EXECUTIVE SUMMARY

9M 2023 Highlights

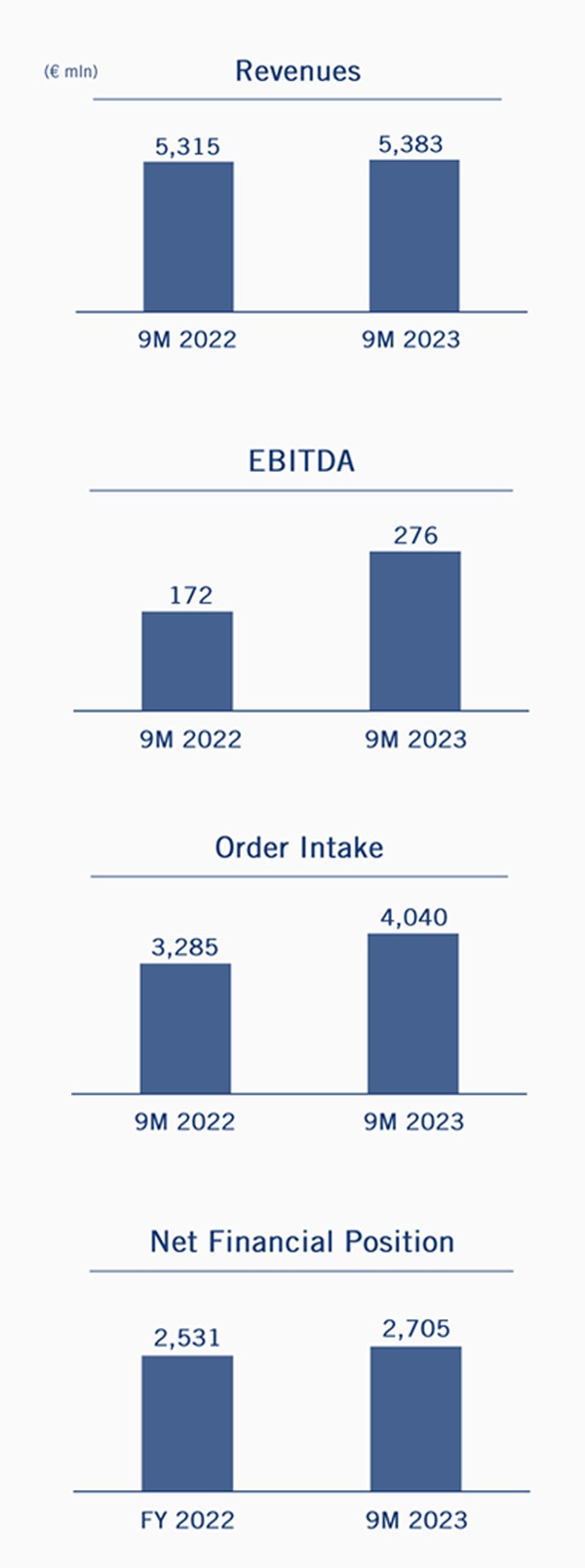

• EBITDA at € 276 mln, up 60% vs 9M 2022, with EBITDA margin at 5.1% (3.2% in 9M 2022)

• Solid top line with revenues at € 5,383 mln, up by 1.3% vs 9M 2022

• Negative net financial position at euro 2,705 million, in line with FY 2023 outlook

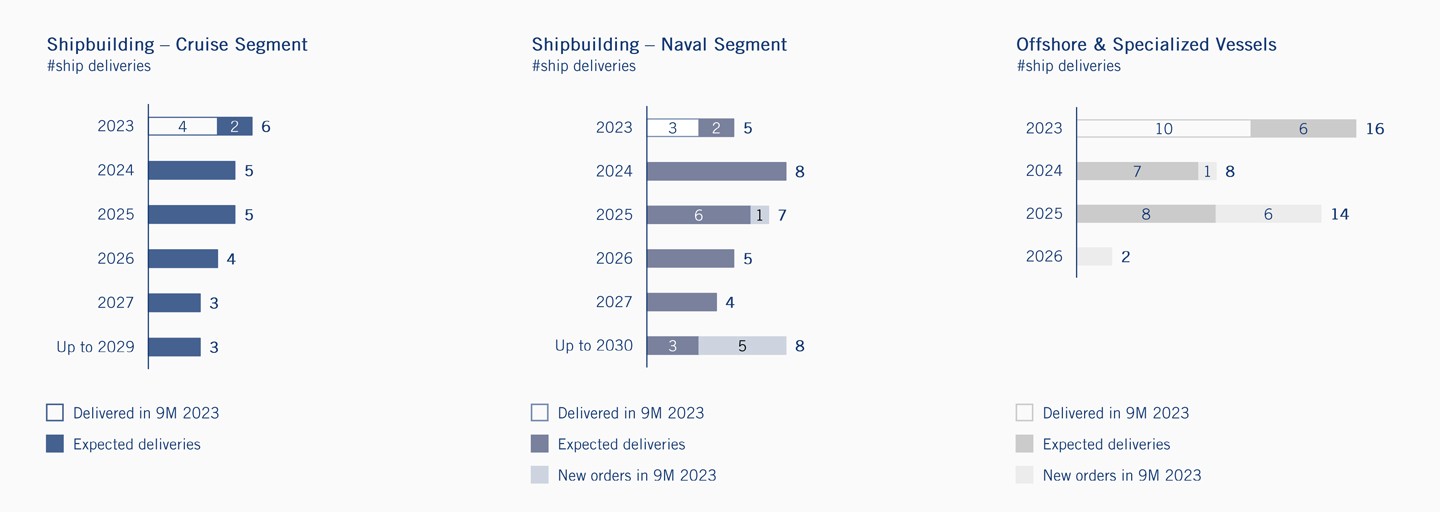

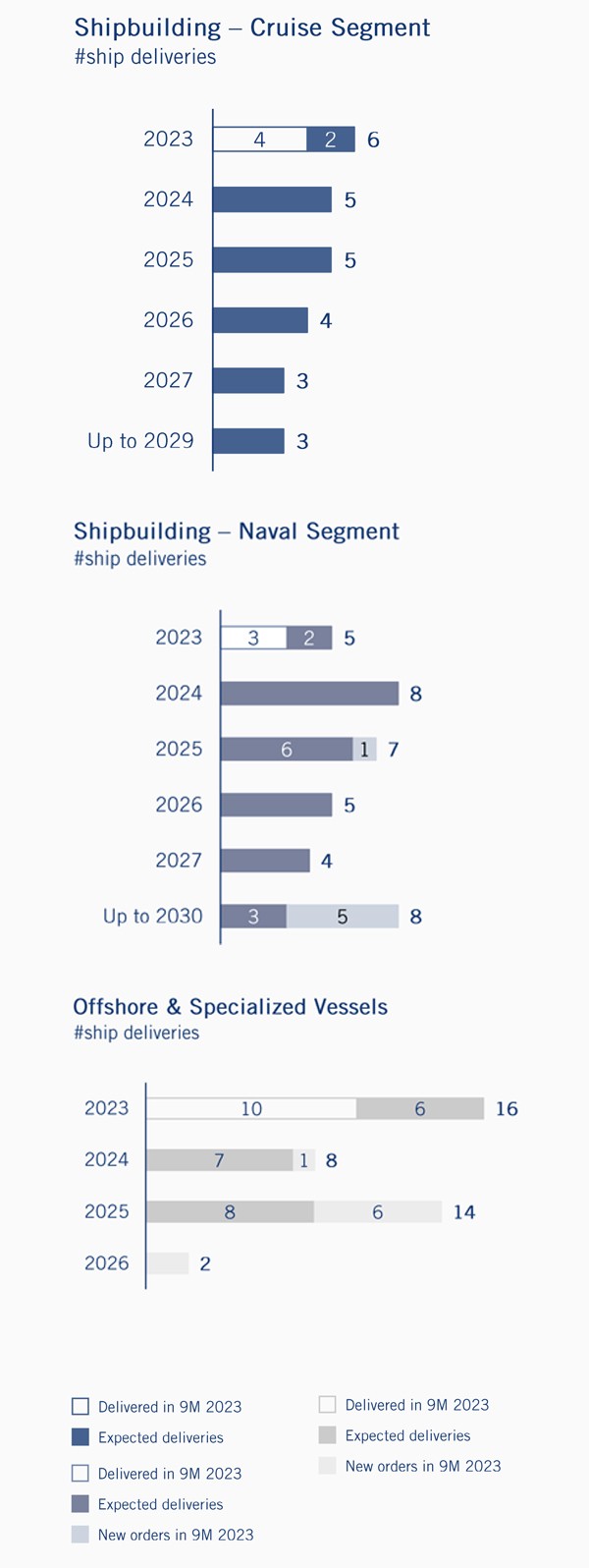

• 86 ships in portfolio with deliveries up to 2030 and robust backlog at euro 22.2 billion

• Order intake at euro 4.0 billion vs euro 3.3 billion in 9M 2022 supported by a strong contribution from Defence and Wind Offshore

BUSINESS UPDATE

Business operating performance consistent with targets

| Cruise | ▪ Floating out of «Sun Princess», the first of two LNG (liquefied natural gas) cruise ships for Princess Cruises ▪ Ordered the second ultra-luxury vessel for Four Seasons Yachts ▪ Four cruise ships delivered: «Viking Saturn», tenth unit of the fleet for Viking Cruises; «Vista», the first of two units for Oceania Cruises; «Norwegian Viva», the second of six new generation Prima class cruise ships for NCL; the first «MSC Explora» ▪ In October finalized a contract with the Region of Sicily for the construction of a new hybrid-powered (diesel and liquefied natural gas) Ropax ferry and the order for two hydrogen-powered ships to join MSC Explora Journeys’ fleet |

| Naval | ▪ Italian Navy:

▪ Signed a contract for the mid-life upgrade of the Italian and French Horizon-class frigates, assigned to Naviris and eurosam |

| Offshore | ▪ Signed orders for eight Commissioning Service Operation Vessels (CSOVs) units (four for Edda Wind, two hybrid-electric ones for Purus Wind and two for North Star) and finalized an order for a cable-laying vessel in the first half of the year ▪ Signed in October an order for the design and construction of two hybrid CSOVs (two options to be exercised) for Windward Offshore ▪ Delivery of five SOVs (one for the Norwegian Coast Guard, one for Luntos and three for Ocean Infinity), four CSOVs (two for North Star Renewables, one for Rem Wind and one for Norwind Offshore) and a cable laying vessel for Van Oord Ship Management BV |

Newly awarded “landmark” projects

MSC Explora Journeys

▪ Two new hydrogen-powered ships ordered by MSC to join Explora Journeys fleet worth € 1.1 billion. The agreement completes the total investment of € 3.5 billion in six luxury ships

▪ The two ships, EXPLORA V and EXPLORA VI, will be delivered in 2027 and 2028

▪ The fleet will be equipped with the latest technology, including hydrogen powered fuel cells for zero emission operations while in port, and a full range of energy-efficient on-board equipment

Near Future Submarine

▪ Third next-generation submarine related to the U212NFS (Near Future Submarine) program for the Italian Navy with a value of ~ € 500 mln, with additional € 160 mln for future activities

▪ The submarine will be delivered in 2030

▪ The submarine will be highly innovative, developed independently with the Group acting as Design Authority

Commissioning Service Operation Vessels

▪ Four CSOVs for the new client Edda Wind with a contract value of ~ € 250 mln

▪ The first two vessels are expected to be delivered in Q1 2025, the third in Q2 2025 and the fourth in Q1 2026

▪ The ships for Edda Wind are added to the CSOVs or Service Operation Vessels (SOVs) in portfolio, that now are 16

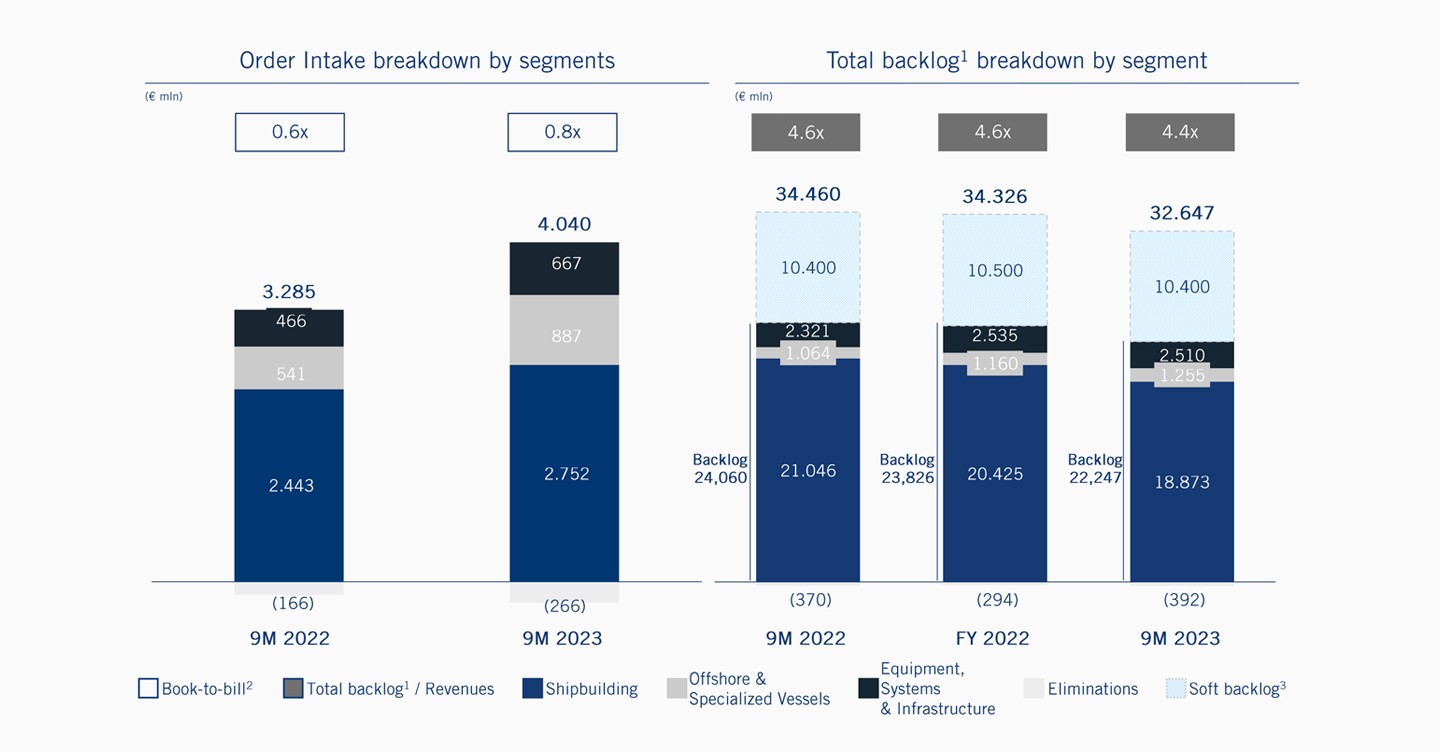

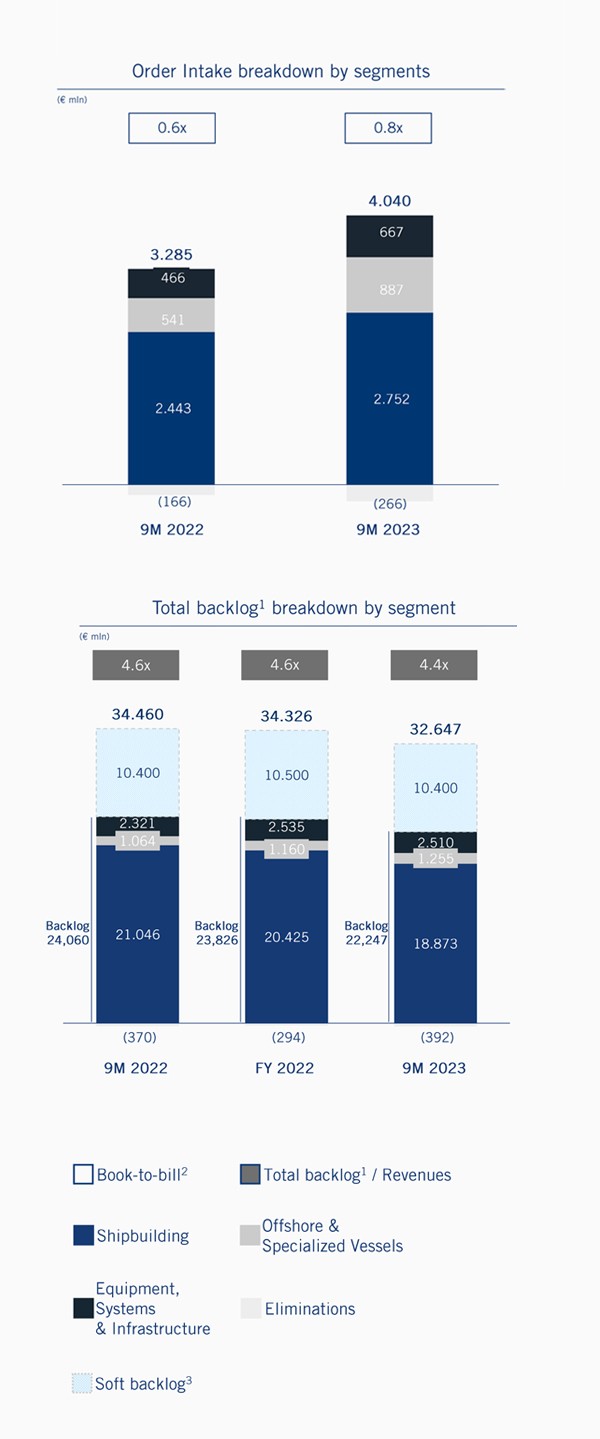

Solid Order Book with strong visibility up to 2030

Total backlog of € 32.6 bn equal to 4.4x 2022 Revenues

Soft Backlog at € 10.4 bn further supporting the commercial pipeline (1.4x 2022 revenues)

FINANCIAL RESULTS

Order Intake & Total Backlog

▪ Order intake at € 4.0 bn (€ 1.9 bn in the third quarter) with strong contribution from Wind Offshore, up 64.0% YoY and the Defence business

▪ Book to bill > 100% in the third quarter 2023

▪ Orders for two new hydrogen powered ships by MSC, a Ropax ferry for the Region of Sicily and two hybrid CSOVs for Windward Offshore consortium signed in October

▪ 2023 Total backlog representing 4.4x 2022 revenues

Figures subject to rounding

In 9M 2022 reallocation of VARD from Offshore and Specialized Vessels to Shipbuilding

1. Total backlog is the sum of backlog and soft backlog. Backlog coverage calculated as Total Backlog/ previous year revenues ex pass through activities

2. Order intake/revenues

3. Soft backlog represents the value of existing contract options and letters of intent as well as contracts in advanced negotiation, none of which yet reflected in the order backlog

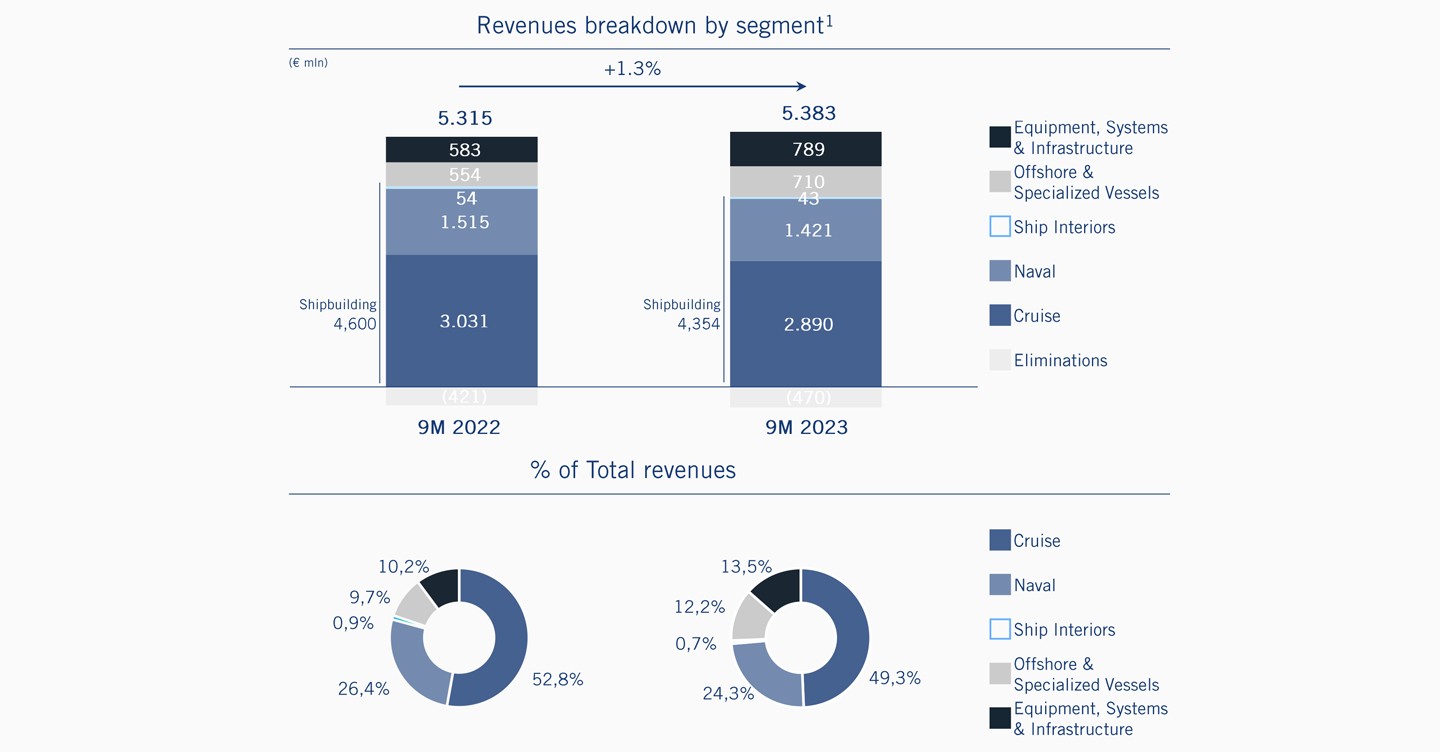

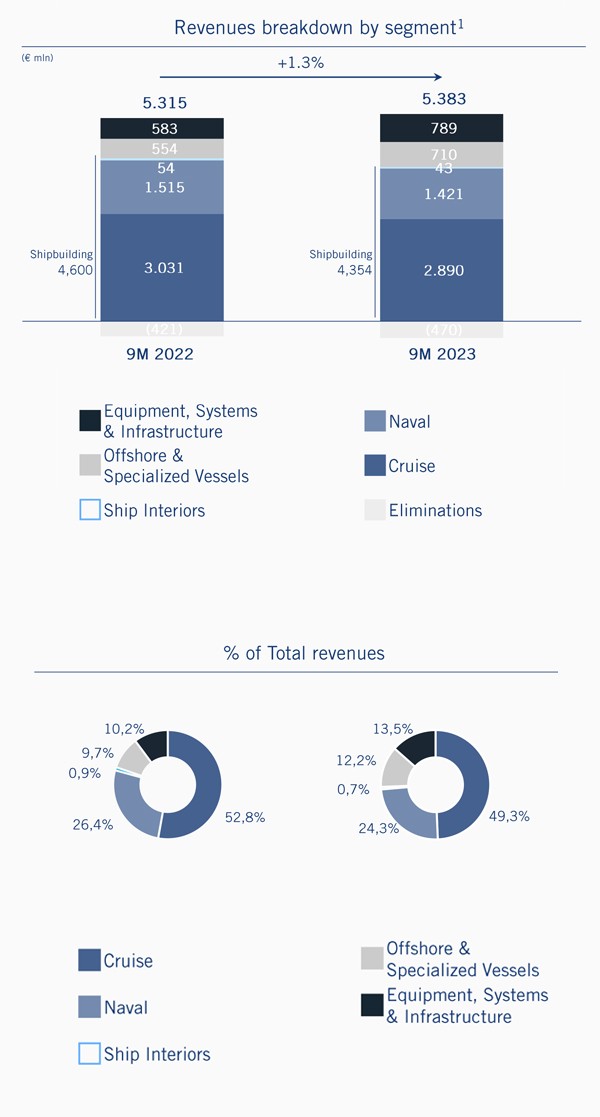

Revenues

Revenues up 1.3% at € 5,383 mln

▪ Cruise accounting for 49.3% and Naval for 24.3% of total revenues, respectively at € 2,890 mln and € 1,421 mln. The rest of the Shipbuilding revenues, 43 mln to Ship Interiors (54 mln in 9M 2022)

▪ Offshore & Specialized Vessels revenues at € 710 mln, up 28.2% YoY

▪ Equipment, Systems & Infrastructure revenues at € 789 mln, up 35.3% YoY (583 mln in 9M 2022)

- Electronics: revenues up 1.5% at € 109 mln (€ 108 mln in 9M 2022)

- Mechatronics: revenues down by 5.6% at € 305 mln (€ 323 mln in 9M 2022)

- Infrastructure: revenues up 158.6% at € 375 mln (€ 145 mln in 9M 2022)

Figures subject to rounding

In 9M 2022 reallocation of VARD from Offshore and Specialized Vessels to Shipbuilding

1. Breakdown calculated before eliminations

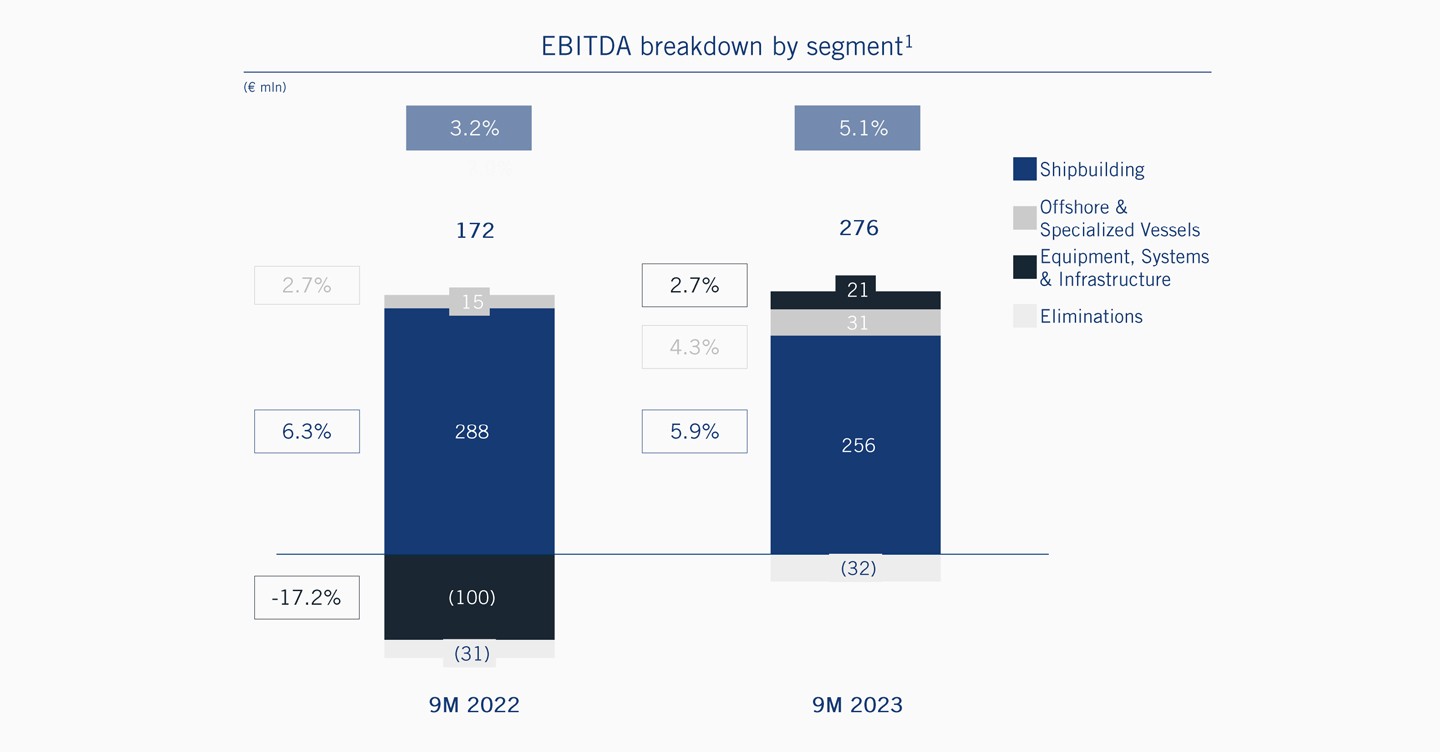

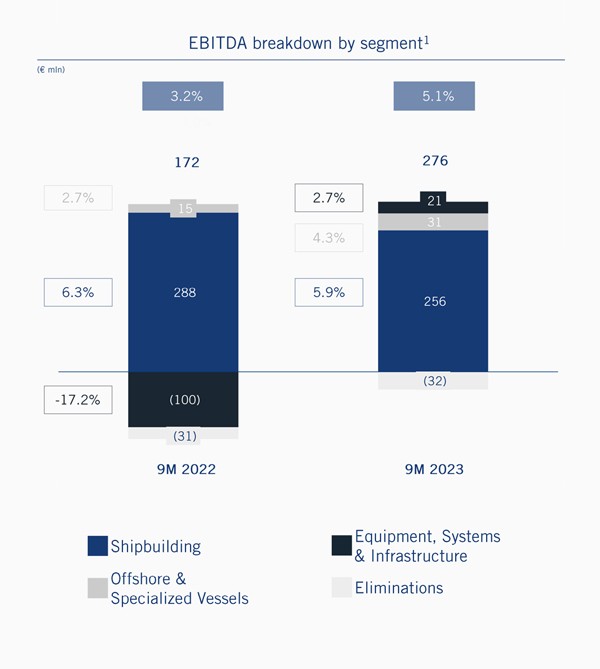

EBITDA

EBITDA at € 276 mln with an EBITDA margin at 5.1%

▪ Shipbuilding EBITDA at € 256 mln with margin at 5.9%

▪ Offshore & Specialized Vessels EBITDA at € 31 mln with an improving margin at 4.3%, confirming the positive momentum in the offshore wind sector

▪ Equipment, Systems & Infrastructure EBITDA significantly improved at € 21 mln with a positive margin at 2.7%

- Electronics: EBITDA at negative € 1 mln (€ 3 mln in 9M 2022) and negative margin at 0.6% (2.4% in 9M 2022)

- Mechatronics: EBITDA at € 26 mln (€ 30 mln in 9M 2022) and margin at 8.5% (9.3% in 9M 2022)

- Infrastructure: EBITDA negative for € 4 mln

(negative € 133 mln in 9M 2022) and a negative margin at 1.1% (negative at 91.5% in 9M 2022)

Figures subject to rounding

In 9M 2022 reallocation of VARD from Offshore and Specialized Vessels to Shipbuilding

1. Breakdown calculated before eliminations

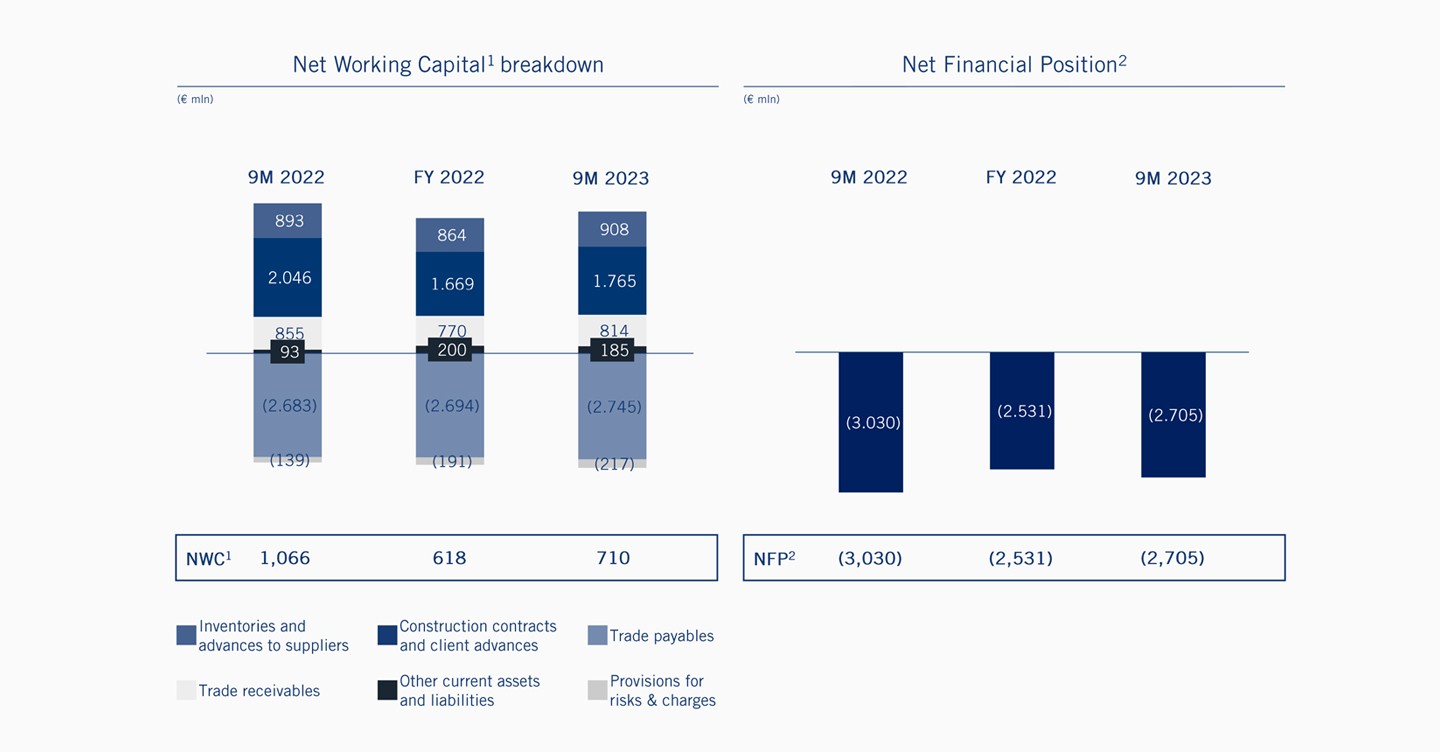

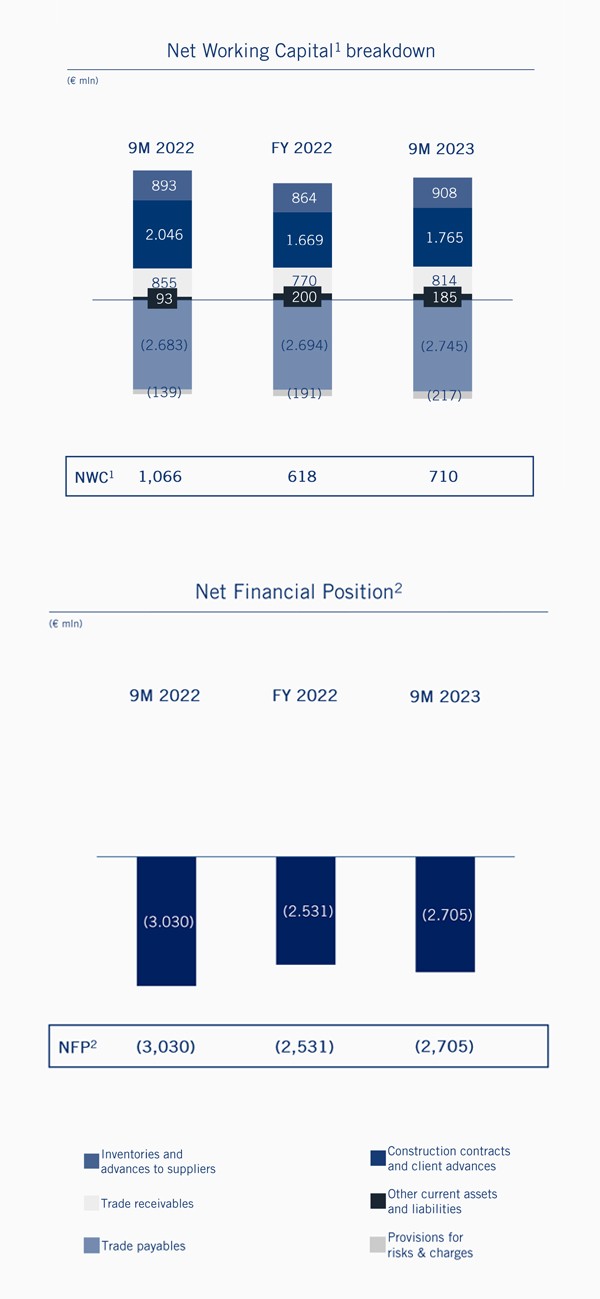

Net Financial Position & Net Working Capital

▪ Net financial position at € 2,705 mln, in line with production schedule

▪ Four cruise ships delivered in 9M 2023 and 2 more expected by the end of the year

▪ Net working capital at € 710 mln

Figures subject to rounding

1. Group Net Working Capital aligned with ESMA guidelines excludes (i) construction loans, (ii) current portion of derivative liabilities for non-financial items, and (iii) the current portion of the fair value of option on equity investment

2. Group Net financial position has been aligned with ESMA guidelines and it includes (i) construction loans, (ii) non-current financial liabilities on hedging instruments and (iii) liabilities for fair-value options investments that were previously excluded, furthermore it excludes non-current financial receivables

MARKET TRENDS

Cruise and Environmental Sustainability

Cruise

Market outlook

▪ Global fleet back in operation with occupancy above the 100% mark

▪ Value proposition gap between cruises and land-based holidays further shifting towards cruising

▪ Resumption of orders already recorded for the luxury niche segment and for medium to small vessels

▪ Booking trend for the remainder of 2023 is ahead of 2019 levels, at continued higher pricing

▪ Cruise shipowners back to positive operating cash flows

▪ Cruise passengers in 2022 amounted to 20 mln. CLIA expects global passenger to reach 31.5 mln in 2023 (106% of 2019 levels), 39 mln by 20271 and 46 mln by 20302

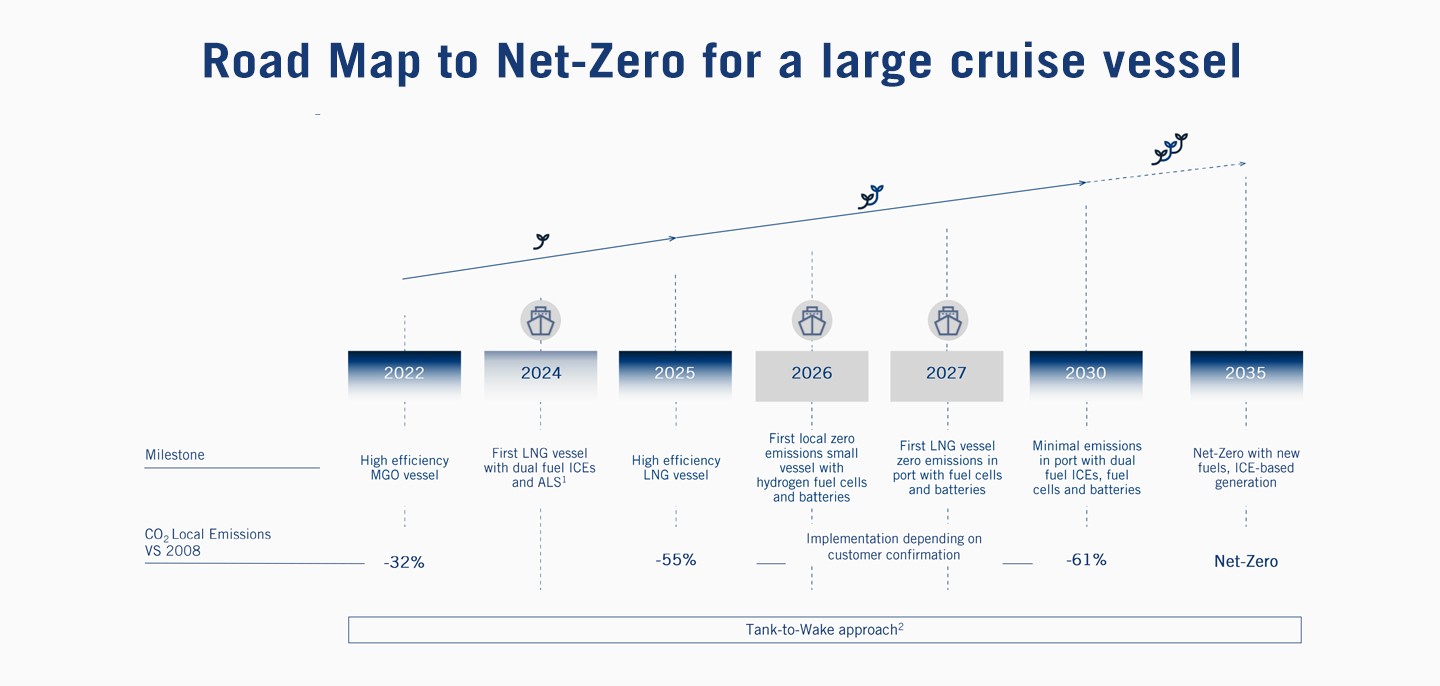

Sustainability

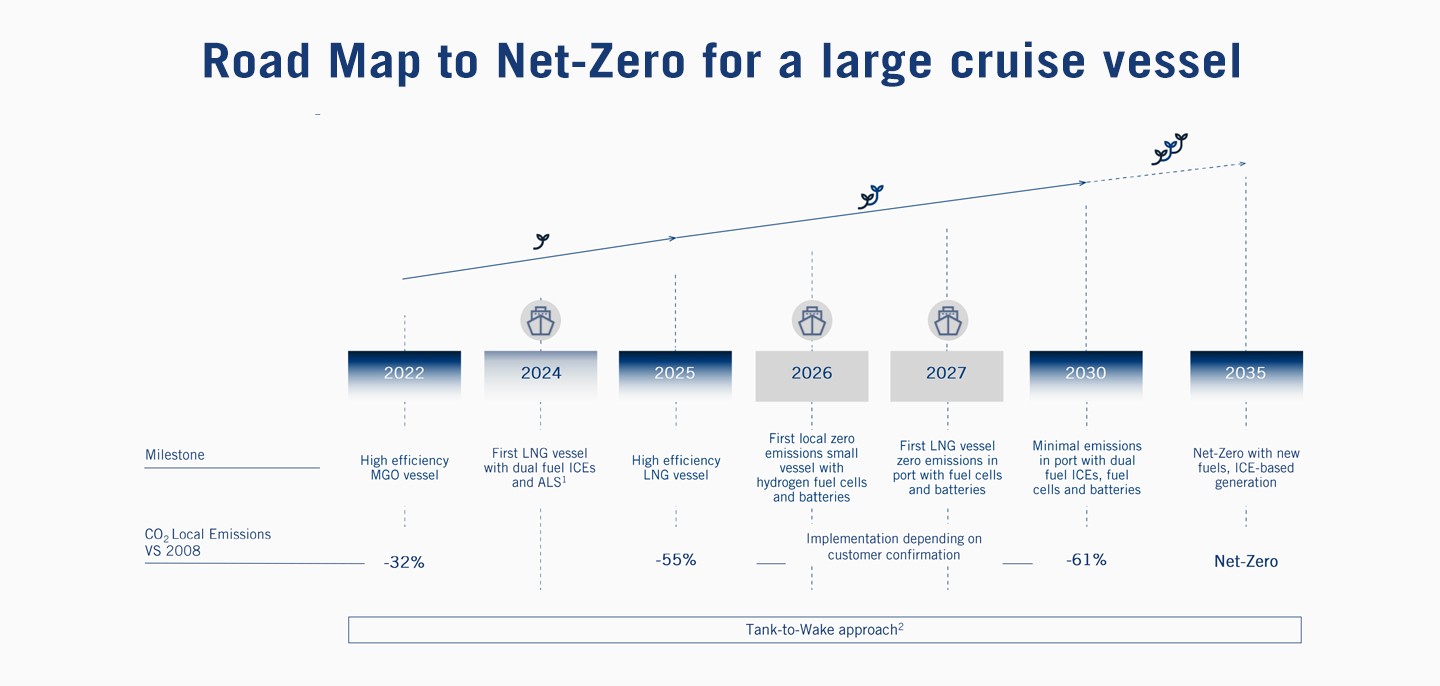

▪ Net carbon neutrality for cruise industry by 20503 and 40% reduction of average CO2 intensity per tonne/mile required by International Maritime Organization (IMO) regulations by 2030 vs 2008

▪ Shore-side power connectivity: 222 ships expected in operation by 20283, including ships already fitted, ships planned to be retrofitted and 98% of ships on order book through 2028

▪ Alternative fuels: shipowners increasingly interested in green propulsion systems and new fuels (LNG, methanol and hydrogen) for a fully decarbonized cruise industry

▪ Pillars for the achievement of zero GHG emissions: Efficiency (optimizing efficiency for existing fleet with systems upgrades and operational enhancements), Innovation (development of new technologies in order to operate green fuel ships) and Collaboration across stakeholders

1. CLIA – State of the Cruise Industry, September 2023 update

2. Fincantieri analysis based on CLIA data (CAGR 2023-2030 = CARG 2009-2019 = 5%)

3. CLIA – Cruise Industry August 2023, Environmental Technologies and Practices

Emissions reduction based on «selected standard profile»: 63% in navigation, 37% in harbor and vs baseline of Fincantieri reference

1. ICE: Internal Combustion Engine; ALS: Air Lubrication System

2. Tank-to-Wake approach: it takes into account the emissions resulting from burning or using a fuel once it is already in the tank

Naval and Offshore

Naval

▪ Defence budgets is expected to further increase globally by 10% in 2023 reaching USD 2.4 bn1, with approx. 6.2% allocated to navy procurement

▪ Increased interest by the EU member states for the creation of a common EU Defence framework, overcoming the fragmentation of European Defense Industry, while fostering cooperation between companies

▪ EU major defence programs include the Permanent Structured Cooperation (PESCO) for a new class of modular military ships, the European Patrol Corvette

▪ Ongoing geopolitical tensions worldwide may require to further investments for the protection and preservation of the maritime domain

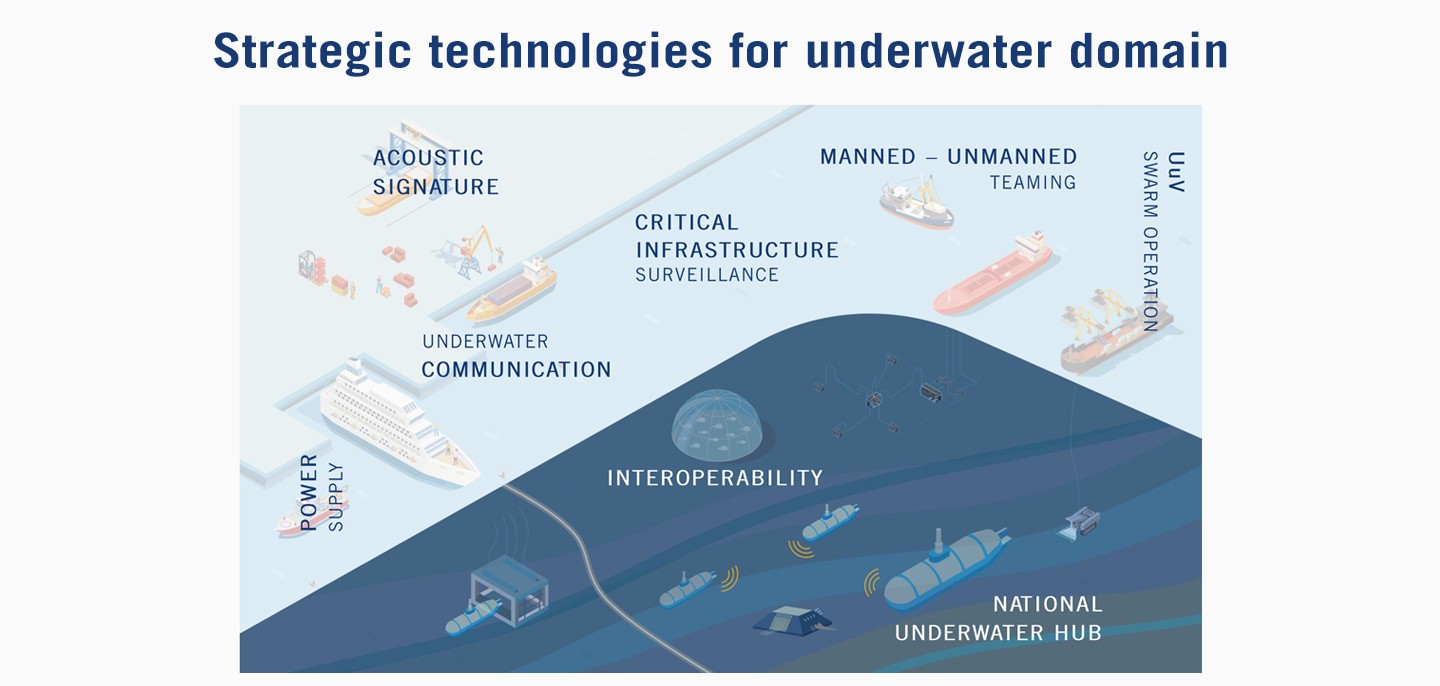

▪ Growing importance of the underwater domain to ensure, among others, the security of subsea infrastructure for energy supply and international communications and data traffic

Offshore

▪ Worldwide wind farms now delivering nominal power of ca. 64 GW2, with a favorable growth scenario with almost 270 GW of total offshore wind capacity to be installed by 2030 (CAGR 14.3%)2

▪ Unprecedented political support for green transition, enhanced build out target, attempts to streamline permitting and softening of inflationary tensions are expected to result in a strong acceleration of offshore wind activity starting in 2028, with a doubling of GW installed per year

▪ Expected growth in the Floating offshore wind sector: ca. 12 GW of floating offshore wind capacity to be installed or underway globally by 2030, ca. 32 al 2035, ca. 69 GW by 20402

▪ The upturn in the oil & gas market prevents or limits the transfer of tier2 vessels to the wind power sector, resulting in a strong demand for new generation SOV - Service Operation Vessels and CSOV - Construction Service Operations Vessels: 18 ships ordered in the first 9 months of 2023, leading to 59 units ordered since January 2020, compared with current fleet of 38 vessels3

▪ Demand for subsea installation of offshore wind and interconnectors cables expected to rise4, generating opportunities in the specialized niche market of cable layers

1. Jane’s – Global Defence Budget, September 2023. Data in real terms (adjusted for inflation)

2. 4C Offshore – Wind Farm Projects Pipeline, 30 September 2023

3. 4C Offshore – New Orders and fleet as of September 30, 2023, excluding Chinese shipowners; Fincantieri analysis

4. 4C Offshore – Subsea cable forecast, predicting cable demand for 2023-32, January 2023. Cables be installed between 2023-2032: 96.8 K Km of Offshore wind cables + 55.4 K Km of interconnectors cables

CONCLUDING REMARKS

9M 2023 |

|

2023 targets confirmed |

|