SUMMARY & BUSINESS UPDATE

Executive summary

Revenues up by 28% and EBITDA +65%, Backlog at €36 bn, 2021 guidance fully confirmed

• FY 2021 guidance fully confirmed with revenues expected to reach +25-30% YoY and EBITDA margin over 7%

• Total backlog with 110 units at €36.0 bn, 6.9x 2020 revenues: backlog with 92 units at €26.6 bn and soft backlog at €9.4 bn

• Order intake at €2.3 bn

• Record-high production volumes with 12.3 mln production hours at Italian sites, +34% YoY

• 13 ships successfully delivered from 10 different shipyards, of which 3 cruise ships delivered in July

• Operating cash flow more than compensates Capex needs, also after €350 mln repayment of construction loans

• COVID-19 managed effectively

Business update

Positive business operating performance across all segments

| CRUISE |

• Sound operating performance with 4 units delivered in 3Q: |

| DEFENCE |

• Program for the Qatari Ministry of Defence: • Program for the Italian Navy • Program for the US Navy: LCS 23 «Cooperstown» delivered, 10th unit of the class • MoU with Navantia to boost collaboration in the naval and maritime fields within the European Defence framework |

| OFFHORE AND SPECIALIZED VESSELS |

• Confirmed VARD positioning in the offshore wind sector, with 8 SOVs in the portfolio, of which 4 ordered this quarter, out of 18 overall units ordered worldwide, becoming market leader |

| EQUIPMENT, SYSTEMS AND SERVICES |

• Infrastructure: launch of construction activities for the new MSC Cruise terminal at PortMiami • Fincantieri NexTech: finalized the acquisition of IDS group, which operates in the realization of high-tech products in both civil and defence fields |

Sustainable strategy

Tireless effort to become a model of excellence

Green Finance

• Group’s first trade finance credit line to support the construction of custom-built green cable layer for a Van Oord vessel to operate in offshore wind farms with low gas emissions

Decarbonization

• MoU with ENI to develop decarbonization projects in the fields of energy, transports, and circular economy

Green Hydrogen

• Agreement with Enel Green Power Italia for the production, supply, management and use of green hydrogen for port areas and long-range maritime transport

ESG Awards

|

• Range “Advanced” and #1 among its peers in 2021 |

|

• Score A- and Leader score (A) in the Supplier Engagement Rating survey(1) – 2021 Under Review |

|

• Score of 85/100 and #2 out of 512 companies evaluated |

|

• Under Review |

(1) Rating related to the engagement of the supply chain on sustainability and climate change topics

Hydrogen-Powered Ships

• MoU with MSC and SNAM for a feasibility study to design and build the first oceangoing hydrogen-powered cruise ship

(1) Rating related to the engagement of the supply chain on sustainability and climate change topics

New orders

New orders across all segments amount to € 2.3 bn

|

Segment |

Vessel |

Client |

Expected Delivery |

|

|

FFG-62 frigate |

US Navy |

Beyond 2025 |

|

Somnio |

Somnio Superyachts |

2024 |

|

|

|

|||

|

|

3 Service Operation Vessels |

North Star Renewables |

2023 |

|

2 Service Operation Vessels(1) |

Rem Offshore |

2023-2024 |

|

|

2 Service Operation Vessels(1) |

Norwind Offshore |

2022-2024 |

|

(1) Ordered in Q3

Main deliveries

13 ships successfully delivered from 10 different shipyards in 3 different continents

|

Segment |

Vessel |

Client |

Shipyard |

|

|

LSS “Vulcano” |

Italian Navy |

Muggiano (ITA) |

|

Viking Venus |

Viking Cruises |

Ancona (ITA) |

|

|

Hanseatic Spirit |

Hapag-Lloyd Cruises |

Langsten (NOR) |

|

|

LCS21 USS Minneapolis St. Paul |

US Navy |

Wisconsin (USA) |

|

|

FREMM |

Riva Trigoso (ITA) |

||

|

Valiant Lady(2) |

Virgin Voyages |

Sestri Ponente (ITA) |

|

|

MSC Seashore(2) |

MSC Cruises |

Monfalcone (ITA) |

|

|

Rotterdam(2) |

Holland America Line |

Marghera (ITA) |

|

|

Le Commandant Charcot(2) |

Ponant |

Søviknes (NOR) |

|

|

LCS23 USS Cooperstown(2) |

US Navy |

Wisconsin (USA) |

|

|

|

|||

|

|

Cruise ship “Coral Geographer” (3) |

Coral Expeditions |

Vung Tau (VNM) |

|

Fishing Vessel |

Luntos |

Vung Tau (VNM) |

|

|

Leonardo da Vinci(2) |

Prysmian |

Brattvag (NOR) |

|

(2) Delivered in Q3

(3) For reasons connected to the organizational responsibility of VARD yards split between Cruise and Offshore, “Coral Geographer” for Coral Expeditions delivered in Q1 2021 is included in the Offshore & Specialized Vessels deliveries

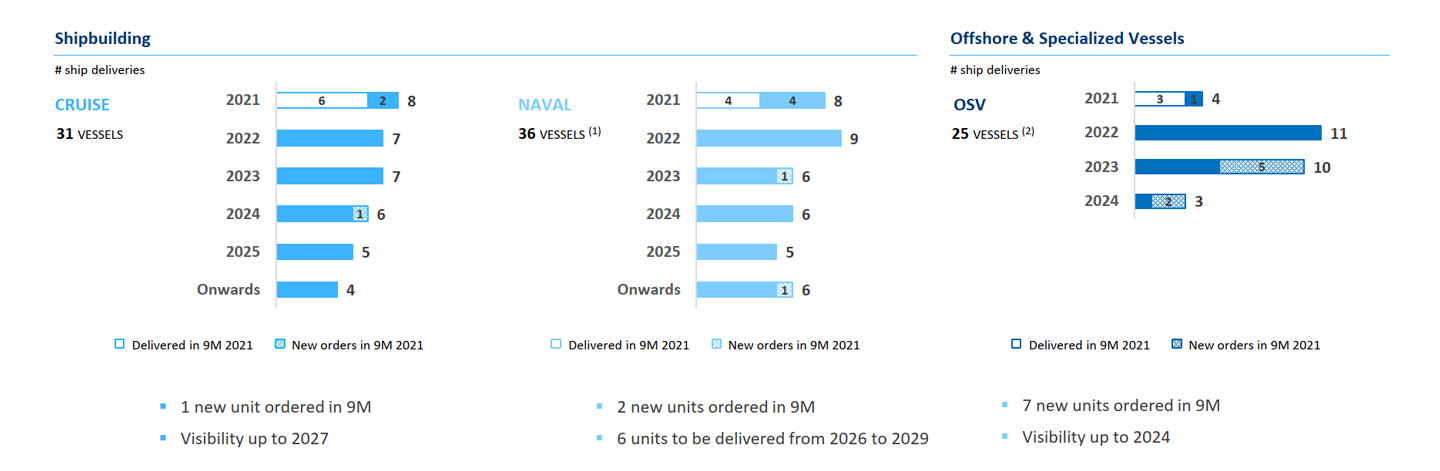

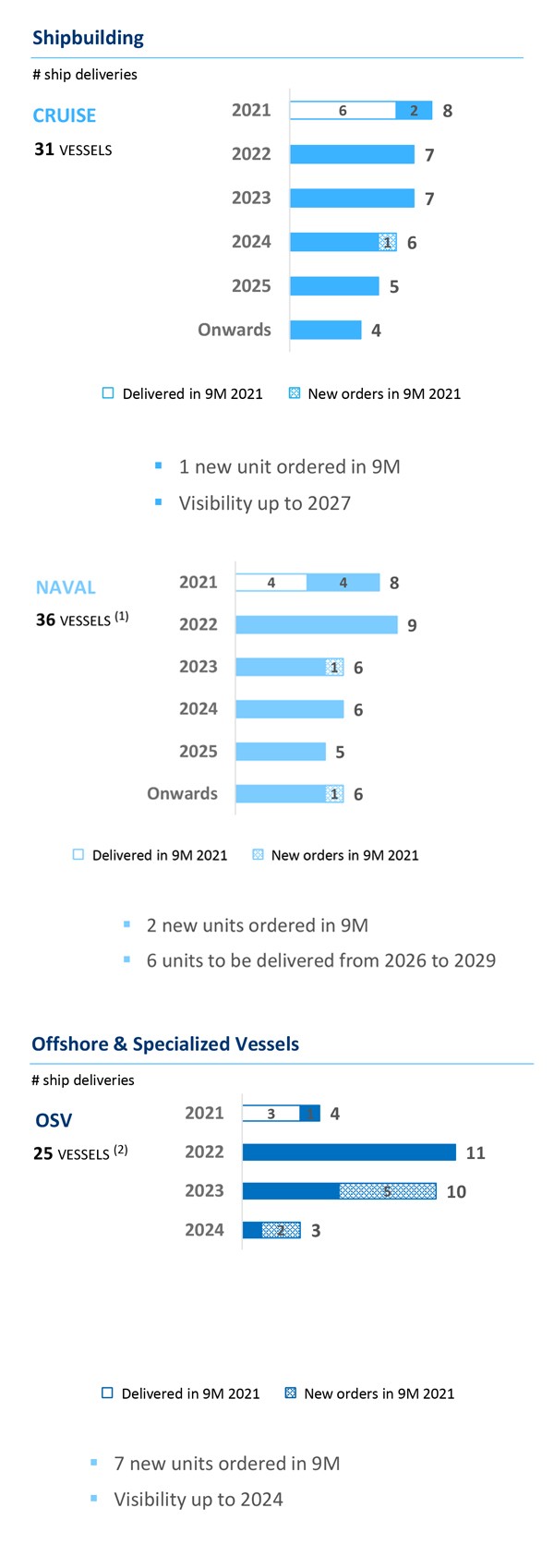

Backlog deployment

Well-balanced visibility both in Cruise and Naval, 4 new orders in Offshore and Specialized Vessels in 3Q

(1) Articulated Tug Barge (ATB) is an articulated unit consisting of a barge and a tug, thus being counted as two vessels in one unit

(2) The Offshore & Specialized Vessels business generally has shorter production times and, as a consequence, shorter backlog and quicker order turnaround than Cruise and Naval

9M 2021

FINANCIAL RESULTS

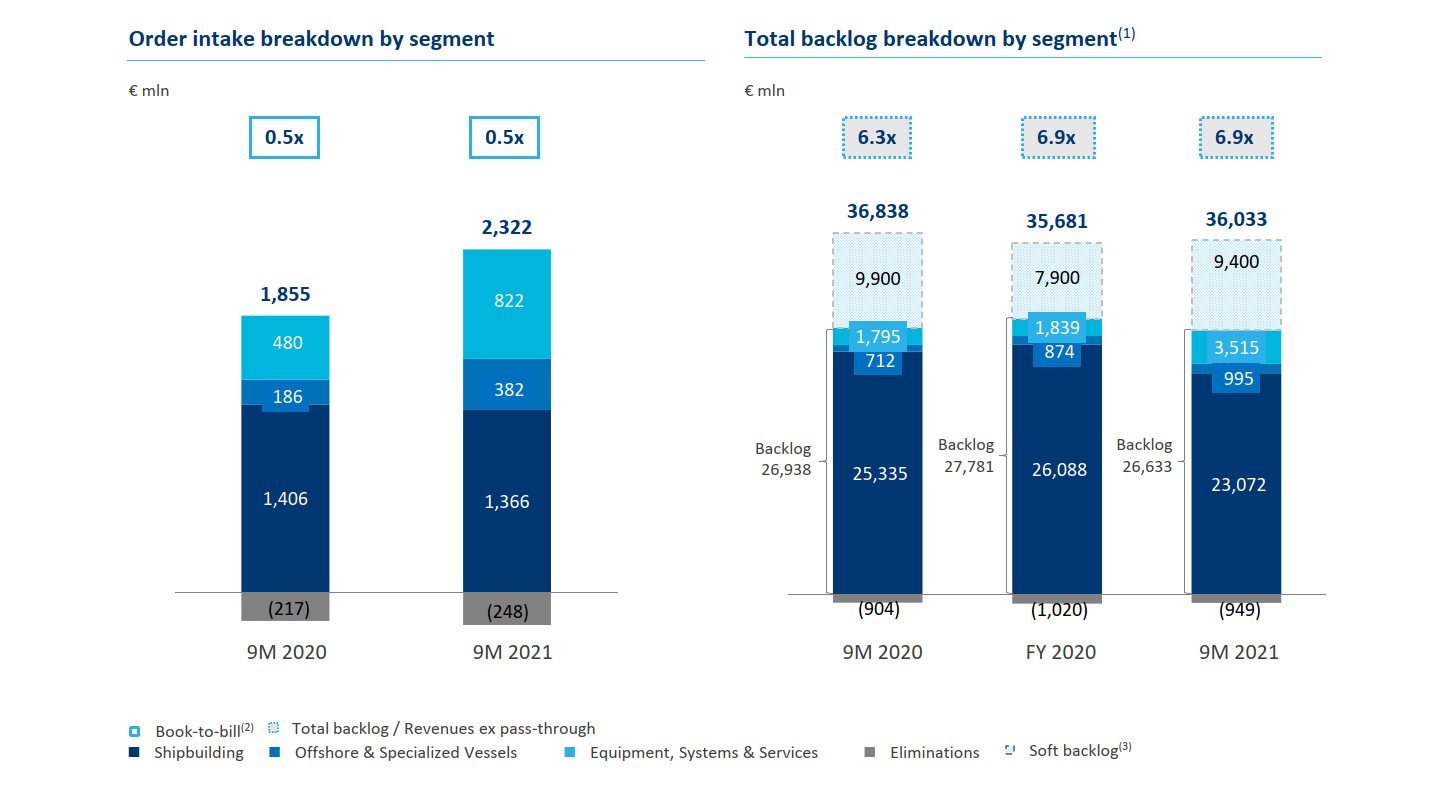

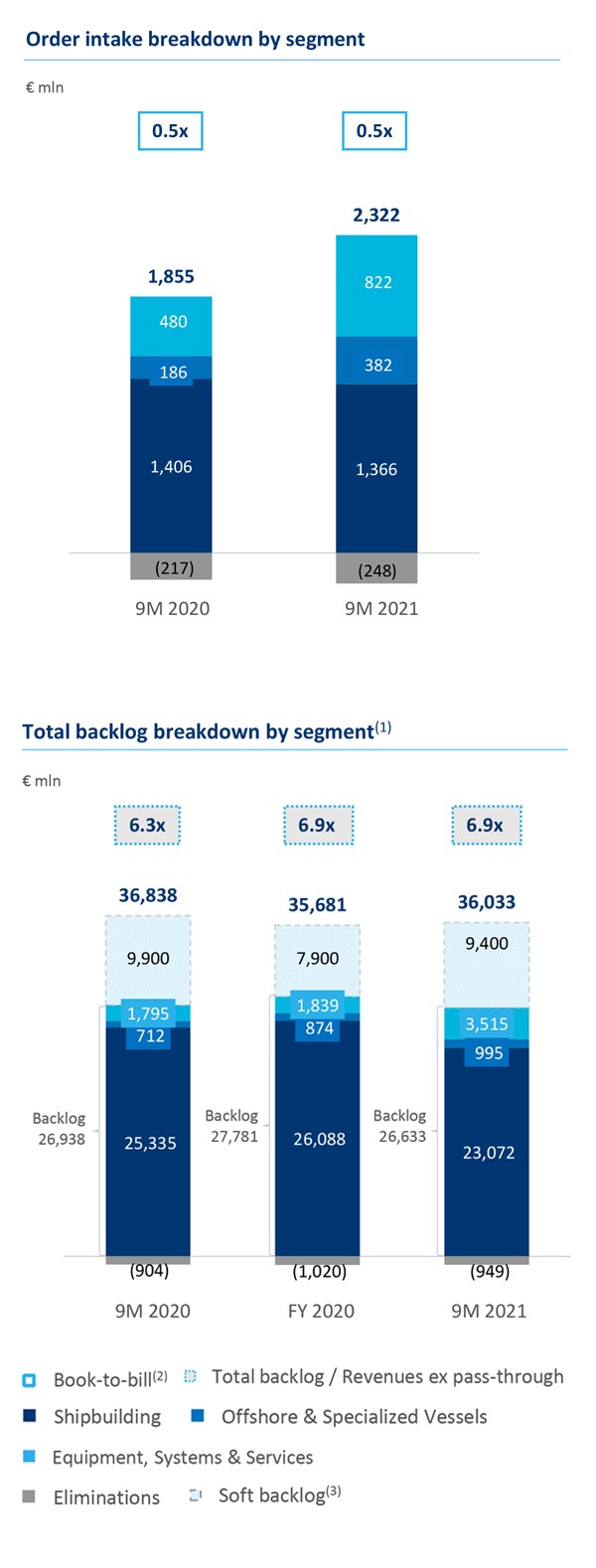

Order intake and backlog

Solid order intake and hefty soft backlog

• No orders cancellation

• Sizeable order intake at € 2.3 bn, thanks to the positive impact of Offshore & Special Vessels and ESS

• Soft backlog includes the agreement of Fincantieri as prime contractor for the supply of 6 frigates to the Indonesian Navy

• Total backlog represents 6.9x 2020 revenues

(1) Total backlog is the sum of backlog and soft backlog

(2) Order intake/revenues

(3) Soft backlog represents the value of existing contract options and letters of intent as well as contracts in advanced negotiation, none of which yet reflected in the order backlog

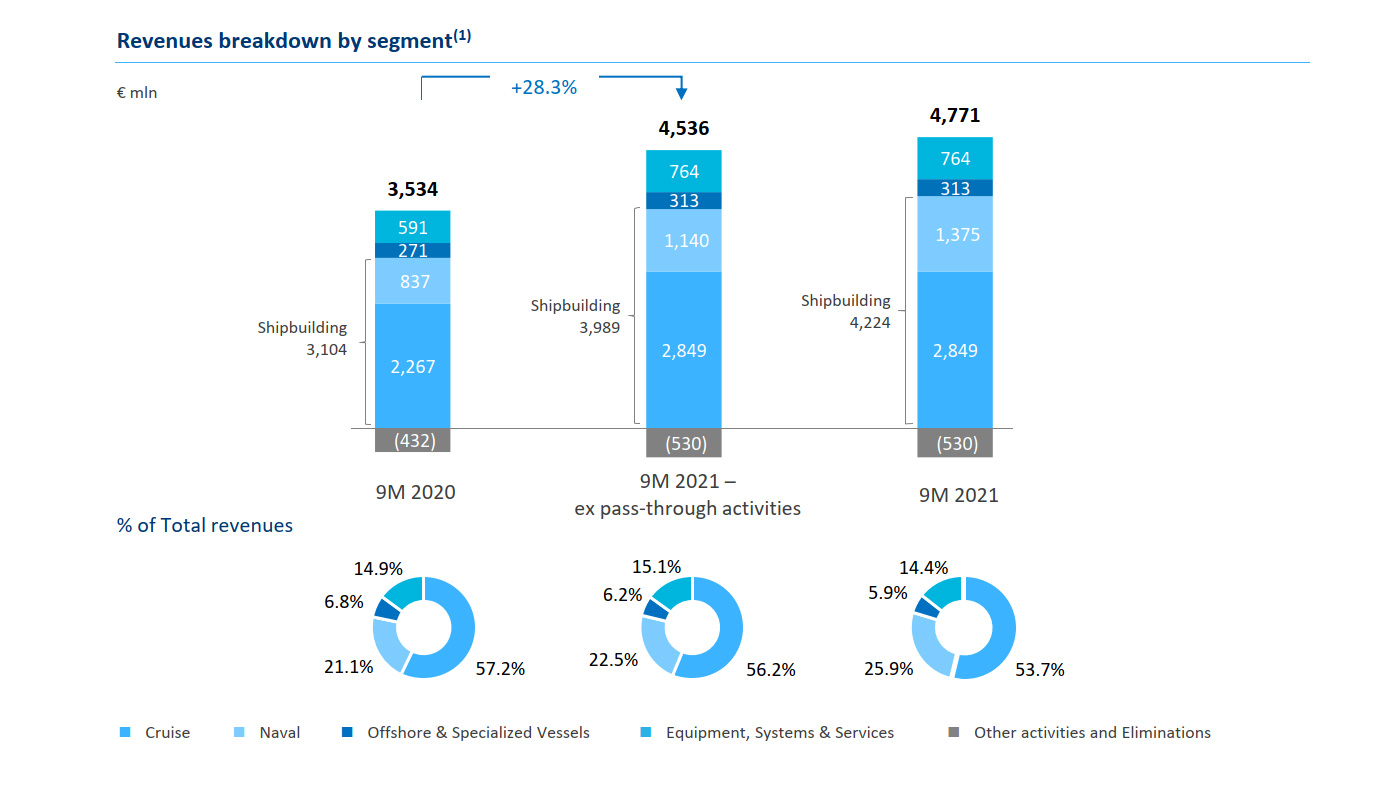

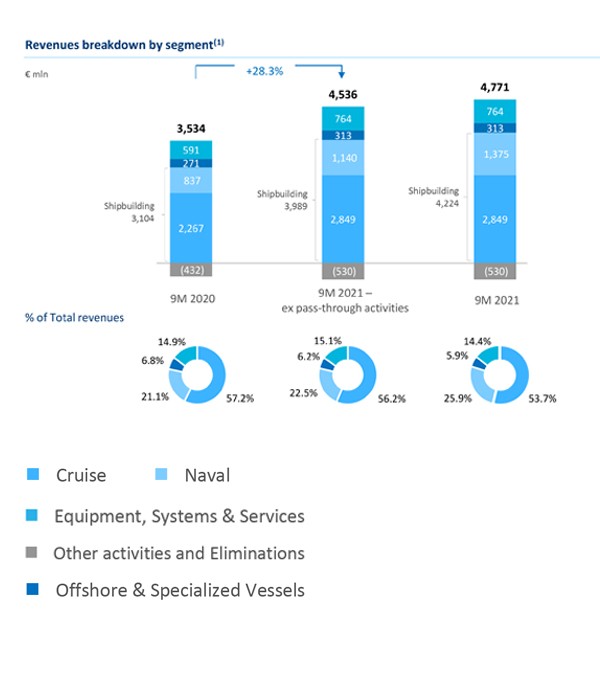

Revenues

Revenue growth in line with 2021 guidance, with positive contribution across all segments

Revenues excluding pass-through activities are up 28.3% YoY thanks to record-high production volumes in the 9M 2021 (12.3 mln production hours)

![]() Shipbuilding up 28.5% YoY thanks to the programmed production ramp-up

Shipbuilding up 28.5% YoY thanks to the programmed production ramp-up

![]() Offshore & Specialized Vessels up 15.3% YoY

Offshore & Specialized Vessels up 15.3% YoY

![]() Equipment, Systems & Services up 29.1% YoY mainly related to the complete accommodation business area

Equipment, Systems & Services up 29.1% YoY mainly related to the complete accommodation business area

88% of revenues from international clients

(1) Breakdown calculated before eliminations

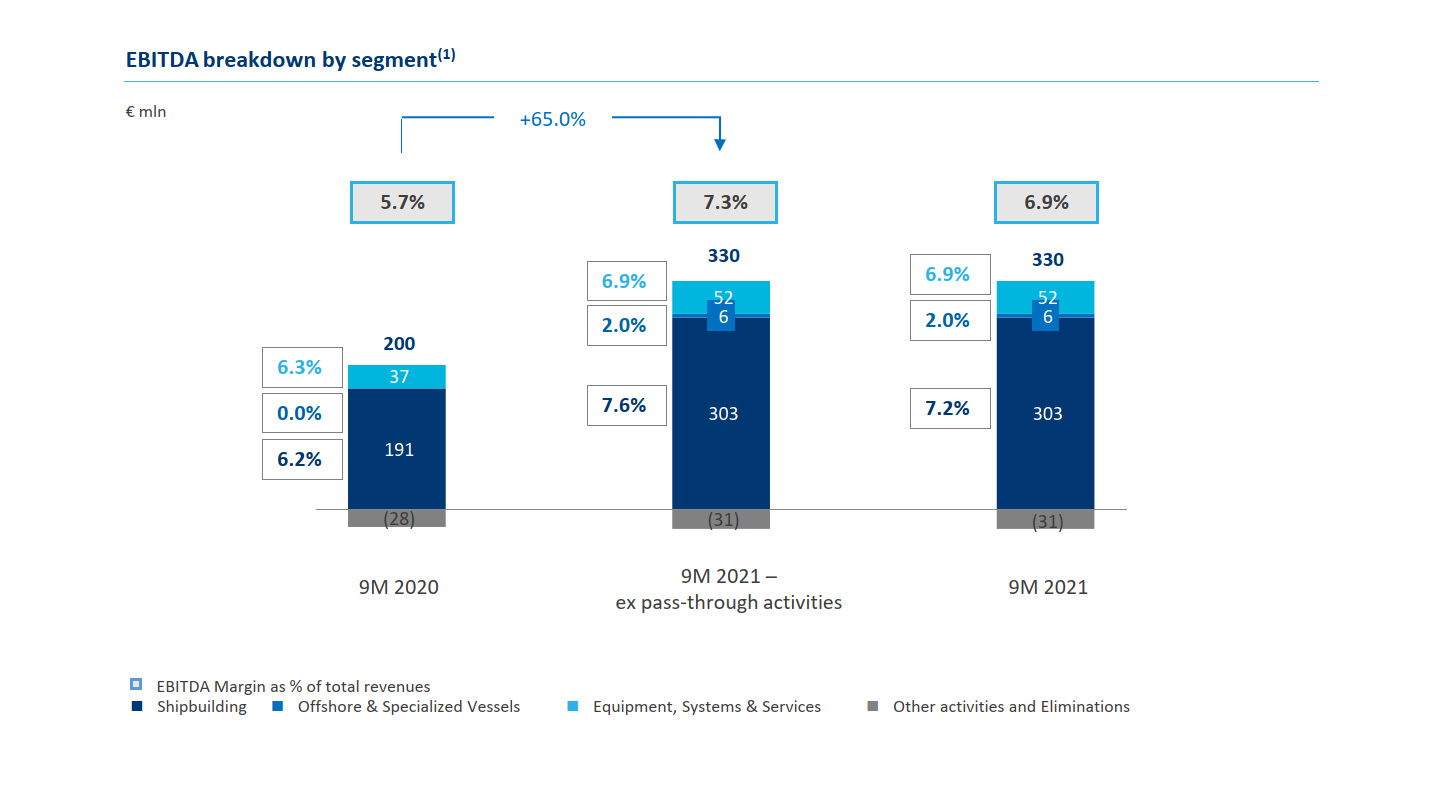

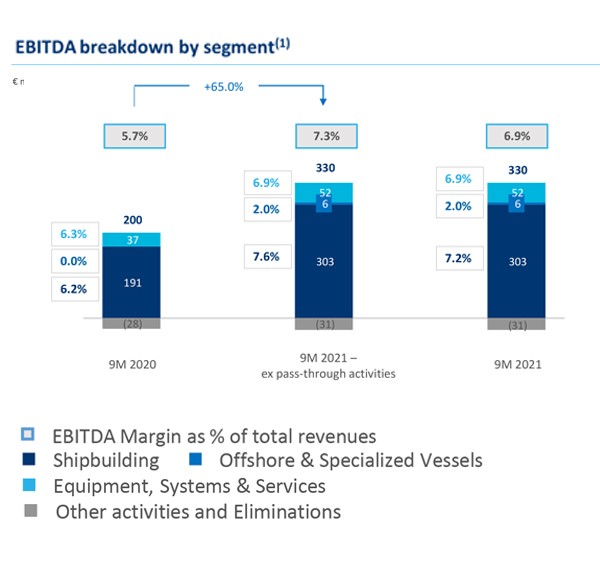

EBITDA

Remarkable increase in volumes and margins

EBITDA margin at 7.3% excluding pass-through activities mainly thanks to the positive contribution from Shipbuilding despite the impact from increased steel prices

![]() Shipbuilding EBITDA is up €112 mln YoY with margin at 7.6%

Shipbuilding EBITDA is up €112 mln YoY with margin at 7.6%

![]() Offshore EBITDA is up €6 mln YoY thanks to the effective repositioning strategy in more promising sectors

Offshore EBITDA is up €6 mln YoY thanks to the effective repositioning strategy in more promising sectors

![]() ESS EBITDA is up €15 mln YoY despite the lower Ship Repair and Conversion margins

ESS EBITDA is up €15 mln YoY despite the lower Ship Repair and Conversion margins

(1) EBITDA is a Non-GAAP Financial Measure. The Company defines EBITDA as profit/(loss) for the period before (i) income taxes, (ii) share of profit/(loss) from equity investments, (iii) income/expense from investments, (iv) finance costs, (v) finance income, (vi) depreciation and amortization (vii) expenses for corporate restructuring, (viii) accruals to provision and cost of legal services for asbestos claims, (ix) other non recurring items

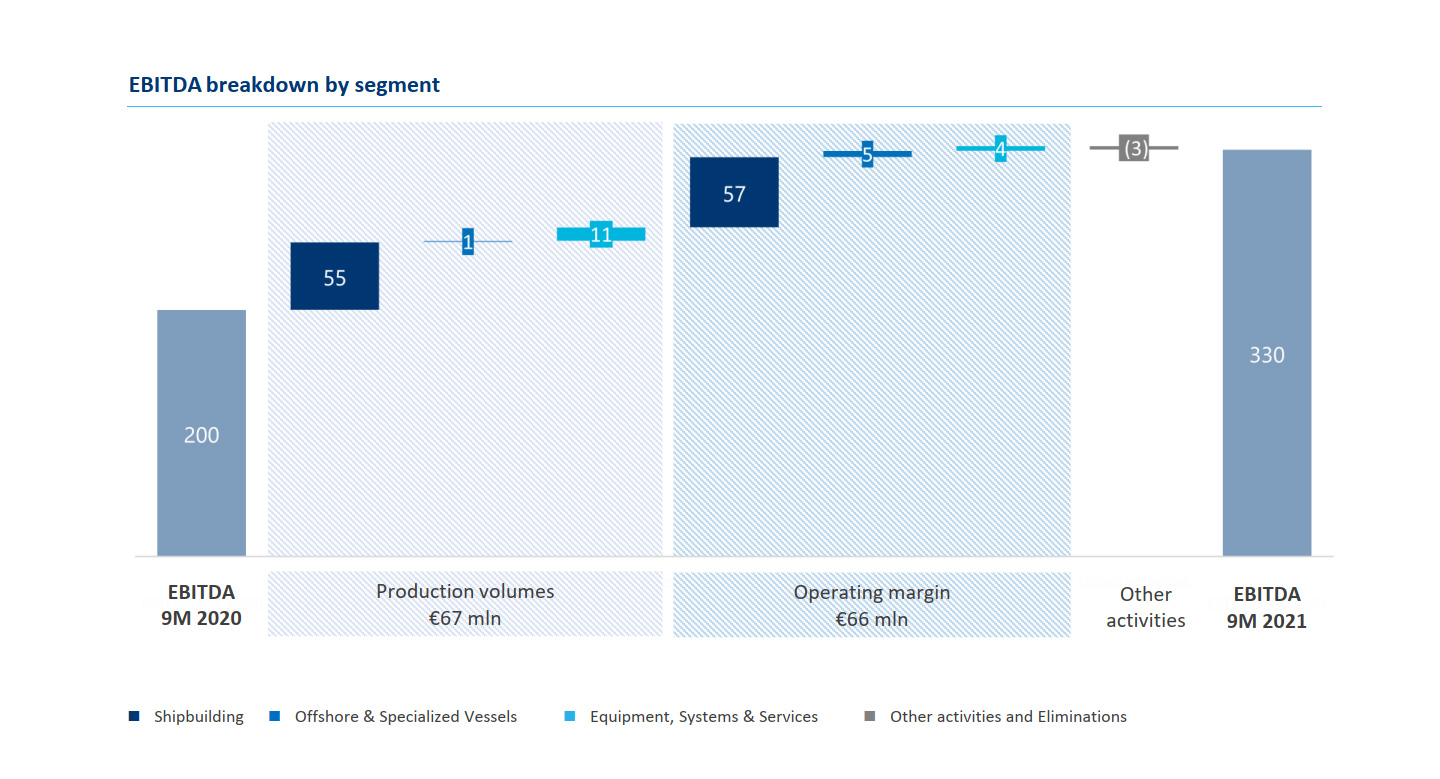

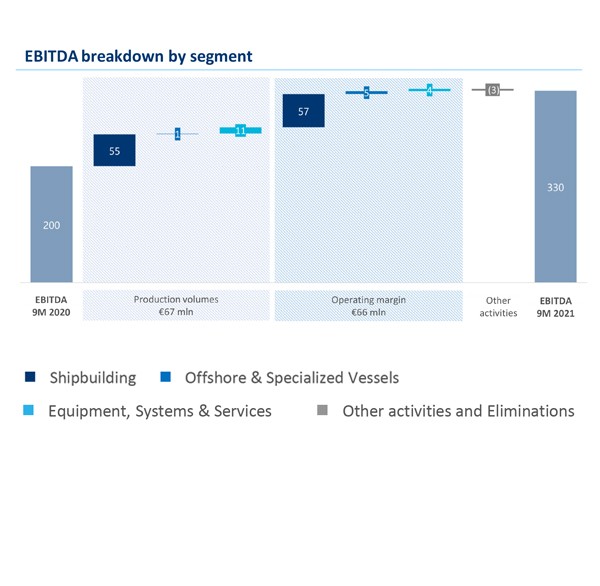

EBITDA growth

Better operating margin thanks to higher production volumes and improved margins

![]() Shipbuilding: EBITDA improvement driven by higher production volumes and improved operating margin

Shipbuilding: EBITDA improvement driven by higher production volumes and improved operating margin

![]() Offshore and Specialized Vessels: increased EBITDA thanks to higher operating margins

Offshore and Specialized Vessels: increased EBITDA thanks to higher operating margins

![]() ESS: positive effect brought about by higher production volumes and better margins

ESS: positive effect brought about by higher production volumes and better margins

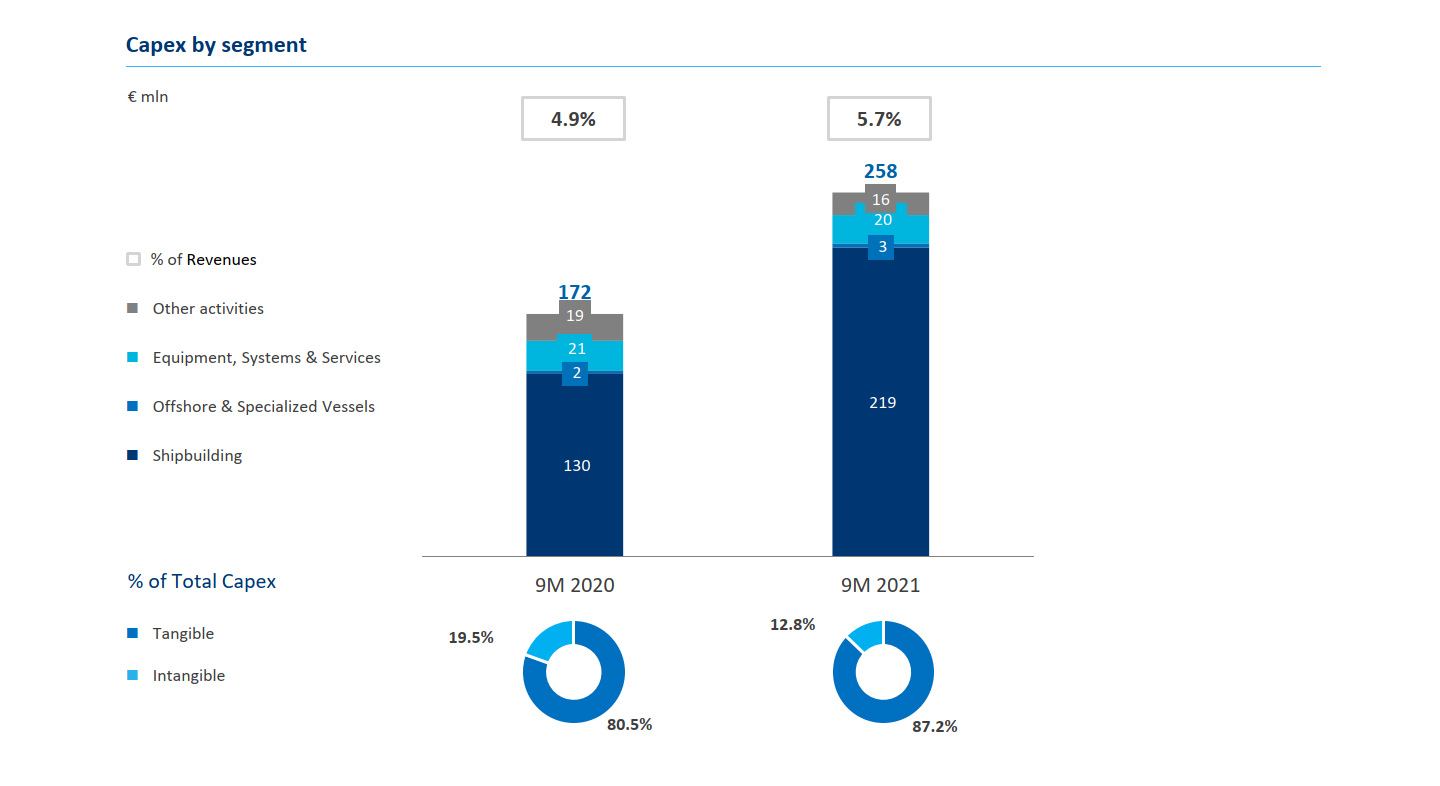

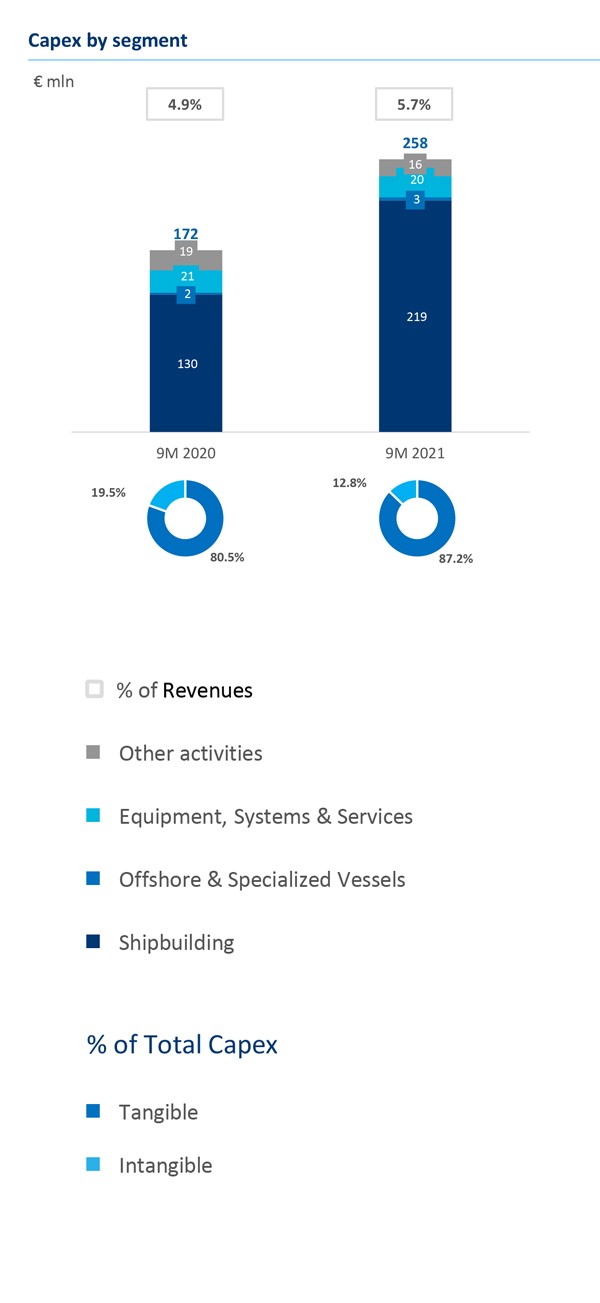

Capex

Significant investments creating further efficiencies in engineering and production scenarios

• Capex up 50% vs 9M 2020 to support shipyards upgrade and further efficiencies to address new productive scenarios

• Investments breakdown as follows:

- Intangible activities for €33 mln, in line with 9M 2020

- Tangible activities for €225 mln

• Solid coverage of industrial fixed costs structure, allowing greater cash generation and progressive deleveraging

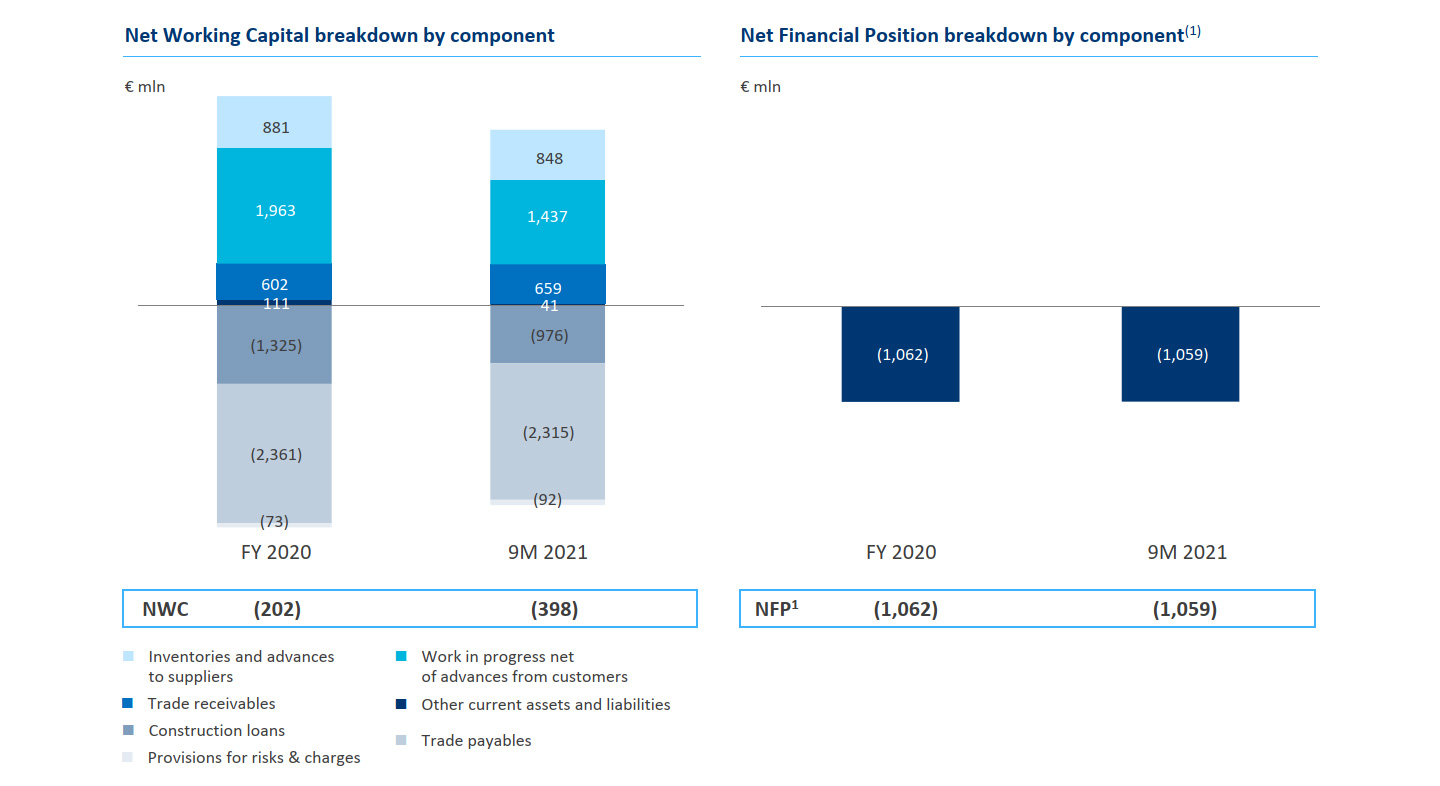

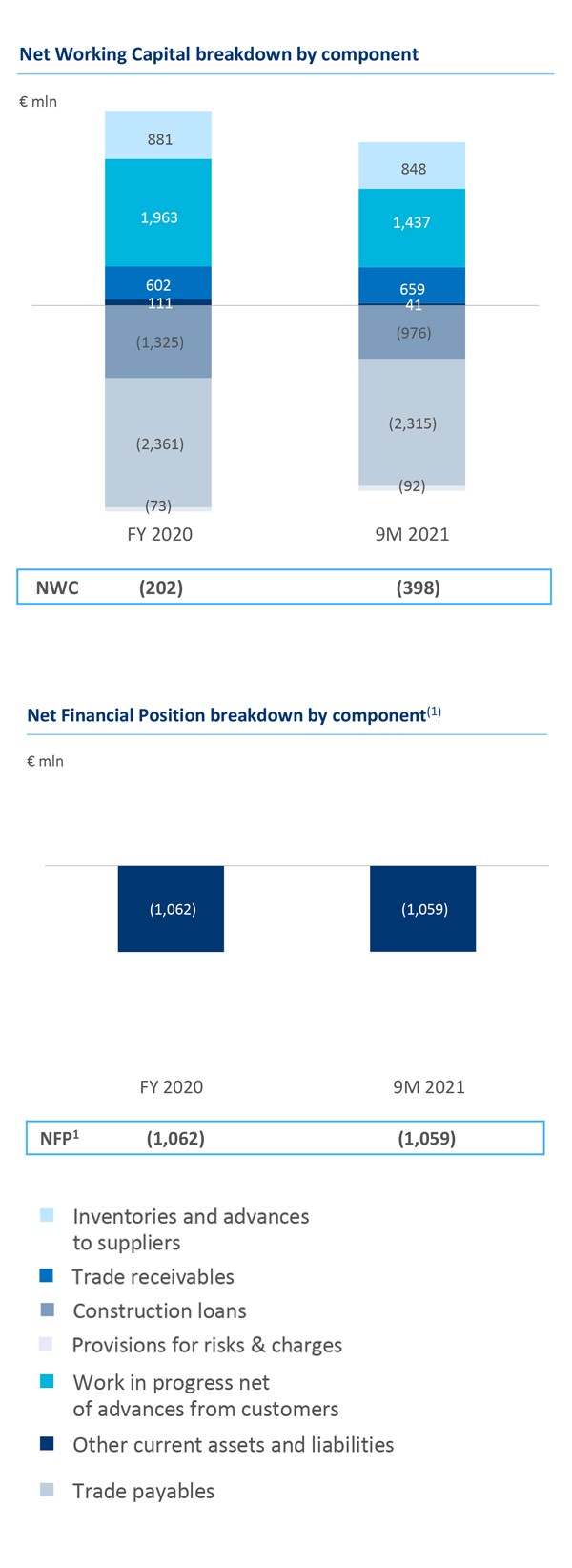

Net working capital and net financial position

NFP in line with expectations with 2 cruise units to be delivered in 4Q

• NWC negative at €398 mln, - € 196 mln vs FY 2020, mainly due to the deliveries in the period

• Net debt at €1,059 mln in line with FY 2020 and FY 2021 expectations

• NFP still affected by the strategy of deferrals granted to clients (€ 298 mln), with cash-in to occur in 4Q and in 2022

• Operating cash flow more than compensates the Capex needs, allowing also €350 mln repayment of construction loans

(1) Construction loans are comlnitted working capital financing facilities, treated as part of Net working capital, not in Net debt, as they are not general purpose loans and can be a source of financing only in connection with ship contracts

OUTLOOK

Update on cruise

Around 57% of the global fleet in service with 65 brands already operating by the end of October

| CRUISE RESTART | • The Conditional Sailing Order will expire in January 2022; After January 15, CDC will transition to a voluntary program in coordination with cruise ship operators • Pent up demand reflected in strong bookings for 2022, even though uncertainty related to the Delta variant persists • Occupancy levels vary across and within the main operators’ brands, constantly improving quarter by quarter • Carnival: occupancy in the third quarter of 2021 was 54%, growing consistently from 39% in June to 59% in August |

| FINANCIAL MARKETS RESPONSE | • Carnival: Successful closing of private offering of secured notes(1) of $2.3 bn at 4% due 2028, replacing existing debt of $2.0 bn at 11.5% due 2023 (savings up to $135 mln interest/year) • TUI Group has announced further strengthening of its balance sheet via fully underwritten €1.1 bn capital increase. The Company intends to use the net proceeds of the offering to reduce interest costs and net debt by reducing current drawings, in line with the Group’s goal to rapidly repay government loans |

| FORECASTS | • The big 3 cruise groups should have roughly 65-80% of their capacity back in operation by the end of 2021 • Carnival: about 65%(2) of total operating capacity back in service by year-end, with full fleet sailing at the end of the first half 2022(3) • Booking trends for 2022 are in line with 2019 levels; for some operators even higher, with no reduction on ticket prices |

(1) First-Priority Senior Secured Notes

(2) Carnival Corporation on Pace to Restart Over 50% of Fleet Capacity by October (https://www.carnivalcorp.com/news-releases/news-release-details/carnival-corporation-pace-restart-over-50-fleet-capacity-october)

(3) Carnival 3Q 2021 Business Update (3Q 2021 Business Update - Final PDF (1).pdf (carnivalcorp.com))

Business outlook

Confirmed FY 2021 guidance

Expected Financial Performance in 2021

• Revenues +25%-30% YoY and EBITDA margin over 7.0% despite the surge in commodity and energy prices

• FY 2021 net debt to be in line with FY 2020 levels

Medium to Long Term Expectations

• Backlog preservation with production activities at full speed, thanks to the solid coverage of industrial fixed costs structure, allowing greater cash generation and progressive deleveraging

• Increased commodity prices mitigated by the positive effect of planning and design processes’ revision, by the important Capex plan in both production and technology and by human capital investments

Focus on ESG

• Development of technological solutions able to satisfy clients’ needs, while reducing emissions and raising energy efficiencies

• Promotion of growth, enhancement and training of human capital, with a particular focus on highly motivated people, in particular youth, able to spread an inclusive and innovative company culture

• Reduction of CO2 and other pollutant emissions in order to fight against climate change also by purchasing energy from renewable sources