EXECUTIVE SUMMARY

1H 2023 Highlights

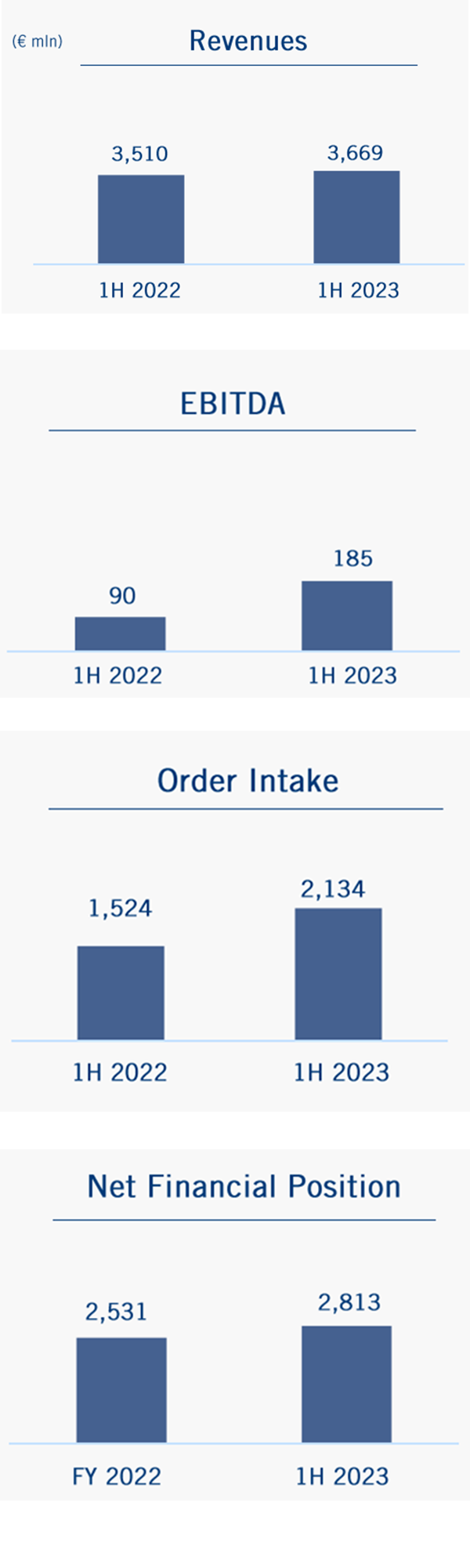

• Revenues at € 3,669 mln, up by 4.5%, in line with expectations

• EBITDA at € 185 mln and EBITDA margin at 5.0%

• Adjusted net profit at € 3 million, before extraordinary or non-recurring asbestos-related items

• Order intake at € 2.1 bn, mainly thanks to the Offshore and total backlog at € 32.9 bn further supported by the raising commercial pipeline

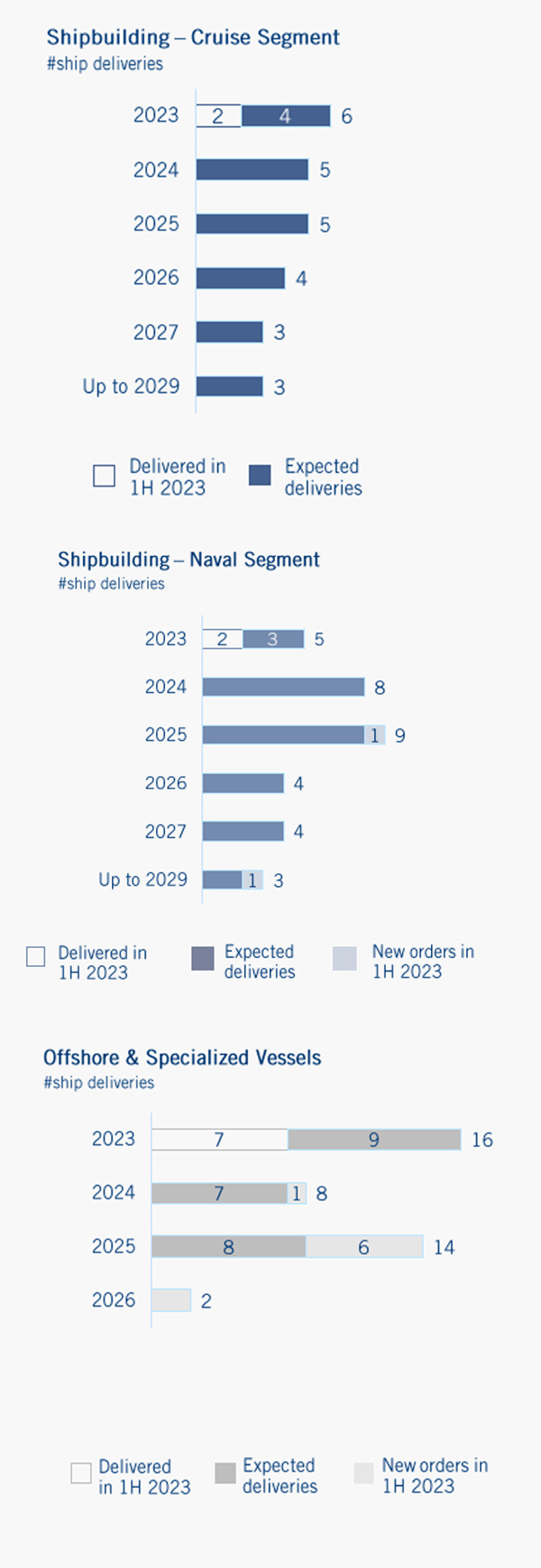

• Net financial position at € 2,813 mln; 2 cruise ships delivered in 1H 2023 and 4 units expected in 2H 2023

BUSINESS UPDATE

Business operating performance consistent with targets

| Q1 | Q2 | |

| Cruise | ▪ Floating out of “Sun Princess” the first of two LNG (liquefied natural gas) cruise ships for Princess Cruises | ▪ Order for the second ultra-luxury vessel for Four Seasons Yachts ▪ Delivery of «Viking Saturn», tenth unit of the fleet for Viking Cruises ▪ Delivery of «Vista», the first of two units for Oceania Cruises, a NCL brand |

| Naval | ▪ US Navy: delivery of the Littoral Combat Ship «USS Marinette» | ▪ Italian Navy: order to the third Near Future Submarine (NFS) approved by the Parliament and fully effective in 3Q ▪ US Navy: award for the construction of the fourth frigate of the Constellation program ▪ Qatari Ministry of Defence: delivery of the fourth and last Corvette «Semaisma» |

| Offshore | ▪ Order of four Commissioning Service Operation Vessels for the new client, Edda Wind ▪ Delivery of four vessels for the Norwegian Coast Guard, Luntos, Ocean Infinity and North Star |

▪ Order for 2 hybrid-electric Commissioning Service Operation Vessels for Purus Wind ▪ Order for 2 additional Commissioning Service Operation Vessels for North Star ▪ Delivery of 3 units, for Rem Wind, Norwind Offshore and North Star |

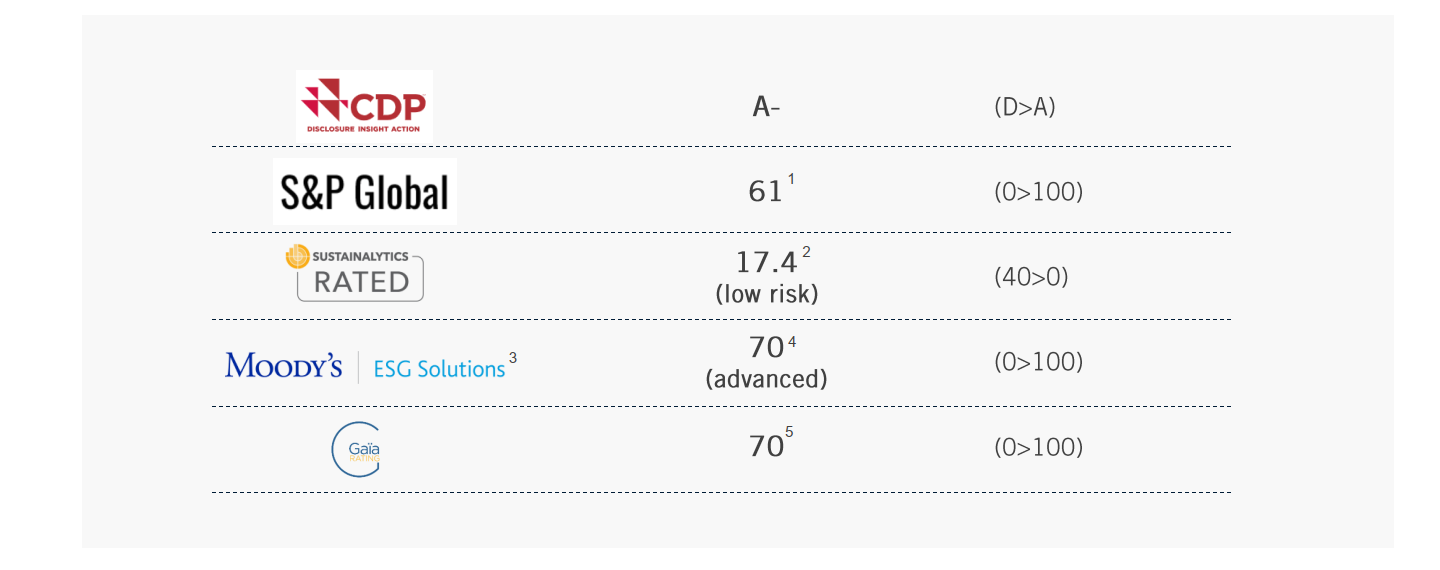

Sector leadership with top-notch ESG rating

1. As of June 16, 2023

2. Last full update as of January 26, 2023; last update as of June 16, 2023

3. Formerly known as V.E

4. The last evaluation was held in 2021, placing Fincantieri in the “Advanced” range; the next evaluation will take place in 2023

5. In 2022, the score attribution criteria and methodology was revised

Solid Order Book with strong visibility up to 2029

Total backlog of € 32.9 bn equal to 4.4x 2022 Revenues

Soft Backlog at € 10.9 bn further supporting the commercial pipeline (1.5x 2022 Revenues)

FINANCIAL RESULTS

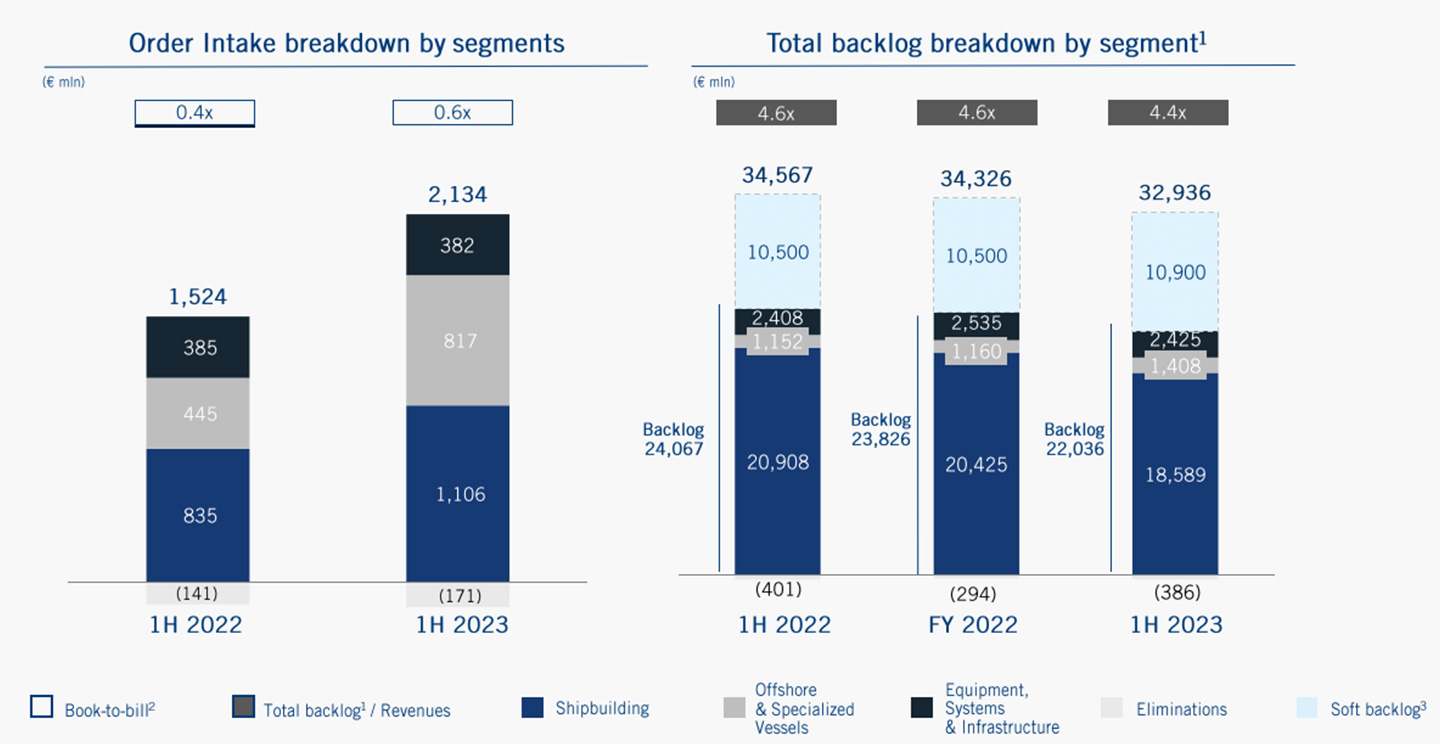

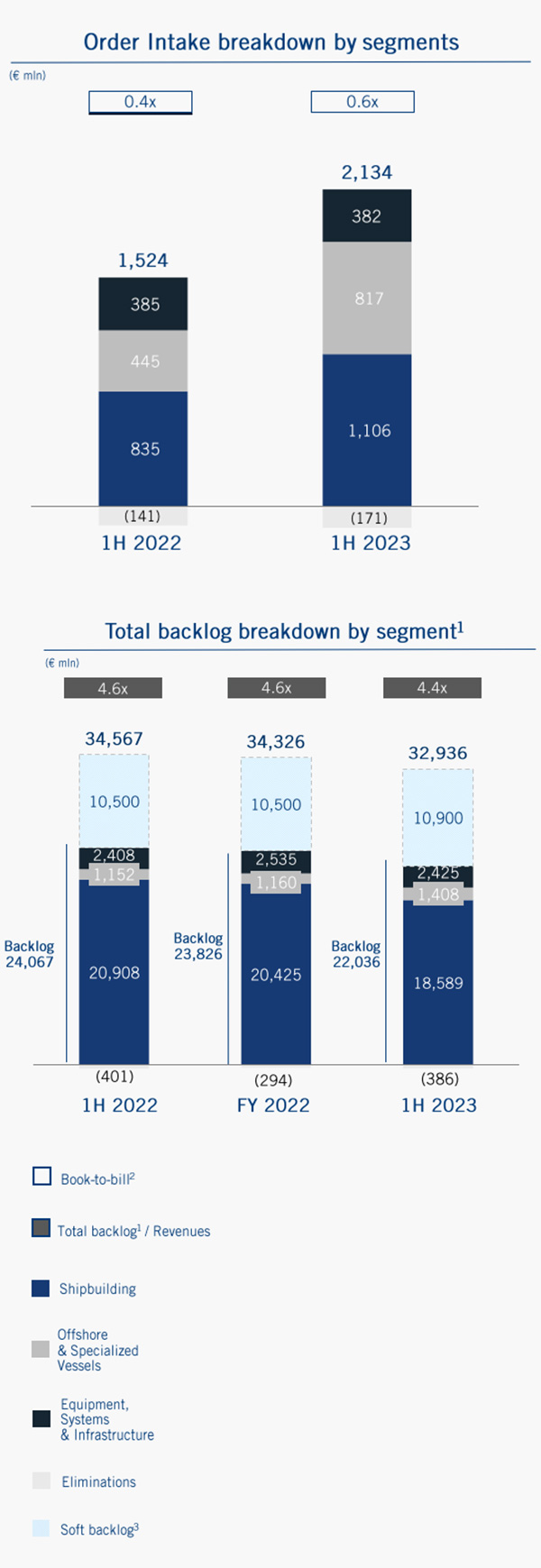

1H 2023 Order Intake & Total Backlog

▪ Order intake at € 2.1 bn, with strong contribution from Offshore, up 83.8% YoY and accounting for 35.4% of the total order intake

▪ Orders for eight new CSOV and one SOV and a cable layer, together with the exercise of the option for the fourth Constellation-class frigate by the US Navy

▪ Total backlog representing 4.4x 2022 revenues

1.Total backlog is the sum of backlog and soft backlog. Backlog coverage calculated as Total Backlog/ previous year revenues ex pass through activities

2. Order intake/revenues

3. Soft backlog represents the value of existing contract options and letters of intent as well as contracts in advanced negotiation, none of which yet reflected in the order backlog

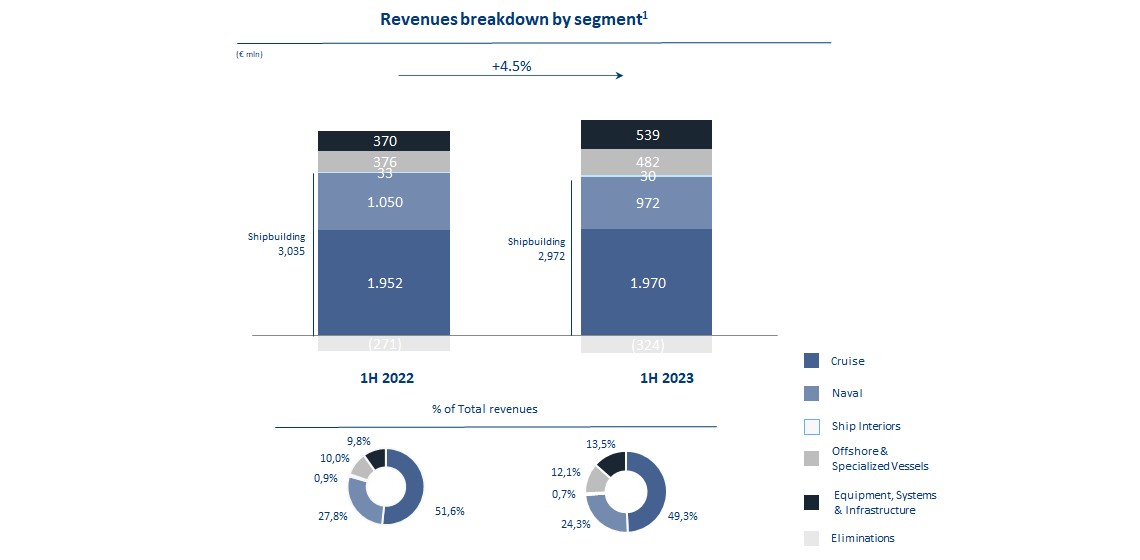

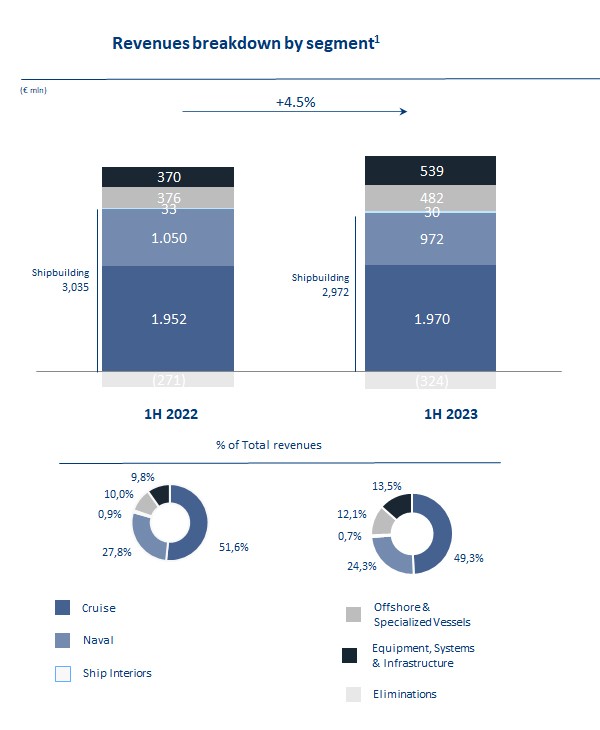

Revenues

Revenues up 4.5% at € 3,669 mln

▪ Cruise accounting for 49.3% and Naval for 24.3% of total revenues, respectively at € 1,970 mln and € 972 mln

▪ Offshore & Specialized Vessels revenues at € 482 mln up 27.9% YoY

▪ Equipment, Systems & Infrastructure revenues at € 539 mln up 45.8% YoY (370 mln in 1H 2022)

- Electronics: revenues up 9.8% at € 78 mln (€ 71 mln in 1H 2022)

- Mechanical components: revenues down 5.1% at € 212 mln (€ 223 mln in 1H 2022)

- Infrastructure: revenues up to € 250 mln (€ 72 mln in 1H 2022)

1. Breakdown calculated before eliminations

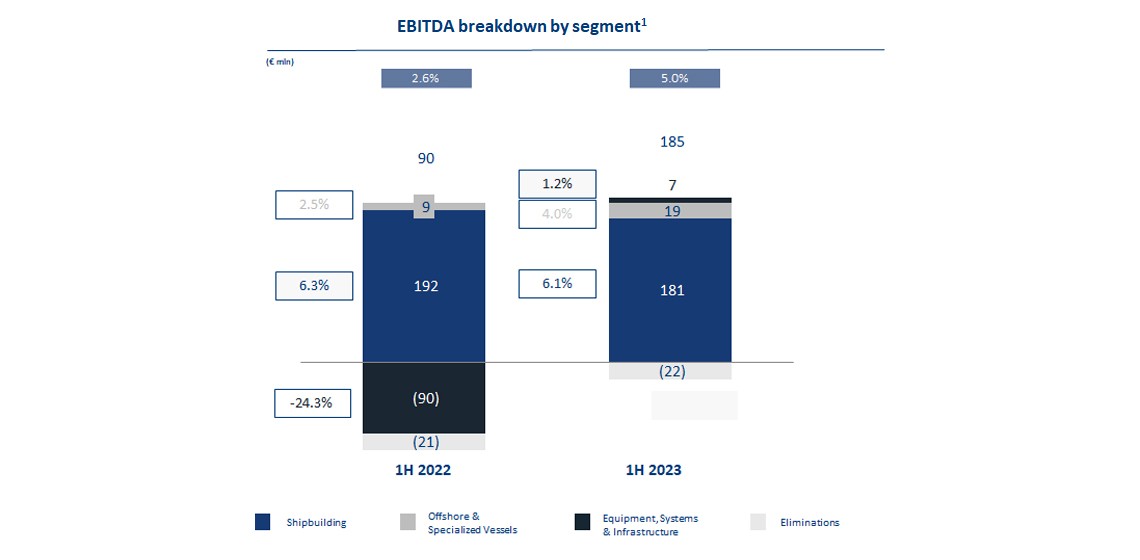

EBITDA

EBITDA at € 185 mln with an EBITDA margin at 5.0%

▪ Shipbuilding EBITDA at € 181 mln with a margin at 6.1%

▪ Offshore & Specialized Vessels EBITDA at €19 mln with an improving margin at 4.0%, confirming the positive trend towards more promising offshore sector

▪ Equipment, Systems & Infrastructure EBITDA at € 7 mln ( negative € 90 mln in 1H 2022) with an improved margin at 1.2% (negative 24.3% in 1H 2022)

- Electronics: EBITDA at € 1 mln (€ 2 mln in 1H 2022) and margin at 1.8% (2.8% in 1H 2022)

- Mechanical components: EBITDA at € 16 mln (€ 18 mln in 1H 2022) and margin at 7.3% (8.0% in 1H 2022)

- Infrastructure: EBITDA negative for € 10 mln ( negative € 110 mln in 1H 2022) and negative margin at -4.0% (-152.6% in 1H 2022)

1. Breakdown calculated before eliminations

Figures subject to rounding

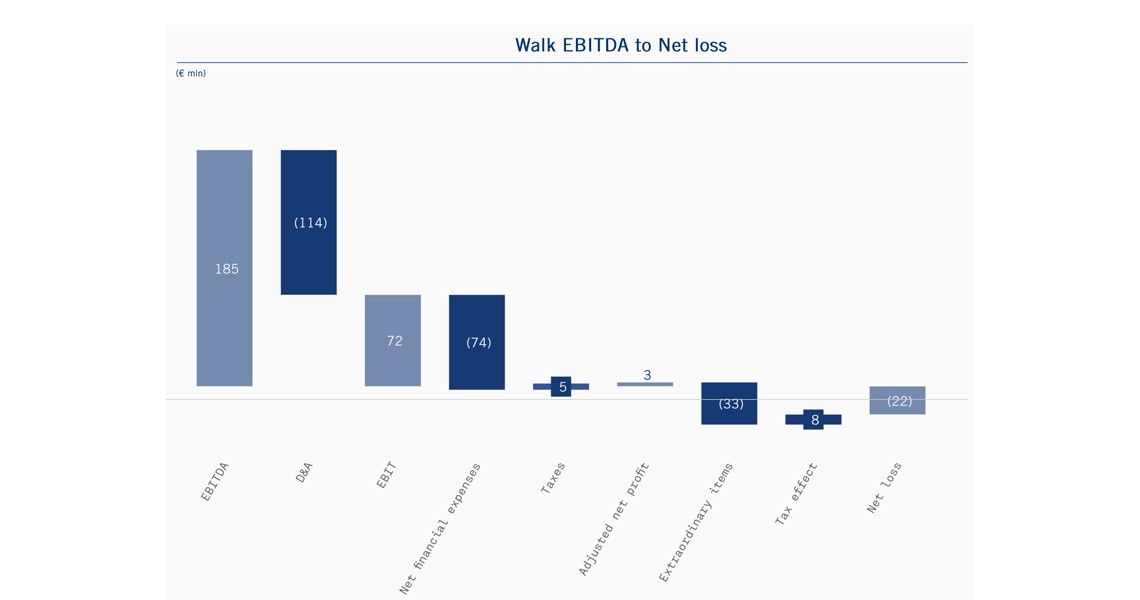

Net result

Net result for 1H 2023 negative at € 22 mln despite positive business operating performance impacted by:

▪ Financial expenses at € 74 mln

▪ Extraordinary items at € 33 mln for asbestos related litigations costs

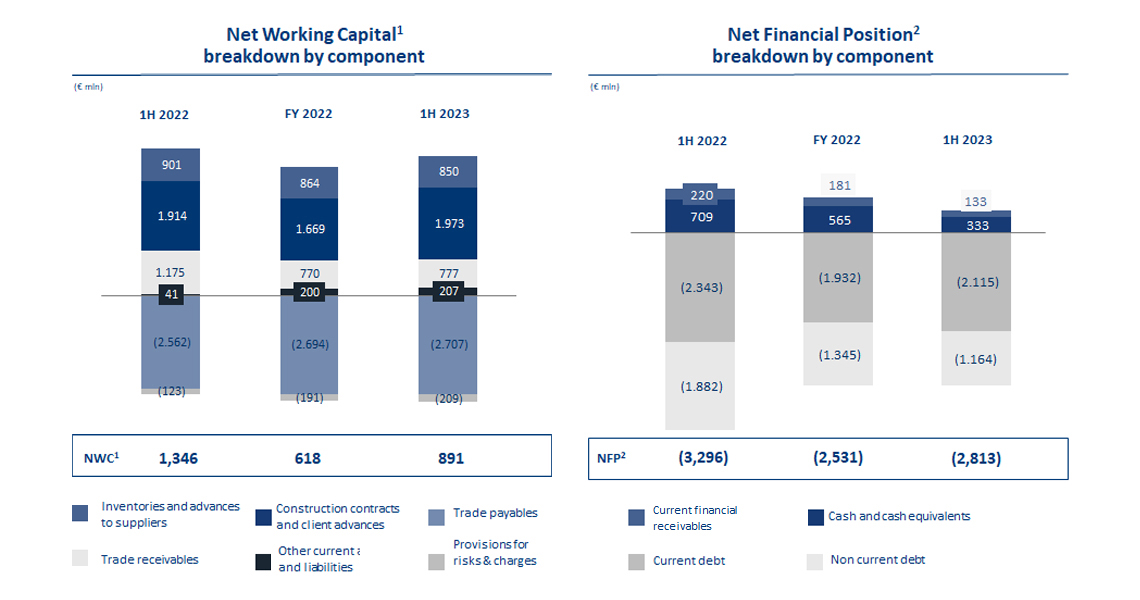

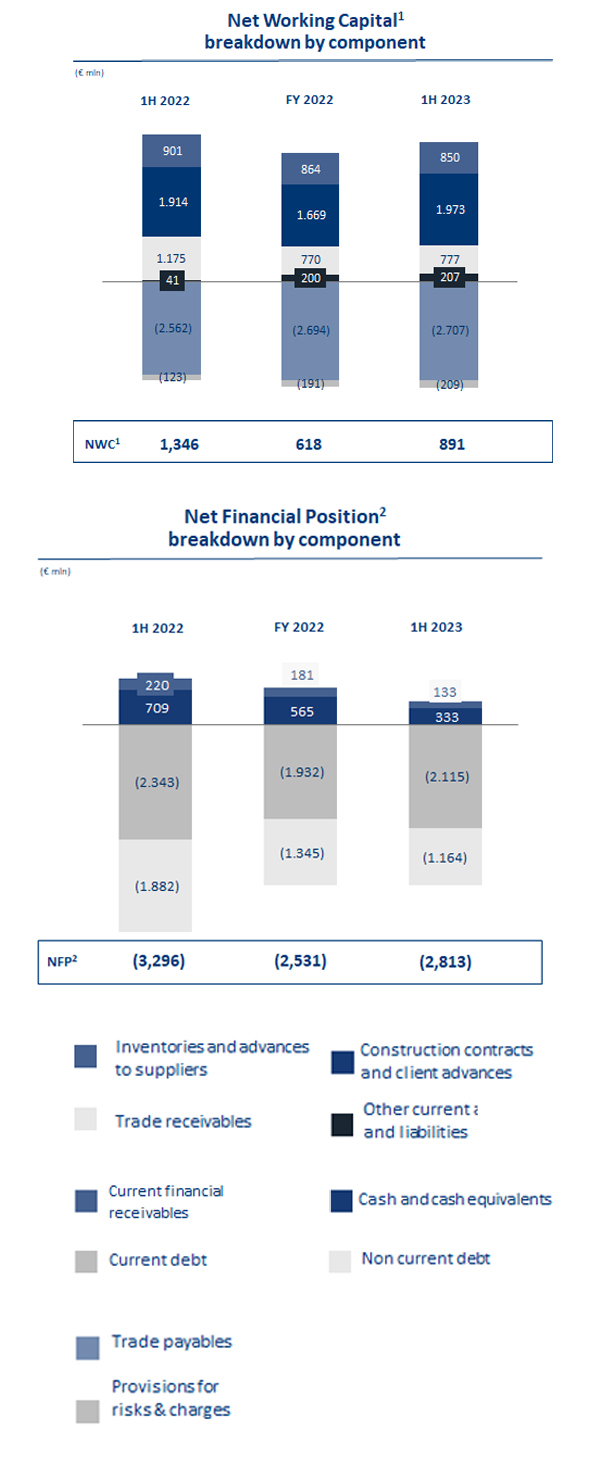

Net Financial Position & Net Working Capital

▪ Net financial position at € 2,813 mln, in line with production schedule for the semester

▪ Two cruise ships delivered in 1H 2023 and four expected in 2H 2023

▪ Net working capital at € 891 mln

1. Group Net Working Capital aligned with ESMA guidelines excludes (i) construction loans, (ii) current portion of derivative liabilities for non-financial items, and (iii) the current portion of the fair value of option on equity investment

2. Group Net financial position has been aligned with ESMA guidelines and it includes (i) construction loans, (ii) non-current financial liabilities on hedging instruments and (iii) liabilities for fair-value options investments that were previously excluded, furthermore it excludes non-current financial receivables

MARKETS UPDATE

Cruise and Environmental Sustainability

Market outlook

▪ Global fleet back in operation with occupancy above the 100% mark: occupancy Gap vs. 2019 nearly closed

▪ Value proposition gap between cruises and land-based holidays further shifting towards cruising

▪ Resumption of orders already recorded for the luxury niche segment for medium to small vessels, with the entry of operators coming from the hotel sector who have succeeded in bridging the gap between cruises and the experience of travel on private yachts

▪ Booking trend for the remainder of 2023 is ahead of 2019 levels, at continued higher pricing

▪ Cruise passengers in 2022 amounted to 20 mln. CLIA expects global passenger to reach 31.5 mln in 2023 (106% of 2019 levels), 38 mln by 2026 and 46 mln by 20301

Sustainability

▪ Net carbon neutrality for cruise industry by 20502 and 40% reduction of average CO2 intensity per tonne/mile required by International Maritime Organization (IMO) regulations by 2030 vs 2008

▪ Shore-side power connectivity: 209 ships expected in operation by 20283, including ships already fitted, ships planned to be retrofitted and 98% of ships on order book through 2028

▪ Alternative fuels: shipowners increasingly interested in green propulsion systems and new fuels (LNG, methanol, ammonia and hydrogen) for a fully decarbonized cruise industry

▪ Pillars for the achievement of zero GHG emissions: Efficiency (optimizing efficiency for existing fleet with systems upgrades and operational enhancements), Innovation (development of new technologies in order to operate green fuel ships) and Collaboration across stakeholders

1. CLIA – State of the Cruise Industry 2022 Report

2. CLIA - Cruise Industry August 2022, Environmental Technologies and Practices

▪ Defence budgets have been revised upwards, also according to NATO guidelines, and is expected to further increase globally by 5.9% in 20231 reaching USD 2.3 bn

▪ Defence budget allocated to navy procurement estimated at 6.5% of global budget

▪ Increased interest by the EU member states for the creation of a common EU Defence framework, overcoming the fragmentation of European Defense Industry, while fostering cooperation between companies

▪ EU major defence programs include the Permanent Structured Cooperation (PESCO) for a new class of modular military ships, the European Patrol Corvette

▪ Growing importance of the underwater domain to ensure, among others, the security of subsea infrastructure for energy supply and international communications and data traffic

▪ Commercial pipeline with the Italian Navy encompasses 1.2 bn orders either in the process of finalization (the European Patrol Corvette and the Mid-Life Upgrade of the Horizon frigates) or already effective (U212NFS submarine)

1. Jane’s – Global Defence Budget, June 2023

▪ Worldwide wind farms now delivering nominal power of ca. 59 GW2, with a favorable growth scenario with almost 270 GW of total offshore wind capacity to be installed by 2030 (CAGR 15.8%)2

▪ Floating offshore wind expected to rapidly grow: ca. 14 GW of floating offshore wind capacity to be installed or underway globally by 20302

▪ Growing demand for SOV - Service Operation Vessels and CSOV - Construction Service Operations Vessels: 55 units ordered since January 2020, compared with current fleet of 37 vessels3

▪ Demand for subsea installation of offshore wind and interconnectors cables expected to rise4, generating opportunities in the specialized niche market of cable layers

1. Jane’s – Global Defence Budget, June 2023

2. 4C Offshore – Wind Farm POP, June 2023

3. 4C Offshore – Orderbook and fleet as of June 2023, excluding Chinese shipowners; Fincantieri analysis

4. 4COffshore – Subsea cable forecast, predicting cable demand for 2023-32, January 2023. Cables be installed between 2023-2032: 96.8 K Km of Offshore wind cables + 55.4 K Km of interconnectors cables

CONCLUDING REMARKS

1H 2023 |

|

2023 targets confirmed |

|