, Systems & Services down 16.7% YoY due to lower profitability in Ship Repair and Conversion

Equipment, Systems & Services down 16.7% YoY due to lower profitability in Ship Repair and Conversion

(1) EBITDA is a Non-GAAP Financial Measure. The Company defines EBITDA as profit/(loss) for the period before (i) income taxes, (ii) share of profit/(loss) from equity investments, (iii) income/expense from investments, (iv) finance costs, (v) finance income, (vi) depreciation and amortization (vii) expenses for corporate restructuring, (viii) accruals to provision and cost of legal services for asbestos claims, (ix) other non recurring items

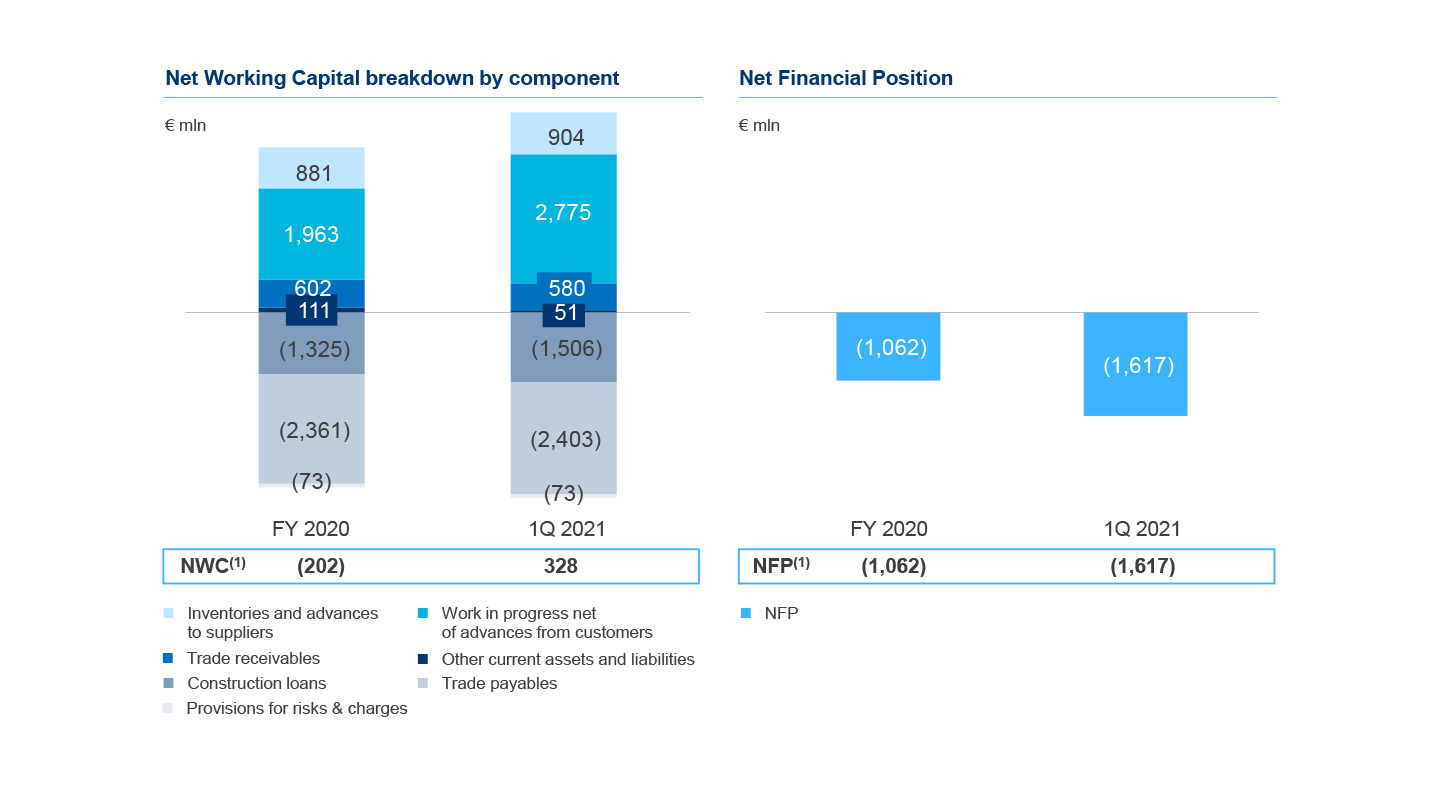

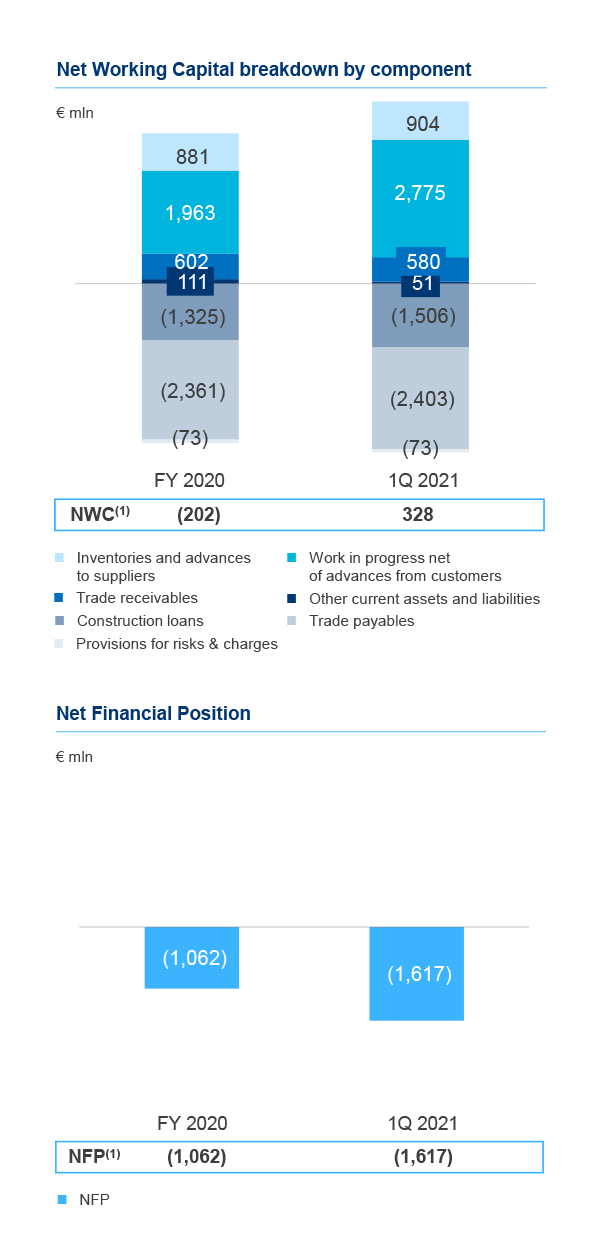

Net working capital and net financial position

NWC and net debt increase are consistent with the delivery schedule: deleveraging expected by year-end

• Net debt mirrors net working capital dynamics driven by a concentrated delivery schedule

• Deleveraging starting from 3Q

(1) Construction loans are committed working capital financing facilities, treated as part of Net working capital, not in Net debt, as they are not general purpose loans and can be a source of financing only in connection with ship contracts

OUTLOOK

2021 Company outlook

CRUISE INDUSTRY OUTLOOK

• In the US, the CDC may reportedly be open to lift or modify the Conditional Sailing Order - in Europe cruise operations are about to be resumed starting from late spring/early summer

• Strong 2022 booking volumes for cruises are ahead of pre COVID-19 levels and are driven by pent-up demand

COMPANY OUTLOOK

Operations and financials

• Operations to run at full swing with a production ramp-up expected to bridge the gap experienced in 2020

• Long-term growth and profitability are ensured by a fully preserved order portfolio in Cruise and a highly diversified backlog

• Sound revenue growth expected to accelerate in the remaining part of the year

• Increase in net financial position (owing to a delivery schedule concentrated in 3Q) expected to rapidly reverse in the second half of 2021

Guidance 2021

Confirmed guidance on year-end:

• Revenues excluding pass-through activities will be up 25%-30% and EBITDA margin is expected at ~7.0%

• Net financial position is expected to come in broadly in line with 2020