For years, we have conducted a structured and well-established materiality analysis process aimed at identifying the sustainability topics most relevant to our internal and external stakeholders. Over time, this activity has enabled us to recognize actual and potential impacts—both positive and negative, short- and long-term—that our activities generate on the economy, the environment, and people, including human rights. At the same time, we have assessed the factors that substantially influence the decisions and evaluations of our stakeholders.

In 2024, in alignment with the requirements introduced by the Corporate Sustainability Reporting Directive (CSRD), we updated our approach by conducting a double materiality analysis, compliant with the European Sustainability Reporting Standards (ESRS).

The analysis is structured around two interconnected dimensions:

• Impact materiality: an assessment of the current or potential impacts, positive or negative, that the company may have on people and the environment. This evaluation covers the entire value chain, upstream and downstream, including products, services, and commercial relationships, even those not governed by contracts.

• Financial materiality: an evaluation of risks and opportunities that may have significant effects on the Group’s economic and financial situation.

The process is organized into four main phases.

Specifically, we first conducted an in-depth study of the national and European regulatory framework, internal documentation, and the main trends within the naval and shipbuilding sector.

Subsequently, we identified impacts, risks, and opportunities by mapping the entire value chain and the involved stakeholders, analyzing inputs, outputs, and the geographical contexts in which the Group operates. This study was further enriched by the analysis of the Risk Universe developed as part of the Enterprise Risk Management (ERM) system.

The identified elements were then aligned with the topics outlined by the ESRS and assessed through specific methodological approaches:

• Impacts were evaluated via a Sustainability Survey involving over 500 internal and external stakeholders (including customers, suppliers, institutions, unions, financial community, etc.);

• Risks were selected from the Group’s Risk Universe (approximately 200 events), with a focus on ESG-related risks. The assessment followed the ERM model, considering probability and impact, in accordance with the Risk Appetite and Risk Tolerance thresholds;

• Opportunities were assessed by a cross-functional working group through dedicated workshops, using an analysis based on the likelihood of occurrence and the potential financial effects in the short, medium, and long term.

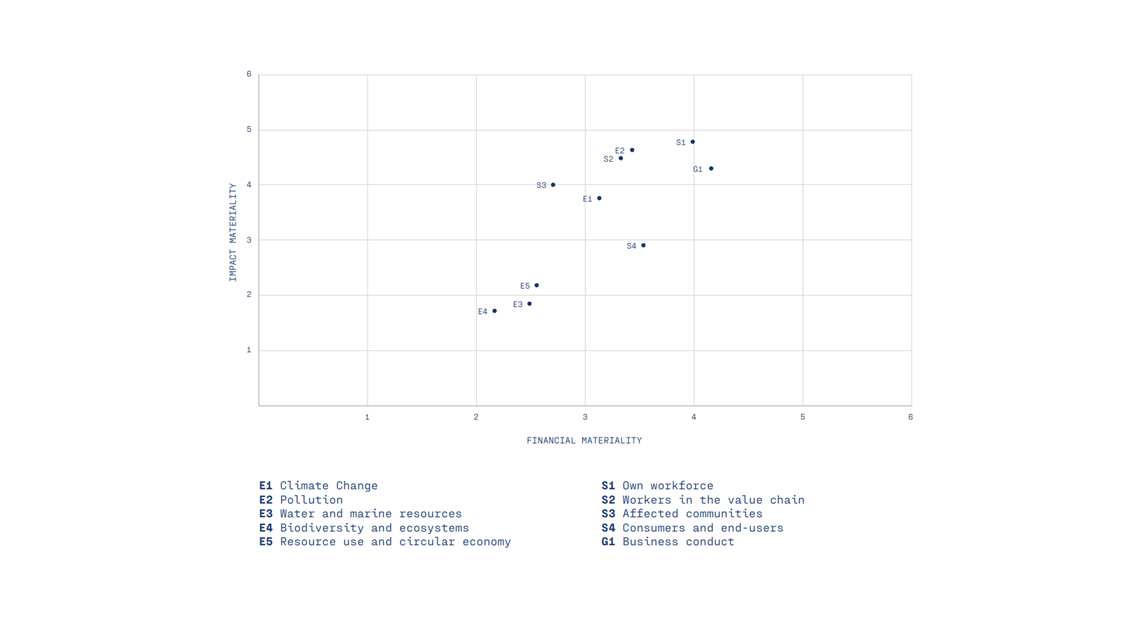

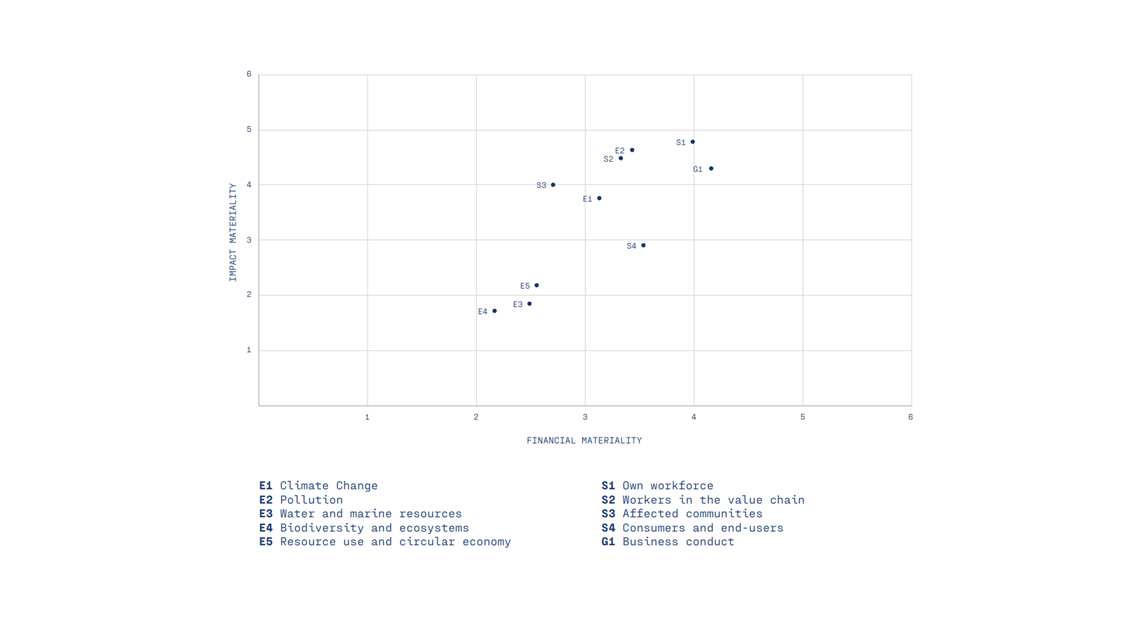

The double materiality analysis conducted in 2024 identified 30 relevant impacts, 27 risks, and 21 opportunities, all aligned with the material topics outlined by the ESRS, as illustrated in the double materiality matrix below:

The table below provides a concise overview of the main Impacts, Risks, and Opportunities (IRO) for each topic.

The main Impacts, Risks, and Opportunities (IRO)

| TOPIC | DESCRIPTION |

| E1 – Climate Change | The Group’s activities generate greenhouse gas emissions across the entire value chain. At the same time, the adoption of more energy-efficient technologies in both processes and products, combined with awareness-raising initiatives targeting end users, represents a concrete opportunity. The main risks relate to inadequate emissions management, challenges in timely alignment with emerging technologies for the ecological transition, and the potential for unexpected costs associated with adapting to extreme weather events. Opportunities lie in the development of solutions aligned with global decarbonization goals, leading to benefits in competitiveness, efficiency, and attractiveness to investors. |

| E2 – Pollution | The Group’s activities generate impacts related to the presence of greenhouse gases across the entire value chain. At the same time, the adoption of more energy-efficient technologies in both processes and products—along with awareness-raising initiatives targeting end users—represents a concrete opportunity. The main risks concern the inadequate management of emissions, the challenge of keeping pace with emerging technologies for the ecological transition, and the potential for unexpected costs linked to adaptation to extreme weather events. Opportunities arise from the development of solutions aligned with global decarbonisation goals, yielding benefits in terms of competitiveness, efficiency, and attractiveness to investors. |

| E3 – Water and marine resources | Operations within shipyards generate impacts related to increased water consumption, particularly at sites located in areas experiencing water stress. The main risk is associated with inadequate management of wastewater discharges, which could lead to potential consequences for the marine environment and regulatory compliance. |

| E4 – Biodiversity | The Group’s production activities impact biodiversity by reducing the variety of species in surrounding areas and altering natural habitats and ecological balances. In response, the development of innovative solutions with reduced impact on marine biodiversity represents a significant opportunity to enhance the Group’s competitiveness and profitability. |

| E5 – Resource use and circular economy | The main impacts concern the environmental consequences of inadequate treatment and disposal of waste generated during the various operational phases. Key risks include potential shortages of raw materials and ineffective management of both hazardous and non-hazardous waste. The opportunity lies in developing circular processes that promote reuse and more efficient disposal, thereby enhancing the Group’s competitiveness and profitability. |

| S1 – Own workforce | The impacts of this topic primarily concern the improvement of employee well-being and work-life balance, supported by welfare plans and training programs focused on health and safety. At the same time, potential negative impacts include increased incidents, occupational illnesses, and harm to physical and mental health resulting from inadequate safety management or malfunctioning company assets. Significant impacts also arise in terms of rights protection, with risks of discriminatory behavior and non-compliance with labor regulations. In the field of cybersecurity, impacts relate to potential breaches of sensitive data, with harmful consequences for the company and all involved stakeholders. Key risks include non-compliance with national and international health, safety, and data protection regulations, as well as challenges in managing labor relations and retaining key personnel, which could affect the Group’s production continuity and competitiveness. Main opportunities lie in strengthening competitiveness and innovation through an inclusive and engaging work environment that fosters skill development, talent retention, and a corporate culture grounded in fairness and safety. This translates into enhanced reputation and reduced costs related to accidents and inefficiencies, while ensuring robust data protection and unlocking new business opportunities in the cybersecurity domain. |

| S2 – Workers in the value chain | The main impacts concern potential human rights violations along the supply chain due to insufficient oversight, as well as the protection of the confidentiality, integrity, and availability of corporate data, which may be threatened by unauthorized disclosures or improper handling of sensitive information. At the same time, there has been a strengthening of data protection and security, supported by the development of targeted security plans and systems involving all internal and external stakeholders. Associated risks include non-compliance with national and international regulations on personal data protection and cybersecurity, with specific reference to sector-specific and military regulations and the National Cybersecurity Perimeter. Additionally, the Group faces the risk of a shortage of specialized external labor, which is crucial to meeting production needs. Opportunities arise from the efficient management of cybersecurity, enabling cost reductions related to potential breaches, ensuring operational continuity, and reinforcing the trust of customers and stakeholders. |

| S3 – Affected communities | Impacts include disruptions to local communities resulting from corporate activities, as well as economic benefits generated through collaborations, contracts, tax contributions, and investments in infrastructure. Risks stem from a potential failure to address local needs and from human rights violations, with social and environmental repercussions. Opportunities lie in fostering local economic development through the creation of new jobs and in reducing disputes through active dialogue and cooperation with public institutions. |

| S4 – Consumers and end-users | The main impacts concern increased customer satisfaction and trust, achieved through effective relationship management and the development of tailored solutions, alongside improved efficiency, safety, and reliability of products. However, risks remain related to delivery delays, non-compliance with quality standards, and breaches in data protection. Reputational and legal risks are also associated with commercial agreements and cybersecurity regulations. Opportunities lie in strengthening competitiveness and profitability through customer loyalty and the attraction of new clients, the development of innovative technologies—particularly in offshore wind and product connectivity—and the assurance of high-quality standards that bolster the company’s reputation. Lastly, efficient cybersecurity management ensures business continuity and opens up new business opportunities linked to the use of autonomous navigation systems. |

| G1 – Business conduct | The main impacts relate to the potential compromise of the company’s reputation due to unethical conduct, such as tax evasion and anti-competitive practices, as well as the promotion of ethical values and transparency within the maritime sector and the supply chain. The most significant risks include non-compliance with anti-corruption regulations and data protection laws, along with potential exposure to advanced cyber threats. Opportunities focus on strengthening business continuity and reducing costs through effective cybersecurity management, while enhancing investor appeal through transparent and robust ESG performance. |